Introduction:

In the past two years, the cryptocurrency market has undergone a profound transformation, from a deep adjustment in 2022-2023, to gradually clearer regulations in 2024, and then to an accelerated influx of institutional funds and compliant channels in 2025. Recently, signals of an "altcoin season" have begun to emerge, but unlike the previous "general rise" frenzy, this round is more inclined towards structured rotation: institutional funds are primarily flowing through compliant channels such as ETFs and DAT, with high-quality projects and narrative-driven sectors receiving more premiums.

This report will take a professional investment perspective, focusing on market signals, capital flows, core sectors, risks, and strategies, and will primarily address three questions: Has the altcoin season truly started? Where is the capital flowing? How should investors position themselves?

CoinEx Research believes that the altcoin season in 2025 is no longer a "blind general rise" speculative feast, but rather a compliant, institutional, and fundamental structural bull market. Understanding this evolution can help grasp short-term trading windows and assist in long-term positioning. This report will provide a cross-cycle, executable investment framework based on data and logic, combined with macro policies, on-chain indicators, and project fundamentals, to help capture true excess returns in a highly volatile and differentiated market.

1. Verification Signals and Market Characteristics of the Altcoin Season

Recently, we have monitored three signals: BTC.D has declined for six consecutive weeks, the Altseason Index is approaching the critical threshold of 75, and the total market capitalization of altcoins has reached a two-year high. This is the first time since 2021 that all three core indicators have simultaneously shown "altcoin season initiation" signals. However, unlike before, investors need to shift from a "general rise" mindset to a "structured selection" mindset.

1.1 Core Altcoin Season Cycle Indicators: BTC.D, Altseason Index, and Total Market Capitalization

After multiple rounds of cycle testing, Bitcoin dominance (BTC.D), the Altseason Index, and changes in total market capitalization can serve as core cycle indicators to verify the initiation of the altcoin season, reflecting the direction of capital flow and changes in market sentiment from different perspectives.

Bitcoin Dominance (BTC.D): The "Barometer" of Capital Flow

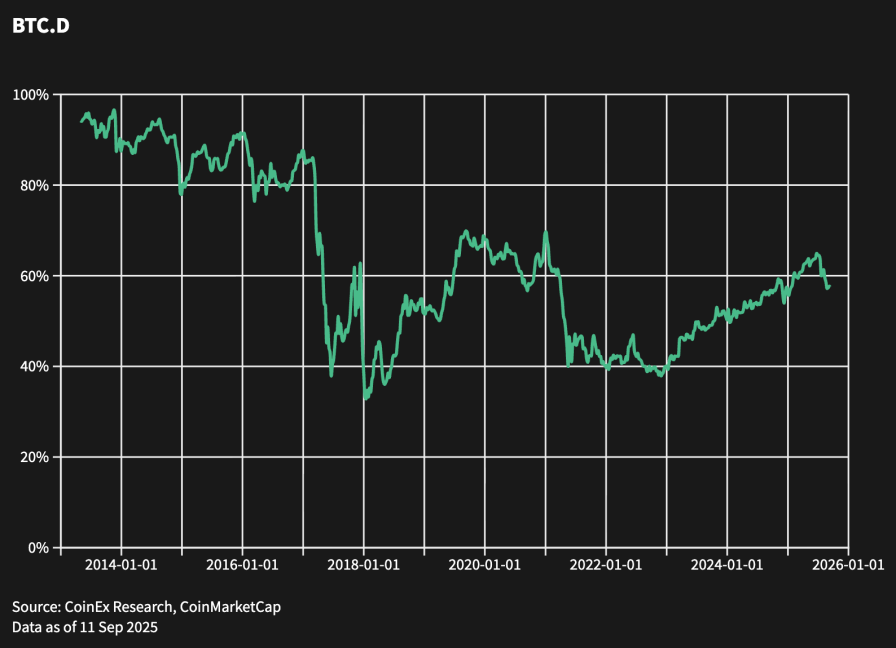

BTC.D reflects Bitcoin's market capitalization as a proportion of the overall cryptocurrency market, serving as the "first indicator" for judging the rotation of capital between Bitcoin and altcoins. The cyclical fluctuations of BTC.D show a significant negative correlation with the altcoin season; when this indicator shows a sustained downward trend, it usually indicates that capital is shifting from Bitcoin to altcoins.

Historical data shows a clear threshold effect for BTC.D:

● 2017 Altcoin Season: BTC.D fell from 86% to 33%, a drop of over 50 percentage points, with the market structure highly dispersed and capital generally flowing into altcoins, exhibiting "general rise" characteristics.

● 2021: BTC.D dropped from 69% to 40%, a decline of nearly 30 percentage points.

● 2025 (as of September): BTC.D has slowly decreased from 64% to 57%, a drop of about 7 percentage points. Although not as severe as the previous two rounds, this is the first significant decline exceeding 7 percentage points since 2022.

We believe that when Bitcoin's price is stable and BTC.D continues to decline (i.e., the "Bitcoin sideways + declining dominance" combination), it is a strong signal for the initiation of the altcoin season. This indicates that capital is flowing into altcoins without selling Bitcoin, reflecting an increase in market risk appetite. From August to September 2025, Bitcoin's price remained in the range of $110,000 to $120,000, while BTC.D decreased by 7 percentage points, aligning with the typical technical pattern of past altcoin season initiations.

Altseason Index: The "Quantifier" of Market Sentiment

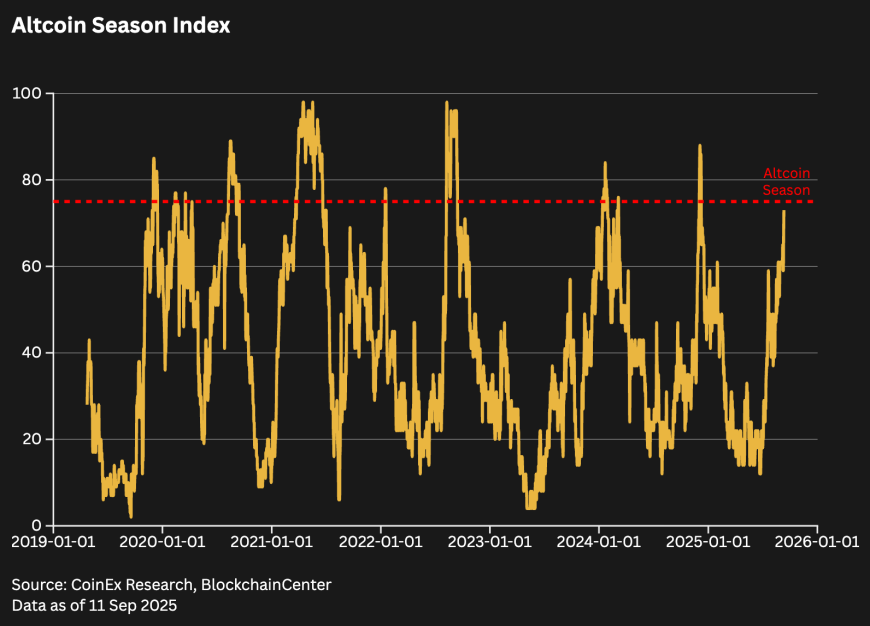

The Altseason Index is a comprehensive indicator specifically used to measure the performance of altcoins relative to Bitcoin. Currently, there are two mainstream versions in the market—Blockchaincenter (top 50 coins) and CoinMarketCap (top 100 coins, excluding stablecoins). Although their methodologies differ, both agree that when 75% of non-Bitcoin coins have increased in value more than Bitcoin over 90 days, it enters an "altcoin season."

