Canton Network offers customizable privacy, full network interoperability, and unlimited horizontal scalability, aiming to better connect traditional finance with the crypto capital markets.

Written by: Shenchao TechFlow

Introduction

"The future of finance is on-chain" has become a consensus, and with the U.S. SEC launching the "Crypto Initiative" to promote the comprehensive migration of the U.S. financial market to on-chain, this belief is becoming increasingly firm.

So, how can the future of finance occur more effectively and quickly on-chain?

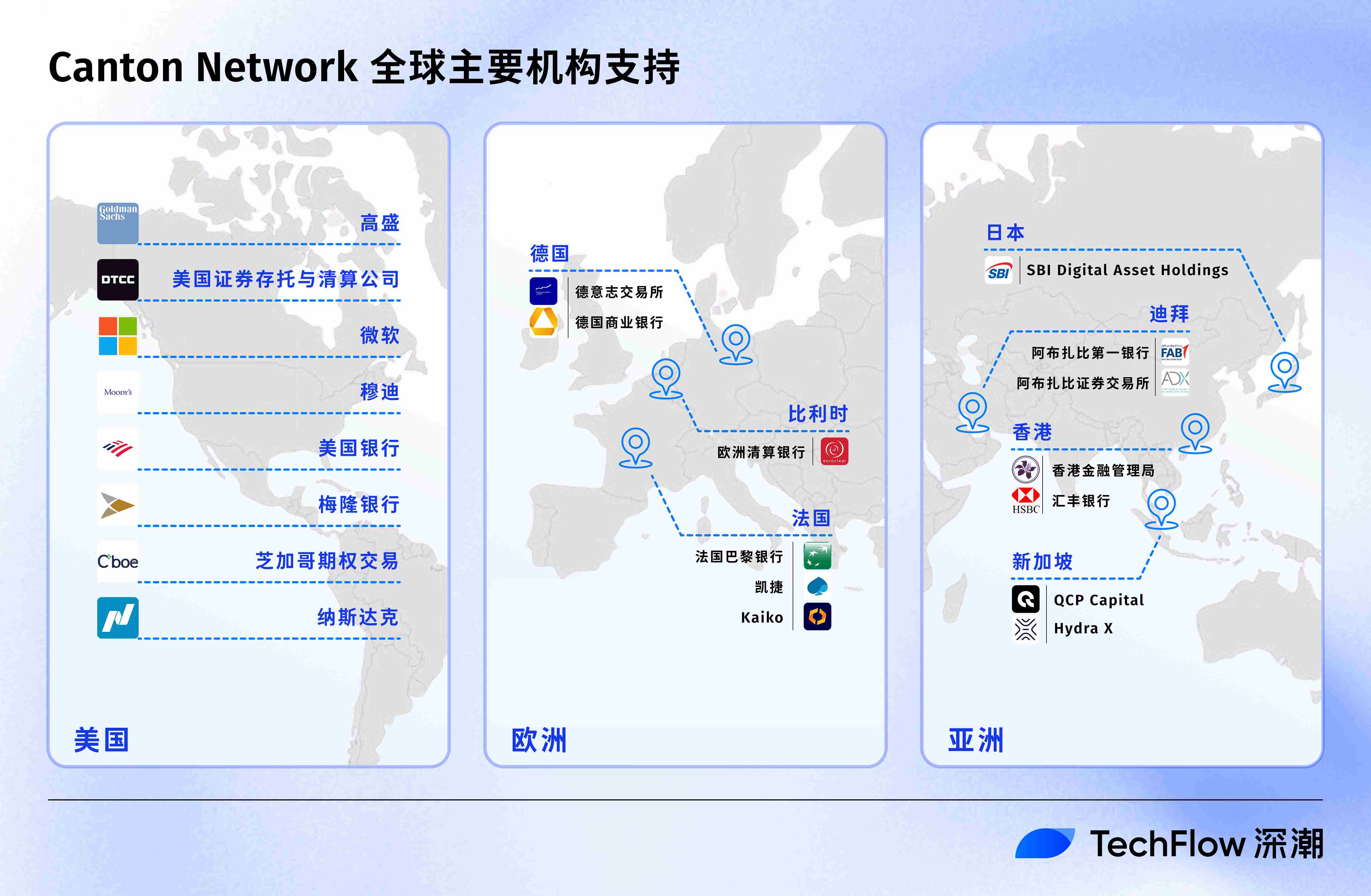

We see a common choice from both Eastern and Western traditional capital markets: Canton Network.

In June 2025, Canton Network developer Digital Asset completed a $135 million Series E funding round, led by DRW Venture Capital and Tradeweb Markets, with participating institutions including BNP Paribas, Circle Ventures, Citadel Securities, the U.S. Depository Trust & Clearing Corporation, and Goldman Sachs, bringing Digital Asset's total funding to nearly $400 million.

In terms of specific adoption:

In the Western world, Goldman Sachs' digital asset platform GS DAP, BNP Paribas' Neobonds, and Broadridge's DLR all utilize Canton technology for development;

On the Eastern front, HSBC's Orion employs Canton technology, and the Hong Kong Monetary Authority (HKMA) has joined the Canton Foundation.

