Author: Frank, PANews

Previously, PANews conducted an analysis on the correlation between the activity characteristics of tokens on Binance Alpha and their market performance. The research found that the best-performing tokens on Binance Alpha share several characteristics: they have launched Binance contract trading, have not launched spot trading pairs, have not participated in airdrop activities, and are issued on the BSC chain. However, simply knowing "which" tokens perform well is not enough; the more critical question is "why." This purely historical data-based filtering is akin to carving a boat to seek a sword.

Therefore, this article will delve into the core of these 26 projects, analyzing their respective technologies, narratives, and ecological niches, aiming to penetrate the surface and reveal the true drivers behind their price increases, while exploring the popular tracks and core values that will lead the next market cycle.

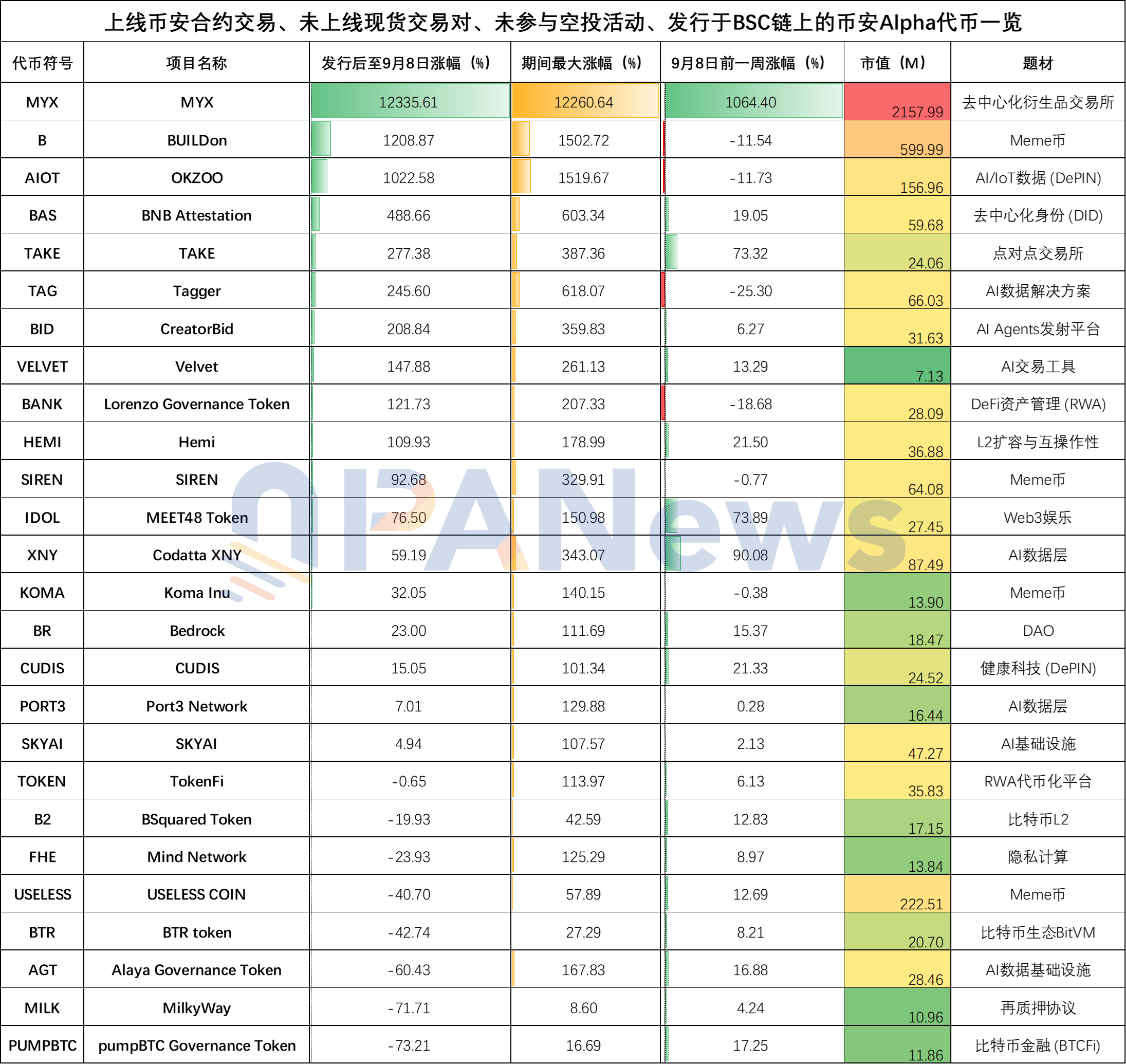

The following table provides some basic information about these 26 tokens (as of September 8):

Overall, not all tokens that meet these characteristics are in a rising state; among them, 8 tokens fell below their launch price after going live on Binance Alpha. The largest drop even exceeded 70%. Additionally, the overall characteristic of these tokens is that they are generally from projects with real applications, and a significant proportion of them are related to AI. In contrast, the relatively lively MEME coins in the previous market appear scarce on this list, with only 4, and they are mostly well-known or have clear endorsements.

In terms of market capitalization distribution, the average market cap of these tokens reached $147 million, with the lowest market cap being $7 million.

Here is a brief introduction to these projects:

DeFi & RWA Related:

MYX Finance (MYX): A decentralized exchange (DEX) focused on perpetual contract trading. The project is supported by venture capital firms including Sequoia, Consensys, and Hack VC.

Velvet (VELVET): A DeFi asset and portfolio management operating system integrated with AI and intent-driven architecture. According to official information, the project is a candidate for the MVB V incubation project on the BNB Chain. Velvet offers services including native user applications, proxy TG bots, easy-to-integrate APIs, and a DeFAI operating system for proxies.

