This report is written by Tiger Research, analyzing how Plasma aims to become the "Chrome of stablecoins" by revolutionizing blockchain infrastructure, just as the Chrome browser transformed the web browsing experience by breaking the limitations of Internet Explorer.

1. Do You Really Understand Stablecoins?

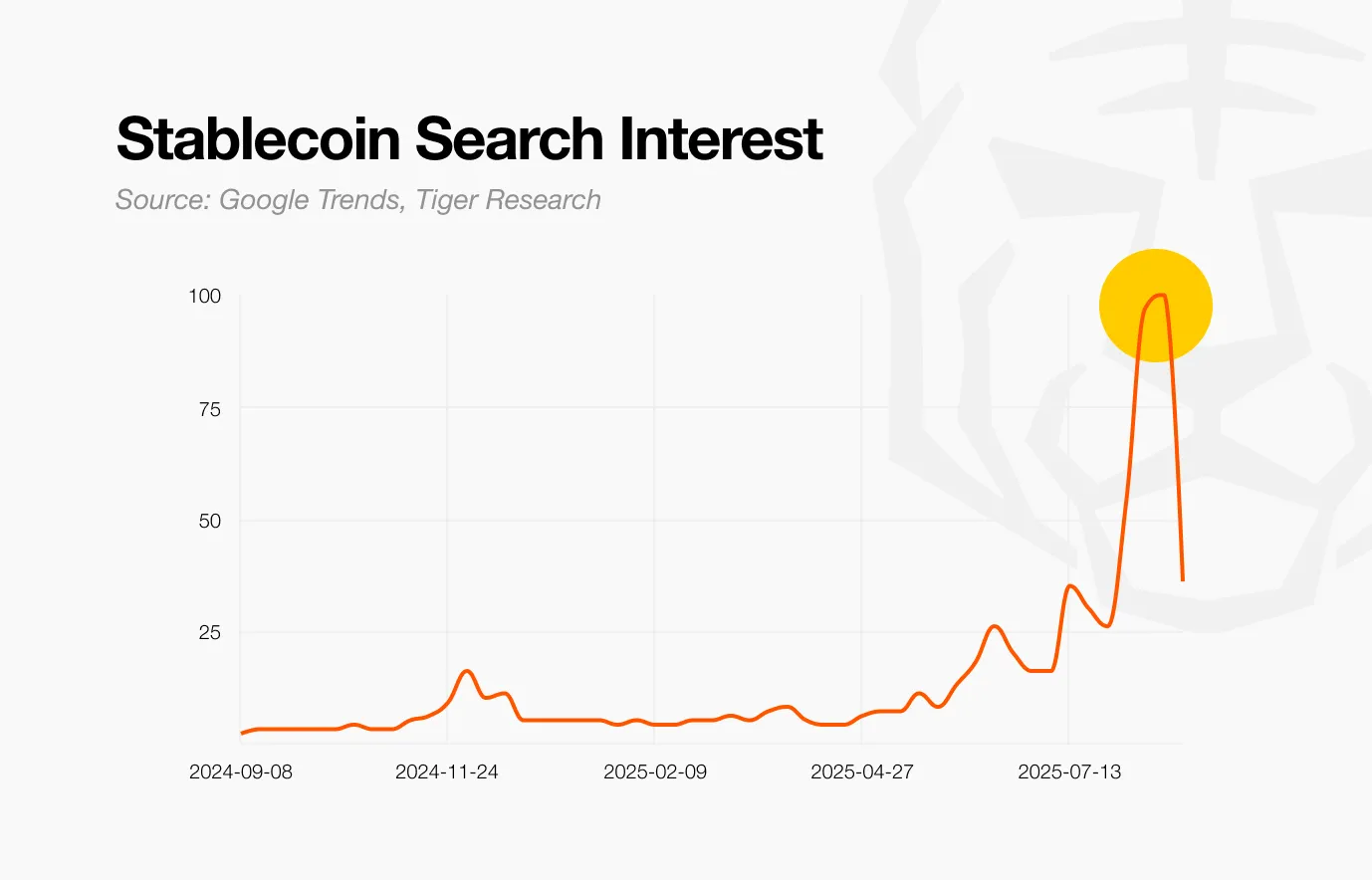

Global interest in stablecoins is rising. However, the distinction between stablecoins and traditional digital payment methods remains unclear to many. This is partly because the digital financial system is already well-known. Credit cards and mobile wallets have long enabled digital transactions.

