Recommended Stablecoin Yield Scenarios with 10% Returns Suitable for DeFi Beginners

Author: @Web3Mario

Abstract: This week, Binance's subsidy program for USDC's flexible savings has ended. Such low-risk financial scenarios that allow for instant deposits and withdrawals with immediate returns are ideal for DeFi beginners, especially for those outside the crypto space looking to allocate assets. A yield close to 12% is quite competitive in the entire Web3 landscape. Therefore, many may be eager to find low-risk stablecoin investment alternatives. In this article, the author will outline principles for DeFi newcomers, particularly those from traditional sectors, and analyze several stablecoin investment scenarios that offer similar yields with lower risks.

Seven Principles for "Non-Crypto Workers" Participating in Stablecoin Investments

First, the author wants to describe a scenario. If you find this scenario appealing, then the content of this article will be useful to you:

By simply managing your assets on-chain, you can achieve an annualized return of 10% in USD terms, with funds available for instant deposits and withdrawals, no locking required, and very low risk of principal loss. You won't need to frequently check your dashboard.

Such scenarios are quite rare in traditional finance. To achieve a yield exceeding the short-term US Treasury rate of 3.7%, you would have to learn complex hedging and arbitrage strategies, monitor the fundamentals of certain junk bonds, and bear the risks of P2P defaults. However, in the DeFi world, due to varying market maturity and changes in the regulatory environment for stablecoins, there are numerous stablecoin issuers and lending protocols. In this competitive market landscape, companies will allocate additional subsidies to stimulate product adoption, much like the generous coupons offered during a "food delivery war." Therefore, at this market stage, it is still possible to find stablecoin investment scenarios that offer considerable returns with controllable risks.

These stablecoin investment scenarios are suitable for non-crypto believers and conservative investors, especially for middle-class workers outside the crypto space. You do not need to bet on the price movements of cryptocurrencies; instead, you can benefit from the on-chain capital premiums paid by speculators or degens seeking alpha returns. Moreover, during the asset allocation process, you do not need to invest much in learning or time costs. Therefore, during a rate-cutting cycle, if you still want to maintain your exposure to USD stablecoins, it is worth paying extra attention to stablecoin investment scenarios.

First, the author would like to outline several important principles for this group of users when choosing stablecoin investment scenarios:

Simple Operations, Avoid Complex On-Chain Interactions: For DeFi beginners, it is essential to remember that the more complex the on-chain interactions, the greater the risk exposure and the higher the usage costs. You might accidentally open a phishing platform and authorize your funds to a malicious address during an interaction. Or, when moving funds across chains, you might incorrectly fill in the receiving address. Therefore, DeFi beginners should choose investment scenarios that are as simple as possible to avoid unnecessary losses.

Only Choose Mature Platform Products, Control Your Greed: Typically, new protocols will offer more rewards to users. When faced with the temptation of extremely high yields, please control your greed, as many DeFi products are developed by anonymous teams. In the event of malicious incidents like fund theft, you may only receive a letter of explanation and a bunch of worthless tokens as compensation in the recovery plan. New protocols will also face challenges from hidden hackers in the on-chain dark forest, and whether they can withstand this is uncertain. Therefore, for DeFi beginners, the author recommends initially choosing only mature platforms and protocols, and to remain cautious about stablecoin investment scenarios offering yields exceeding 10%.

Pay Attention to Yield Models, Avoid "Tokenomics" Traps: We should also pay attention to the APR values indicated on official websites and carefully study the composition of yields and the conditions for yield realization. Many projects try to alleviate the pressure on token prices from subsidies through tokenomics design. For example, the rewards you receive may not be directly sellable on the secondary market for compounding, requiring a long unlocking period before you can access your rewards. This introduces significant uncertainty, as you cannot predict the price trend of the reward tokens during this unlocking period, which will greatly affect your final actual yield. Therefore, when choosing investment scenarios, try to select those where yield acquisition is relatively easy.

Not All "Stablecoins" Will Be Stable: In fact, stablecoins have been an important innovation direction since DeFi Summer. Remember the algorithmic stablecoin boom driven by Luna? That vibrant and competitive landscape is still fresh in our minds… However, as time has progressed, only stablecoins with 100% reserves can guarantee a certain level of stability. However, there are significant differences in how various entities manage their reserves. For example, Ethena's USDe reserves are composed of a delta-neutral perpetual contract funding rate arbitrage combination, while the management mechanism behind the recently popular Falcon's USDf is even more complex. In this article, we will not delve into further details. Here, the author suggests that if you do not want to worry about whether your principal is de-pegged during work hours, choose payment-type stablecoins backed by large institutions with reserves composed of highly liquid assets, such as USDT, USDC, or decentralized stablecoins over-collateralized by blue-chip assets, such as USDS, GHO, crvUSD, etc.

