Original Title: Avantis: The Universal Leverage Layer - What You Need to Know

Original Source: Alea Research Daily Newsletter

Original Translation: Zhou, ChainCatcher

Rhythm Note: From September 10 to 15, Avantis (AVNT) successively launched on several leading trading platforms such as Coinbase, Upbit, Bithumb, and Binance. After going live on Binance on the 15th, the price of the coin briefly surpassed $2, with a daily increase of over 100%.

Avantis allows users to use stablecoins as collateral for trading cryptocurrencies, foreign exchange, commodities, and indices. Since its mainnet launch in February 2024, Avantis has grown to become the largest derivatives trading platform in the Base ecosystem. This article provides a detailed introduction to Avantis, and BlockBeats reprints the original text as follows:

Synthetic derivatives, decentralized oracles, and composable liquidity protocols enable traders to access everything from Bitcoin and ETH to gold and foreign exchange using stablecoin collateral.

Since Avantis launched on the mainnet in February 2024, it has become the largest derivatives trading platform on Base and the largest DEX in the field of RWA trading and market making.

The protocol has processed over $18 billion in trading volume and executed over 2 million trades for more than 38,500 traders. Avantis has a total value locked (TVL) of $23 million across over 25,000 LPs and more than 80 markets, solidifying its position as a center for perps.

This article will explore Universal Leverage, the architecture of Avantis, and the launch of $AVNT.

Introduction to Avantis

Avantis is a perps DEX that allows users to trade cryptocurrencies, foreign exchange, commodities, and indices using stablecoin collateral. The protocol abstracts a single order book and instead builds a "Universal Leverage Layer," where any asset with reliable price information can be listed.