MilkyWay (MILK): A modular staking hub designed for various blockchain networks. Its main goals are to provide "shared security" for developers building new projects and to offer a customizable "re-staking" layer protocol.

TokenFi (TOKEN): A no-code tokenization platform for creating crypto assets and tokenizing real-world assets (RWA). It allows users to quickly launch tokens (ERC-20/721) through a web interface or Telegram/Discord bot without programming knowledge.

Lorenzo Governance Token (BANK): A decentralized asset management platform focused on institutional-grade yield products. It creates "on-chain trading funds" that integrate RWA, quantitative strategies, and DeFi protocol yield products. The platform's flagship product is an on-chain yield product combined with USD1.

AI Related:

Alaya Governance Token (AGT): A distributed AI data collection and labeling platform that crowdsources high-quality AI training data.

Port3 Network (PORT3): A decentralized unified AI operating system. Its main products include a machine learning dedicated computing network, cross-chain execution layer, data aggregation layer, and a complete proxy market. The project's main goal is to simplify the development and deployment process of AI applications by integrating necessary infrastructure.

Mind Network (FHE): A fully encrypted security layer for Web3 and AI built using fully homomorphic encryption (FHE) technology. Its core technology, FHE, allows computation on encrypted data without decryption, addressing critical privacy and security issues.

Tagger (TAG): A Web3 infrastructure project aimed at managing AI digital content metadata through a decentralized tagging system. It incentivizes users to provide accurate content tags through token rewards and employs a hybrid mining model that combines proof of work and proof of contribution.

CreatorBid (BID): A decentralized ecosystem empowering creators and AI agents. It features an AI agent launch platform that allows tokenization and launching of AI projects through bonding curves.

Codatta XNY (XNY): A decentralized multi-chain AI knowledge protocol aimed at transforming data into verifiable and valuable digital assets. Its core is a royalty model that allows data contributors to earn ongoing royalty income from AI and decentralized science (DeSci) projects using their data.

MEET48 Token (IDOL): A Web3 entertainment ecosystem that combines AI, the metaverse, and fan-driven governance. It collaborates with the real-world idol group SNH48 GROUP, which has over 30 million fans, to merge traditional idol culture with Web3 technology.

