Fed Rate Cut Drives Market Shifts as Bitcoin Stays Under Pressure

Gold, Equity and Bitcoin are all moving in different directions, but they share one common driver, which is the next Fed Rate Cut meeting on 17 September. Peter Schiff is celebrating, while Dave Ramsey is again calling Bitcoin “dumber than crap.”

All the assets are hitting All time high except BTC.

-

Gold is trading near a record $3,650.

-

The S & P 500 is at $ 6,584.29 with an increase of 19.25%.

-

NASDAQ is at $ 22,141 with a six month increase of 27.96% as per Google Finance.

-

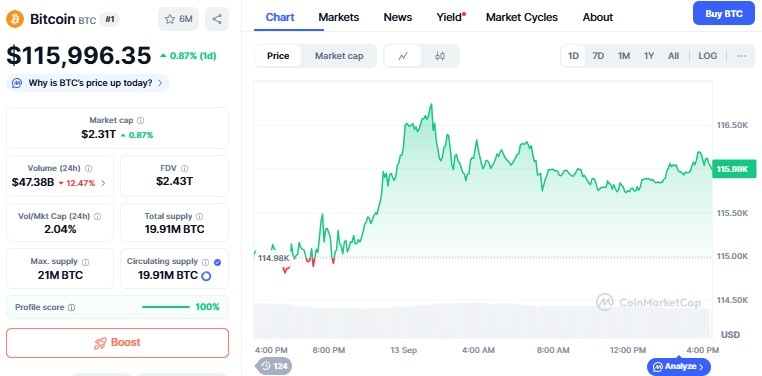

Bitcoin is steady around $116,000 after a two-week rebound.

Investors are now asking the same question: what happens when the Fed finally cuts rates next week?

US Economic Data Supports Rate Cut Expectations

Recent economic data gives the Federal Reserve good reason to act.

PPI

The wholesale price measure, the Producer Price Index (PPI), moderated to 2.6% in August. Core PPI, excluding food and energy, also declined relative to July.

Job Data

Unemployed claims increased to 263,000, the highest in almost four years. That indicates the labor market is softening and puts pressure on the Fed to act to ease policy.

CPI

Inflation came in mixed. Headline CPI gained 0.4% in August, above expectations, whereas core CPI continued unchanged at 0.3% .

Impact on Bitcoin and Crypto Markets

BTC has recovered, gaining around 4.7% in the week.

Whales changed positions, indicating long-term optimism.

Institutional investors (Microstrategy and Metaplanet) have been accumulating.

-

With $300 million coming into Bitcoin ETFs alone this week.

-

Technical charts show BTC remaining firm above $112,000.

-

The next resistance level may be at $120,000.

Source: CoinMarketCap

If the Federal Reserve chair Jerome Powell delivers on a Fed Rate Cut, Bitcoin could benefit as investors move money out of bonds and into riskier assets. Analysts are betting that it could soar towards $200K if rate cut happens.

The broader crypto market has also increased by 1.92% with a total market cap of 4 Trillion. Ethereum and even altcoins like Dogecoin are seeing new interest due to ETF speculation and fresh inflows of stablecoins.

Gold’s Strength Amid Rate Cut Speculation

Gold is considered a safe haven by the investors seeking safety in a low-rate environment. Lower interest rates tend to boost non-yielding assets like gold.

Source: TradingView

The 20-day EMA shows a bullish trend near $3,517, with support at $3,500 and resistance near $3,700.

Pressure on the US Dollar

The dollar index has lost strength in recent trading sessions as markets anticipate more easier policy.

A weaker dollar tends to drive commodities such as gold upwards, as well as boost Bitcoin, which is denominated in dollars.

If the Fed reduces rates, the dollar may lose further strength. That would most probably lengthen gains in gold and crypto, as well as making US exports competitively priced.

What Investors Should Watch

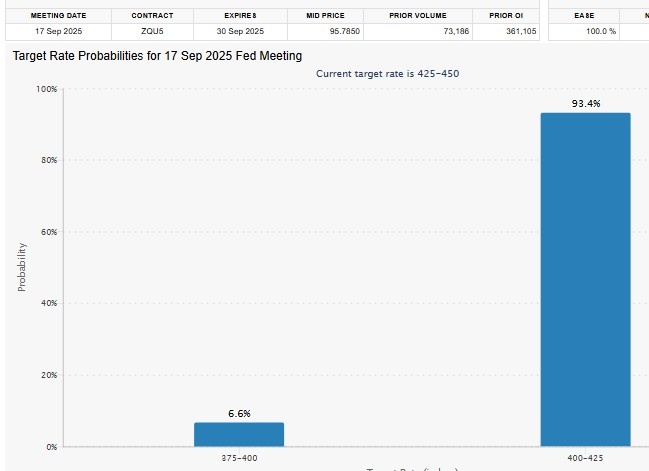

Markets are pricing in a 93% chance of a 25-basis-point cut and a smaller chance of a bigger 50-basis-point move. Whatever the Fed decides, the impact will ripple across gold, stocks, and crypto.

Source: FedWatch Tool

Investors are advised to monitor technical signals and liquidity flows to make informed decisions.

For now, optimism is building. If liquidity rotates as it usually does after a Fed Rate Cut, BTC and other digital assets may be the next big winners.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。