In this context, the question arises: Do we really understand stablecoins?

Stablecoins are digital assets pegged to fiat currencies (like the US dollar) to maintain price stability. The key difference lies in their reliance on blockchain rather than traditional financial infrastructure. Blockchain supports peer-to-peer transactions without the need for intermediaries, including banks, payment processors, or card organizations.

In the fiat currency system, banks, card companies, and remittance service providers act as multiple layers of intermediaries. Each additional layer of intermediary introduces time delays and higher costs. Cross-border remittances often take days or even weeks to settle, incurring high fees. Transactions are also subject to bank operating hours, excluding weekends and holidays.

Stablecoins eliminate these frictions by directly connecting users on the blockchain network. No approvals or permissions are needed. As long as there is an internet connection, instant transfers can occur anytime and anywhere. Functionally, this is similar to the handover of physical cash, but in a digital, borderless form.

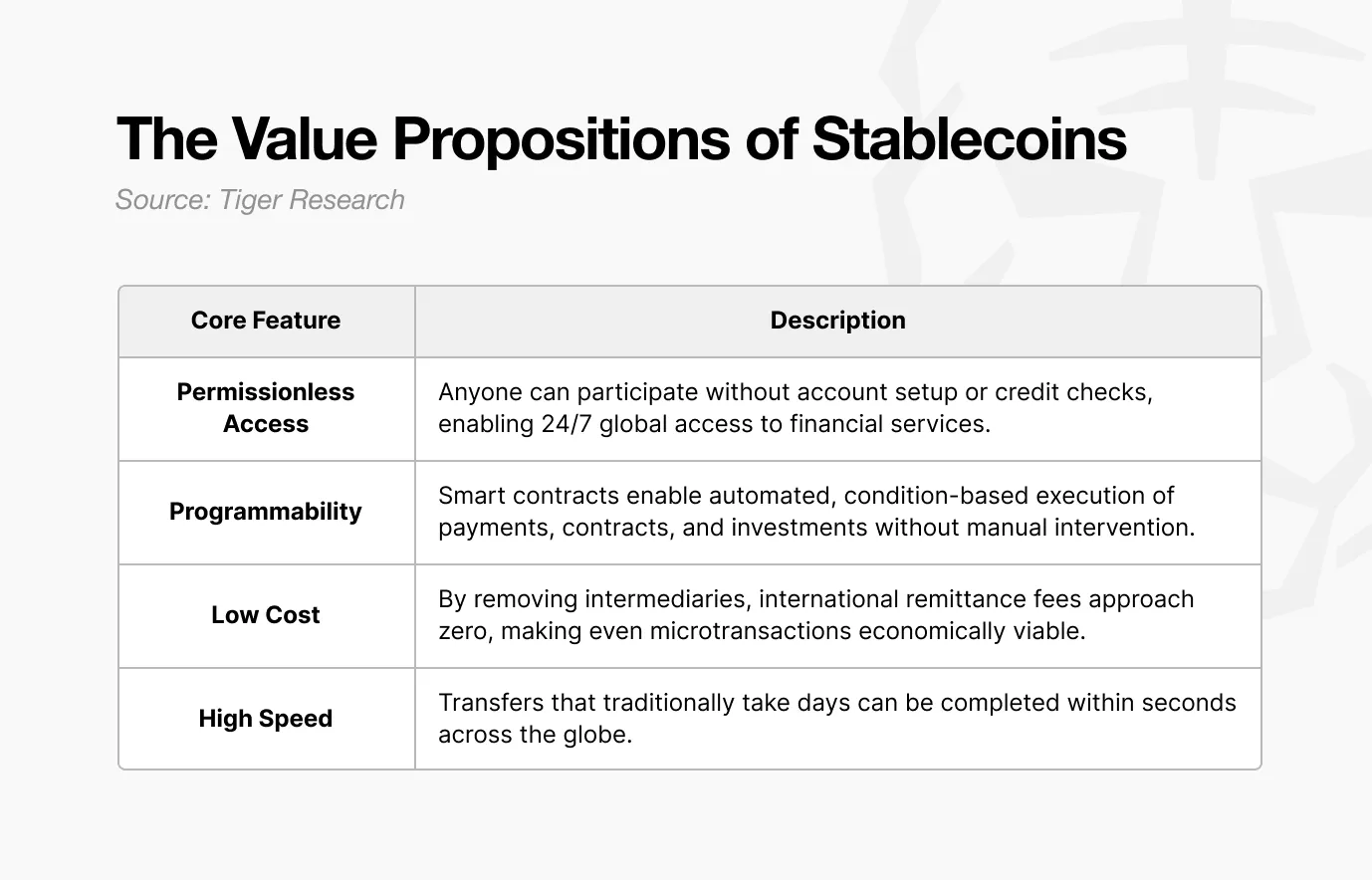

These attributes translate into four core values: permissionless access supports global financial inclusion; programmability enables automated financial processes; low costs enhance efficiency; high speed builds real-time global settlement infrastructure.

These attributes translate into four core values: permissionless access supports global financial inclusion; programmability enables automated financial processes; low costs enhance efficiency; high speed builds real-time global settlement infrastructure.

Consider a demonstrative case: freelancers in Argentina can open digital wallets to store US dollars without bank approval. Smart contracts can then facilitate automatic monthly deposits. Currency exchange costs drop from $10 to $0.1. Within seconds of receiving payment, earnings can be converted to stable dollars, protecting income from inflation.