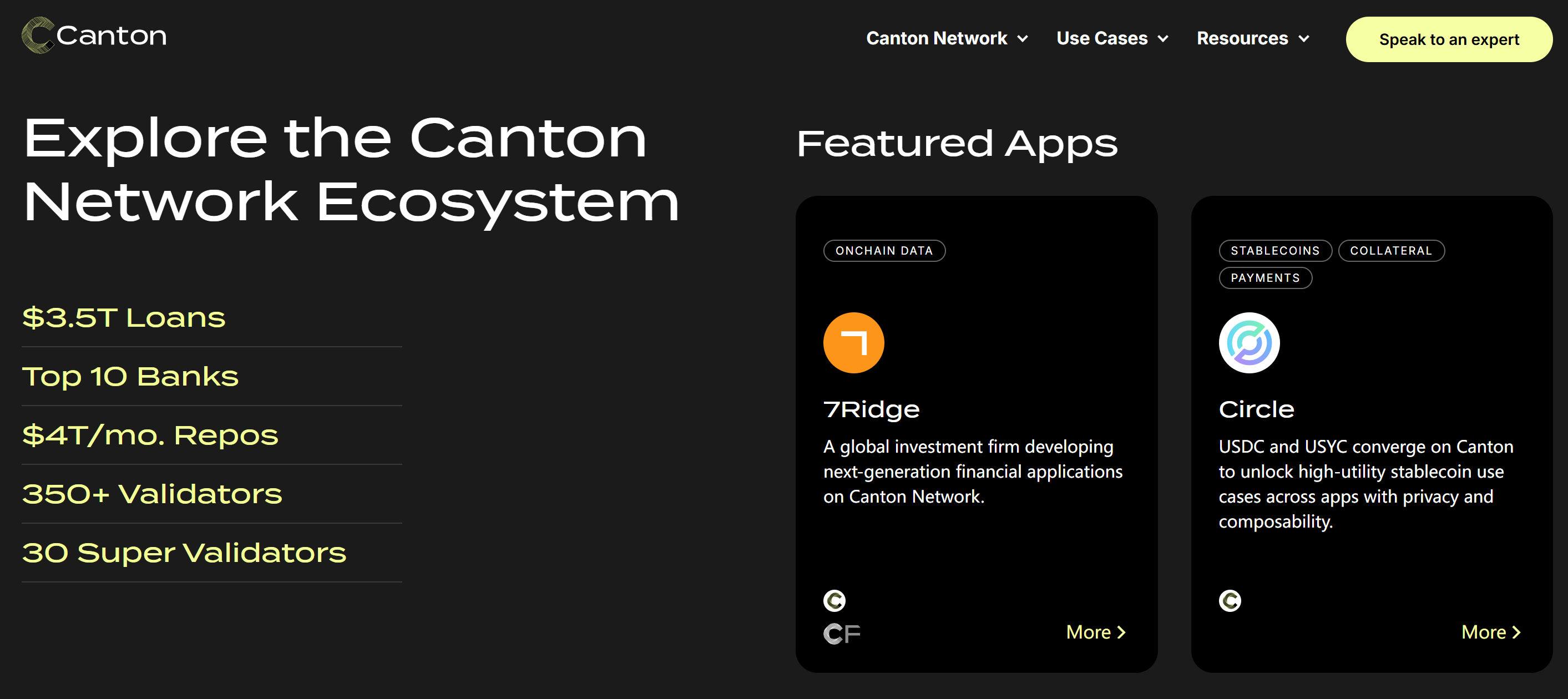

According to the "On-Chain Financial Real-World Asset Report" released by RedStone in June 2025, the scale of tokenized assets on Canton exceeds $40 trillion. Since 2022, more than half of digital bond issuances have been executed through Canton applications.

In the initial phase of the comprehensive explosion of on-chain finance led by institutions, Canton Network has already become the core engine for the digital transformation of traditional financial markets. This widespread adoption by top global institutions not only reflects a high recognition of Canton’s technical architecture and business philosophy but also confirms its outstanding capabilities in institutional-level security, compliance, and interoperability.

As a public blockchain network launched by Digital Asset specifically designed for institutional applications, Canton Network features customizable privacy, full network interoperability, and unlimited horizontal scalability, aiming to better connect traditional finance with the crypto capital markets.

With multiple large-scale pilot projects, including U.S. Treasury collateralization, gold, and European bond tokenization, set to be completed by Canton Network in 2025, it is officially transitioning from the "experimental growth phase" to the "scalable implementation phase." Canton Network is accelerating the on-chain pace for institutions, fully shaping the future of institutional-level on-chain finance that is 7 x 24 hours liquid, globally trusted, and secure and compliant, as stated on its official X platform homepage "where finance flows."

Born from institutional demand, jointly launched by top institutional alliances

The idea of building Canton Network originated in 2023.

Amid the first wave of DeFi and RWA trends, many traditional financial institutions recognized the advantages of on-chain finance: efficient capital circulation around the clock, borderless low-friction low-cost access, global access without permission, and the infinite financial innovation that can be unleashed under the programmability of smart contracts.

At the same time, the vast user base, strong capital strength, mature risk control systems, and the trust accumulated over a century of operation in traditional financial institutions will inevitably drive broader adoption of the blockchain ecosystem.

This was meant to be a two-way journey, but traditional institutions face numerous challenges in going on-chain:

Privacy and compliance pain points: The completely transparent ledger of public blockchains is at odds with the strict privacy requirements of the financial industry (such as KYC, AML, and GDPR). The public disclosure of many data details may lead to legal risks and competitive disadvantages, while private chains, although providing privacy, lack openness and ecological connectivity.

Interoperability and liquidity fragmentation pain points: The financial system is highly siloed and fragmented, with low efficiency in cross-system collaboration. Meanwhile, blockchain cross-chain solutions are also troubled by high operational thresholds, costs, and security issues.

Technical integration and development complexity pain points: The integration threshold and costs between traditional financial institutions and blockchain are high, and any misstep may trigger significant financial risks. Additionally, institutions need to balance innovation and compliance, increasing the difficulty of going on-chain.

Private chains are not feasible due to a lack of openness; general public chains are also not feasible due to a lack of privacy. Institutions are waiting for a solution that balances both privacy and performance while maintaining low barriers to entry.

This dilemma was quickly recognized by Digital Asset, whose core team members all come from large traditional financial institutions.

Investment equals investing in people, and behind Digital Asset's $400 million funding is a team configuration that is often talked about.

As co-founder and CEO, Yuval Rooz worked at quantitative trading giant DRW and renowned market-making firm Citadel Securities, and was a member of the U.S. Commodity Futures Trading Commission's Global Markets Advisory Committee's Digital Asset Markets Subcommittee.

Another co-founder, Don Wilson, founded DRW in 1992, and under his leadership, DRW has developed into one of the largest proprietary trading firms in the world with over 2,000 employees.