Understand Yield Variation Mechanisms, Choose Products Wisely: Another point you need to understand is that the yield you see at a certain time may not be sustainable. Therefore, you need to be able to judge how long the attractive yield can last. A typical example is when you find that the supply rate for USDC in a lending protocol exceeds 15%, but this usually means that the utilization rate of that liquidity pool exceeds 95%, and borrowers will bear borrowing rates exceeding 20%. Therefore, this is typically unsustainable. Do not harbor any illusions, as automated arbitrage protocols will continuously scan for such rate anomalies and quickly arbitrage them away. Once you are familiar with the basic usage logic of DeFi protocols, you can explore fixed-rate products like Pendle.

Choose to Interact During Network Downtime to Avoid High Operation Costs: Another easily overlooked detail is to choose the timing of your interactions with DeFi. Try to interact during times of low network congestion. Therefore, when operating, you can open Etherscan to check the current gas levels. Currently, a gas price below 0.2 GWEI is the average level when the network is relatively idle. Therefore, when invoking Metamask, check the fee cost; otherwise, the $100 reward you accumulate may cost you $120 in gas to claim.

In the New Cycle, Do Not Ignore Exchange Rate Risks: Finally, if you are a non-USD-based investor reading this, please pay attention to exchange rate risks. Current macroeconomic changes point towards a trend of USD depreciation. In the past month, the RMB has appreciated by about 1%. Therefore, when making investment decisions, consider exchange rate factors.

Recommended Stablecoin Yield Scenarios with 10% Returns Suitable for DeFi Beginners

After introducing these principles, the author would like to recommend two stablecoin investment scenarios that are quite suitable for DeFi beginners as alternatives to Binance's USDC flexible savings.

The first is providing RLUSD in Ethereum AAVE V3, which can yield a relatively consistent 11% APR. First, RLUSD is a fiat-backed stablecoin initiated by Ripple Labs, pegged 1:1 to the US dollar. Most of its reserves consist of high liquidity assets such as USD and short-term government bonds, and it operates under strict regulatory frameworks in New York State. Therefore, its stability and security can be assured. Additionally, the issuance of RLUSD has surpassed 700M, and it has over 50M in liquidity on Curve, meaning that users will incur lower slippage costs when entering positions.

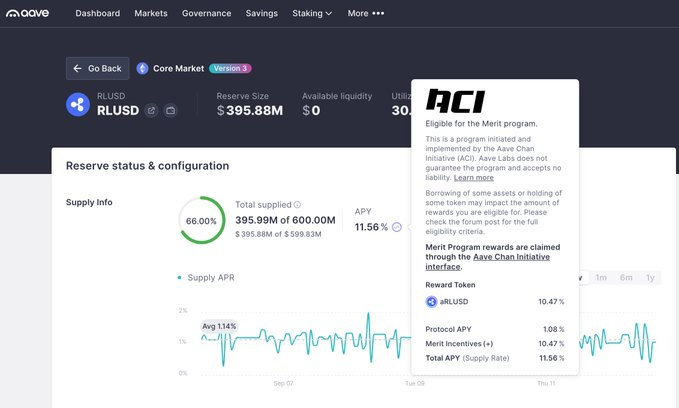

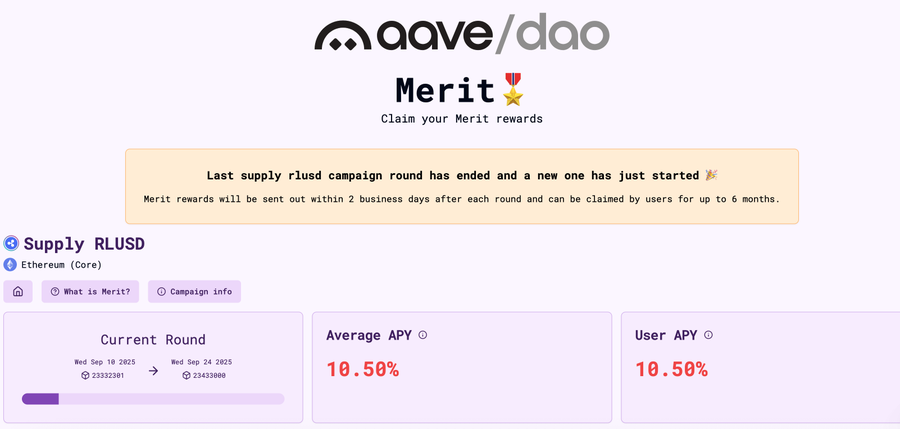

In Ethereum AAVE V3, we can see that providing RLUSD can yield an APR of 11.56%, where 1.08% of the yield comes from interest paid by RLUSD borrowers in AAVE. This portion of the reward will automatically roll into the user's principal. The other 10.47% of the reward comes from Ripple's official subsidies for liquidity providers, which are distributed through the Merit Program and issued bi-weekly. Users can actively claim these rewards on the Aave Chan Initiative Dashboard. Based on the author's observations, the subsidies have been ongoing for several months, indicating that this yield has been maintained for a considerable period. Participation in this scenario is also quite simple; you just need to exchange for RLUSD on Curve and supply it to AAVE.

