The TRON ecosystem has built a complete stablecoin system consisting of USDT (settlement layer), USDD (yield layer), and USD1 (compliance layer).

In September, the crypto market has reignited. The leading decentralized derivatives protocol Hyperliquid has prominently launched its native stablecoin USDH, announcing another strong player joining the fray.

Once, the stablecoin arena was a simple script of the "duopoly" between USDT and USDC. But today, the landscape has completely changed. Stablecoins are no longer just "tool coins" used by traders to avoid volatility; their identity has evolved into the underlying liquidity of the entire crypto financial system.

When we examine the entire stablecoin ecosystem, TRON is an absolutely indispensable presence. With its high throughput and low fee network characteristics, TRON has long become the main battlefield for the issuance and circulation of stablecoins, especially USDT. Meanwhile, the TRON ecosystem has also laid out the decentralized stablecoin USDD and deeply integrated with the compliant stablecoin USD1, forming a complete stablecoin matrix that covers payment settlement, decentralization, and compliance needs, making it a crucial pillar in the current stablecoin landscape.

So, why have stablecoins become the core infrastructure that all top protocols are vying for? Is the future heading towards diversified coexistence, or will it once again form a monopolistic situation? On September 16, during a special roundtable AMA co-hosted by SunPump and 1783DAO, several industry veterans engaged in deep discussions on this topic. This article will take you through the exciting viewpoints and intellectual collisions from this event.

Why are stablecoins the battleground of the Crypto world?

"The most fascinating aspect of the stablecoin arena is that it is essentially one of the two most profitable businesses in the entire crypto field, just like exchanges," Block Tiger pointed out incisively during the roundtable discussion. "Issuing stablecoins is equivalent to establishing a central bank in the crypto space." Taking the TRON stablecoin ecosystem as an example, the USDT issued on the TRON network has long accounted for over 50%, firmly holding the global first place, and is widely used for high-frequency transfers and cross-border payments worldwide, fully demonstrating the immense value of the stablecoin business. Block Tiger finally highlighted the key factors for the success of the stablecoin business: user scale and use cases, both are indispensable.

Amber analyzed from a business essence perspective: "Stablecoins are like a faucet; as long as you grasp the settlement aspect, you can continuously generate cash flow. The closer the business is to settlement, the more profitable it is." She pointed out that stablecoins, in addition to obvious interest income, also contain the enormous potential to replay all traditional financial plays on-chain.

Web3 Miya added from practical application scenarios: "Stablecoins are essential because they are the best bridge connecting the traditional world and the crypto world." Comrade Jianguo also pointed out that the current annualized yield of 10-12% provided by stablecoins is a highly attractive entry opportunity for traditional-sized funds.

In this chess game revolving around profitability, strategic position, user base, and regulatory compliance, various forces are fiercely competing. Whether it is new players like Hyperliquid or veterans like TRON that have built a complete ecosystem, all are striving to find breakthroughs in this challenging and opportunity-filled red sea.

Intense competition in stablecoins: diversified coexistence or winner-takes-all?

Regarding the current competitive landscape, the roundtable guests unanimously believe that the stablecoin market will present a pattern of multiple coins coexisting and several oligarchs in the future, rather than an absolute winner-takes-all situation. K1KO made a clever analogy using the history of internet development: "Just like in the mobile payment era, WeChat and Alipay occupy 90% of the market, but Douyin and JD also want to do payments; in the browser field, there are Chrome and Firefox, but also Quark and UC Browser." He pointed out that different vertical scenarios will have their own kings. Amber agreed and added, "For now, USDT is still the dominant player due to its scale and the depth of derivatives that have formed a usage inertia, but there will always be a leading stablecoin in different scenarios."

In this diverse ecosystem, the TRON ecosystem has built a complete three-layer stablecoin strategic system, forming a complete product matrix that covers payment settlement, decentralization, and compliance needs. This multi-layered layout perfectly aligns with the future trend of layered and scenario-based coexistence in the stablecoin market.

l First Layer: USDT—The Core Infrastructure Dominating the Market

The TRON network has become the primary issuance and circulation network for USDT. Data from September 5 shows that the market value of stablecoins on the TRON chain exceeds $83.3 billion, with the issuance of TRC20-USDT exceeding 82.6 billion, firmly holding the global first place. Currently, the number of accounts holding USDT on the TRON chain exceeds 68 million, fully demonstrating its adoption level globally and highlighting the leading position of the TRON network as the core infrastructure for stablecoins.