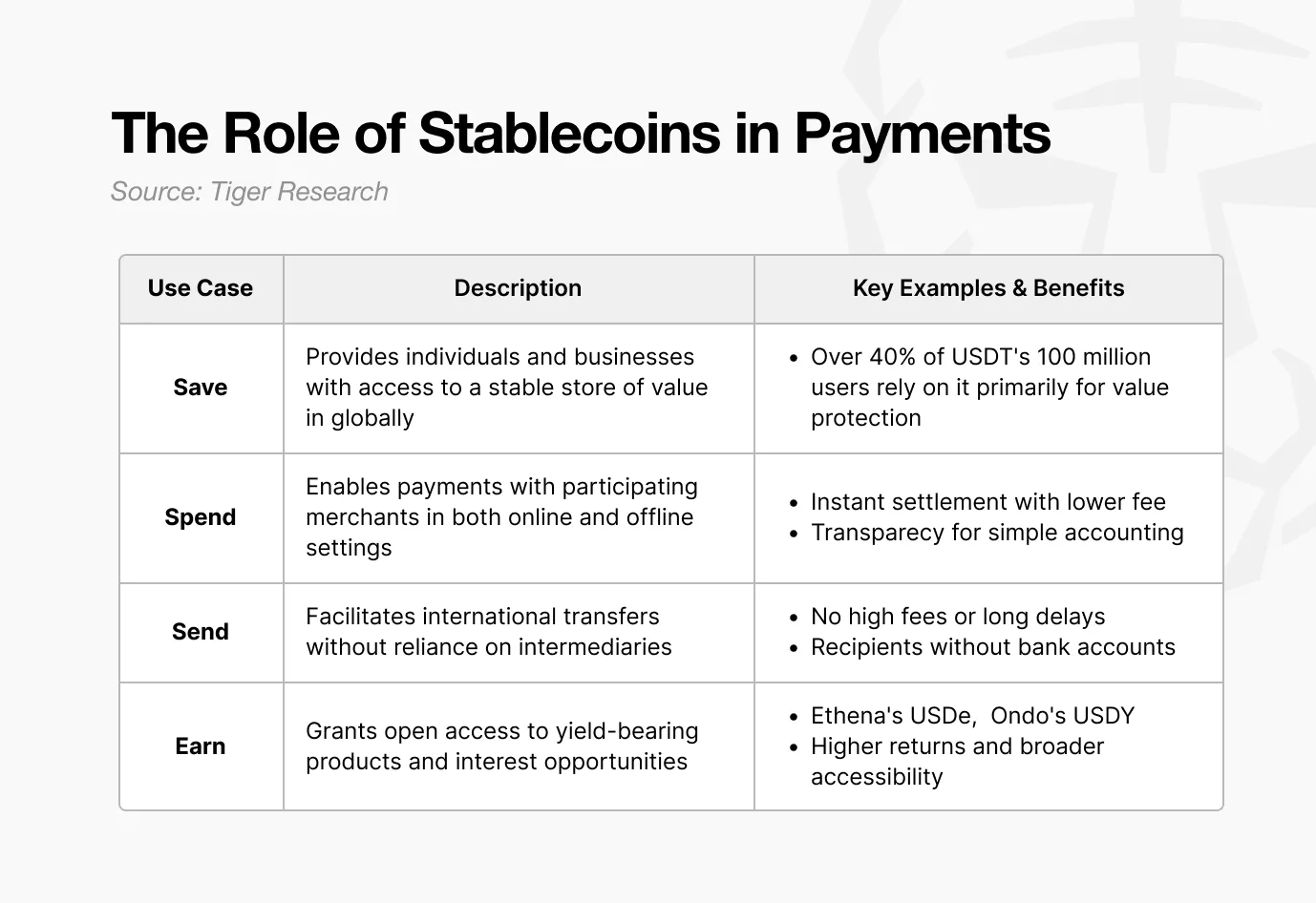

These applications collectively demonstrate how stablecoins break through traditional financial limitations. They provide new ways to store, consume, send, and earn funds.

However, the barriers to adoption remain high. Users must navigate multiple blockchains, manage wallet addresses, secure private keys, and perform cross-chain asset transfers. Each task requires technical expertise that most users lack.

To fully realize the potential of stablecoins, simplifying the infrastructure is crucial. Just as Chrome simplified web access, stablecoins need a similar service layer to achieve widespread availability.

