Stablecoins are the backbone of the on-chain economy in Latin America.

Original: Dune

Translation: Will A-Wang

In Latin America, due to long-term inflation, currency fluctuations, and limited access to traditional banking services, millions have turned to cryptocurrencies/stablecoins out of necessity rather than speculation. Cryptocurrencies have evolved into practical financial tools used for everyday savings, remittances, and consumption. Against this backdrop, Dune's report is groundbreaking in both breadth and depth, providing us with a panoramic view of the Latin American crypto-financial ecosystem supported by on-chain data, focusing on the most urgent and impactful layer of crypto applications: Crypto as Payment.

To benefit, one must first build the road. Similarly, we need to construct an analytical framework through four dimensions: exchanges, stablecoins, deposit and withdrawal channels, and payment applications. Together, they form the infrastructure that supports real-world use cases (such as remittances, salaries, savings, and payments) linked to crypto finance.

Dune's report primarily approaches from an on-chain perspective, making it difficult to cover some large-scale real-world trade scenarios (such as import and export goods trade, as well as the significant service trade in Latin America). However, we can still analyze its on-chain data to see the ecological niches of local stablecoins, on-chain payment protocols, and DEXs in this active market, along with their early development trajectories. This is quite informative for participants in stablecoin payments.

As shown in the Lemon Cash "2024 Crypto Industry Status Report," the Latin American region is vast, rapidly changing, yet largely uncharted, with significant differences in usage patterns across countries: Brazil is primarily driven by institutional flow and retail speculation, Mexico's on-chain activity is driven by remittances, while Venezuela and Argentina heavily rely on stablecoins to hedge against inflation. Therefore, Dune focuses on common and practical use cases rather than viewing Latin America as a single market.

"The report indicates that Ethereum and stablecoins are being widely used for everyday savings, remittances, and consumption, with Brazil, Mexico, and Argentina leading an unprecedented wave of adoption. On-chain data provides hard-core support for this narrative, revealing the true workings of the Latin American crypto market." — Nathan, Head of Devconnect at the Ethereum Foundation

The Dune report is an exploratory, collaborative effort aimed at presenting key trends in crypto adoption in Latin America, focusing on the "Crypto as Payment" use case. Given the region's diversity in terms of countries, languages, economic environments, and regulatory frameworks, the report is not a comprehensive market map but rather a snapshot of real on-chain financial activities. It prioritizes projects that primarily serve Latin American users and utilize crypto for daily life (such as remittances, salaries, savings, and payments), rather than "Latin American teams targeting the global market."

Key Points

Exchanges remain the core financial infrastructure. They support retail adoption, institutional activity, and cross-border value transfer across Latin America: annual flows surged 9 times from 2021 to 2024, reaching $27 billion. Ethereum is used for large settlements, Tron for low-cost USDT payments, while Solana and Polygon support the expanding retail flow.

Stablecoins are the backbone of the on-chain economy in Latin America. Payment applications and stablecoins represent the regional product-market fit, with a lack of trust in the traditional financial system and economic crises driving demand. By July 2025, USDT and USDC accounted for over 90% of the tracked exchange transaction volume. At the same time, local currency-pegged stablecoins are also on the rise: BRL stablecoin volume increased by 660% year-on-year, and MXN stablecoin volume surged by 1,100 times, becoming new tools for domestic payments.

Payment applications are evolving into "crypto-native digital banks." Crypto has become the backend infrastructure, with strong demand for payments and savings. Platforms like Picnic, Exa, and BlindPay integrate stablecoin balances, savings, and real-world consumption into a single interface. Whether or not they have bank accounts, a growing number of young, mobile-first users are increasingly using crypto to meet their daily financial needs.

1. Four Pillars of Crypto Finance in Latin America

Latin America is one of the most active regions for global crypto adoption, driven by economic volatility, exclusion from the financial system, and everyday necessities. Faced with long-term inflation, continuous currency depreciation, and a lack of traditional banking services, millions of Latin Americans have turned to cryptocurrencies, not for speculation or novelty, but for survival, stability, and efficiency.