The other three co-founders are technical backbones of Digital Asset: Eric Saraniecki, as the network strategy director, established a trading platform focused on illiquid commodity markets at DRW Trading and co-founded Cumberland Mining; Chief Operating Officer Shaul Kfir was the CTO of two startups and has a background in cryptographic research; and as CTO, Ratko Veprek is a major contributor to Digital Asset's self-developed smart contract language Daml.

With solid institutional work experience, research in the crypto field, and technical implementation capabilities driving the initiative, the idea of an open public chain tailored for institutional applications, balancing decentralized transparency with the privacy needs of financial regulation, quickly took shape:

Each institution operates an independent sub-ledger, achieving atomic settlement across ledgers through a shared synchronization layer, while ensuring privacy and autonomy, enabling seamless collaboration and scalability between systems.

Soon, this concept resonated with top global institutions, forming an alliance of over 30 institutions, including BNP Paribas, Capgemini, CBOE, Deloitte, and Deutsche Börse, aimed at helping the idea take root. In May 2023, the Canton Network mainnet officially launched.

So, as a highly anticipated open public chain, how does Canton Network solve all these challenges?

Custom-designed for institutional on-chain: Canton’s product design philosophy

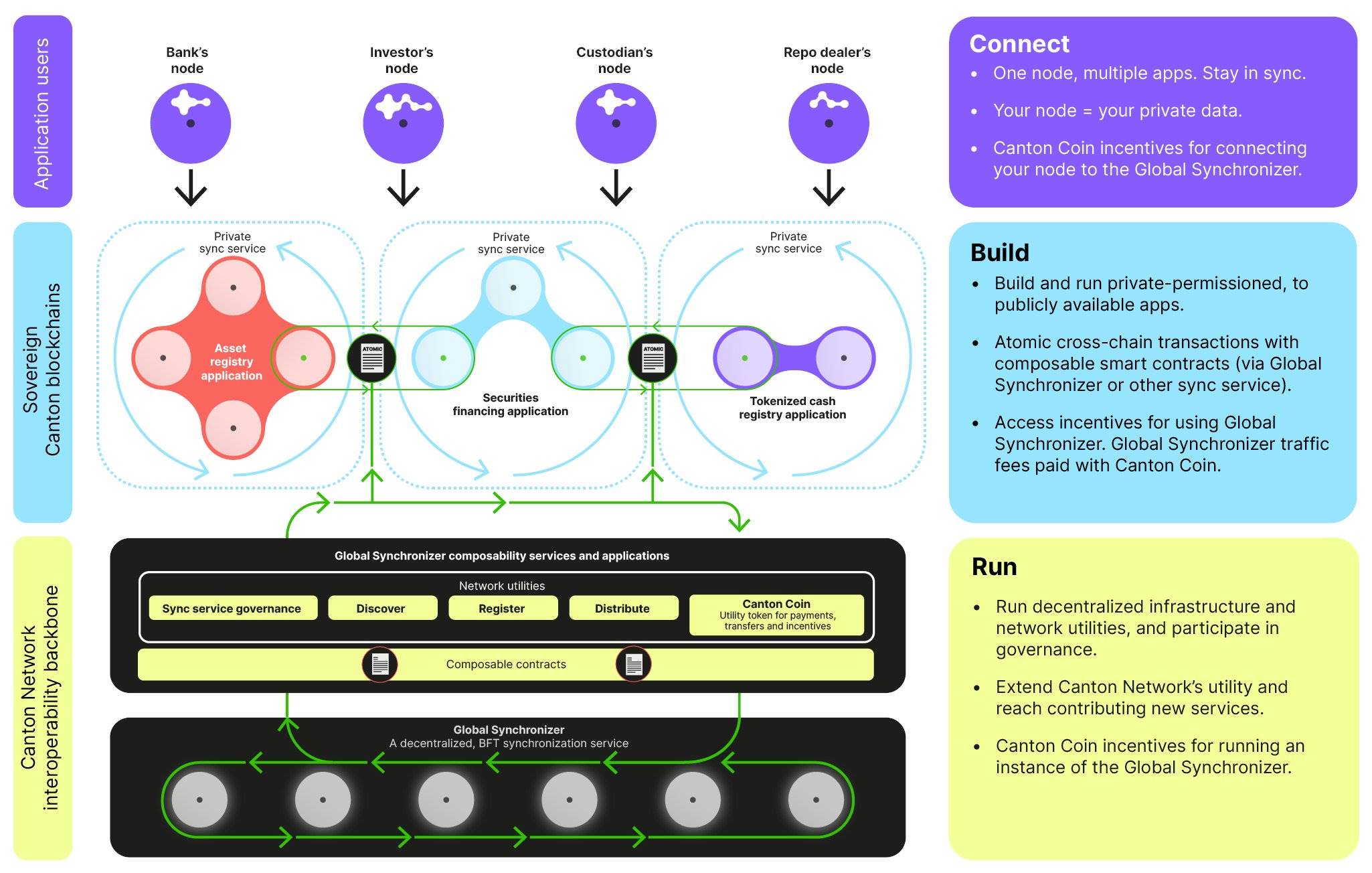

In summary, Canton Network employs a unique two-layer consensus mechanism and achieves unlimited horizontal scalability and full network interoperability through core modules such as the Daml smart contract language, global synchronization layer, and Canton Coin token, while ensuring privacy protection and efficient synchronization.