2. Plasma: The "Chrome" Core of Stablecoins

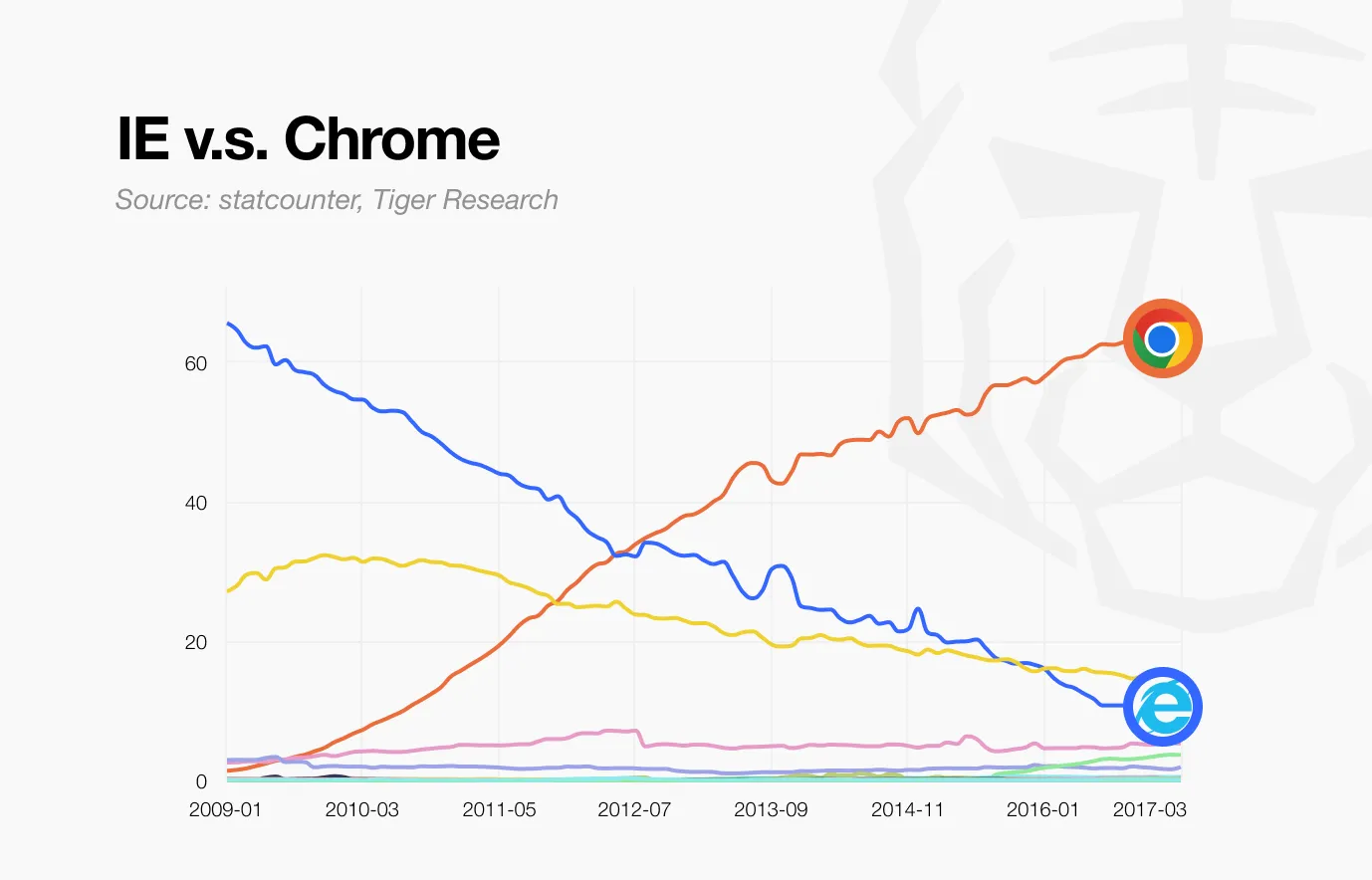

Internet Explorer (IE) popularized web access but suffered from slow speeds, weak security, and poor standards support—despite initially holding 95% of the market share. Users tolerated complex plugin installations, frequent crashes, and sluggish performance because there were no viable alternatives at the time.

In 2008, Google Chrome changed everything. It offered nearly ten times the speed and employed a multi-process architecture to ensure stability. Automatic updates enhanced security. Complex technologies were hidden behind the browser, leaving users with a fast and reliable web experience. Within five years, Chrome surpassed IE to become the global leader.

The stablecoin market faces a similar situation. Existing blockchains support stablecoins but, like IE, have failed to unleash their full potential. Users accept high fees, complex processes, and frequent network congestion as unavoidable costs.

Plasma enters this space as a high-performance Layer 1 blockchain specifically designed for stablecoins. Just as Chrome redefined web browsers, Plasma aims to redefine stablecoin infrastructure.