As of June 2024, the region received a total of $415 billion in crypto value, with Brazil, Mexico, Venezuela, and Argentina ranking among the top 20 globally (Chainalysis, 2024). Behavioral changes are evident: in Argentina and Colombia, stablecoins have replaced Bitcoin as the most purchased crypto asset; trading volume surges around salary payment dates, as users convert their wages into digital dollars to preserve value (Bitso, 2024).

In this ecosystem:

Stablecoins—whether pegged to the dollar or local currencies—are an important financial lifeline in Latin America, helping people save, remit, and maintain purchasing power. In 2024, over 70% of crypto purchases in Argentina were stablecoins (Lemon, 2024).

Exchanges (Lemon, Bitso, Ripio, etc.) are key infrastructures for accessing liquidity. Centralized platforms account for 68.7% of the region's crypto transaction volume, comparable to North American levels (Chainalysis, 2024).

Deposit and withdrawal channels (ZKP2P, PayDece, Capa, etc.) connect crypto with the local economy, which is especially important in countries with insufficient traditional financial coverage.

Payment applications (Picnic, Exa, BlindPay, etc.) make crypto truly usable, integrating wallets, remittances, exchanges, and even interest-earning functions within a mobile-native interface, designed specifically for local users.

These pillars collectively build a parallel financial system in Latin America, often more stable, accessible, and practical than traditional solutions.

2. Centralized Exchanges (CEX)

Centralized exchanges remain the main entry point for Latin Americans into the crypto world, accounting for 68.7% of regional activity in mid-2024, slightly lower than North America but far higher than other emerging markets (Chainalysis, 2024). Users prefer regulated, trustworthy platforms that allow direct fiat deposits. These exchanges have expanded from basic trading to payments, savings, and cross-border transfers, becoming key gateways to the crypto economy.

The market is highly concentrated. The Lemon 2024 report shows that Binance accounts for 54% of the CEX volume in Latin America, maintaining its leading position. Among regional competitors (Bitso, Foxbit, Mercado Bitcoin, etc.), Lemon leads with a 15% share, highlighting the complementary role of local applications to the neglected needs of global platforms (Lemon, 2024).

Use cases are also upgrading. On the retail side, exchange functionalities are becoming increasingly rich: in 2024, Bitso Pro (the professional version) had transaction volumes comparable to the classic version, despite having fewer users, demonstrating the significant influence of advanced traders (Bitso, 2024). On the institutional side, Brazil is leading: from Q4 2023 to Q1 2024, transaction volumes over $1 million increased by 48.4% quarter-on-quarter (Chainalysis, 2024), driven by interest from traditional finance, ETF demand, and the Drex central bank digital currency pilot. Major banks like Itaú and BTG Pactual have launched crypto investment services, blurring the lines between exchanges and banks. Small and medium-sized enterprises are also using exchanges for cross-border settlements and currency hedging; in Brazil, companies are using crypto to pay Asian suppliers to avoid high bank fees, and local Bitcoin and stablecoins have been widely accepted (Frontera, 2024).

2.1 Analysis of On-Chain Fund Flows in Latin American Exchanges

This analysis tracks the flow of assets in and out of exchange hot wallets, presenting the real inflows and outflows of funds on these platforms. Unlike "trading volume," which reflects market activity, on-chain flows record user deposits, withdrawals to external wallets, and settlements with other counterparties, thus providing a more accurate reflection of exchange usage, liquidity demand, and their role as deposit and withdrawal channels between crypto and the real economy. Due to data availability limitations, the analysis does not include the native Bitcoin network, so total transaction volume is underestimated, with BTC only represented through mapped assets on other chains (such as BTCB).

