Author: Frank, PANews

With the explosive growth of several Binance Alpha tokens, discussions about whether Binance Alpha is leading a altcoin season have once again become rampant.

Many users are discussing on social media what kind of logic could be a potential wealth code. However, this so-called altcoin season is actually just a cognitive bias triggered by a few "explosive" projects. But if we are to find commonalities among these wealth codes, what kind of token conditions among the Binance Alpha tokens could lead the market?

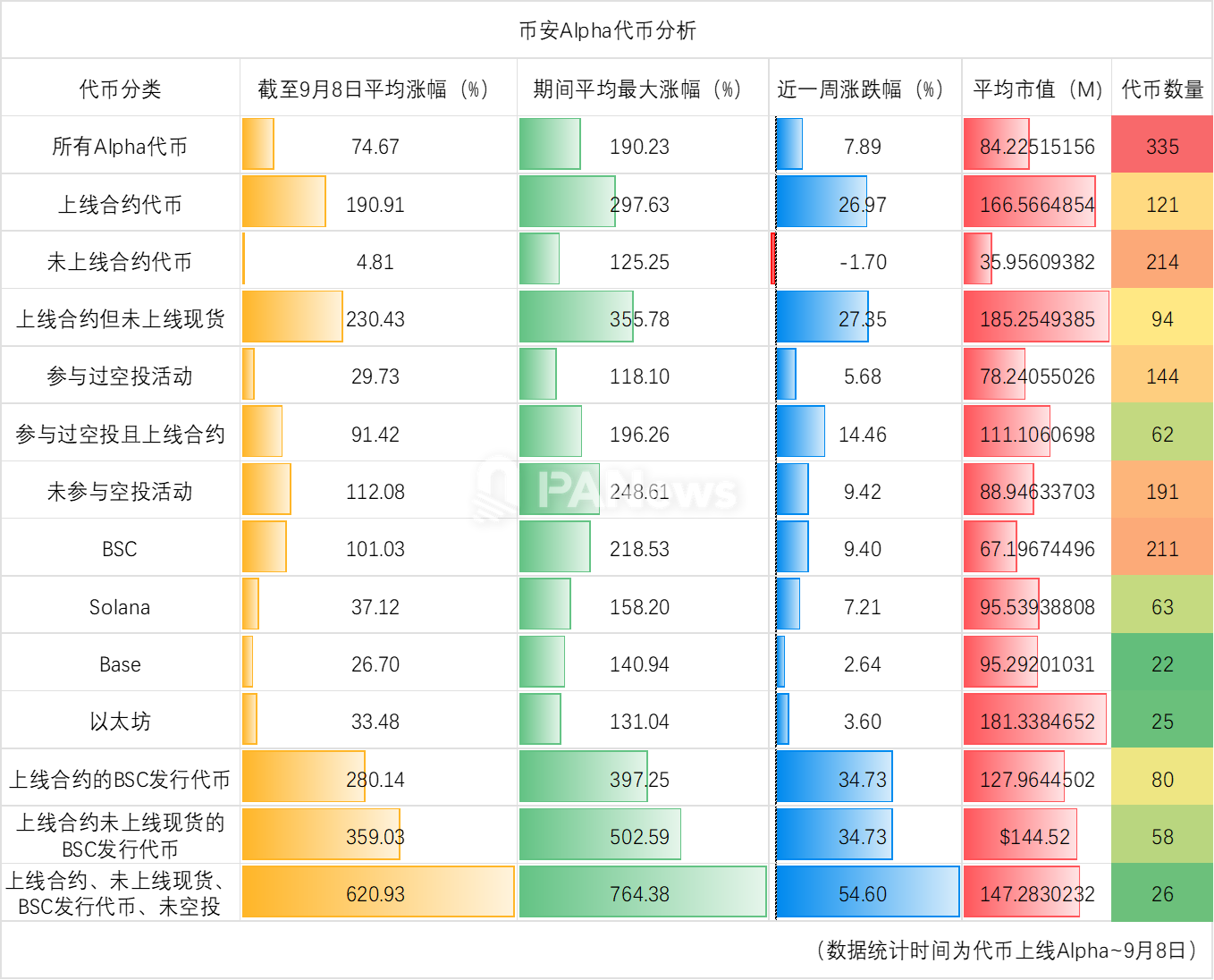

PANews conducted a comprehensive data analysis of the 335 tokens launched on Binance Alpha, exploring the true wealth codes behind them from multiple dimensions such as market capitalization, chain distribution, trading pair types, and whether they were airdropped, and delving into an ultimate question: Has the so-called Binance Alpha "altcoin season" really arrived?