From the current data, the Blockchaincenter index is at 73, and the CoinMarketCap index is at 69, both approaching the critical threshold of 75, indicating that the market has not yet fully entered the traditional sense of an altcoin season, but the clear upward trend shows a definite initiation signal.

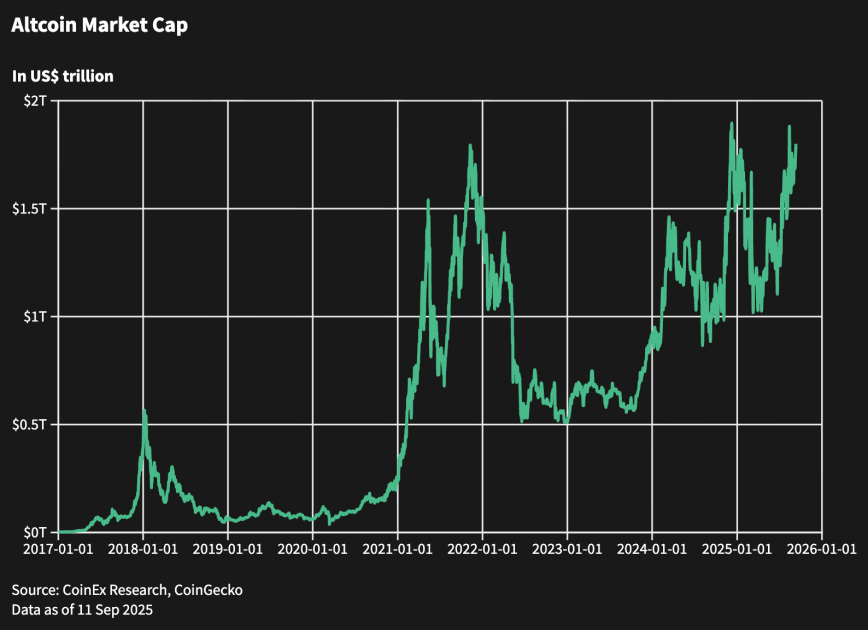

Changes in Total Market Capitalization: The "Measuring Stick" for Capital Inflow

Changes in the total market capitalization of cryptocurrencies and segmented market capitalizations provide funding verification for the altcoin season and are important supplementary indicators for judging market heat. From March to September 2025, the total market capitalization of the cryptocurrency market rose from $2.5 trillion to $4 trillion, a growth of 60%. The total market capitalization of altcoins (excluding BTC) exceeded $1.88 trillion in August, nearing historical highs. Notably, unlike the historical "straight-line rise," this round of altcoin market capitalization has shown a "stair-step" growth pattern, consistent with the characteristic of institutional funds entering in batches. This structural growth, coupled with the decline in BTC.D, further enhances the probability of the altcoin season's initiation.

1.2 Capital Flows and Market Structure: Institutional Entry and Retail Sentiment Deficiency

If an altcoin season occurs in 2025, its dominant logic is likely to be "selective rise" rather than "general rise." The changes in capital flows and market structure are particularly prominent, primarily reflected in the following three points:

Historical Cycle Comparison: From Wild Growth to Structural Differentiation

Looking back at history, the 2017 altcoin season was driven by ICOs, where regulatory gaps and the ERC-20 standard lowered issuance thresholds, leading to a surge in project numbers and retail funds "casting a wide net." The 2020-2021 period was driven by DeFi and liquidity mining, with institutional funds tentatively entering, favoring protocols with real product prototypes. By 2025, the altcoin market has entered the "compliance era":

● Regulatory clarity, such as the classification regulation of utility tokens by the U.S. SEC and the EU MiCA regulations, has created a market environment where "compliance equals survival";

● Institutional dominance, with traditional financial institutions entering through compliant channels such as ETFs and digital asset treasury (DAT), changing the market capital structure;

● Increased differentiation in project quality, with the narrative-driven markets of the previous two rounds significantly enhancing investor awareness, leading current funds to favor projects with fundamentals and compliance capabilities.

