DBS Franklin and Ripple Bring sgBENJI Fund to XRP Ledger

Ripple Teams up with DBS Bank and Franklin Templeton on Tokenized Trading and Lending Solutions

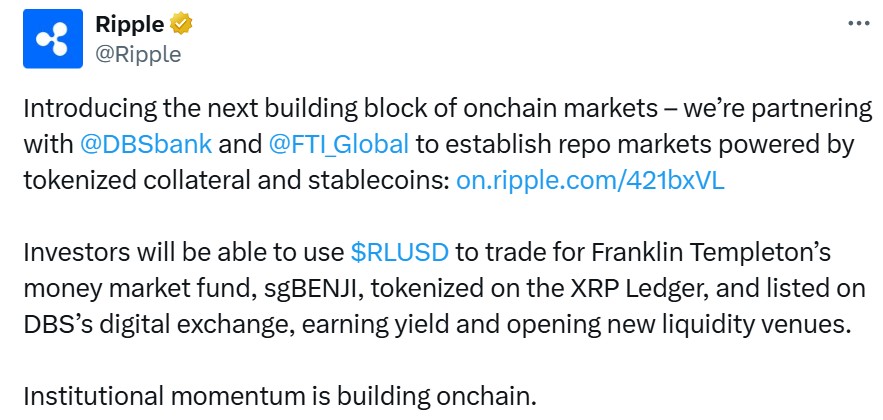

DBS Franklin and Ripple partners to build tokenised trading and lending solitions that let institutional investors trade Franklin Templeton ’s sgBENJI tokenized money market fund for Ripple’s RLUSD stablecoin on the XRP Ledger. The move opens new ways to earn yield and add on-chain liquidity to short-term cash instruments.

Source : Website

What’s the deal

Under the memorandum announced on September 18, 2025, DBS will list the sgBENJI token on its Digital Exchange and make it swappable with RLUSD. Eligible, accredited investors can trade between sgBENJI and RLUSD, earning a yield from the money market fund.

They can later use sgBENJI as collateral in bank-run repo transactions or on third-party platforms with DBS acting as collateral agent. This is designed to speed up settlement and bring 24/7 liquidity to a product that has historically moved on slow rails.

Why this matters now

Tokenised money market funds mixed with compliance-focused stablecoins could change how short-term cash is used. RLUSD was introduced in late 2024 and has grown quickly.

Reports show RLUSD’s combined market cap reached about $244 million in Q1 2025, underscoring early demand for a regulated on-chain dollar rail. Putting sgBENJI on the XRP Ledger aims to use fast, low-cost blockchain rails while preserving fund structure and compliance.

How Institutions Could Use it

Banks and asset managers can use tokenised money market funds as a yield-bearing digital cash bucket. With RLUSD as the on-chain cash leg, institutions could do instant swaps, short-term lending, or repurchase agreements using token as collateral.

That could cut friction, reduce settlement time, and keep liquidity flowing outside standard banking hours. Investors and ops teams will watch custody rules, pricing oracles, and legal wrappers closely.

Franklin Templeton has been active in tokenising cash-like funds and has described tokenised money market funds as a bridge to faster markets. Major banks and asset managers have been piloting similar products as tokenisation gains traction worldwide. This DBS–Franklin– Ripple tie-up comes as regulators and markets adjust to tokenised assets and new stablecoin rules.

What to Watch Next

Key details to follow are which clients qualify, how DBS prices and values sgBENJI on-chain, whether the new token becomes accepted collateral across multiple platforms, and how regulators respond. If it works, more banks and managers may launch tokenised cash products and expand the market for on-chain short-term credit.

Final Thoughts

This partnership links a major Asian bank, a global asset manager, and a blockchain payments firm to bring a familiar product, a money fund onto a blockchain in a way that could speed funding and expand liquidity.

The move is another sign that institutional momentum for tokenised assets is growing and that the rails for on-chain finance are steadily becoming more useful for real-world cash and credit.

Also read: Hamster Kombat Daily Cipher September 18 2025: Play And Win免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。