Altcoin Season May Be an Illusion, Only 5 Tokens Doubled in Value in the Past Week

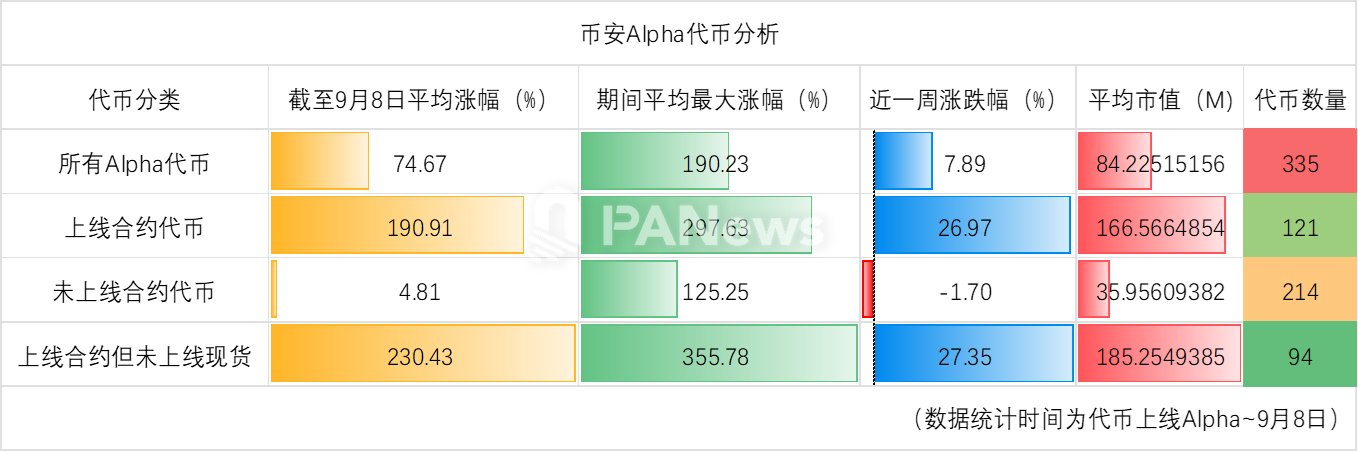

According to PANews' analysis of the 335 tokens launched on Binance Alpha, their market performance exhibits two core characteristics: a general "listing uplift effect" and a stark "performance polarization."

General Uplift Effect: From the overall data, the average increase of these tokens since their launch is 74.6%, while the historical average maximum increase is as high as 190%. This means that the vast majority of tokens experienced a strong uplift after landing on the Alpha platform. Specifically, 120 tokens (35% of the total) saw their highest price double after listing, with only 19 tokens never surpassing their issuance price.

Performance Polarization: However, the long-term performance after the uplift varies greatly. As of now, although 146 tokens (43.5% of the total) have increased in value, with 44 of them doubling, the star project MYX has even achieved an astonishing return of 123 times. At the same time, 81 tokens (24%) have seen their prices halved, with the maximum drop exceeding 97%.

Market Capitalization Distribution: In terms of project size, the average market capitalization of these tokens is $84.22 million, with a median of $18.58 million. Among them, the number of projects with a market capitalization exceeding $100 million is the highest (48), followed by those in the $10 million to $20 million range. This indicates that although there are small projects with a total market capitalization below $1 million in the market, the mainstream projects on the Alpha platform still possess a certain scale.

Recent Week Data: In the past week, 141 tokens have increased in value, with MYX still leading with a 7-day increase of 1064%. However, there are actually not many tokens that have doubled in value in the past week, only 5. From the statistical data, the average price fluctuation of Binance Alpha tokens in the past week is only 7.8%, far less than the fluctuations over the entire period. Therefore, the recent explosion of the altcoin season on Binance Alpha may just be a cognitive bias and does not exist universally.