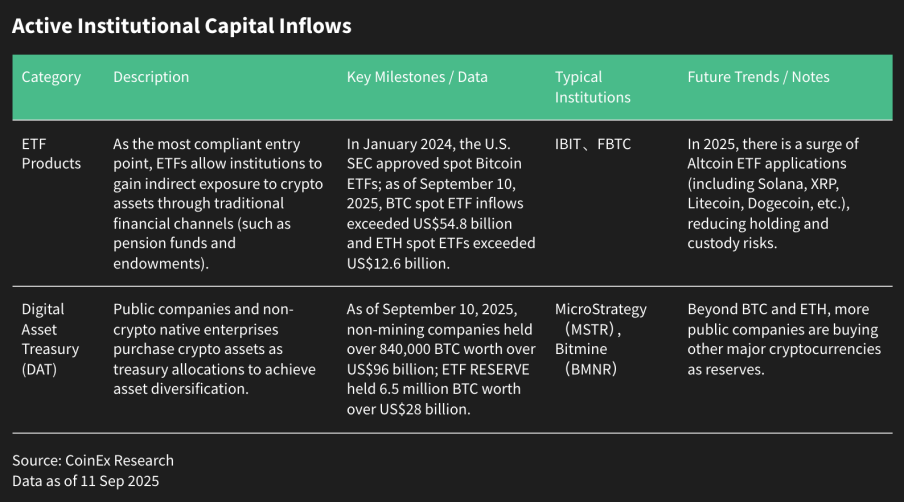

Active Institutional Capital Entry

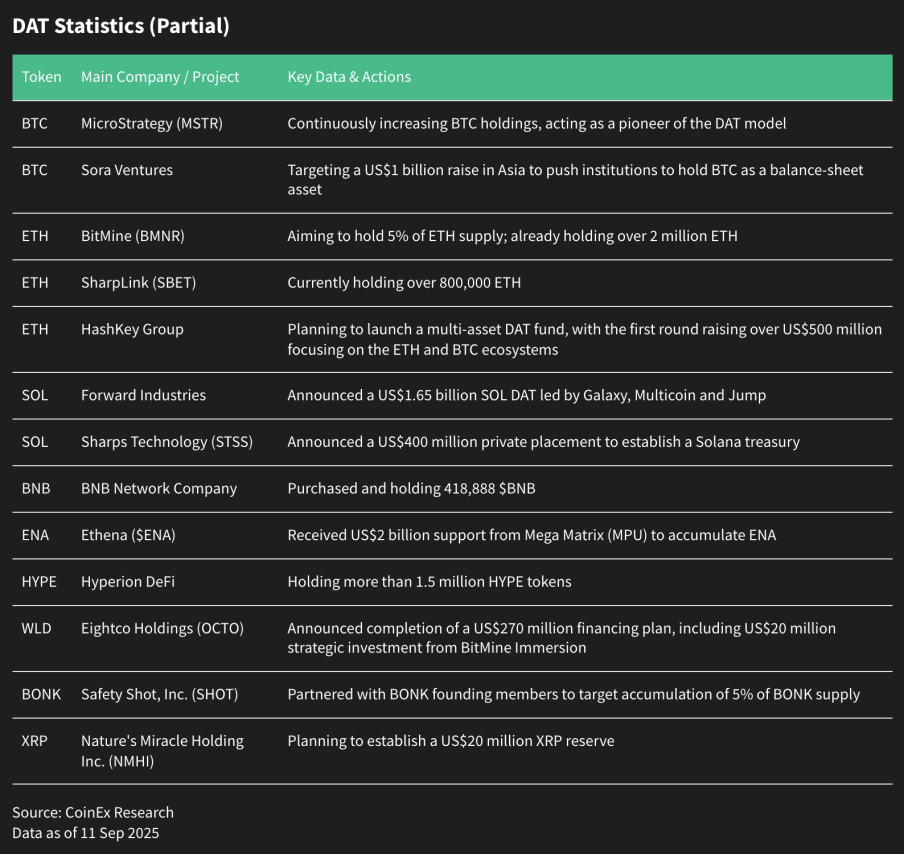

In 2025, institutional capital's entry into the cryptocurrency market is indeed more diversified and compliant than in previous cycles, primarily achieved through spot ETFs, DAT, and other means. Notably, current institutional capital allocation is highly focused on mainstream assets (such as BTC and ETH) with clear compliance and strong liquidity. Even more flexible digital asset treasury (DAT) strategies generally tend to choose mainstream assets (such as SOL, XRP, BNB, HYPE, ENA, etc.) to avoid regulatory uncertainties. This preference differentiation leads to significant structural rotation of funds within altcoins, rather than a uniform "flooding." This differentiation essentially reflects institutional investors' dual considerations of compliance safety and growth potential, further exacerbating the internal performance differences in the altcoin market.

Retail Sentiment "Deficiency" and Market Maturity

In stark contrast to the active entry of institutional capital, retail sentiment at the beginning of the altcoin season in 2025 appears relatively lukewarm. This phenomenon primarily stems from three aspects: first, after experiencing a deep bear market in 2022-2023, retail investors' risk appetite has generally declined, preferring to allocate to lower-risk assets like Bitcoin; second, with the increasing global regulatory compliance requirements, KYC and other identity verification thresholds have led some retail investors to choose to exit the market or temporarily observe. Additionally, multiple market cycles have enhanced investor awareness, leading retail investors to prefer projects with fundamental support rather than blindly chasing highs.

1.3 Investment Strategies Under Differentiation: Compliance Thresholds and Project Quality Screening

In a highly differentiated market, blindly chasing hot spots will face greater volatility risks; instead, constructing an investment portfolio around "compliance + fundamentals" may truly traverse cycles and capture excess returns.

Compliance: The Precondition for Capital Inflow

As the regulatory frameworks of major jurisdictions (such as the U.S., EU, and Hong Kong) become increasingly clear, whether a project can meet local regulations becomes crucial. Institutional capital favors projects that have passed strict regulatory scrutiny through compliant channels (such as ETFs, DAT) or operate in friendly jurisdictions, indicating higher safety and stability.

Project Fundamentals: The Core Competitiveness to Traverse Market Cycles

Beyond "narrative-driven," the market is returning to "fundamentals-driven," with capital further screening for projects that possess actual revenue (DeFi), technological innovation (such as the combination of AI and blockchain), clear application scenarios (such as RWA), sustainable token economic models, and active ecosystem development.

We believe this screening logic requires investors to shift from "story-driven" to "data-driven," deeply assessing team backgrounds and execution capabilities (whether they possess cross-cycle capabilities), technical feasibility and ecosystem activity (on-chain data, address growth, TVL changes), and revenue capabilities and token economic models (protocol revenue, dividend mechanisms, governance token incentives).

2. Core Investment Sectors and Quality Target Recommendations

The capital flows and sector performance in this round of the altcoin season indicate that institutionalization, compliance, and fundamentals are becoming the main lines of the market: the ETF/DAT track provides stable capital inflows, DeFi blue chips and RWA tracks constitute mid-to-long-term growth value, while AI and meme narratives offer short-term high beta speculative opportunities. In this context, investment strategies should shift from "chasing hot spots" to "multi-layered structural layouts," stabilizing the portfolio with core leading assets, capturing increments with growth-oriented DeFi or RWA projects, and seeking short-term alpha through AI and meme sectors, thereby achieving sustainable excess returns in a highly volatile environment.

2.1 Institutional Dividend Track: ETF and DAT

Institutional capital is accelerating its entry into the cryptocurrency market through compliant channels, with BTC and ETH as core assets continuously favored by institutions. Their allocation logic places greater emphasis on project compliance, technical fundamentals, and long-term application value, which brings significant "compliance premiums" to altcoins that have strong institutional backing, clear business models, and actively embrace regulation.

In addition to BTC and ETH, some altcoins with good compliance prospects and innovative narratives have also begun to enter the institutional spotlight. Currently, several altcoins have submitted applications for spot ETFs, covering mainstream altcoins such as XRP, SOL, ADA, LTC, DOGE, SUI, and APT.

In the DAT field, institutional funds are more inclined to allocate to assets with solid fundamentals and clear compliance prospects. Reserve assets are evolving from a single BTC to a diversified range of crypto assets, with ETH, SOL, BNB, HYPE, and ENA becoming new reserve hotspots. However, as the market saturates and regulations tighten, the DAT model is facing sustainability challenges, and investors need to pay attention to the associated risks.

2.2 DeFi Blue Chips and Innovative Protocols: Income and Growth Opportunities

Hyperliquid: A Decentralized Perpetual Contract Leader Cutting into the Stablecoin Narrative with USDH