1. Sub-ledgers and synchronization layer: Achieving cross-system collaboration

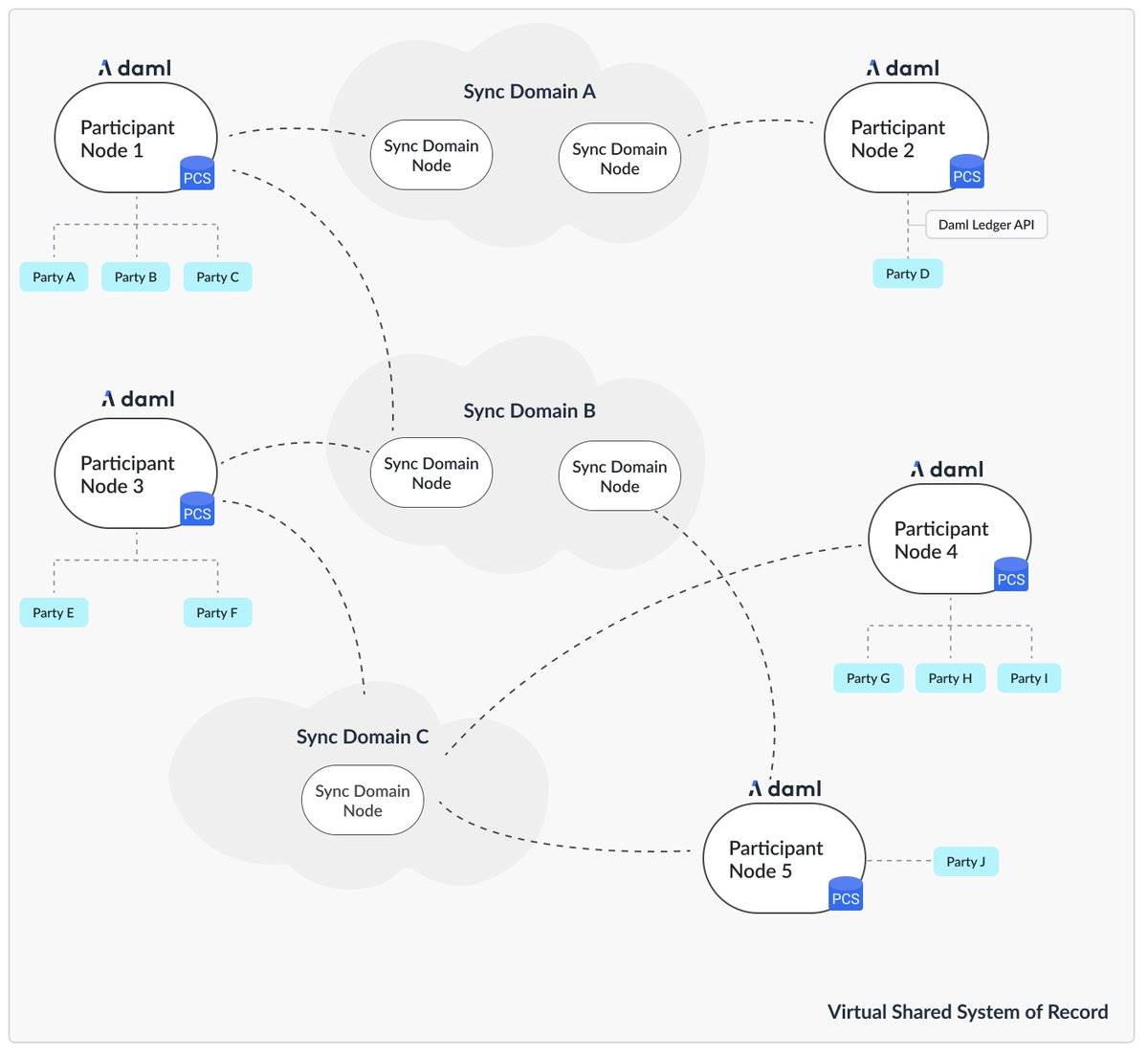

Canton Network aims to create a "network of networks." This description may sound abstract at first, but it is not difficult to understand.

- Sub-ledgers:

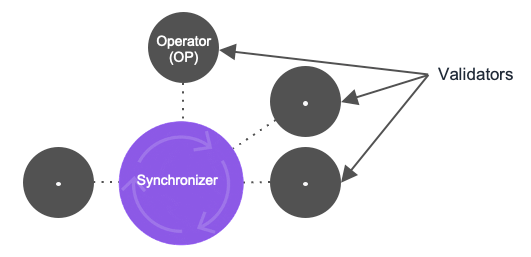

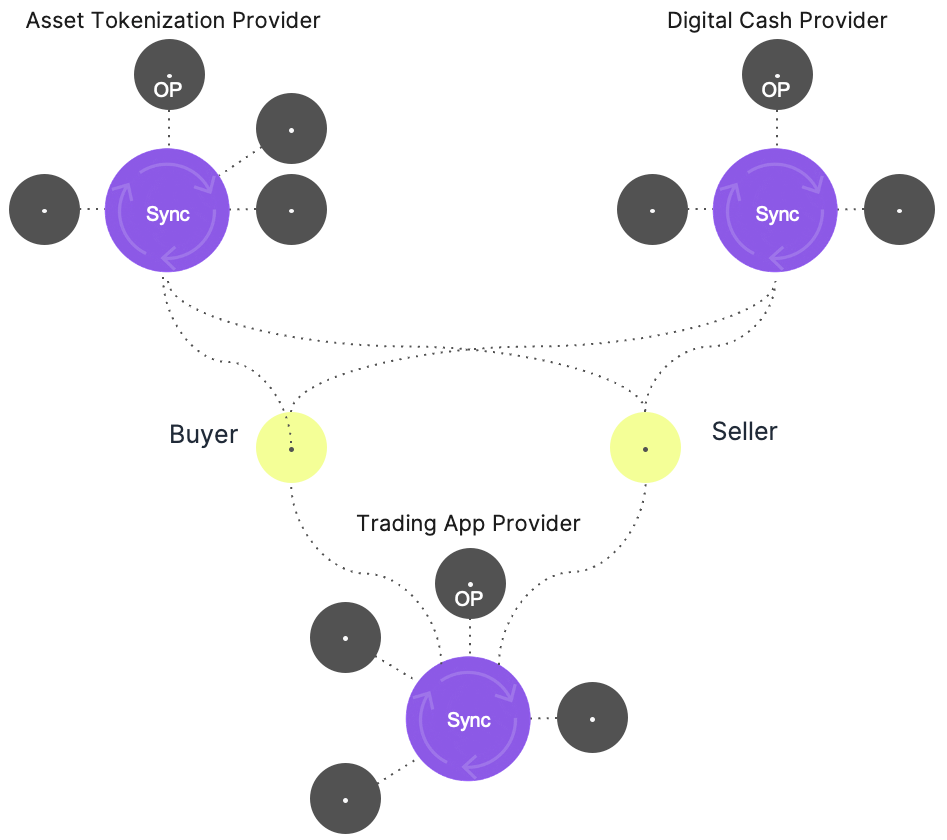

In Canton Network, each institution operates its own independent distributed ledger, such as banks, exchanges, and funds, which stores transaction data related to itself.