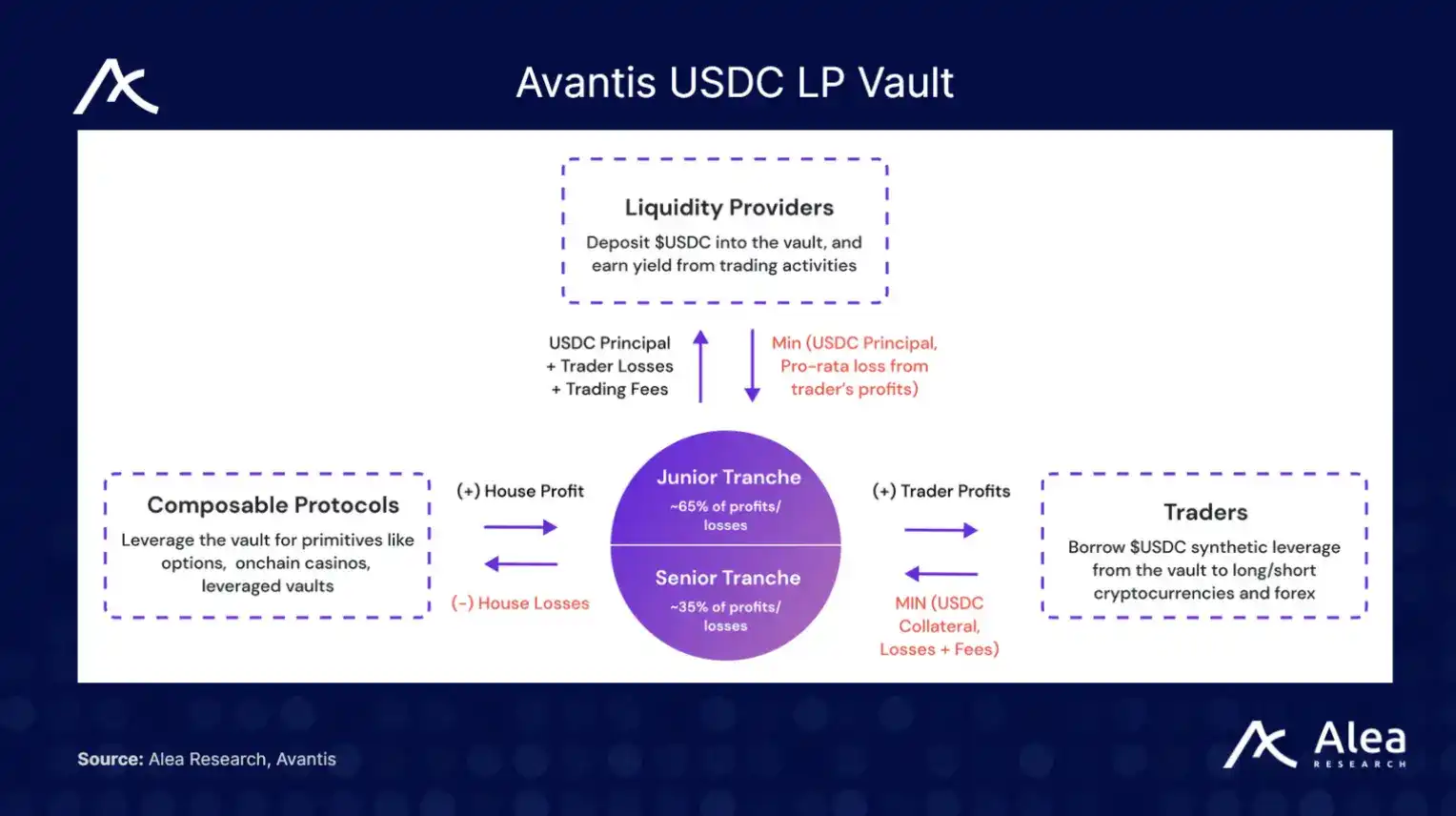

Synthetic leverage is achieved through a USDC-based liquidity vault, which acts as the counterparty for all trades, allowing for capital-efficient exposure across multiple markets. Traders can choose leverage of up to 500 times, enabling them to express directional views with minimal capital, while liquidity providers (LPs) earn returns by providing USDC to support positions.

What sets Avantis apart from other perpetual contract trading platforms is that users can trade non-crypto markets such as the Japanese yen, gold, and U.S. stock indices alongside BTC or ETH. The design of the protocol also supports features like zero trading fees, loss rebates, and positive slippage, adjusting incentives between traders and LPs by returning part of the fees or profits to users when they improve the protocol's risk profile.

Architecture of Avantis

At the core of Avantis is a capital-efficient synthetic engine. Traders use the protocol's interface to open positions on supported assets. Avantis does not match orders in an order book; instead, it pairs each trader with the USDC vault that takes on the other side of the trade. This vault aggregates deposits from thousands of LPs and acts as a single counterparty. This structure allows the protocol to provide deep liquidity across many markets without needing separate liquidity pools for each currency pair, enabling Avantis to list over 80 markets, including 22 RWA assets.