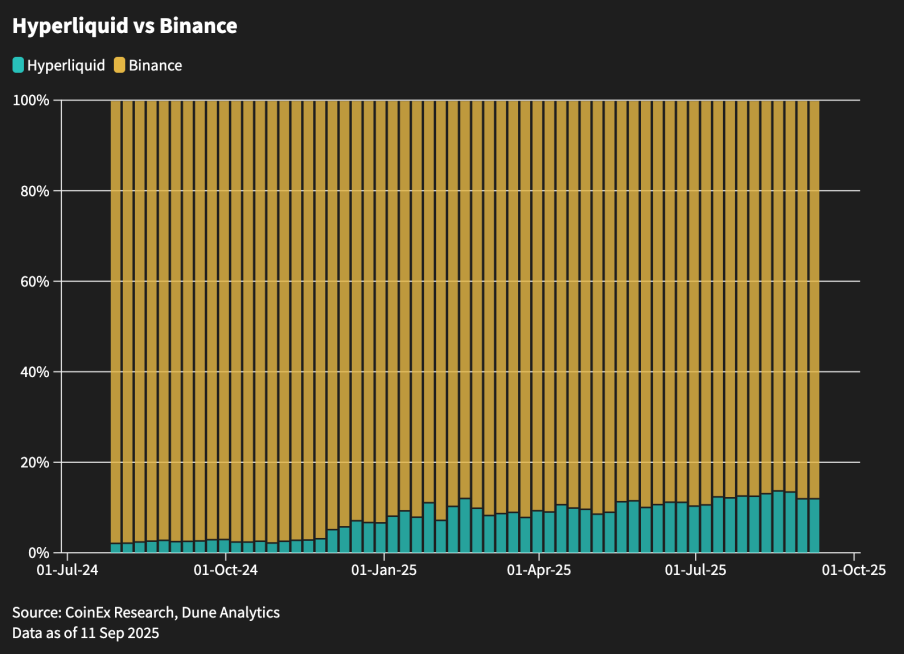

As a leader in the decentralized perpetual contract market, Hyperliquid's monthly trading volume has approached $400 billion, capturing about 70% of the decentralized perpetual contract market share, with monthly revenue reaching approximately $106 million. Notably, this trading volume data is gradually eroding the market share of centralized exchanges, with its monthly perpetual contract trading volume ratio with Binance rising from about 8% at the beginning of the year to a recent 13.6%. More importantly, Hyperliquid is attempting to break free from its reliance on USDC by launching its native stablecoin USDH, aiming to convert hundreds of millions of dollars in annual interest income into community benefits. This strategic transformation will determine its future revenue growth ceiling and is a key factor in assessing its long-term value.

We believe that USDH is not just a new stablecoin but also a strategic pivot for capturing the ecological value of Hyperliquid. Its success or failure will determine the future revenue ceiling of the protocol and the distribution of governance rights, constituting risks and opportunities that long-term investors need to closely track.

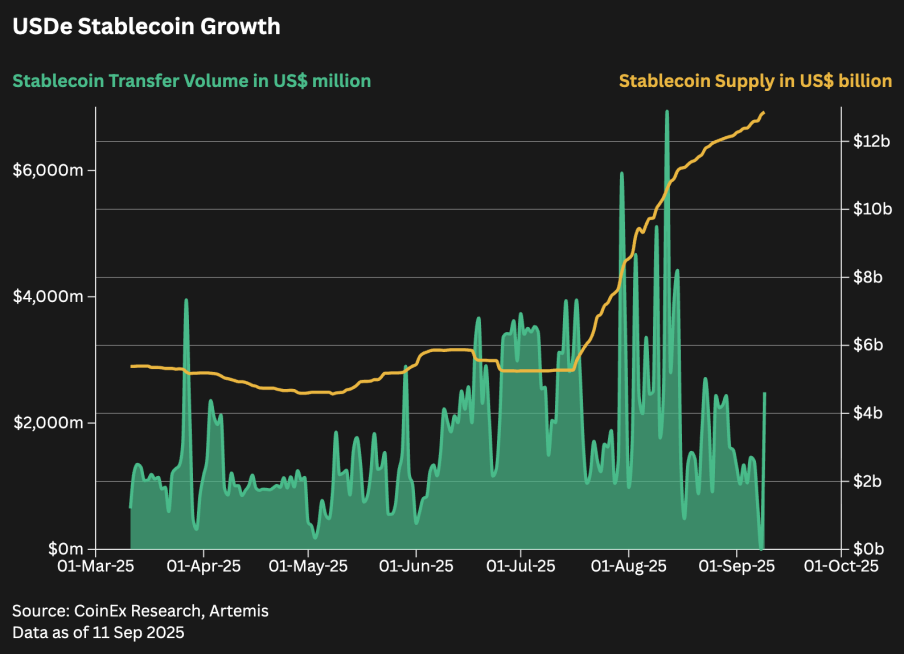

Ethena: Value Reconstruction with Synthetic Dollars and Fee Switch

Ethena's synthetic dollar USDe supply has doubled to $12 billion in just one month, with cumulative protocol revenue exceeding $500 million and August's monthly revenue reaching $61 million. Its core mechanism, the "Fee Switch," is about to be activated, which will directly distribute protocol profits to ENA token holders, with Arthur Hayes predicting it could lead to $500 million in token buybacks. Additionally, the publicly listed company Mega Matrix plans to raise $2 billion to establish an Ethena stablecoin governance treasury, with a strategy to directly purchase ENA governance tokens, marking a shift where traditional capital no longer merely holds crypto assets but actively participates in protocol governance to obtain long-term returns.

We believe that the activation of the Fee Switch will become a fundamental turning point for the ENA token, and the involvement of traditional institutions in governance signifies that the model of "protocol as an investment target" is taking shape.

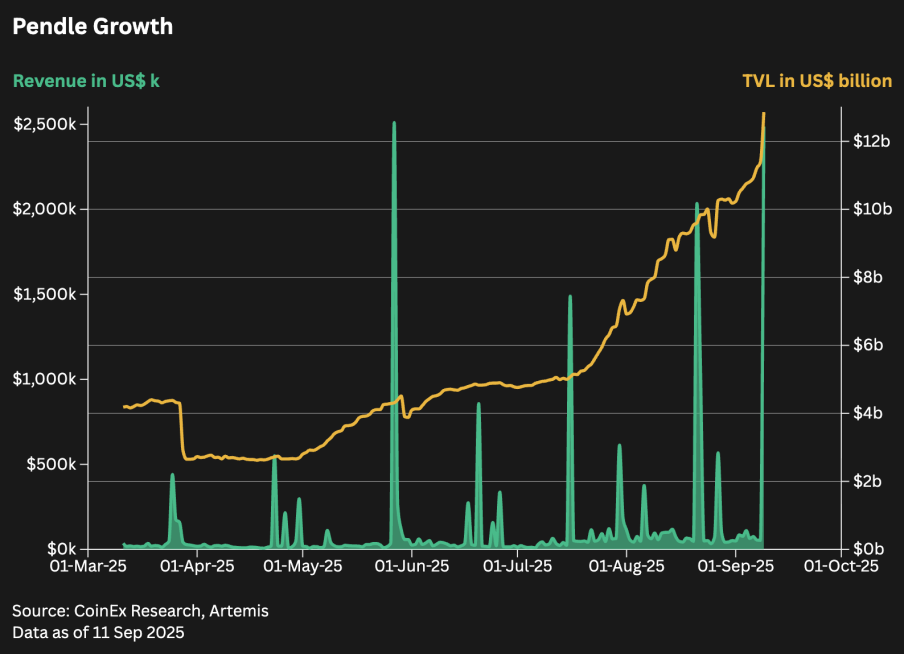

Pendle: The Flywheel Effect of Yield Aggregators

Pendle's TVL has exceeded $12 billion, with an annualized revenue of approximately $75 million. Among this, Ethena's sUSDe+USDe contributes over 70% of the liquidity. Pendle played the role of a "cold start engine" in Ethena's early days, driving its issuance from $500 million to $3.5 billion in just four months. Furthermore, Pendle is expanding into new derivatives fields, launching the Boros platform to support funding rate trading and hedging.