Validation nodes can be run by the institution itself or outsourced to Canton service providers. Each sub-ledger's validation nodes are only responsible for validating transactions related to themselves, maintaining network security, and executing consensus protocols, while interacting with the synchronization layer to complete cross-ledger transactions. Currently, the scale of Canton Network's validation nodes exceeds 350+.

We can view these sub-ledgers as small networks exclusive to each institution.

- Global synchronization layer:

How do these small networks connect with the outside? The global synchronization layer makes this possible.

As the core coordination mechanism of Canton, the global synchronization layer connects all sub-ledgers, enabling message transmission and transaction validation between different sub-ledgers, while ensuring transaction consistency and atomicity.

It is important to emphasize that it does not store transaction data with complete details but only processes metadata, such as transaction hashes, ZKP proofs, etc., used for validation, further safeguarding privacy while significantly optimizing overall network performance.

The Super Validator Alliance aims to ensure connections with sub-ledgers. Currently, Canton has 30 super validators, including well-known institutional members such as Broadridge, LayerZero, Moody's, and SBI Digital Asset Holdings, further ensuring decentralization and compliance friendliness.

In this way, the barriers between different sub-ledgers, or different financial ecosystems, are broken down, achieving global interoperability, allowing institutions to retain control over their data and nodes while gaining the ability to collaborate efficiently with the global financial ecosystem. Each sub-ledger small network is interconnected, making Canton Network a "network of networks."

2. Daml smart contract-driven: Achieving customizable privacy

Under different financial businesses and compliance requirements, institutions' privacy needs are also more complex. The Daml smart contract language is key to achieving customized privacy management.

As a high-level smart contract language designed specifically for institutional finance, Daml has outstanding features:

Permission Management: Daml contracts define the rights and obligations of the parties involved in transactions, ensuring that only relevant parties can access the data.

Programmable Workflows: Daml supports complex financial logic, such as conditional payments, collateral transfers, and multi-party agreements.

Formal Verification: Mathematical verification techniques are applied to Daml contract logic to reduce code vulnerabilities and ensure the correctness of contract logic.

Low Barrier to Entry: Daml is easier to develop and audit, and supports one-click ecosystem migration without the need to rewrite code, reducing migration costs.

Based on the transaction logic and privacy rules defined by Daml smart contracts in the sub-ledgers, Canton is equipped with privacy technology stacks such as ZKP and MPC. Throughout the process: ZKP verifies transaction validity, MPC enables decentralized computation, and Daml contracts define access permissions (e.g., embedding AML/KYC logic), while transaction details are stored only in the relevant parties' sub-ledgers to isolate data. The synchronization layer only processes metadata to coordinate consensus, collectively achieving "need-to-know" access.

In this way, institutions can not only conduct on-chain business and expand their ecosystems with the lowest technical barriers but also configure privacy rules according to regulatory requirements in different countries/regions. Since transaction details are stored only in the relevant parties' sub-ledgers, it further ensures that institutions' on-chain activities comply with the "data minimization" principle.

3. High-Performance Atomic Settlement: Secure and Efficient Fund Flow

In terms of performance, Canton achieves "logical sharding" through the design of sub-ledgers and the synchronization layer, where each participant only stores the ledger relevant to them. This not only enhances privacy but also improves throughput performance, better supporting high-frequency financial scenarios.

Moreover, the synchronization layer of Canton executes atomic operations, ensuring that transactions either fully succeed or fully fail, thereby minimizing execution risks and further achieving secure and efficient fund flow.

4. Canton Coin: Core Means of Governance and Incentives

As the native token, Canton Coin has a wide range of use cases within the Canton ecosystem:

Transaction Fees: Institutions pay Canton Coin as transaction fees, covering computation and storage costs. Fees are dynamically adjusted based on network load.

Node Incentives: Validation nodes earn Canton Coin rewards for running consensus and maintaining sub-ledgers.

Governance Support: Canton Coin can be used to participate in governance voting for the Canton Network Foundation's Global Synchronizer Foundation (GSF), deciding on network upgrades and rules.

At the same time, Canton Coin adopts a "burn-mint balance" mechanism to ensure that the token supply aligns with the actual needs of the network and maintains stable token value. Currently, Canton Coin has undergone a comprehensive audit by the well-known auditing firm Quantstamp.