Do Tokens Listed on Contracts but Not on Spot Have Greater Increases?

In addition, one of the hot topics discussed on social media is that tokens listed on Binance contracts but not on spot may have larger increases.

First of all, from an overall perspective, currently, only 28 tokens have been listed on Binance's spot trading pairs, accounting for only 8.3%, and the vast majority have also been listed on contract trading pairs. The number of trading pairs listed on contracts is relatively high, reaching 121, accounting for 36%. There are 94 tokens that are only listed on contracts but not on spot trading pairs, and these tokens have an average increase of 27% over the past 7 days, indeed higher than the average of all tokens. In comparison, tokens that have not been listed on contract trading pairs have an average increase of -1.7%, indicating an overall downward trend in the past week.

In terms of market capitalization, tokens that have not been listed on contracts have an average market capitalization of about $35.96 million, while those that have been listed on contracts have an average market capitalization of about $160 million. Clearly, tokens with higher market capitalizations are more likely to be prioritized for contract trading listings. Over the entire period, tokens that have been listed on contracts have achieved an average increase of 190%, with the historical maximum increase averaging 297%, showing better performance, while tokens listed on spot have only achieved an average increase of 45.77% (referring to performance after listing on Alpha).

In comparison, tokens listed on contracts but not on spot have an average increase of 230%, with an average maximum increase of 355%, indicating that tokens meeting this condition indeed perform better.

BSC Chain Has Clear Local Advantages, Average Increase Exceeds 100%

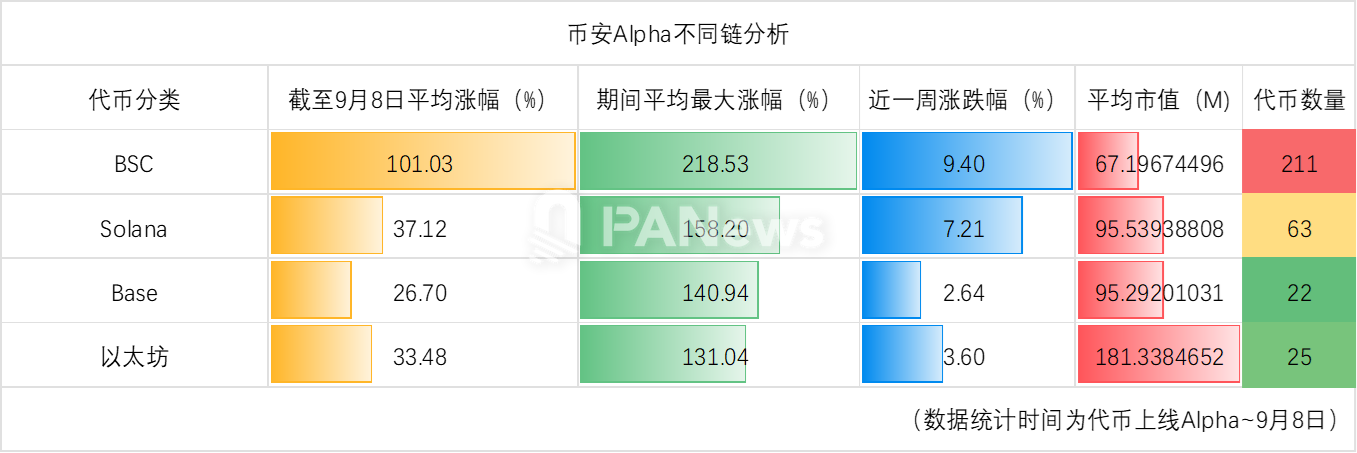

Is there also a different effect based on the chain?

From the chain distribution perspective, among the currently listed tokens, there are 22 on the Base chain, with an average increase of 26%; there are 211 tokens on the BSC chain, with an average increase of 101%; there are 28 tokens on the Ethereum chain, with an average increase of about 33.4%; and there are 64 tokens on the Solana chain, with an average increase of about 37%.

From the chain distribution, BSC, as a native public chain, is indeed more favored by the market, with market performance superior to that of tokens on other public chains.