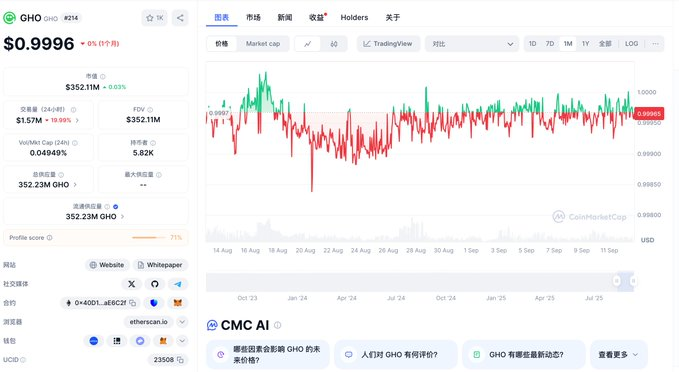

The second scenario is providing the GHO stablecoin in Avalanche AAVE V3, which can yield a relatively consistent 11.8% APR. GHO is an over-collateralized decentralized stablecoin issued by AAVE. We have previously detailed its specific mechanism in earlier articles, so we will not elaborate here. The collateral for GHO consists of blue-chip crypto assets designated by AAVE, and it relies on AAVE's liquidation mechanism to ensure the price stability of GHO.

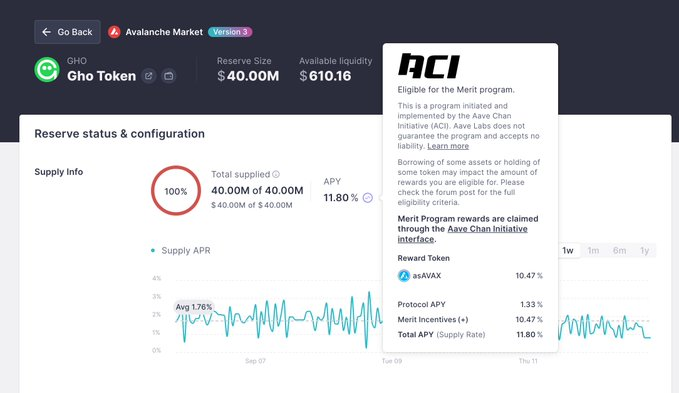

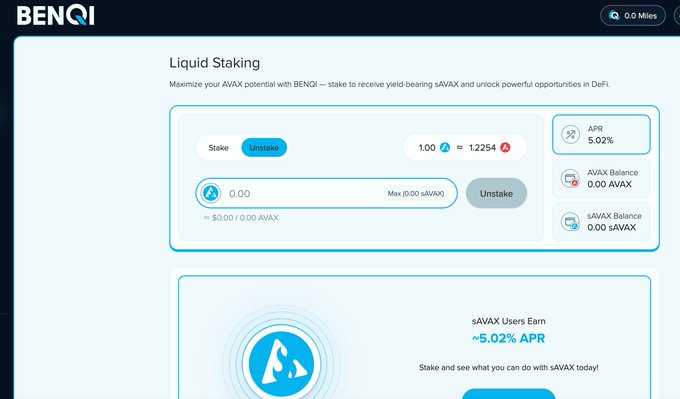

Avalanche is a high-performance L1. Although it is gradually falling behind in ecological development, it has strong compliance resources behind it. Similar to RLUSD, the 11.8% APR obtained by providing the GHO stablecoin in Avalanche AAVE V3 is also composed of two parts: a 1.33% borrowing rate and a 10.47% yield from official AVAX subsidies. This portion is also distributed through the Merit Program and is issued bi-weekly, allowing users to actively claim it on the Aave Chan Initiative Dashboard. The subsidies have also been ongoing for quite some time. It is important to note that this reward is issued in the form of asAVAX, which is a deposit certificate for sAVAX in AAVE. sAVAX is a deposit certificate for staking AVAX in the leading Liquid Staking protocol BENQI within the AVAX ecosystem to participate in POS mining. If you wish to exchange this reward for other tokens, you need to perform an unstake operation through BENQI, and there is a cooling-off period of 15 days. Of course, this portion of the tokens is also an interest-bearing asset, yielding a 5% staking return.

The author believes that these two stablecoin yield scenarios are quite suitable for DeFi beginners and non-crypto workers, and everyone can participate cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。