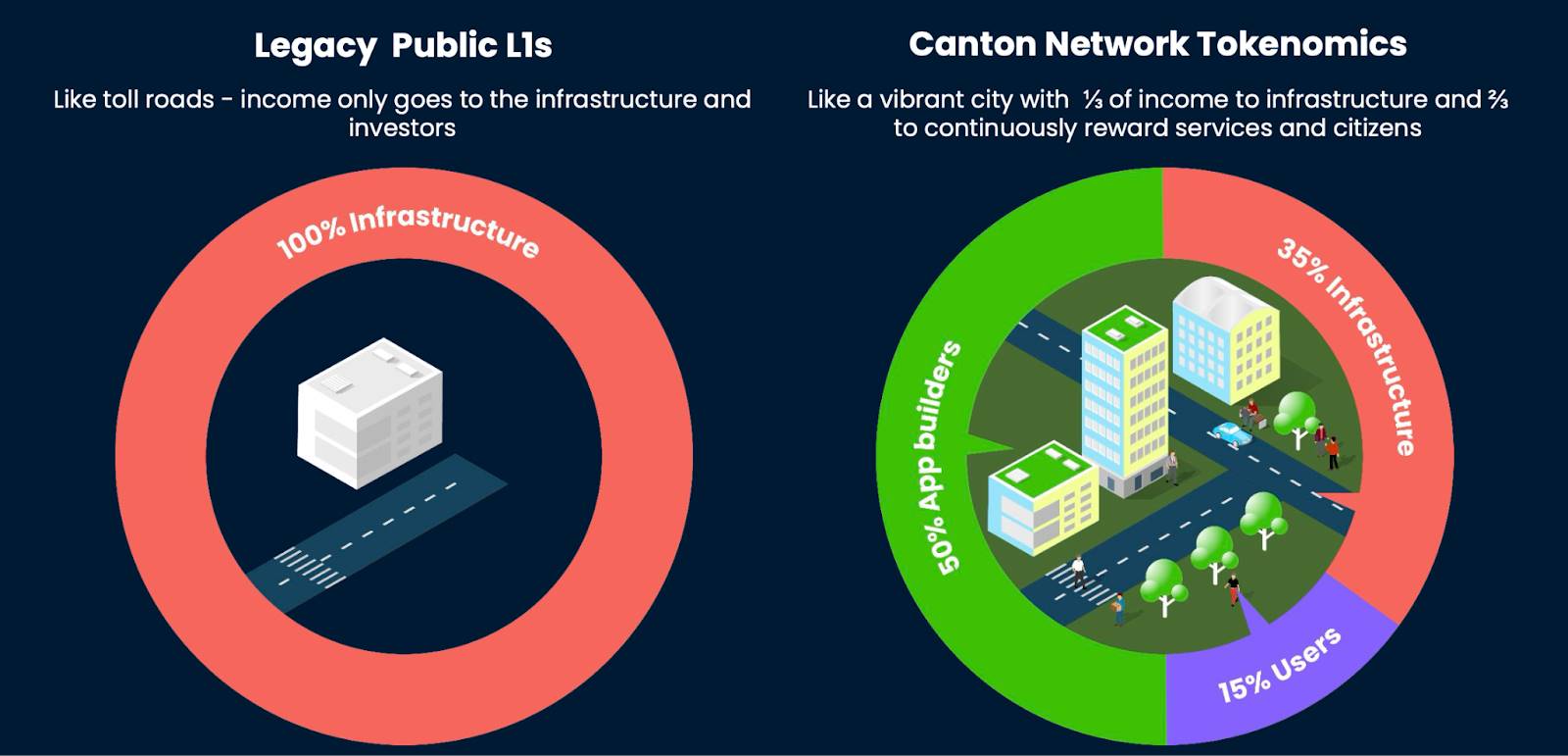

In terms of specific allocation rules, 50% is used to incentivize application builders, demonstrating Canton’s commitment to attracting developers and building the ecosystem.

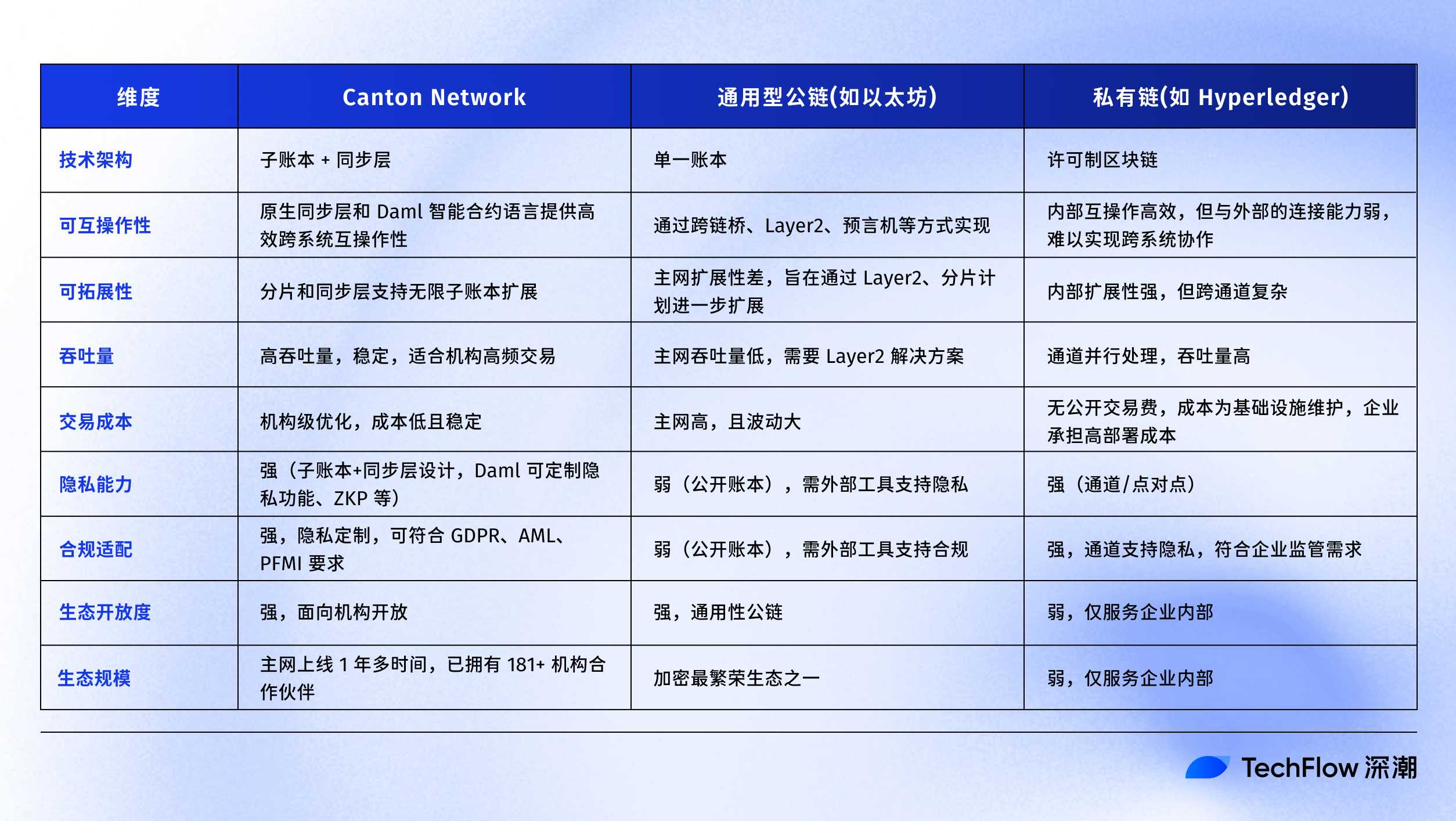

Through the following diagram, we can more intuitively feel the main differences between Canton Network, a public blockchain network designed for institutional applications, and private chains and other general public chains:

From Pilot to Implementation: Catalyzing the Comprehensive Explosion of On-Chain Finance

Canton Network is an open Layer 1 designed for institutional applications, meaning that all institutional financial businesses can go on-chain through Canton Network.