We believe that Pendle served as a "customer acquisition and liquidity guiding engine" during the initial phase of Ethena's launch, making it an excellent example of the "flywheel effect." Its ecological binding with Ethena and expansion into the derivatives field exemplifies a typical "continuously growing DeFi blue chip."

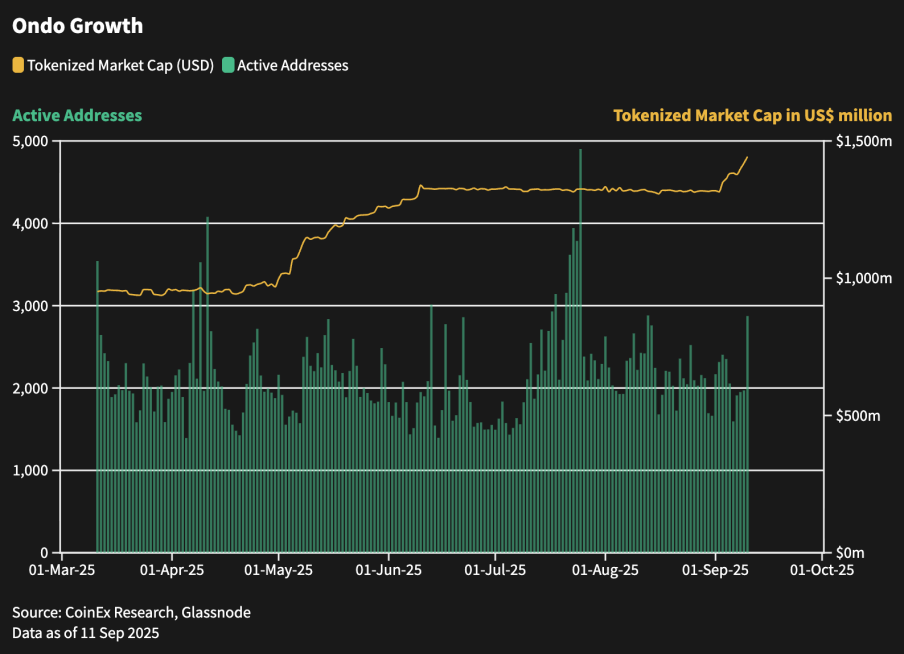

ONDO: A New On-Chain Journey for RWA Giants

As a leader in the Real World Assets (RWA) sector, ONDO's total locked value (TVL) has reached $1.4 billion. Its recent launch of the "Ondo Global Markets" platform provides non-U.S. investors with over 100 tokenized U.S. stocks and ETFs, supported by multiple mainstream exchanges, with a daily trading volume exceeding $32 million and a total market capitalization of over $129 million.

We believe that ONDO's success is not only a technological breakthrough but also a compliance breakthrough. By collaborating with mainstream exchanges and focusing on institutional-grade solutions, ONDO is building a compliant bridge between TradFi and DeFi, attracting a large number of institutions and high-net-worth users seeking compliant investment channels, representing a new opportunity for growth in this round of DeFi blue chips.

2.3 Narrative-Driven Speculative Opportunities: AI and Meme Sectors

AI Sector: Multi-Layer Value Chain of Computing Power, Data, and Agents

The integration of AI and Web 3 is forming a multi-layered investment narrative. At the foundational level, decentralized computing power (such as Aethir) has delivered over 1.15 billion computing hours and achieved monthly revenue of $13 million; at the data layer, Sapien addresses the quality issues of AI training data through token staking and reputation mechanisms, with registered contributors exceeding 1.8 million; at the intermediate layer, Kite AI has processed over 640 million AI agent calls in its testnet, with user numbers surpassing 14.34 million; at the top layer, Openmind combines AI agents with real-world robots, attempting to build a "robotic version of iOS," pushing the AI value chain into the physical realm.

We believe that the investment logic of the AI narrative has shifted from "single-point explosion" to "multi-layer penetration," with the maturity of foundational computing power driving breakthroughs in data, agents, and physical robots layer by layer. This "narrative progression" can provide investors with a multi-dimensional layout approach from infrastructure to application layers.

Meme Narrative: From Speculation to Creative Capital Markets

As one of the largest meme coin issuance platforms, Pump.fun distributes income to creators through "Project Ascend," with creator income reaching $15.5 million in just seven days, ten times the protocol's own revenue, marking its transformation from a speculative tool to a "Creative Capital Market (CCM)." Additionally, new narratives such as ICM (Internet Capital Market) and PM (Prediction Market) are also on the rise. Leaders like Polymarket and Kalshi are promoting the compliance of prediction markets, providing new imaginative space for the meme sector narrative.

We believe that the structural transformation of the meme market may give rise to a new generation of "creator economy" platforms. Investors should pay attention to whether protocols have income distribution mechanisms, ecological incentive designs, and compliance layouts, as these factors will determine their sustainability.

3. Short-Term Volatility Risk Warning: How to Avoid Pullback Traps

Although the altcoin season often starts with strong upward momentum, history shows that short-term risks are also high. Factors such as macro liquidity, geopolitical issues, market sentiment, technical vulnerabilities, and policy uncertainties intertwine, potentially triggering sharp declines of 20%–40% in altcoins within a short period, or even greater volatility. Investors need to flexibly utilize on-chain indicators, derivatives data, and compliance dynamics to grasp the rhythm and avoid chasing highs and excessive leverage.

3.1 Macro Liquidity and Geopolitical Risks: Fed Rate Cut Expectations and Sudden Events

The crypto market is extremely sensitive to global liquidity, especially the Federal Reserve's policies. Currently, the market widely expects a 25 basis point rate cut in September, with the CME FedWatch indicating a probability of over 90% (as of September 11). This expectation has already been priced into risk assets. If the results announced at the FOMC meeting on September 17 fall short of market expectations, the evaporation of liquidity could quickly trigger sell-offs. If the dollar index reclaims 105 (currently around 98), or if U.S. Treasury yields rise, funds will quickly withdraw from high-beta altcoins and flow back into BTC and stablecoins.

Geopolitical situations further amplify uncertainty. Conflicts such as the Israel-Iran situation, the U.S.-China tech rivalry, and extreme weather pushing up energy prices could disrupt market rhythms. If Brent crude oil breaks above $85 (around $68 on September 11), inflation concerns will reignite, compressing the Fed's easing space. Geopolitical escalations can often trigger a 5%–10% pullback in BTC within a single day, while altcoins lacking the "digital gold" narrative often face more severe declines. A VIX above 20 (currently around 15) can serve as one reference signal.

Regarding macro factors, we believe investors should focus on whether indicators such as DXY, VIX, and BTC market share show a sustained upward trend.

3.2 Market Sentiment and Technical Aspects: Overbought Alerts and Leverage Risks

Altcoin trends are often driven by excessive leverage and emotional exuberance, which also lays the groundwork for severe pullbacks. According to TradingView, most top market cap projects are currently in the 50-70 range, indicating strong bullish momentum. Investors should be wary of overbought zones (e.g., >70), and it is even more concerning if RSI and MACD show divergence—where prices reach new highs but momentum is unconfirmed, which is a typical signal of trend exhaustion.