With TRON's low fees and high throughput network characteristics, TRC20-USDT has become the preferred choice for many cross-border payment and daily transaction scenarios, widely used in financial trusts, communication transfers, travel settlements, and cross-border payments, and gaining support from more mainstream platforms.

l Second Layer: USDD—Innovative Breakthrough of Decentralized Stablecoins

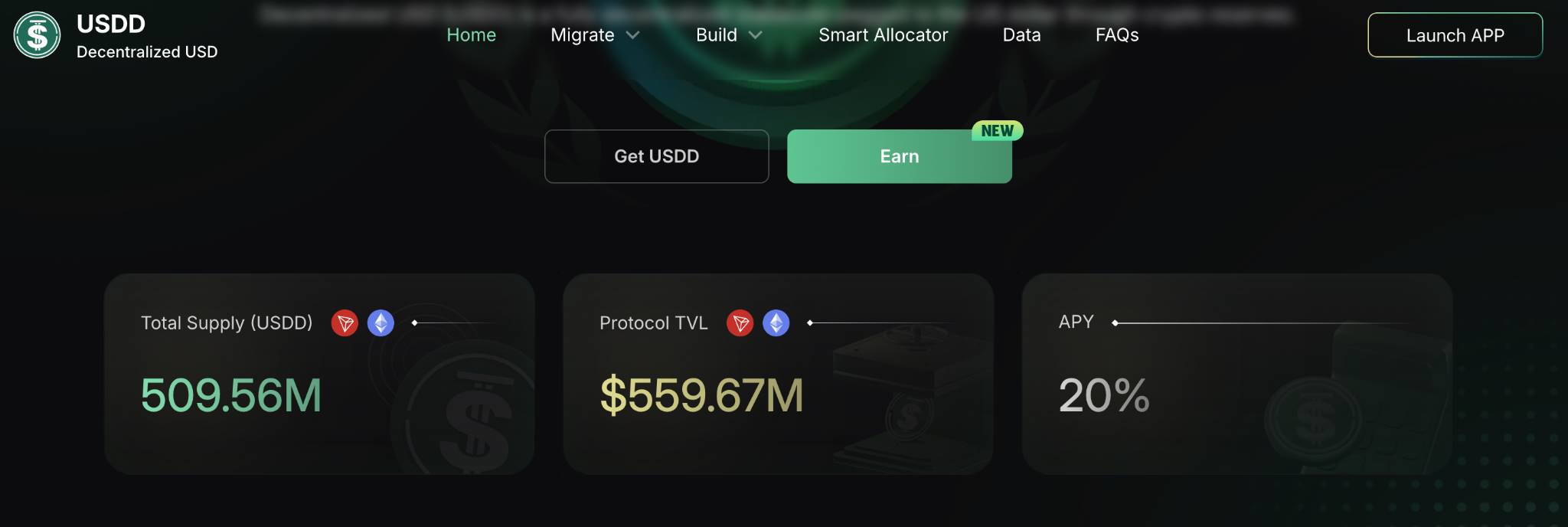

As a "dark horse" in the decentralized stablecoin market, USDD has maintained long-term stable operation and rapid growth since its launch. Its iterative 2.0 version went live in January this year, achieving a circulation volume of over 100 million within two weeks, showing a rapid growth momentum. Currently, the supply of USDD 2.0 has surpassed 500 million, with an APY (annual percentage yield) as high as 20%.

On September 8, USDD was officially natively deployed on Ethereum, and a reward activity with up to 12% APY was launched on the Ethereum mainnet. This move marks the beginning of USDD's expansion into a multi-chain ecosystem, injecting new vitality into the decentralized stablecoin market.

l Third Layer: Integrating USD1—Strategic Layout for Compliance Development

USD1, a compliant dollar stablecoin issued by the Trump family-associated project WLFI, has rapidly gained market recognition since its launch in March this year due to its "high transparency and strong compliance." As of September 17, the circulation of USD1 has exceeded $2.6 billion, making it the sixth-largest stablecoin globally.

It is worth noting that the TRON ecosystem has completed the full process deployment of USD1 from technical access to DeFi infrastructure integration. On June 11 of this year, USD1 officially began minting on the TRON network, with an initial minting volume of 1,000, marking USD1's formal integration into the TRON ecosystem. On July 7, the one-stop decentralized exchange SUN.io in the TRON ecosystem was the first to launch multiple USD1 trading pairs, providing users with convenient trading channels. Following that, on August 19, the lending protocol JustLend DAO fully supported USD1 deposits and loans, greatly expanding the yield application scenarios for this stablecoin.

As of September 17, the issuance of USD1 on the TRON chain has surpassed 54.47 million, with a 24-hour trading volume exceeding $350 million, and the number of holding addresses exceeding 20,000, with over 88,000 total transactions on-chain. This series of data fully demonstrates the rapid growth of USD1's liquidity and user acceptance within the TRON ecosystem, showcasing its enormous development potential as a new generation compliant stablecoin, injecting diverse vitality into the TRON stablecoin ecosystem.

Through this three-layer stablecoin system, TRON has formed a powerful synergy: USDT provides liquidity and market coverage, USDD drives decentralized innovation, and USD1 meets compliance needs. This multi-layered layout allows TRON to maintain competitiveness under different market environments and regulatory requirements, providing users with comprehensive stablecoin solutions.

As the stablecoin market continues to develop, the strategic layout of the TRON ecosystem is showing increasing value. Whether it is the entry of new players like Hyperliquid USDH or the participation of traditional financial institutions, the ecological advantages that TRON has established have positioned it favorably in the future competition of stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。