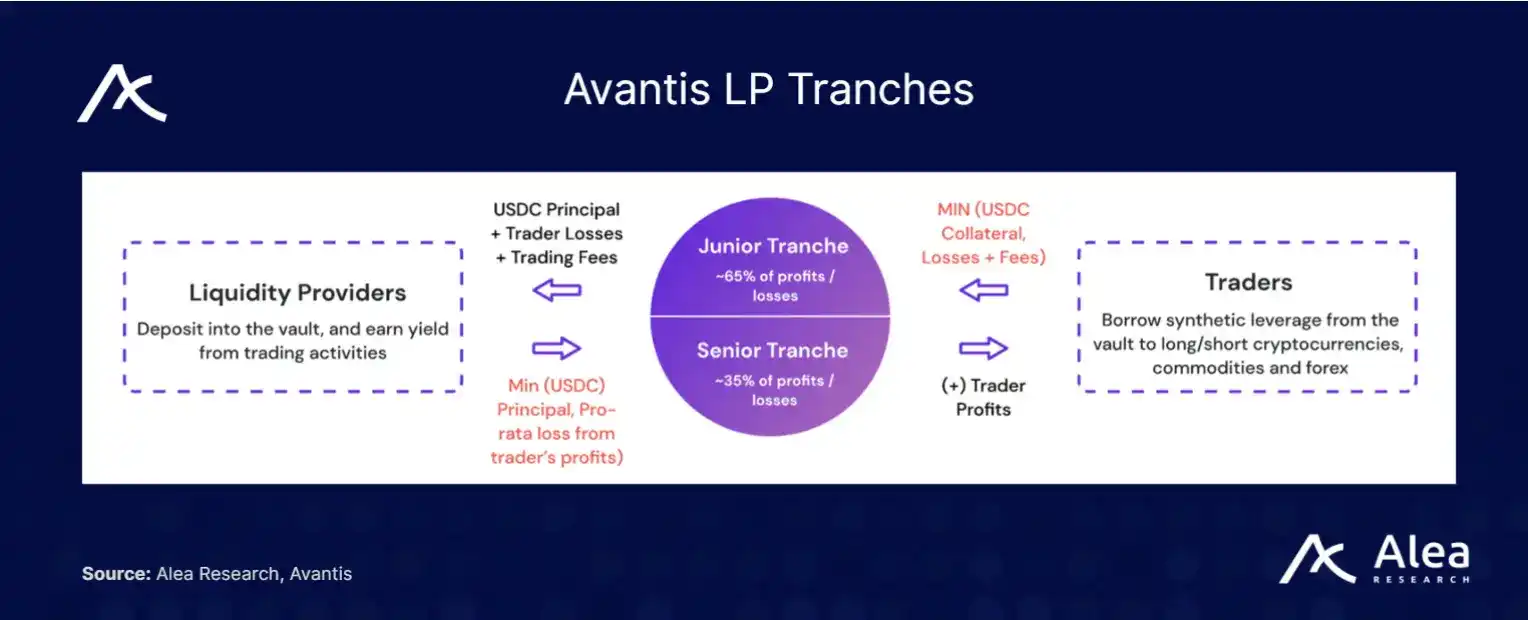

Avantis introduces risk tranches and time-lock parameters so that LPs can choose their preferred risk exposure. LPs can passively deposit into the senior tranche or take on more risk in the junior tranche, which has higher return potential but also absorbs a larger share of losses.

Additionally, LPs choose time locks (e.g., 30 days or 90 days) to control the duration of their capital commitment, with longer locks generating more fees. This design mimics the concentrated liquidity model of Uniswap v3 while applying it to risk management on a perps trading platform.

Trader > LP Alignment

Avantis's innovative mechanisms further align the interests of traders and LPs.