Source: Plasma

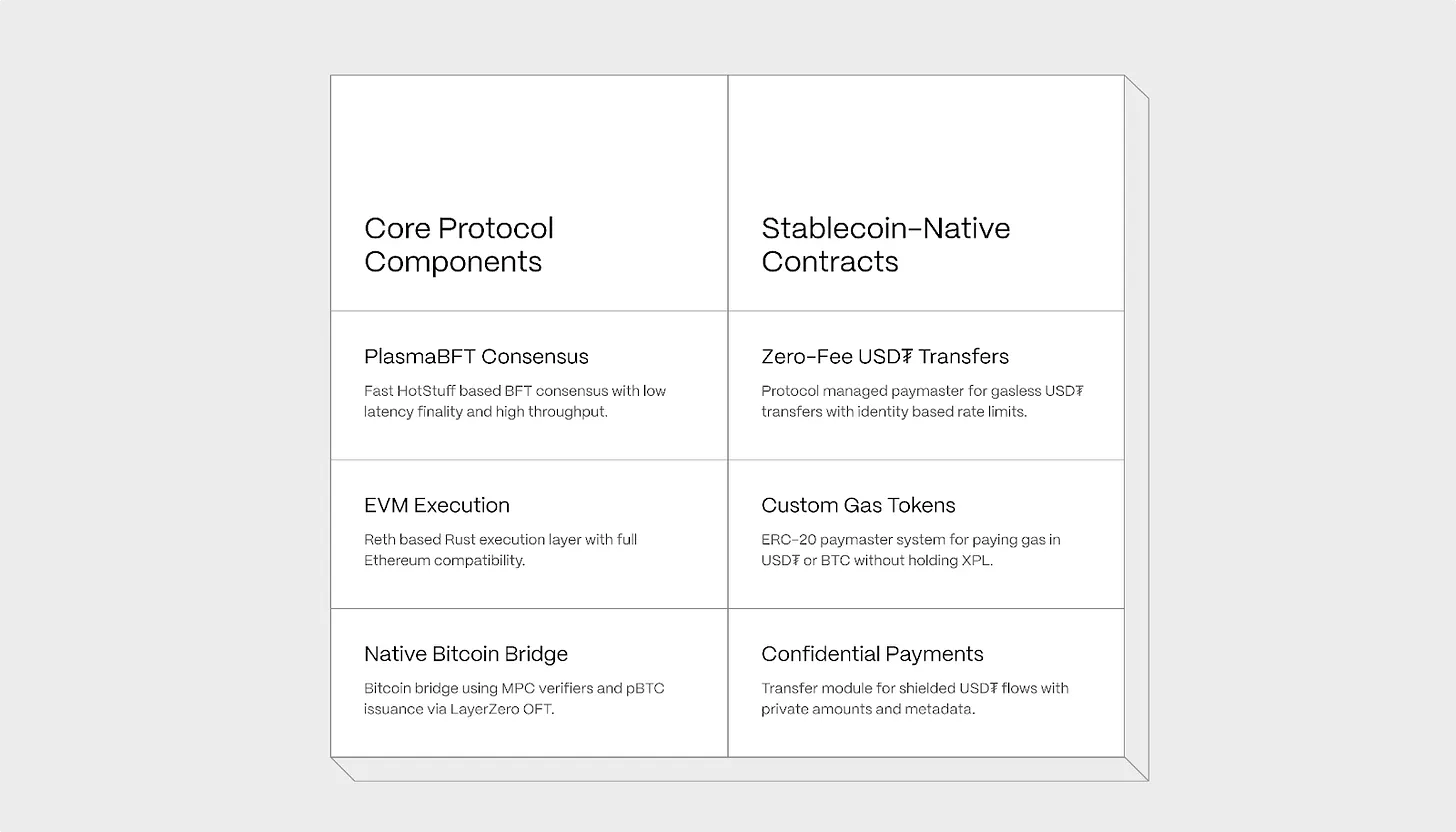

2.1 PlasmaBFT Consensus Mechanism

Traditional blockchains often require minutes or even hours to achieve transaction finality. Sending USD₮ on Ethereum during congestion can involve long delays. Plasma fundamentally addresses this issue. With its novel consensus mechanism, PlasmaBFT, transactions can achieve finality in one second.

The Fast HotStuff algorithm accelerates the consensus process. In short, it ensures participants reach consensus with fewer steps. Multi-signatures from nodes are aggregated, simplifying the verification process. The number of messages exchanged at each step is also reduced. New block proposals can be initiated without waiting for the previous block to complete. The result is an overall increase in throughput. Under optimal conditions, finality can be achieved with just two consecutive proofs.

The analogy with browsers is enlightening. In Internet Explorer, a frozen tab could cause the entire application to crash. Chrome solved this by establishing independent processes for each tab, enhancing stability. Similarly, Plasma optimizes transaction processing, improving the overall stability of the network.

2.2 EVM Compatibility

For developers, the most critical factor is the ability to use existing knowledge and tools without modification. Chrome fully supports web standards, freeing developers from Internet Explorer's compatibility issues. Likewise, Plasma supports all Ethereum applications and tools without requiring code changes.