Buying Old Rather Than New, Popular Tokens Generally Launched Earlier

What characteristics do the recently most increased tokens have?

Tokens on the BSC chain dominate; among the 5 tokens that increased over 100% in the past week, 4 are from the BSC chain, and 1 is issued on the Solana chain.

The launch time is not recent; these tokens were generally launched in May and July, with only one launched on August 24.

Three of the tokens have listed contract trading pairs, but this does not seem to indicate a direct relationship between large increases and the listing of contract trading.

In terms of market capitalization distribution, there is no significant statistical meaning. The market capitalization of these 5 tokens ranges from hundreds of thousands to billions of dollars. However, 4 of the tokens have a market capitalization exceeding $10 million.

If we take a longer view and analyze tokens that have increased over 100% since their launch, there may be more reference points.

In terms of market capitalization, these tokens generally have market capitalizations exceeding $10 million, and those with market capitalizations over $100 million generally rank higher in terms of increase.

The number of tokens listed on contracts accounts for 54.5%, but this does not seem to directly prove a necessary connection between high increases and the listing of contract trading.

The number of tokens issued on the BSC chain accounts for 56%, while the number of tokens issued on Solana accounts for 22.7%. The total proportion of these two chains reaches nearly 80%.

There is a clear distinction in the timing of listing on Binance Alpha. The distribution of launch times is as follows: April (12), May (4), June (3), July (16), August (6), September (3). From this data, it is evident that tokens launched in April, July, and August perform better in the market.

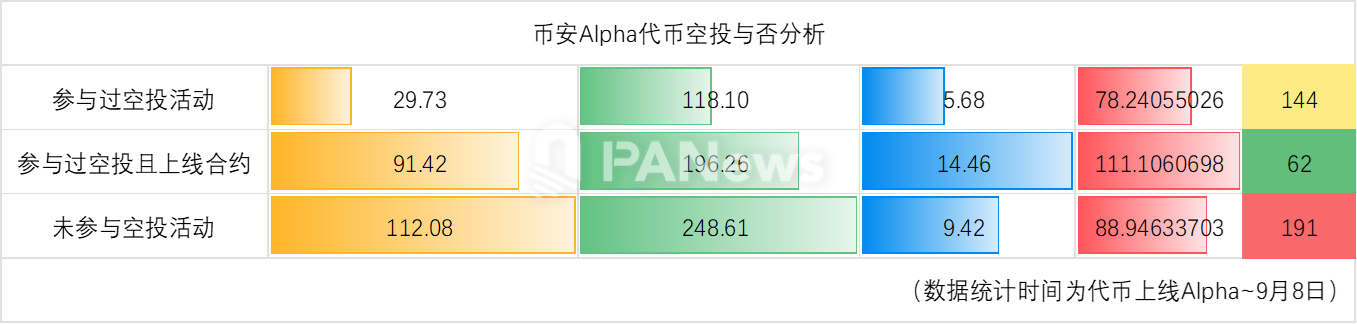

Airdrops May Actually Be Detrimental to Token Price Uplift?

Another aspect of the market that is of concern is how tokens that have participated in Binance Alpha airdrop activities perform. According to PANews' investigation, the number of tokens that have been airdropped on Alpha is 144. The average increase of these tokens to date is about 29%, which is actually lower than the performance of all Alpha tokens. Among them, 91 tokens have seen their prices decline since listing on Alpha, with the largest drop reaching 97%. However, from the perspective of maximum increase, these tokens have all experienced a price surge after listing on Alpha, with an average maximum increase of about 1235%. However, upon examining the data, it can be seen that REX reached a maximum increase of 1457 times after listing, which was caused by a short-term abnormal candlestick. After excluding such abnormal data, the average maximum increase is about 118%.

However, when the data filtering criteria are set to include tokens that have participated in airdrop activities and have already listed on Binance contract trading, the average increase of these tokens reaches 91%, with an average maximum increase of 196%. This data performance is better than the average level of airdropped tokens but lower than the average level of contract tokens.

From this perspective, whether or not to list on contract trading has become one of the most critical favorable factors for Binance Alpha tokens. Conversely, participating in airdrops does not seem to have any positive effect on the market price of the project itself and may even have a counterproductive effect.