The derivatives market is also worth monitoring. According to CoinGlass, the open interest in perpetual contracts has soared past $200 billion (as of September 11), with funding rates for top market cap assets remaining positive, indicating that long leverage is dominant, putting the market in a "powder keg" state. Additionally, retail FOMO and whales adding 3-10x leverage on illiquid altcoins further exacerbate vulnerabilities.

From a technical perspective, we believe investors should pay attention to RSI, open interest in contracts, and whether funding rates experience rapid surges as short-term risk warnings.

3.3 Regulatory and Policy Uncertainties: SEC Stance and MiCA Implementation Risks

Even as overall regulations gradually become clearer, short-term uncertainties will still cause volatility, especially in an unclear macro environment. The U.S. SEC is transitioning from "enforcement priority" to "framework regulation," which is viewed as a positive development in the medium to long term, but various risks may still arise during the transition period: lawsuits targeting staking operations and compliance errors by exchanges could shake investor confidence; while the comprehensive implementation of the European MiCA has raised compliance thresholds for stablecoin issuers and service providers, smaller exchanges and projects may fail to meet these standards, forcing them to exit the market or suddenly dump tokens.

Before market participants complete the transition, short-term disturbances are almost inevitable. We believe investors can appropriately pay attention to SEC announcements, ESMA license updates, and enforcement news as information aids for medium to short-term investment decisions.

4. Practical Guide to Exiting at the Top: How to Secure Profits Safely

In any altcoin season, market peaks are often accompanied by turning points in Bitcoin's dominance and capital flows. When Bitcoin enters a downward cycle, it usually indicates that the altcoin season is nearing its end. By integrating technical indicators, on-chain data, and strategic frameworks, we help investors more confidently identify price warnings, assess market phases, and formulate exit strategies.

4.1 Technical Indicator Combination: Multi-Dimensional Signal Coordination to Identify Peaks

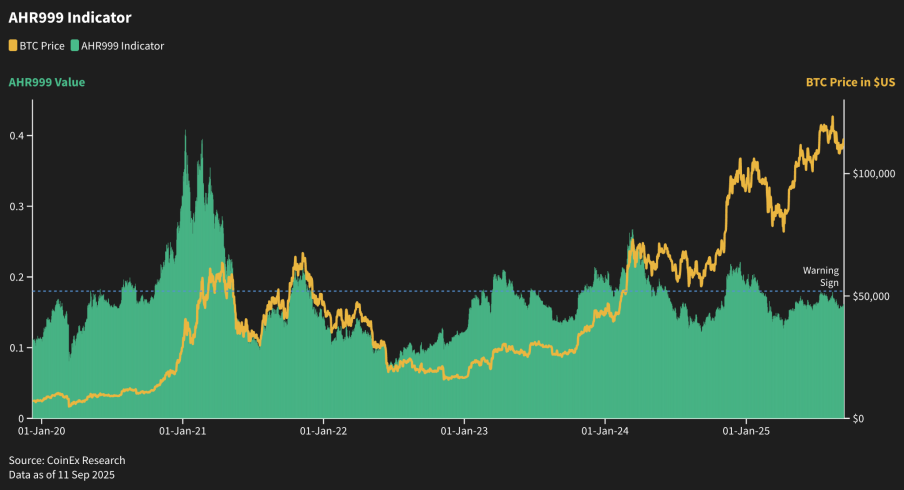

AHR 999 Indicator: Long and Short Cycle Moving Average Validation of Overbought Risks

The AHR 999 indicator is constructed by combining long and short cycle moving averages of prices; a higher value indicates that the market is currently overbought in the short term and that downward risks should be noted. When the indicator enters the warning zone, the altcoin market may be experiencing or about to experience a surge, while when the indicator exits the warning zone, the altcoin market is likely to enter a collapse zone, necessitating a phased exit from positions. Currently, the indicator has not yet entered the warning zone.

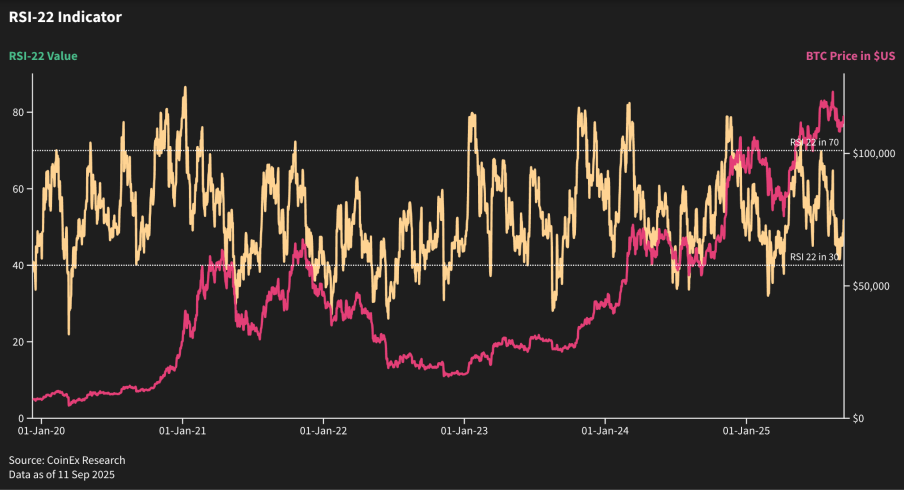

RSI-22: Higher Sensitivity for Short-Term Movements

The RSI-22 indicator is relatively shorter-term compared to other indicators in this article, with a general win rate, but it can respond more sensitively to current market changes. When its value significantly exceeds 70, the probability of price decline surges, suggesting that one should reduce buying positions and pay closer attention to market changes. Currently, the RSI-22 value is around 50, indicating that there is still some distance from overheating (70), suggesting there is potential for short-term upward movement, and one can consider building positions on dips.

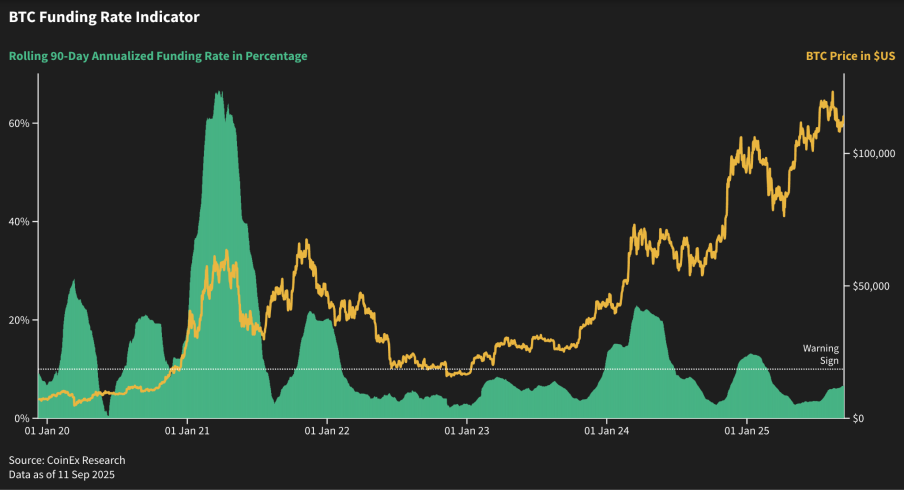

Bitcoin Funding Rate: A Thermometer for Monitoring Leverage

The Bitcoin funding rate is a long-term indicator. Historically, when the 90-day rolling funding rate annualized reaches 10%, it may indicate that BTC is gradually entering an overheated state, and the altcoin market will begin to accelerate, potentially presenting a buying opportunity. According to the current indicators, the market is in a calm period, with a balanced long-short game. The market has not yet entered a period of unilateral high-leverage betting.

