Trump Tariff Revenue Skyrocket, Yet $345B Deficit Show Spending Crisis

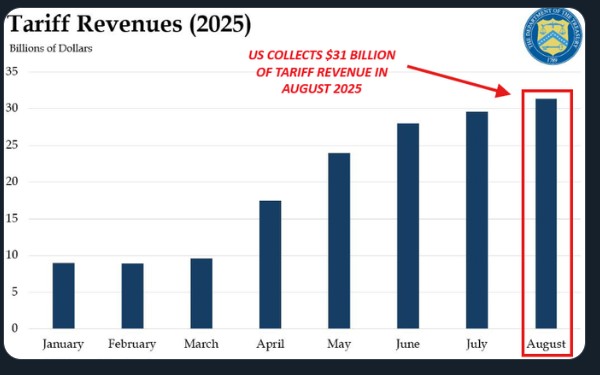

In the recent analysis, it is drawn out that the US recorded $30 billion in Trump Tariff Revenue in August 2025, yet the deficit continues to soar. Despite historic gains, rising government spending highlights a persistent fiscal imbalance, raising questions about the effectiveness of the latest Trump Trade policies.

US Tariff Revenue Collection Record

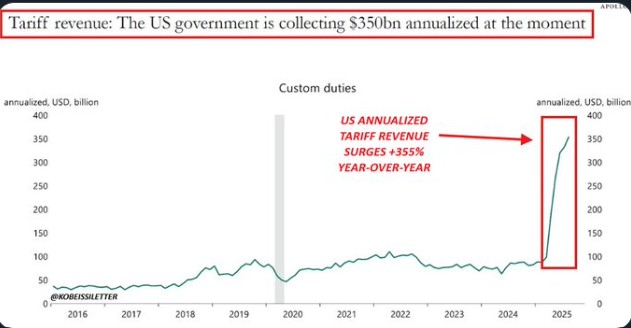

In August 2025, the US government recorded its highest-ever monthly tariff revenue collection, reaching $30–31 billion. This surge is largely attributed to Trump Tariffs on China and other major trading partners. Annualized tariff revenue now totals approximately $350 billion, marking a 355% increase from 2024 and reaching levels not seen since the 1930s.

Source: The Kobeissi Letter X

Remarkably, the revenue now accounts for 18% of individual income taxes, compared to an average of around 4% in previous decades.

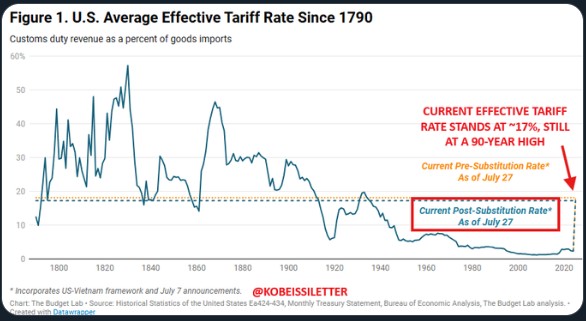

Even though some trade deals have started and certain tariffs have been paused, the effective US tariff rate remains at 17.3%, the highest in nearly 90 years.

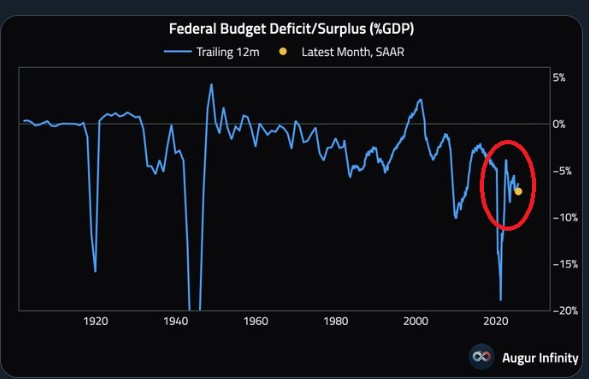

Despite the surge, economists note that tariffs alone cannot resolve fiscal challenges. According to the statistics provided by the Committee of a Responsible Federal Budget, even though the tariffs are expected to produce $3.4 trillion in the decade, the increase in deficits due to tax cuts and expenditures may amount to $4.6 trillion.

Source: X

The impact of these has been priced in by the markets to a large extent. As the S&P 500 has been on a downward trend at the beginning of the year 2025, despite the high tariffs, due to investments in AI and the expected reduction in Fed interest rate cuts .

Still Under US Deficit Mess

Despite the highest record, the US registered a deficit of $345 billion in August 2025, which is 11 times greater than the tariff income. The FY 2025 deficit is currently nearly $2 trillion, and the projections show that the deficit will be $2.7 trillion in 2026. The numbers indicate that Trump trade policies increase revenue, but they are not enough to counter structural expenditure issues.

Source: The Kobeissi Letter

Impact on the Cry ptocurrency market and the Economy.

-

Trump's trade policies are initiating volatility in equities, commodities, and the crypto market

-

Though the impact initially strained the stocks, the growth by AI and the anticipation of rate cuts have stabilized the S&P 500.

-

These macro changes are beneficial to the crypto market because investors are looking to alternative assets due to fiscal uncertainty.

History of US Tariffs

In the past, US tariffs were minimal for decades, at an average of 4% of income taxes, and seldom went beyond 10%. Tariffs were high during the great depression in the 1930s.

The period of Trump Tariff has taken rates to a level not seen since that time, as it represents a historic high in terms of trade protectionism in 2025.

Source: X

Underlying Message in these Records

Even if Trump's policies generated historic revenue, they still cannot alone solve the deficit crisis. Controlling government spending remains critical, as collection is tiny in front of large deficits. Fiscal discipline, rather than collection measures, is key to long-term stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。