Aster's opportunity lies not in trying to become the "next Hyperliquid," but in becoming the first Aster.

Written by: Deep Tide TechFlow

On September 17, Aster completed its TGE, and the $ASTER token's first-day performance exceeded market expectations.

Data shows that within less than 24 hours of its launch, the total trading volume of the token surpassed $310 million, with over 330,000 new independent wallet addresses created. The opening price was $0.03015, reaching a daily high of $0.528, with a single-day increase of approximately 1650%. The platform's TVL also surged from $350 million to $1 billion.

Such a start is indeed remarkable.

A good product that is used by people is the basic foundation for DEXs after airdrops, and it determines whether a project has revenue for buybacks, thereby further enhancing the token's value.

A more fundamental question worth exploring is: when Hyperliquid has already occupied half of the perpetual DEX market with its "performance is justice" approach, achieving a monthly trading volume exceeding $330 billion, do similar products in this track have other paths to pursue?

Some product details of Aster are answering this question.

In June of this year, Binance founder CZ posed a thought-provoking question on social media: "If you were to buy $1 billion worth of tokens, you wouldn't want others to see it before your order is completed." He bluntly stated that perpetual DEXs need "dark pool" functionality.

Aster has chosen this "privacy-first" route. As a perpetual DEX formed by the merger of Astherus and APX Finance, supported by YZi Labs (formerly Binance Labs), Aster did not follow Hyperliquid's performance race but focused on solving another pain point:

In the transparent world of blockchain, how can large traders avoid the costs of being "seen"?

When a track's leader is already so strong, should newcomers chase on the same path or carve out a new one?

Aster's choice may provide some insights.

Aster's Product Code: Finding Its Position in the Perpetual DEX

- ### Product Functionality Overview: Designed for Different Traders

To understand Aster's product design, we must start with its dual-mode architecture. The platform precisely serves two completely different user groups.

Simple Mode targets traders who pursue speed and prefer degen strategies.