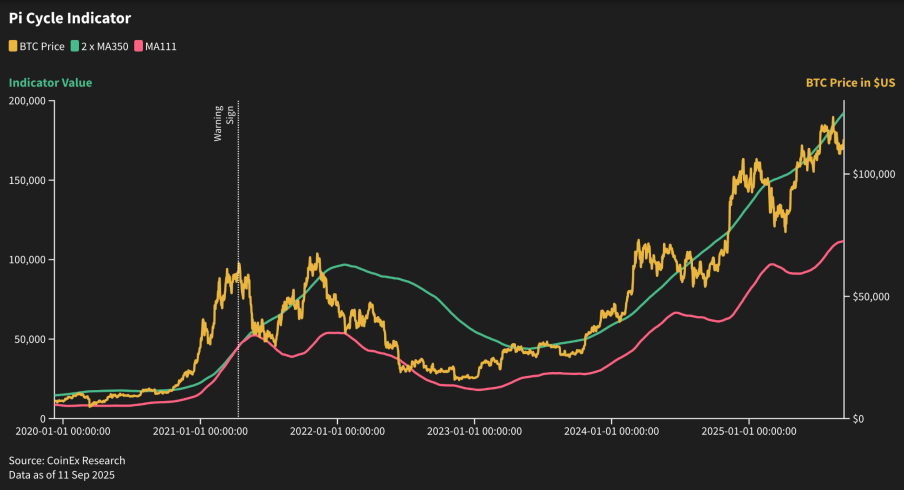

Pi Cycle Indicator: An Absolute Exit Signal for the Longest Cycle

The Pi cycle indicator is the longest-term indicator mentioned in this article. When the MA 111 line rises and crosses the 2x MA 350 line from below, the indicator suggests that the market has entered an overheated phase, indicating potential downward risks. It has only been triggered during the super altcoin season in April 2021. The Pi cycle indicator can be considered one of the absolute exit signals, and it is recommended to gradually exit when a trigger is detected.

4.2 On-Chain Indicator Combination: Capital Behavior and Sentiment Turning Points

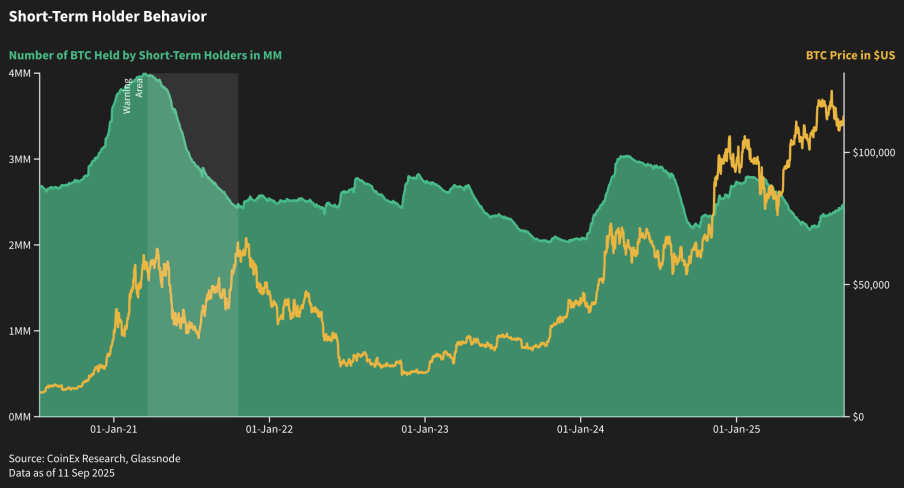

Bitcoin Short-Term Hoarder Behavior: Observing Capital Temperature

An accelerated increase in Bitcoin holdings by short-term hoarders signifies the onset of a short-term market, while a subsequent rapid decrease indicates that the market is about to end. Building positions in altcoins when a rapid increase is observed and exiting when a decrease occurs is a good strategy. Currently, no accelerated increase signals have been detected, suggesting that the market may still be in a warming phase.

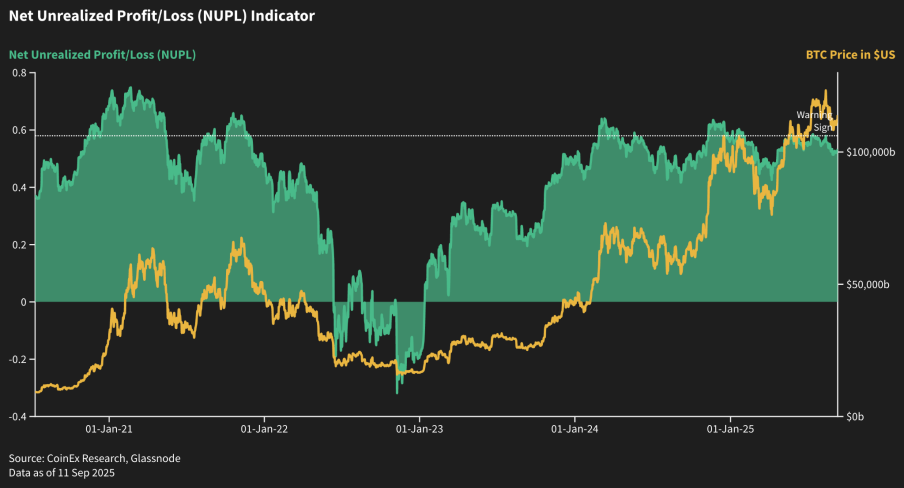

BTC Net Unrealized Profit and Loss Index: Identifying "Holiday" Moments

When BTC net unrealized profits exceed the Warning Sign, it indicates that the market has entered an overheated phase, and the altcoin season may begin. It is recommended to accelerate building positions in altcoins when the indicator exceeds the Warning Sign, betting on the start of the altcoin season. If the indicator is observed to remain above the Warning Sign for one week, one should begin to close positions. If the indicator remains above the Warning Sign for less than a week, it can be considered that the altcoin season has not yet arrived, and this bet was incorrect; it is advisable to close altcoin positions when the indicator falls below the Warning Sign and wait for the next opportunity.