When it comes to institutions going on-chain, many people's first reaction might be RWA, but the true connotation of institutional on-chain is much richer than RWA: RWA is the mapping of real-world assets on-chain, but institutional on-chain includes not only the tokenization of various real assets, including RWA, but also native on-chain assets that operate entirely on-chain from design, issuance to trading, including but not limited to:

Asset Tokenization: Supports converting traditional assets (such as government bonds, bonds, real estate, gold) into on-chain digital tokens, enhancing liquidity, reducing transaction costs, and enabling 24/7 global trading.

Collateral Liquidity Management: Supports institutions in managing collateral (such as bonds, cash) on-chain, enabling instant exchanges across systems and chains, optimizing liquidity, and reducing risk exposure.

Cross-Border Payments and Settlements: Supports cross-border payments and settlements between institutions, achieving instant, transparent, and low-cost fund transfers through blockchain, replacing inefficient, cumbersome, and high-cost traditional settlement systems.

Institutional-Level DeFi: Supports institutions participating in decentralized finance, such as on-chain lending, derivatives trading, and liquidity pools, combining privacy protection and compliance to meet regulatory requirements.

In fact, as the core engine for the digital transformation of traditional financial markets, Canton Network has already gained widespread support and substantial breakthroughs in various financial scenarios involving institutions going on-chain.

In 2024, Canton Network successfully launched three major pilot programs:

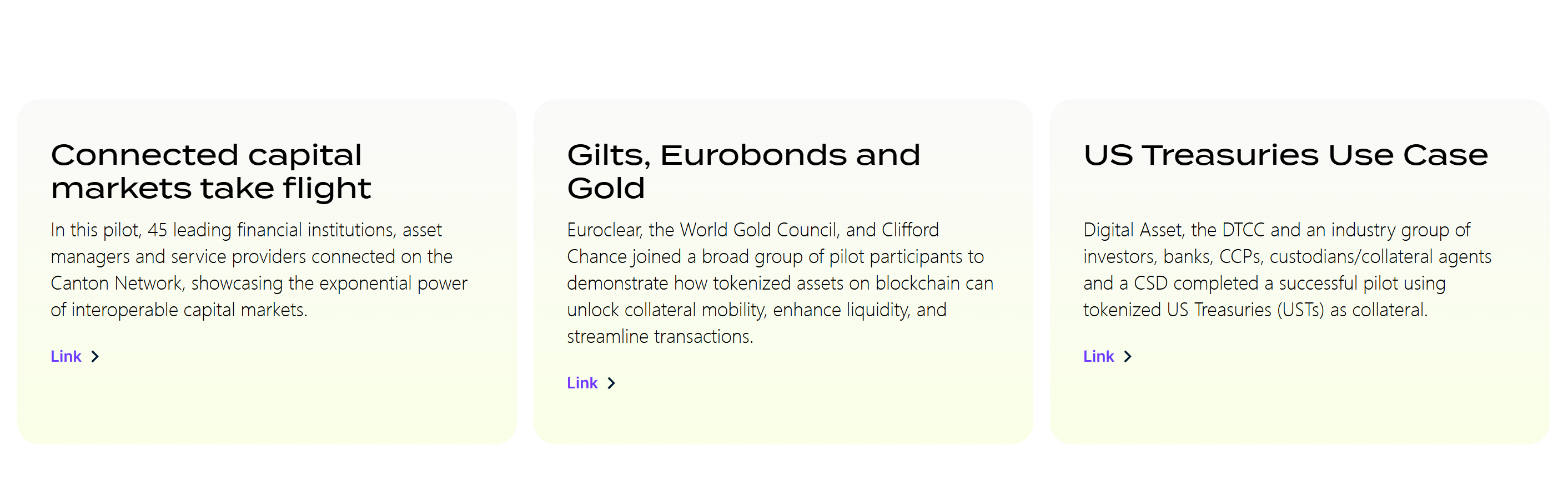

- March 2024: The Most Comprehensive Tokenization RWA Pilot

This pilot aims to validate Canton’s privacy protection and interoperability in capital markets, conducted across 22 dApps, including 5 fund registrations, 5 cash registrations, 3 bond registrations, 3 trading applications, 4 margin applications, and 2 financing applications, covering scenarios such as asset tokenization, fund registration, digital cash, repurchase agreements (repo), securities lending, and margin management.

155 participants from 45 major organizations globally actively participated in the pilot, including well-known institutions such as BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, Paxos, Baymarkets, BNP Paribas, BOK Financial, Chicago Board Options Exchange, Deutsche Bank, DTCC, Generali Investments, Harvest Fund Management, Visa, and Microsoft.

- September 2024: On-Chain Collateral Pilot for U.S. Treasury Bonds

This pilot aims to validate Canton’s significant role in optimizing collateral liquidity, settlement efficiency, costs, and delays. The pilot primarily focuses on achieving on-chain financing and collateral trading of U.S. Treasury bonds through Canton, supporting 7x24 operations, reducing risk exposure, and complying with SEC regulations.

Many well-known institutions globally have also shown enthusiasm for this pilot: it is primarily led by Digital Asset and DTCC, with participation from several well-known banks and custodians, including BNP Paribas, Goldman Sachs, and Paxos.

- October 2024: Multi-Asset Tokenization Pilot

This pilot aims to validate Canton’s privacy protection and interoperability across multiple asset classes, covering the tokenization of UK government bonds, euro bonds, and gold.

27 top institutions from around the world participated in the pilot and chose to issue tokenized assets based on Canton, including Euroclear, World Gold Council, Clifford Chance, BNP Paribas, and Microsoft.