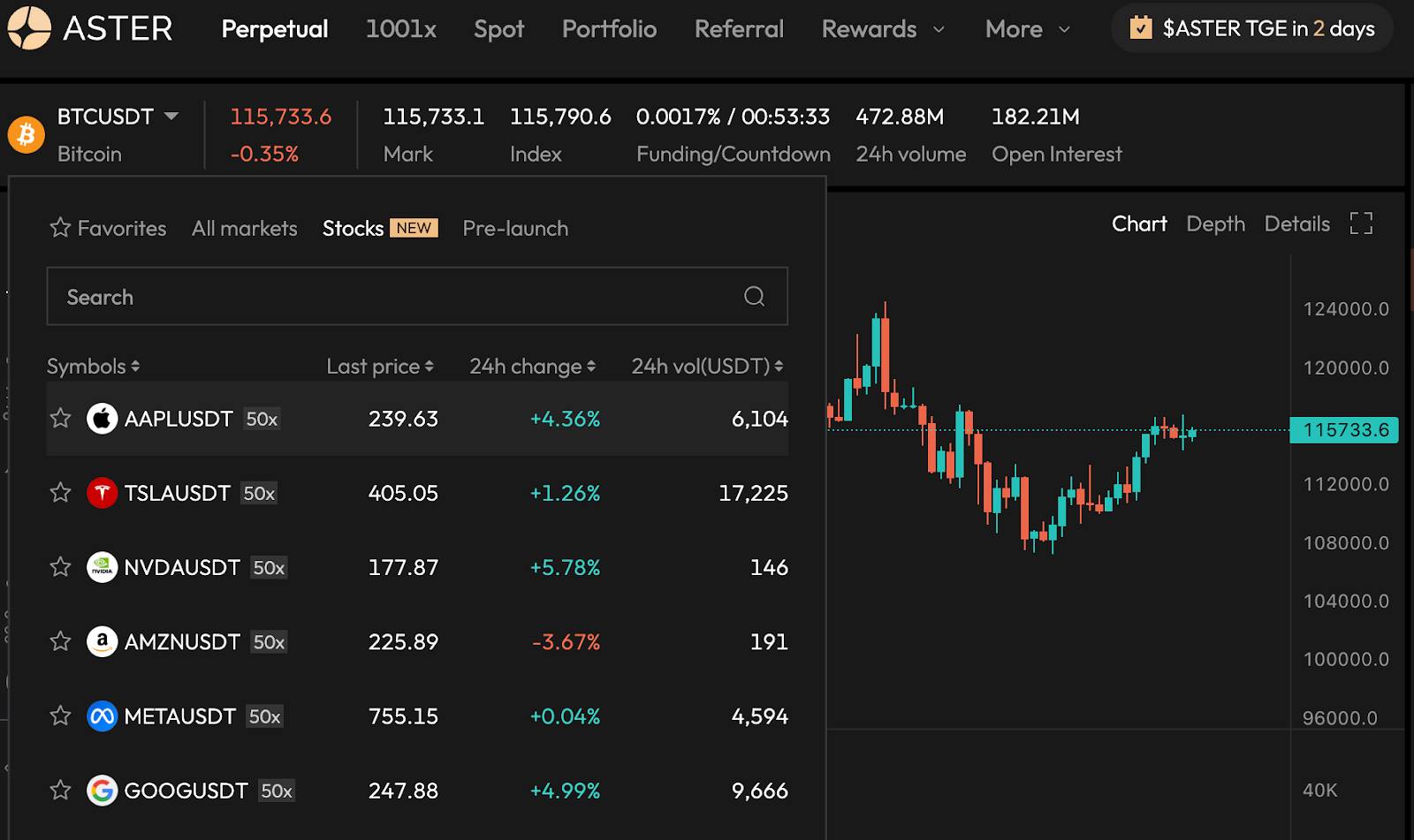

One-click ordering, automatic MEV protection, and that hard-to-ignore 1001x leverage. While Hyperliquid offers 50x and most CEXs provide 100-125x leverage, Aster directly pushes the number into four digits. This may seem radical, but it indeed targets a specific user group.

On the other hand, Pro Mode is the territory of professional traders.

Here, there is complete order book depth, professional charting tools, grid trading, and of course, the previously mentioned Hidden Orders. Meanwhile, the platform's fee structure is also quite competitive:

According to public information, Aster's Maker fee is 0.010%, and Taker fee is 0.035%, while Hyperliquid's is 0.015%/0.045%. Although the differences may seem small, for high-frequency traders, these basis point differences can lead to significant cost variations after numerous trades.

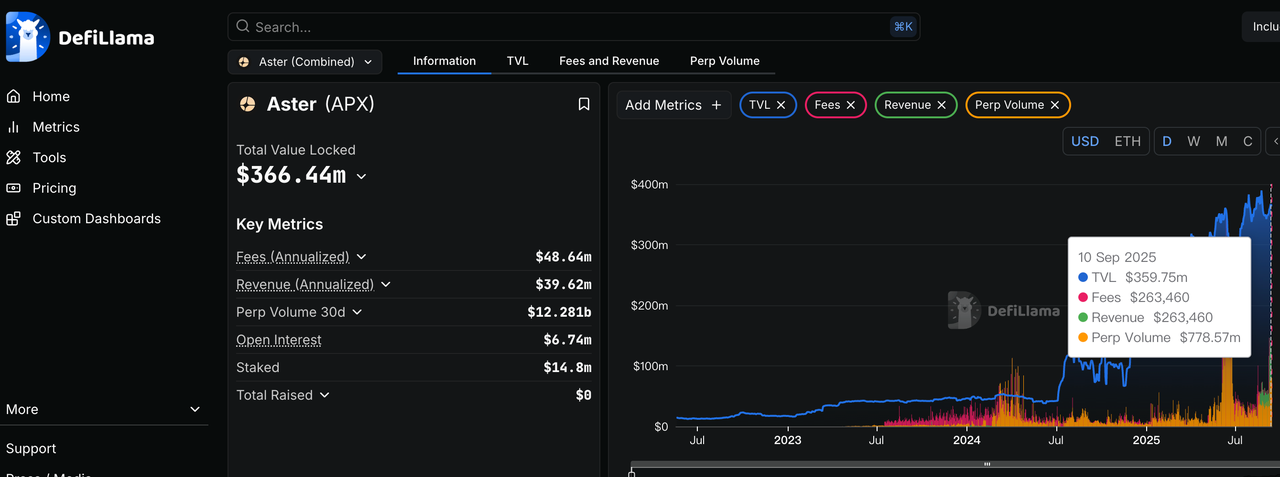

Cross-chain capability is another noteworthy feature. Aster supports more than seven chains, including BNB Chain, Ethereum, Solana, and Arbitrum, allowing users to switch without cross-chain bridging. As of September, the platform's TVL has also reached $360 million, indicating a certain level of market recognition.

