编译:深潮TechFlow

稳定币已成为去中心化金融(DeFi)不可或缺的一部分,但它们也带来了诸多权衡与挑战。

例如,超额抵押的加密资产支持稳定币(如 DAI)面临波动性风险;中心化稳定币(如 USDC 和 USDT)在储备透明度方面几乎没有保障;算法稳定币(如 UST 或 FRAX)则被证明难以维持稳定。此外,稳定币发行方通常会捕获由支持资产产生的收益,而用户却无法从中获益。

STBL 提出了第四种方案:允许用户通过现实世界资产(RWA)完全抵押的方式铸造稳定币,并保留所产生的收益。STBL将用户的存款分为可支配的稳定币和一个收益型NFT头寸,为持有者提供流动性和可预测的收益。

在本期内容中,我们将深入探讨STBL的架构、其解决的市场问题以及产品的具体运作方式。

什么是$STBL

$STBL 是一种非托管型稳定币,由美国国债或私人信贷支持。与其他解决方案的关键区别在于其三代币设计:$STBL、$USST 和 $YLD。其中 $STBL 为治理代币,两种主要的稳定币工具为:

-

USST:一种完全抵押的稳定币,与美元1:1挂钩,由ERC-20/4626标准发行,可用于链上支付、交换和借贷。USST可用于链上支付、流动性提供、借贷或质押到协议的流动性与铸造池(LAMP)。用户可以随时无罚金赎回其底层抵押资产。

-

YLD:一种ERC-721 NFT,代表持有者对存入资产所产生收益的权利。每个YLD代币根据来自代币化国债、私人信贷或其他固定收益工具的票息支付实时累积利息。NFT设计实现了收益隔离和可通过场外交易(OTC)转让,同时防止散户投机。

(此前,STBL 曾被称为Pi,其中 USI 即为 YLD,USP 即为 USST。)

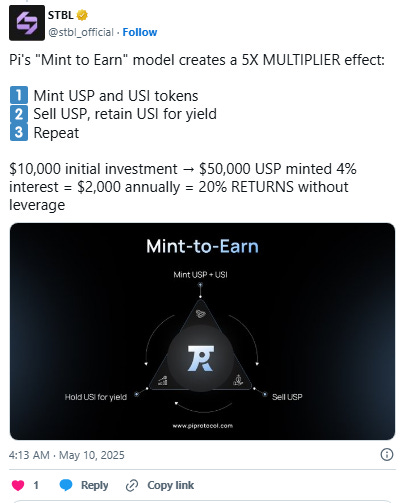

STBL采用了“铸造即赚取”(Mint-to-Earn)模式,通过奖励早期用户的铸造活动比例分发治理代币STBL,从而帮助启动流动性。该模式允许用户通过持有YLD代币赚取被动收益,这些收益来源于现实世界资产(RWA),而非通胀性发行或杠杆操作。用户可以选择多个金库,包括低风险、可预测年化收益率为4-5%的国债金库,或年化收益率为10-12%的高回报私人信贷金库。

STBL还保持透明的费用结构,将所有收益的20%用于确保可持续性。这些费用分配到以下用途:开发的财政储备、吸收违约的损失储备池、奖励质押者的USST,以及为长期锁仓者(sUSST)提供额外收益。