Developers can work in a familiar environment. Plasma achieves full EVM compatibility through Reth (a high-performance Ethereum client written in Rust). Smart contracts can migrate to Plasma without changing a single line of code, eliminating a major barrier to entry.

The browser analogy is clear: when users switch from IE to Chrome, website functionality runs without adjustments. Similarly, Plasma integrates seamlessly with the existing Ethereum ecosystem.

2.3 Native Bitcoin Cross-Chain Bridge

Plasma is simultaneously developing a Bitcoin cross-chain bridge outside its stablecoin infrastructure. This initiative has two main goals: issuing BTC-collateralized stablecoins and building a Bitcoin-centric financial ecosystem.

In a stablecoin system, the reliability of collateral assets is crucial. Bitcoin, validated over 15 years, is currently the safest digital asset. However, its lack of native smart contract functionality limits its use as direct collateral.

In traditional models, centralized custodians hold Bitcoin and issue wrapped tokens. This model presents two persistent issues: single points of failure and high transaction costs.

Plasma's native cross-chain bridge addresses these limitations by allowing Bitcoin to be directly transferred to the EVM environment, enabling it to be used as programmable collateral.

This approach expands Bitcoin's role in financial applications while retaining its security guarantees. It also integrates Bitcoin into the DeFi ecosystem, allowing users to store BTC while using stablecoins like USDT for transactions, thus advancing a Bitcoin-driven financial environment.

2.4 Zero-Fee USD₮ Transfers

Zero-fee USD₮ transfers are a core feature that enables Plasma to operate as stablecoin infrastructure. Just as Chrome disrupted the browser market with free access, Plasma promotes stablecoin adoption through free transfers.

Users only need to hold USD₮. The system-level payment mainnet covers transaction fees. This policy applies only to official USD₮ token transfers. Basic identity verification and transfer limits prevent abuse.

In practice, the Plasma Foundation allocates a budget to cover Gas costs. Users can complete all transactions using only USD₮ without any Gas fees.

2.5 Custom Gas Tokens

Traditional blockchains limit fees to native tokens. Ethereum requires $ETH, Polygon requires $POL, and Tron requires $TRX. Users must manage tokens other than USD₮.

Plasma eliminates this friction. Users can pay fees directly with familiar assets like USD₮ or BTC. After selecting a token from an approved list, trusted oracles set fees based on real-time exchange rates.

2.6 Privacy Payments

A core feature of blockchain is transaction transparency. Anyone can view the amount, sender, and receiver. While this ensures openness, it limits privacy. In contrast, traditional finance protects privacy but relies on regulatory oversight.

Plasma is exploring a privacy payment module that selectively applies as needed. Just as Chrome offers a choice between normal and incognito modes, transactions can remain public or private based on the context.

On a technical level, the recipient's identity is hidden through a one-time address, and transaction details are encrypted in a memo. This system operates in the EVM environment, ensuring DeFi compatibility.

Importantly, regulators can still access information when needed for anti-money laundering or tax compliance. This balance achieves privacy without sacrificing regulatory standards.

3. Plasma: Current Status and Future

Plasma is currently gaining strong market attention. The XPL token sale ended within minutes. The activity amount on Binance Earn reached $1 billion, quickly closing after attracting over 30,000 participants. However, maintaining growth requires more than just a technological advantage. A broader strategic approach is crucial.

Chrome's success provides a useful reference: initially, Chrome attracted users with its superior speed and performance, but its true growth engine was the expansion of its ecosystem. Everyday tools like MetaMask and DeepL run seamlessly on Chrome, transforming it from a browser into a digital platform.

Plasma follows a similar trajectory. Currently, it focuses on core infrastructure ahead of its mainnet launch. Zero-fee transfers and EVM compatibility are akin to Chrome's speed advantage. But the decisive phase lies ahead.