It is particularly worth mentioning the US stock perpetual contract feature. Aster offers 24/7 trading of several US blue-chip stocks such as Apple, Microsoft, and Nvidia, fully settled in cryptocurrency.

- ### USDF: Allowing Idle Margin to Earn Interest

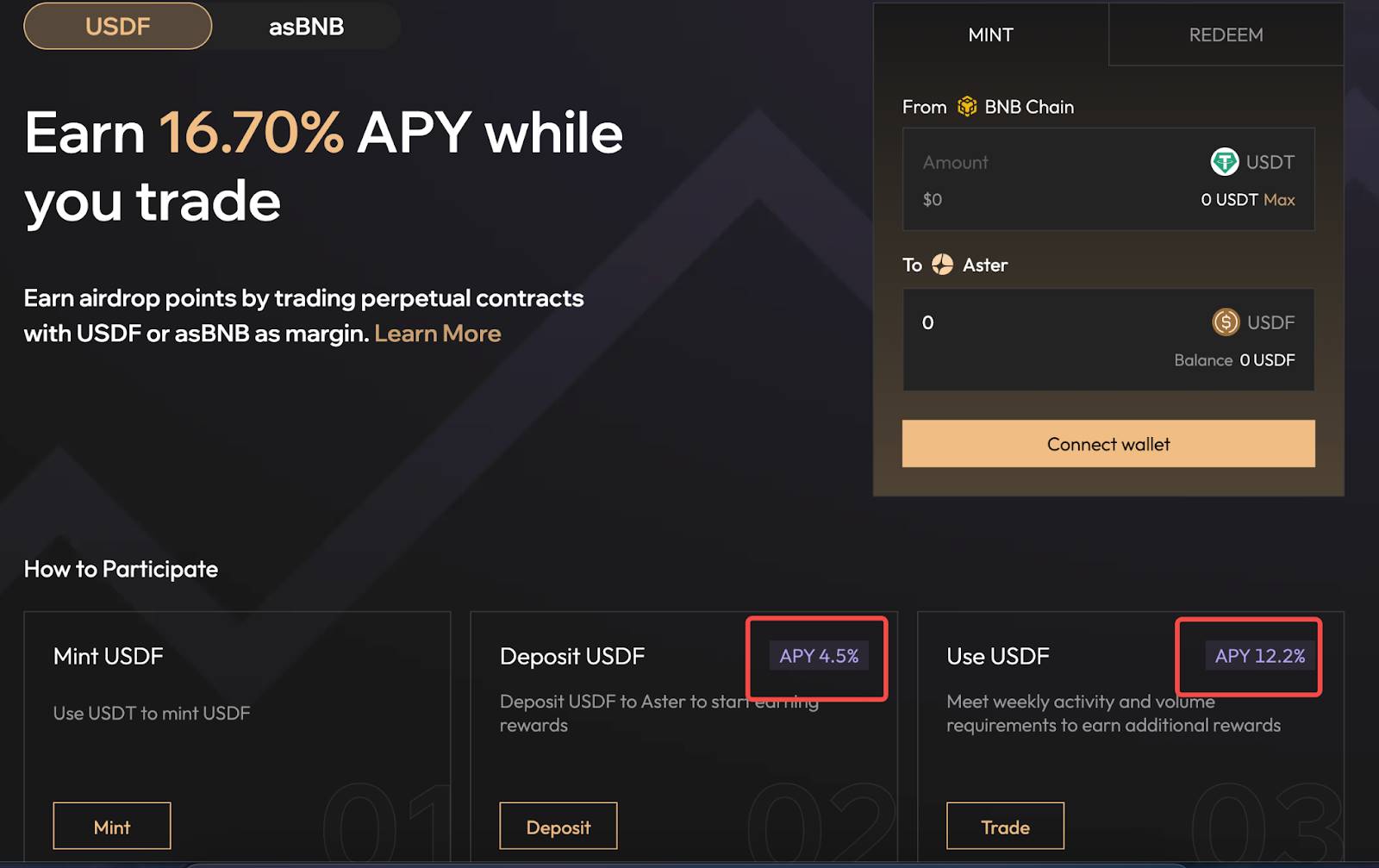

In addition to innovations in trading functionality, Aster's innovations in capital efficiency are also noteworthy. In traditional perpetual trading, USDT or USDC used as margin simply sits idly in the account, generating no returns. However, in Aster, users can choose to use USDF as margin.