Optimal Combination: Listed on Contracts, Not on Spot, BSC Chain, No Airdrop

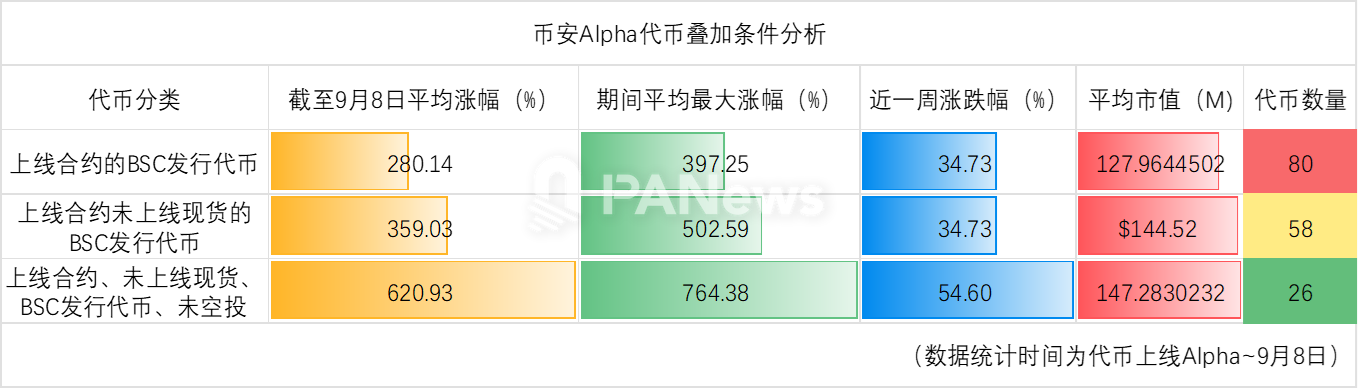

So, returning to our ultimate question, what kind of tokens might be the best-performing category on Binance Alpha? Combining previous analyses, we can see several potential favorable conditions from multiple dimensions: listed on contract trading, issued on the BSC chain, not airdropped, and not listed on spot trading.

After overlapping several conditions, if the tokens are issued on the BSC chain and have listed contract trading, the average increase has already reached 280%, higher than those that are only listed on contracts. If we further add the filter of not being listed on spot, the average increase will reach 359%. The strongest filtering condition is tokens that are listed on contracts, not listed on spot, not airdropped, and issued on the BSC chain; under this condition, the average increase of such tokens reaches 620%, with an average maximum increase of 764%, and a recent week increase of 54%, with data from all angles almost reaching the optimal situation.

Thus, we seem to have found the password for potential stocks on Binance Alpha, and the number of tokens under such condition filtering is only 26. A careful analysis of the reasons for this result reveals that in this process, the listing of contract trading and whether it is issued on the BSC chain have become the most critical factors, while the other factors seem more like auxiliary elements. However, ironically, these auxiliary factors are not due to these projects or tokens doing more, but rather due to not being listed on spot and not airdropped, which is a form of subtraction.

Fundamentally, the underlying logic may be that airdropped tokens flood the market with low-priced chips, creating a dumping effect. Meanwhile, not being listed on spot trading and only being listed on contract trading means that the price of these tokens is relatively easier to manage. Of course, for investors holding spot, an increase is always a good thing, but for those who prefer contract trading, the volatility of such tokens is also greater, making it easy to create a short squeeze effect.

However, it is worth noting that the conditions established by the above research are based on historical data and may be subject to overfitting. Additionally, a major regret in the research process is the inability to classify these tokens and more specific project information, which may be more important factors. Therefore, these research conclusions cannot serve as actual investment judgment criteria. It is hoped that such research merely serves as a method to inspire and provide readers with a new perspective.

The current opportunity is not a mindless buy-in to profit in the early stages of a bull market, but rather a structural market that requires careful selection and in-depth analysis. For investors, understanding the logic behind this phenomenon is far more important than simply chasing hot trends. Because in this game dominated by contract trading and extreme volatility, the other side of opportunity is always the risk that needs to be vigilant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。