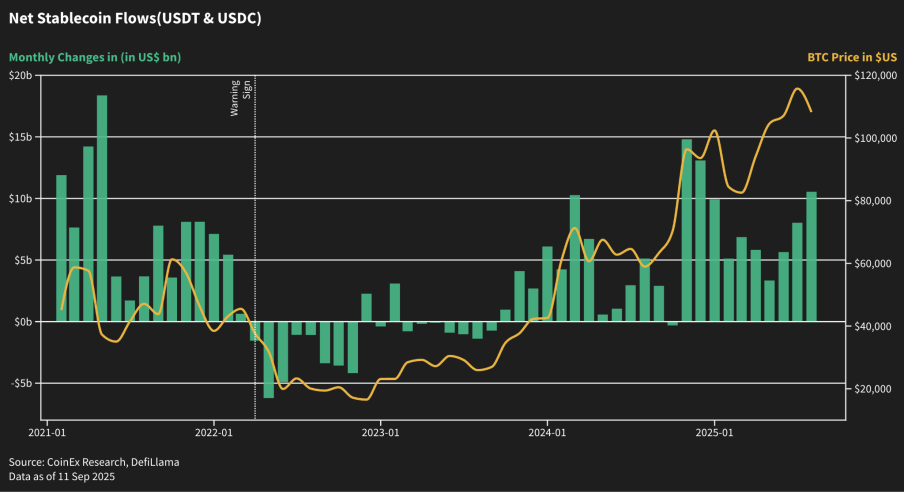

Stablecoin Inflow and Outflow Indicator: A Leading Signal for Capital Flight

During the last altcoin crash, as BTC fell below $35,000, stablecoins began to flow out in large quantities (i.e., redeeming stablecoins for fiat currency, indicating capital exit). Similarly, if the price breaks below key support levels and stablecoins begin to flow out this month, it indicates that mainstream market participants are capitulating and exiting, leading BTC to seek major cycle support, while altcoins begin to crash. We believe that if a stablecoin outflow signal is detected, one should abandon any illusions and liquidate all altcoin positions.

4.3 Strategy Framework: Phased Exits and Dynamic Profit Taking

In addition to data indicators, a phased exit strategy in actual operations can better balance returns and risk management:

● Cost Recovery Method: When the price rises to a certain level, sell a portion first to ensure that the remaining position's cost is zero.

● Time-Based Phased Profit Taking: Regardless of price movements, regularly sell a portion based on time cycles.

● Event-Driven Profit Taking: Gradually reduce positions based on significant event milestones (e.g., listing on major exchanges, successful ETF issuance, and other major positive developments).

5. Conclusion and Outlook: Q4 Market Trends and Long-Term Risk Warnings

5.1 Short-Term Outlook: Tactical Windows in a Structured Bull Market

In the short term, three indicators (BTC.D, Altseason Index, total market cap of altcoins) are simultaneously signaling, marking the first true characteristics of an "altcoin season" since 2021. However, unlike past bull markets, this round is closer to a "structured bull market," placing higher demands on investors' tactical allocation capabilities:

● Market Landscape: Bitcoin's sideways movement + declining dominance constitutes a strong signal, combined with the stepwise growth of altcoin market cap and institutional funds entering in phases, indicating that capital rotation is entering a "selected targets" phase.

● Trading Strategy: In the short term, it is essential to strengthen sector rotation, indicator monitoring, and position management, with a focus on macro liquidity (FOMC, DXY, VIX), derivatives leverage data (OI, funding rates), and on-chain capital flows (stablecoin inflows and outflows).

● Defensive Points: Be wary of "fragile pullbacks" caused by excessive leverage and emotional exuberance, avoid blindly chasing highs, maintain flexible positions, and appropriately use phased building and dynamic profit-taking strategies to lock in profits.

At this stage, capital is more focused on a dual moat of "compliance + fundamentals." The ETF/DAT track, DeFi blue chips (Hyperliquid, Ethena, Pendle), RWA (ONDO), and protocols with clear cash flows or unique narratives in AI/Agent are core layout directions; meme-type or high beta projects still present trading opportunities but require stronger rhythm and risk control.

5.2 Long-Term Perspective: From "Narrative-Driven" to "Structure-Driven"

In the long term, CoinEx Research believes that the altcoin season in 2025 may be a landmark watershed:

● Structural Upgrade: Regulatory frameworks (SEC, MiCA, Hong Kong licenses, etc.) and institutional capital (ETF, DAT) will jointly push altcoins into the "compliance era." Against this backdrop, the altcoin market will transition from "barbaric growth" to "survival of the fittest," with leading projects enjoying valuation and liquidity premiums.

● Capital Behavior Transformation: Traditional financial institutions will no longer only allocate BTC/ETH but will deeply embed themselves in the Web 3 ecosystem through tokenized governance, participating in protocol dividends, and providing liquidity; the logic of "protocol as an investment target" is gradually maturing, and models connecting governance tokens, protocol cash flows, and external compliant capital are forming.

● Industry Trend Progression: Multi-layer narratives such as AI + on-chain computing power, RWA, prediction markets, and creator economies provide medium to long-term growth curves; narratives are shifting from "single-point explosions" to "multi-dimensional penetration," requiring investment portfolios to transition from thematic rotation to industry chain layout.

● Investment Methodology Iteration: Moving from "investing in tracks" to "investing in execution capabilities," from "speculating on emotions" to "speculating on cash flows," cross-cycle capabilities, ecological depth, and the sustainability of token economics will become valuation anchors.

In other words, future alpha will come more from "structured selection" rather than "broad-based arbitrage." For investment institutions, the most important factor is no longer whether they can hit a hot spot but whether they can identify the fundamental support behind it before it matures and achieve sustained excess returns through compliant channels and in-depth research.

5.3 Risk Warnings and Strategy Recommendations

Although this round of altcoin season has multiple resonance signals, its inherent volatility and fragility remain significant, and investors should be wary of the following types of risks:

● Macro and Policy Risks: If the Federal Reserve's monetary policy is less accommodative than expected, or if macro indicators such as the dollar index, VIX, and oil prices undergo sudden changes, it may quickly trigger pullbacks in high beta altcoins. If regulatory policies tighten unexpectedly (SEC enforcement, MiCA implementation, compliance errors by exchanges, etc.), it could also negatively impact market sentiment in the short term.

● Leverage and Liquidity Risks: Currently, the open interest and funding rates for perpetual contracts are relatively high, indicating a crowded long position in the market. If unexpected negative news or liquidity reductions occur, it may trigger a chain reaction of liquidations and a cascading decline.

● Structural Differentiation and Project Risks: Capital is concentrated in a few leading projects, while tail-end altcoins lack fundamental and liquidity support, leading to greater price volatility and the risk of going to zero.

In this context, we recommend:

● Maintain Dynamic Position Management in Strategy: Use phased building, phased profit-taking, and event-driven strategies to lock in profits and reduce the impact of volatility on net value.

● Strengthen Indicator and On-Chain Monitoring: Focus on leading indicators such as BTC.D, Altseason Index, stablecoin flows, funding rates, and OI to grasp market rhythms and identify phase turning points.

● Enhance Portfolio Defensiveness and Diversification: Use BTC, ETH, or leading stablecoins as defensive base positions, and allocate to fundamentally solid and clearly compliant leading altcoins for incremental exposure, while retaining a small amount of capital to participate in high beta narratives like AI and meme for short-term alpha.

● Prioritize Compliance and Due Diligence: Verify the compliance status, token economic model, governance, and team execution capabilities of projects before any investment to avoid "narrative-driven" traps.

Disclaimer: This content is for reference only and does not constitute investment advice. The information may be incomplete or inaccurate. Please conduct your own research; the author bears no responsibility for any losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。