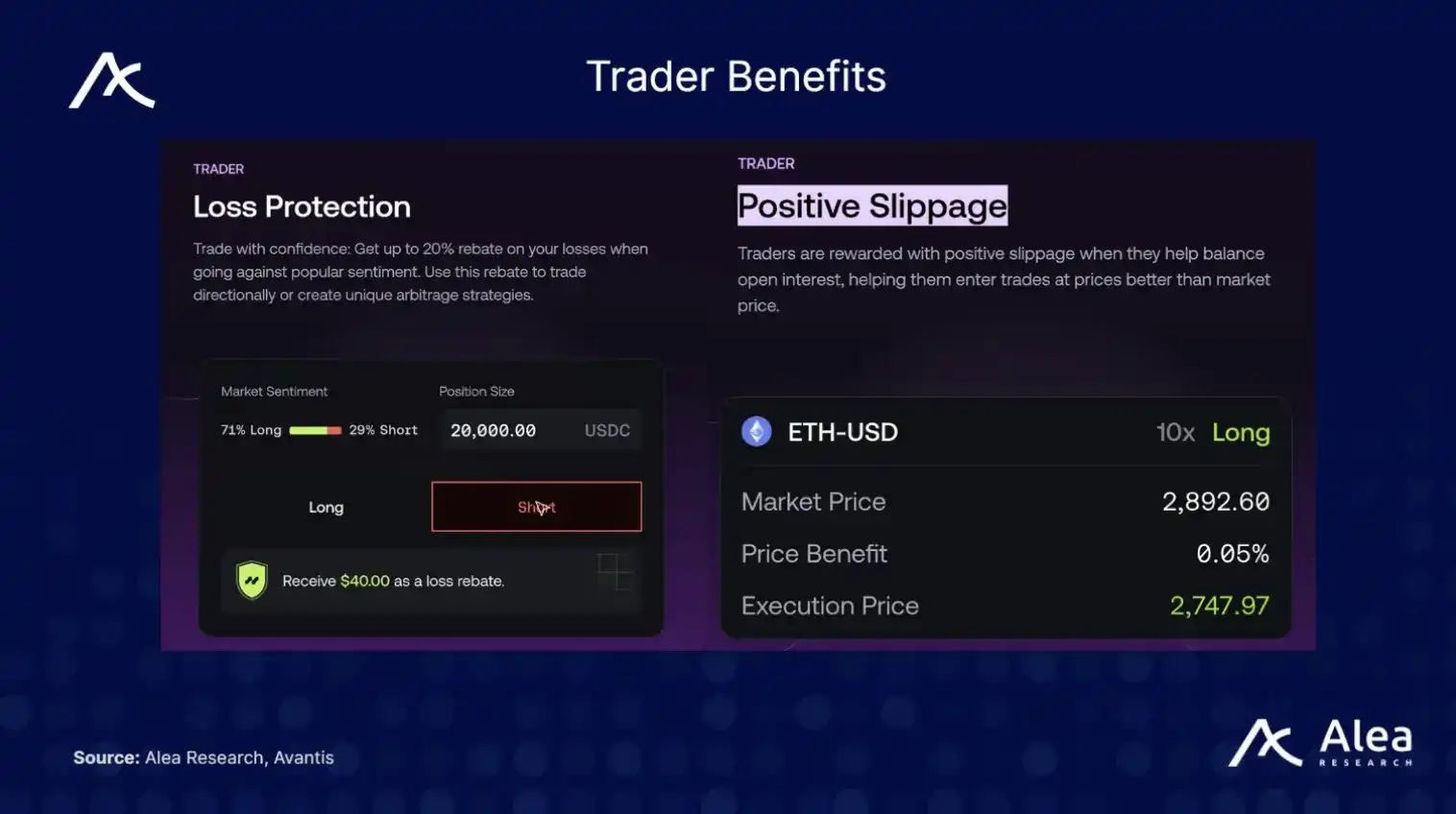

Loss Rebates: Traders who take the opposite side of open contracts (helping to balance the platform's long/short bias) can receive up to 20% in loss rebates. This encourages traders to arbitrage open contracts and stabilize LP exposure.

Positive Slippage: When a trader's order reduces the risk of the vault (e.g., closing a heavily long position), Avantis offers an entry price above the mark price. This "better than market" execution rewards traders for helping to balance flow.

Zero Trading Fees: Avantis has pioneered a product where traders do not have to pay opening, closing, or borrowing fees. Instead, they only pay a portion of the profits when closing winning trades. This tool is available for $BTC, $SOL, and $ETH, with leverage up to 250 times, making it popular among scalpers and high-frequency traders.

Advanced Risk Management: LPs can act as passive lenders or active market makers by choosing risk tranches and time locks. Each tranche has its own fees and potential loss shares, allowing LPs to control risk and return.

$AVNT: Token Issuance and Token Economics

To facilitate its next phase of growth, Avantis has launched the utility and governance token $AVNT.

$AVNT has multiple functions:

Security and Staking: Holders can stake $AVNT in the Avantis security module to support the USDC vault during extreme market volatility. Stakers can earn $AVNT rewards and trading fee discounts.

Community Rewards: 50.1% of the total supply of 1 billion tokens is reserved for traders, liquidity providers, referrers, and builders who contribute to Avantis. An airdrop (12.5% of the supply) will reward protocol activity since February 2024, while on-chain incentives (28.6%) will fund future XP seasons and community contributions. Builders and ecosystem grants (9%) will support the creation of new front-ends and trading tools, such as AI agents and Telegram bots.

Governance: Token holders will be able to propose and vote on protocol decisions, from asset listings and fee structures to buyback plans and cross-chain deployments.

The remaining 49.9% of the supply is allocated as follows:

· Team (13.3%)

· Investors (26.61%)

· Avantis Foundation (4%)

· Liquidity Reserve (6%)

Original Link

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。