What is USDF? In simple terms, it is a delta-neutral yield-bearing stablecoin issued by Lista DAO, generating returns by investing underlying assets into low-risk DeFi protocols.

As an important part of the BNB Chain ecosystem, USDF not only provides users with stable returns but also further strengthens the stability of on-chain TVL.

According to the platform's latest data, the current APY for depositing USDF has reached 4.5%, while the APY for using USDF has reached around 12.2%, which is quite considerable in the current market environment.

It is worth noting that to encourage the use of USDF, Aster grants USDF holders a 20x points bonus in its airdrop points system. Additionally, the Trade & Earn program stipulates that each account can have a maximum of 100,000 USDF participating in trading reward calculations, which encourages adoption while preventing large holders from monopolizing the reward pool.

- ### Hidden Orders: A Privacy Option for Large Traders

After understanding Aster's overall product layout and capital efficiency innovations, let's look at another differentiated feature, Hidden Orders.

Last November, well-known trader James Wynn established a long position worth over $100 million on the Hyperliquid platform, and this massive position was fully exposed on the public order book.

Other traders quickly noticed this "big fish" and began to target his position. Through coordinated price manipulation, they successfully triggered a series of liquidations, and Wynn ultimately lost over $20 million in paper profits.

For institutions and whales that need to execute large trades, being "seen" often means additional costs.

Aster's Hidden Orders feature is based on zero-knowledge proof technology, providing a solution. When traders choose hidden orders in Aster Pro mode, the order information is encrypted through ZK circuits, allowing only the matching engine to verify the order's validity without knowing the specific content. The orders maintain price-time priority but are completely invisible before execution.

This means they can execute large trading strategies on the DEX without worrying about being front-run or maliciously targeted. Traders who value privacy now have a new option.

The DEX Market: A Dominant Player Among Many Strong Competitors

If 2024 is the year of the explosion for perpetual DEXs, then 2025 will be a critical moment for establishing the landscape.

According to dYdX's previous annual report, DEX derivatives trading volume is expected to grow by 132% in 2024, reaching $1.5 trillion, and is projected to reach $3.48 trillion for the entire year of 2025. This growth rate far exceeds that of spot DEXs and has prompted CEXs to take this emerging force seriously.

In this rapidly growing market, different platforms have chosen different development paths.

However, Hyperliquid is undoubtedly the most dazzling star. Aster has chosen a completely different path, focusing on solving another pain point: trading privacy.

This choice is backed by clear market insights. Users of perpetual DEXs can be roughly divided into three categories: retail speculators focus on leverage and fees, professional traders value execution quality and tools, while institutions and whales care most about privacy and market depth. Hyperliquid serves the first two types of users well, but the needs of the third type seem to remain unmet.

According to DefiLlama data, Aster's trading volume over the past 30 days was approximately $16.7 billion, and more importantly, the growth trend is evident.

Aster set a record of $34 billion in monthly trading volume in June 2025, with a cumulative trading volume exceeding $517 billion. This trading volume has firmly placed Aster in the top tier of perpetual DEXs. Considering it only completed its rebranding in March of this year, this growth rate is quite impressive.

From this perspective, Aster's privacy route is not meant to replace Hyperliquid but to carve out a new niche market. When the market is large enough, platforms with different positioning can find their place based on their functionalities. Just like today's CEX market, Binance, Coinbase, and OKX each have their strengths, serving different user groups.

BNB Chain Ecosystem Synergy: Aster is Not a Lone Ranger

In the crypto world, "who invests in you" is often as important as "what you do."

For Aster, the support from YZi Labs (formerly Binance Labs) is not only a trust endorsement but may also determine its future development trajectory.

In March of this year, when Astherus and APX Finance announced their merger to become Aster, the backing from YZi Labs quickly gained market recognition for this "new" brand. After all, in a DeFi world filled with various "innovations," projects with strong backgrounds are more likely to gain user trust.

The more practical value may lie in the potential sharing of ecological resources.

Although YZi Labs has been operating independently, most of its team members come from Binance Labs, and their understanding of the Binance ecosystem and connections have not disappeared. This soft connection may play a role at critical moments, such as when seeking liquidity support or ecological cooperation.

If Hyperliquid has chosen an independent development path, avoiding VC investment and not expanding across other public chain ecosystems, then Aster has clearly opted for an ecological synergy route.