The three pilots fully demonstrate Canton Network's strong capabilities in promoting institutions going on-chain from various dimensions, and they have accumulated rich experience for Canton Network's transition from "pilot" to "practice."

Entering 2025, multiple significant ecological initiatives by Canton showcase its immense energy in helping institutions go on-chain and promoting the comprehensive development of on-chain finance:

In February 2025, Canton launched the first phase of the Global Collateral Network (GCN) in collaboration with Euroclear.

In June 2025, Nasdaq's Calypso platform integrated Canton Network blockchain technology to achieve 24/7 automation of margin and collateral management.

In July 2025, Goldman Sachs and BNY Mellon announced the tokenization of $71 trillion in money market funds, choosing to operate based on Canton.

In July 2025, the four major global digital asset liquidity providers B2C2, Cumberland DRW, FalconX, and GSR announced their participation in the Canton Network on-chain collateral program, which will be open to all derivatives traders after its launch in the third quarter.

In August 2025, CBTC launched on Canton, promoting institutional Bitcoin adoption.

In August 2025, Canton Network collaborated with Bank of America, Citadel, DTCC, Société Générale, Circle, and other institutions to complete the first real-time on-chain U.S. Treasury financing transaction, using USDC stablecoin and tokenized U.S. Treasury bonds for weekend instant settlement, bypassing the traditional weekday-only settlement restrictions.

At the same time, several well-known institutions, including 21Shares and 7Ridge, have announced the development of next-generation financial applications based on Canton Network, with the scale of Canton Network's ecological partners exceeding 181+ institutions.

From DeFi to TradFi, from crypto-native to traditional institutions, Canton Network is becoming the core driving force of on-chain financial infrastructure, achieving true business implementation and ecological prosperity.

Global Institutional Recognition: Asia as the Growth Bridgehead for the Next Stage

Canton is born for institutional on-chain scenarios, and institutional support is a key link in its development. However, gaining widespread recognition from global institutions, whether in Web2 or Web3, is itself a rare achievement.

From North America and Europe to Asia, the top-tier institutional support behind Canton has collectively built a competitive advantage that is difficult for other public chains to replicate, making Canton a leader in the vertical track of "institutional-grade on-chain infrastructure."

North America is home to Digital Asset's headquarters. Based on the team's deep institutional entrepreneurial and employment background, the list of institutional supporters for Canton in the North American market includes renowned names such as Goldman Sachs, Microsoft, BNY Mellon, Bank of America, Moody's, and Paxos. Under the U.S. SEC's "crypto initiative" promoting the comprehensive migration of the U.S. financial market to on-chain, Canton is actively collaborating with supporters to advance the on-chain process of key financial infrastructures such as USD stablecoins and tokenized U.S. Treasury bonds, injecting new vitality into the efficient operation of traditional finance.

Europe is also a stronghold for Canton: Well-known institutions such as BNP Paribas, Deutsche Börse Group, Capgemini, Deloitte, Deutsche Bank, and Kaiko have joined Canton to jointly promote innovative practices in asset tokenization, bond on-chain, and cross-border settlement in the Eurozone.

In the Eastern battleground of Asia, Canton's strategic layout is equally swift and deep: In Hong Kong, HSBC successfully issued multiple bonds through Canton, and the Hong Kong Monetary Authority joined the Canton governance foundation; in Japan, financial giant SBI Digital Asset Holdings is an early supporter and core participant of Canton; in Singapore, Canton collaborates with QCP Capital to build on-chain collateral and margin management solutions for bilateral derivatives, while Hydra X becomes the first authorized custodian of Canton Coin in the Asia-Pacific region; in the Middle East, First Abu Dhabi Bank announced it would issue the first digital bond in the region through HSBC's Orion digital asset platform, which will be listed on the Abu Dhabi Securities Exchange.

Notably, as the Asian market rapidly rises in the global fintech landscape, Canton has significantly increased its strategic investment and resource allocation in the region, demonstrating a sustained optimism and focus on the Asian market.

On September 25, 2025, during Korea Blockchain Week, Canton will participate as a sponsor in the "Asian Stablecoin Conference (ASC)" held in Seoul, where it will collaborate with multiple institutions to explore innovative paths for stablecoins in regulation, cross-border payments, and asset anchoring, further expanding into the Korean and Pan-Asian markets.

At another upcoming top-tier industry event, TOKEN2049 in Singapore, Canton also plans to establish deeper cooperative relationships with top Asian capital, exchanges, custodians, and regulatory bodies through various formats such as hosting special side events, delivering keynote speeches, and participating in roundtable discussions, continuously strengthening its influence in the Asia-Pacific region.

Many readers who wish to further understand Canton may find an interesting coincidence when translating the literature:

"Canton" is the historical old name of Guangzhou, China, which is located in the Greater Bay Area, an important hub for East Asia's financial connections to the world.

From Europe and America to Asia, Canton Network is gaining the trust of the global financial world with its true institutional strength, and Asia is becoming a key area for its next growth phase.

Conclusion

From crypto stocks and RWA to U.S. stocks on-chain, this cycle of on-chain finance is led by institutions.

As a public blockchain network designed specifically for institutional applications, Canton Network not only serves as a key bridge for institutions to transition to the on-chain era with its outstanding privacy architecture, compliance capabilities, and comprehensive interoperability but also relies on the support of numerous top-tier global institutions to become a necessary decentralized infrastructure for the digital transformation of traditional finance.

As Canton Network states, "Where finance flows": wherever institutional finance goes, it converges at Canton Network.

Currently, Canton Network is in a critical transitional phase from multiple large-scale pilots to the large-scale implementation of various scenarios, accelerating its role as an important hub for the deep integration of tradition and innovation, the collaboration between East and West, and the dialogue between the present and the future.

With the launch of multiple cooperative products and the deepening of strategic layouts, from Europe and America to Asia, from efficient on-chain settlement to cross-border stablecoin payments, from RWA asset tokenization to institution-empowered on-chain DeFi innovation, the next wave of on-chain finance led by institutions may continue to unfold in a new form on Canton Network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。