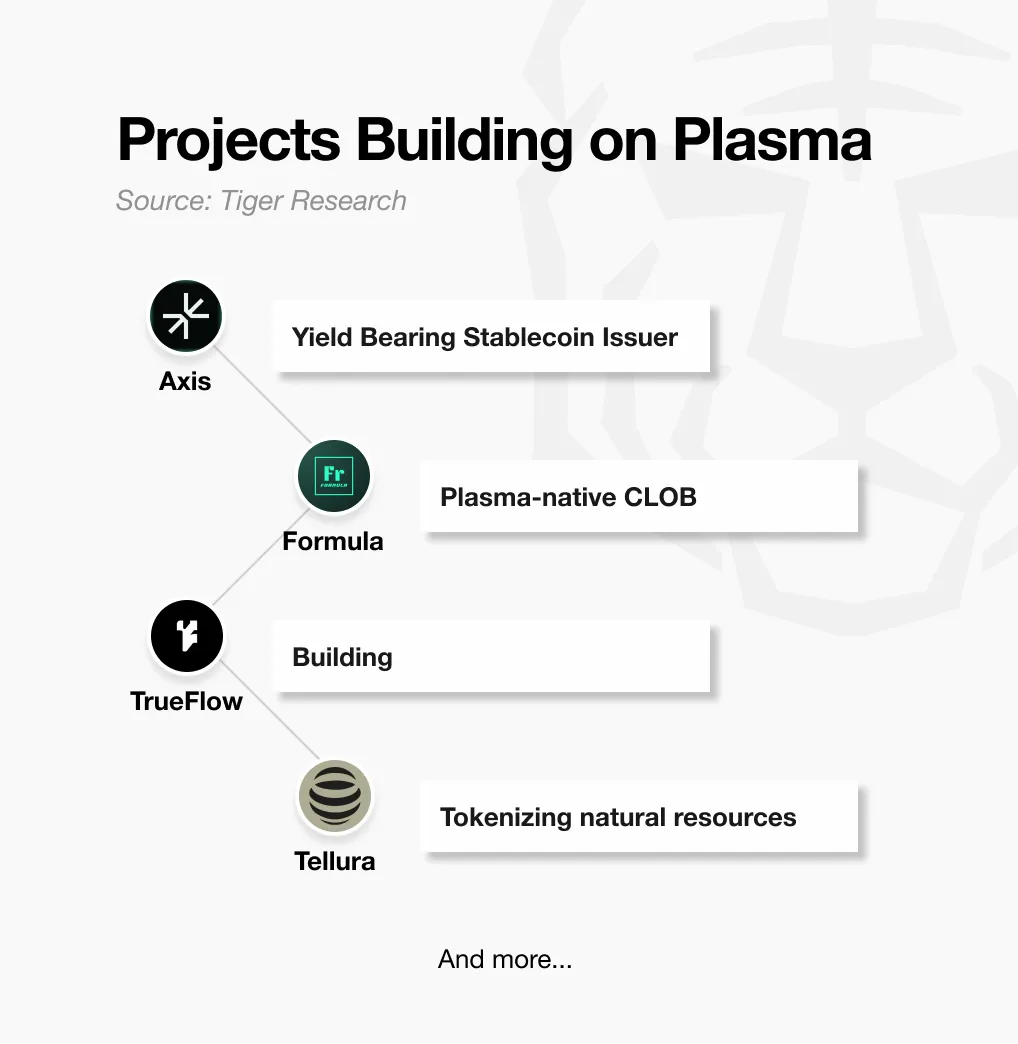

Plasma understands the importance of ecosystem development. Collaborations with top DeFi protocols like AAVE, Pendle, and Ethena affirm this commitment. Through the community builder program, it actively recruits developers. These early investments lay the foundation for diversified services, resembling Chrome's extended ecosystem.

The real potential lies in unlocking new service areas: high fees have previously hindered use cases such as microloans, real-time wage payments, and micropayment-based content services. With Plasma, these become economically viable. As such services emerge, Plasma's utility and user base will significantly expand.

Ultimately, Plasma seeks to achieve a transformation equivalent to what Chrome brought to the internet: complex technology hidden behind the scenes, with a user experience that is simple and intuitive. To mature stablecoins into true digital currencies, usability rather than technical complexity will be the decisive factor.

Plasma is precisely aimed at becoming the "Chrome of stablecoins."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。