SKYAI (SKYAI): An AI infrastructure project that enhances the interaction capabilities of large language models (LLM) with blockchain. Its core technology is "Extended MCP," which enables LLMs to access and aggregate on-chain data in real-time for autonomous decision-making.

MEME Related:

SIREN (SIREN): SIREN is a meme coin launched on Four.Meme. The narrative behind the project is a token analyst combined with AI.

USELESS COIN (USELESS): A satirical meme coin launched on the Solana blockchain.

BUILDon (B): A MEME coin themed around the USD1 mascot.

Koma Inu (KOMA): A community-driven dog-themed meme coin issued on the BSC chain.

BTC Ecosystem:

pumpBTC Governance Token (PUMPBTC): A multi-chain liquidity staking protocol (BTCFi) for Bitcoin. It allows users to stake various forms of wrapped Bitcoin (such as WBTC, BTCB) to earn yields.

Hemi (HEMI): A Layer-2 scaling and interoperability protocol. It treats Bitcoin and Ethereum as components of a single "super network" to scale both and enhance their utility.

Bitlayer (BTR): A Bitcoin Layer 2 network designed to leverage Bitcoin's security to support smart contracts and decentralized applications (dApps), thereby expanding Bitcoin's functionality. Bitlayer has received support from several top investment institutions, including Franklin Templeton, Polychain Capital, OKX Ventures, and ABCDE.

Bedrock (BR): A multi-asset liquidity re-staking protocol focused on bringing assets like Bitcoin and Ethereum into DeFi.

BSquared Token (B2): A Layer 2 solution that extends Bitcoin's functionality. It utilizes zero-knowledge proof (ZK-rollup) technology to achieve compatibility with the Ethereum Virtual Machine (EVM) while maintaining Bitcoin's security, thus supporting smart contracts and DeFi applications.

Others:

BNB Attestation (BAS): A decentralized identity (DID) and data verification protocol. It provides a standardized, decentralized infrastructure on the BNB chain for creating and verifying digital proofs (i.e., "attestations") to address the trust deficit in Web3.

CUDIS (CUDIS): A blockchain-driven health longevity protocol, belonging to the health tech and DePIN fields. Through a "health is mining" model, users can track health data using smart wearable devices like the CUDIS Ring to earn token rewards.

TAKE (The Giving Block): A peer-to-peer (P2P) trading market for game assets that connects Web2 and Web3, aiming to bring traditional player communities into the on-chain economy through partnerships with established platforms like ItemBay and ItemMania.

OKZOO (AIOT): A decentralized AIoT (Artificial Intelligence of Things) project aimed at addressing key issues in traditional environmental data monitoring, such as insufficient coverage, delayed data updates, and difficulty in verifying information authenticity.

Summary:

Through the analysis of these projects, we seem to gain some insights, such as the selection criteria for potential tracks or a re-evaluation of Binance Alpha.

Firstly, the market feedback from Binance Alpha shows us that purely cultural or trendy MEME tokens are no longer leading the market. Instead, some projects with practical uses or innovations have taken their place. Perhaps Binance is intentionally guiding a positive shift from MEME to practical value in its token listings.

For Binance Alpha (not limited to Binance, but also including similar products launched by other exchanges), in addition to frequent airdrops and point accumulation, it may be worthwhile to consider such lists as a thematic library for project selection. Paying attention to the content of these listed projects may provide some reference value for long-term investments or those looking to bet on future directions. After all, from the content and background of these projects, they generally exhibit innovation and good endorsements, although most of these projects are still in their early stages and carry significant volatility risks.

From the distribution of themes, we can see a larger number of AI-related projects and those connected to reality, as well as 5 projects surrounding the Bitcoin ecosystem. This somewhat reflects Binance's enthusiasm for betting on the upcoming popular tracks.

Finally, it should be noted that this research is primarily aimed at providing ideas rather than investment advice. Most of the information about these projects comes from their official content disclosures, and the market data is based on previous historical data. Moreover, many of these projects have not performed well in the market, and specific situations and future developments require further research and validation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。