稳定币市场格局与现实世界资产(RWA)的采用

稳定币是数字金融中使用最广泛的资产之一,2025年的流通量已超过2900亿美元。然而,其储备的收益仍然被发行人所获取。

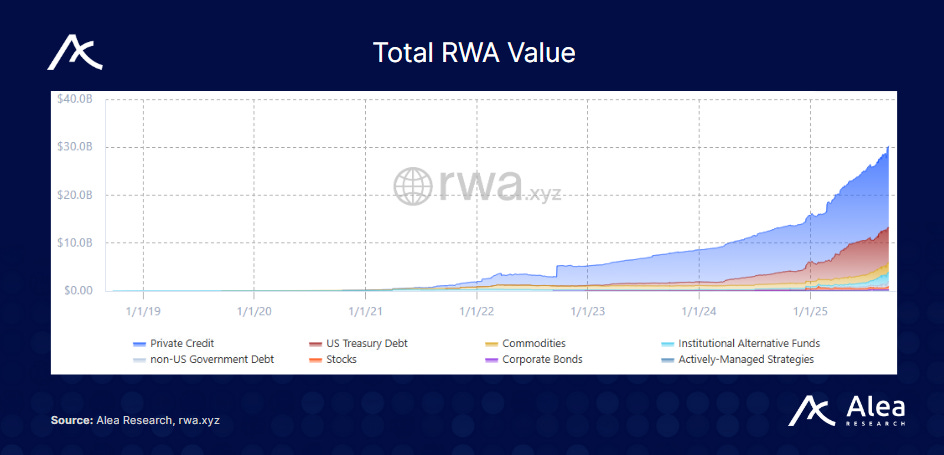

与此同时,代币化国债和其他现实世界资产(RWA)的总锁仓价值已超过300亿美元,反映了链上对受监管、收益型工具的需求增长。STBL将现实世界资产产生的可预测现金流直接引导至稳定币用户,创造了对不稳定算法币和不透明托管模式的可持续替代方案。

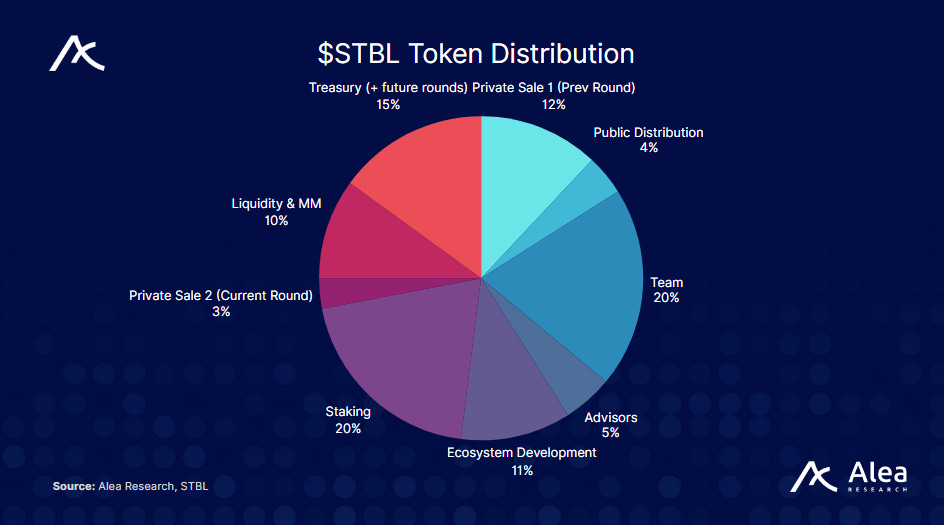

$STBL 代币经济学

$STBL 是一个三资产系统的治理/费用代币,将货币($USST)与收益($YLD)分离。原则上,协议费用(如铸造/赎回、收益路由或拍卖)和参数变更(如预言机、抵押品、代币发行)均由STBL治理决定。

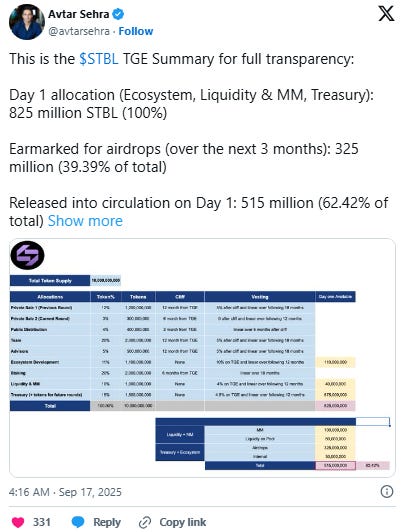

$STBL 总供应量为 100 亿,首日解锁量为 8.25 亿(占供应量的 8.25%)。

代币解锁计划如下:

-

私募 1 / 团队 / 顾问:12 个月的悬崖期(悬崖期后立即释放 5%,之后 18 个月线性释放)

-

私募 2:6 个月悬崖期→12 个月线性释放。

-

公开:3个月悬崖期→6个月线性释放。

-

质押:6 个月悬崖期 → 18 个月线性释放。

-

生态系统:TGE 释放 10%,之后为 12 个月线性释放。

-

流动性与做市:TGE 释放 4%,之后为 12 个月线性释放。

-

财库储备:TGE 释放 45%,之后为 12 个月线性释放。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。