According to public information, Aster has established partnerships with core projects in the BNB Chain ecosystem, such as PancakeSwap, Trust Wallet, and SafePal.

The collaboration with PancakeSwap is particularly noteworthy. As the largest DEX on the BNB Chain, PancakeSwap has billions of dollars in liquidity. Although the specific liquidity-sharing mechanism has not been disclosed, this partnership at least implies potential interoperability of user bases. If PancakeSwap users want to try perpetual trading, Aster would be a natural choice.

The integration with Trust Wallet and SafePal addresses another issue: user access. These two wallets have tens of millions of users globally, and direct integration means these users can seamlessly access Aster within their wallets. This convenience should not be underestimated compared to DEXs that require separate website access.

Perhaps the most interesting collaboration is with Four.meme. Four.meme is a meme coin launch platform on the BNB Chain, and Aster's partnership with it aims to capture the highly active group of meme coin traders. Given that meme coin traders often prefer high-leverage speculation, this user profile matches well.

From the above information, it is clear that Aster's alliance strategy is logically sound: in the world of DeFi, liquidity is the most scarce resource. Rather than building from scratch, it is more efficient to quickly gain initial liquidity and user base through collaboration. While this means sharing some profits, it significantly reduces the difficulty of cold starts.

Another potentially overlooked topic is Aster's previous merger.

Zero-knowledge proofs are theoretically appealing, but their practical application, especially in high-frequency trading environments, requires strong engineering capabilities. This is why, despite ZK technology being discussed for many years, there are still very few cases of large-scale application in DEXs.

Aster's technological accumulation largely comes from the merger. According to official data, Astherus and APX Finance processed over $258 billion in trading volume before merging. This integration of experience, combined with the support from YZi Labs (formerly Binance Labs), provides Aster with a unique development advantage.

Overall, the backing of YZi Labs not only signifies funding but also the potential resources of the entire Binance ecosystem. The integration with platforms like PancakeSwap and Trust Wallet allows Aster to quickly establish a liquidity network, which is one of the biggest challenges most new DEXs face.

It is worth noting that this complete ecological synergy is not unique to Aster.

Other perpetual DEXs are also seeking their own ecological support. Jupiter has the Solana ecosystem, and the previous Vertex had Arbitrum support. This ecological alignment may become a new dimension of competition among perpetual DEXs:

Not just a competition of products and technologies, but also a contest of the ecological resources behind them.

Path to Breakthrough

Aster's opportunity lies in not trying to become the "next Hyperliquid," but in becoming the first Aster. The on-chain DEX market is large enough to accommodate players with different positions.

The key lies in the execution capability within the limited time window ahead.

First, the Hidden Orders feature needs to be genuinely adopted by institutions. This requires not only technical perfection but also market education and trust-building.

Second, the synergy with the Binance ecosystem needs to be realized. Although the official confirmation states that $ASTER will be listed on "major exchanges," the market generally expects it to land on Binance. Given YZi Labs' background, if this happens, whether through direct listing or forms like Launchpool, it would be a significant boon.

First, the actual value of the Hidden Orders feature needs to be validated in real trading. More and more institutional traders are beginning to pay attention to the possibilities of on-chain privacy protection. If Aster can provide stable and efficient hidden order execution, it will naturally attract these users.

Second, the value of ecological synergy needs to be genuinely unleashed.

The portfolio synergy of YZi Labs, liquidity sharing with PancakeSwap, and user access integration with Trust Wallet—if these resources can be effectively activated, they will create a powerful network effect.

The confirmation that $ASTER will be listed on major exchanges is just the beginning; more importantly, it is how to convert these ecological advantages into actual user growth and increased trading volume.

Timing is also crucial. As the institutionalization of the crypto market accelerates, the demand for professional trading tools is growing. If Aster can establish a foothold during this window period and build its own user base, it has the opportunity to secure a place in the perpetual DEX market.

Ultimately, Aster's success may lie in proving that the perpetual DEX market can accommodate multiple models.

The market will provide the answer. In the multiple trade-offs between transparency and privacy, performance and functionality, centralization and decentralization, different choices will attract different users. Hyperliquid has proven the feasibility of the performance route; now it is Aster's turn to validate the value of its own route.

Regardless of the outcome, competition itself is a victory. It drives innovation, offers users more choices, and enriches the entire ecosystem. This may be the most fascinating aspect of DeFi:

There are always new possibilities, and there are always people trying different paths.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。