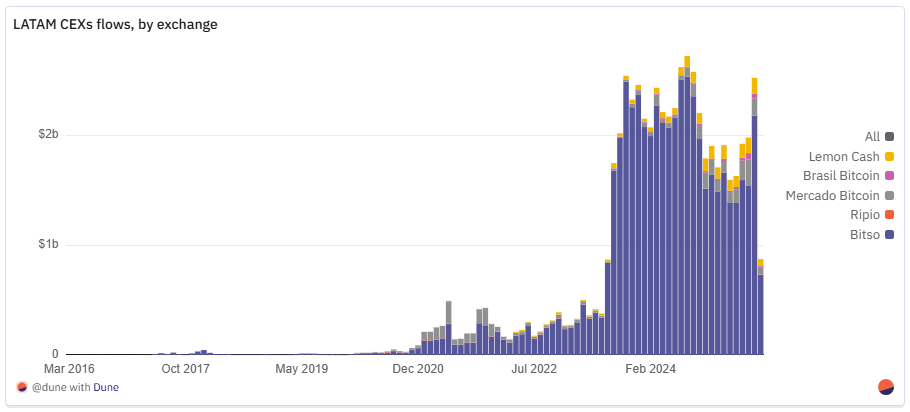

From early 2021 to mid-2025, the flow of centralized exchanges in Latin America depicts a clear curve of "growth—maturity—consolidation": the tracked annual transfer amount increased from $3 billion in 2021 to $27 billion in 2024.

In 2021, Bitso processed less than $2 billion, Mercado Bitcoin around $1.2 billion, and Brasil Bitcoin, Ripio, and others only tens of millions, with the market still fragmented among OTC desks, informal brokers, and a few formal exchanges.

In 2022, diversification began, with the new entrant Lemon Cash recording $90 million in its first year.

2023 marked a true turning point, with transaction volumes quadrupling year-on-year: Bitso jumped from $2.5 billion to $13.6 billion; Lemon Cash nearly tripled to $260 million. Exchanges became deeply embedded in the payment ecosystem, remittance corridors, and corporate treasuries. Inflation and depreciation in Argentina and Brazil boosted demand for stablecoins, making exchanges key gateways for dollar inflows and outflows.

In 2024, liquidity peaked: Bitso reached $25.2 billion, Mercado Bitcoin tripled to $915 million, and Lemon Cash $870 million. Notably, this growth did not rely on a sustained bull market, reflecting real demands such as cross-border trade, remittance settlements, and currency hedging.

In early 2025, there was a brief decline, with January hitting a recent low before steadily recovering, reaching a monthly transaction volume in July that was the highest since September 2024. Bitso recorded $11.2 billion in the first seven months of that year, although lower than the 2024 pace, it was still several times higher than any year before 2023; Mercado Bitcoin $990 million; Lemon Cash $890 million, nearing last year's record within half a year.

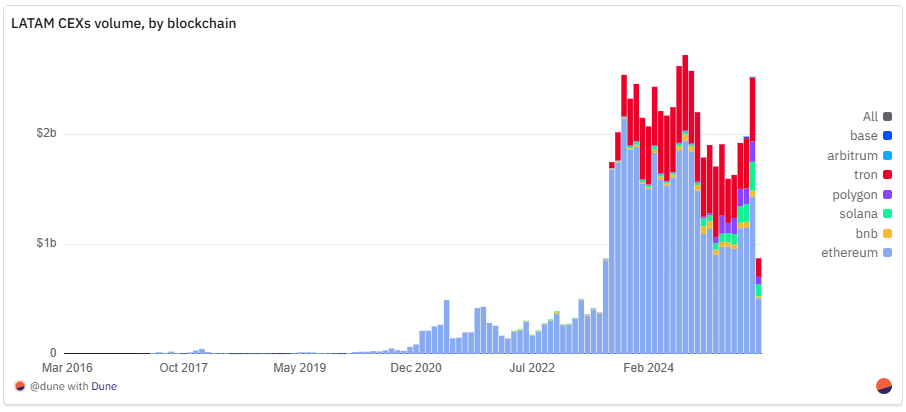

Behind these transactions, the technological landscape of blockchain is also clear:

Ethereum has always been the backbone of exchange activity in Latin America. From January 2021 to July 2025, it accumulated $45.5 billion, accounting for about 75% of the tracked total, dominating large settlements, stablecoins, and tokenized asset transfers.

Tron ranks second with $12.5 billion, benefiting from its low-cost USDT channels, widely used for remittances and cross-border payments.

Solana accumulated $1.45 billion, placing third, just ahead of Polygon's $1.17 billion. Since 2025, Polygon's share has steadily increased, reaching 7.2% in July, surpassing Solana's 7.1% for the first time.

BNB Chain accumulated $963 million; Base ($23.6 million) and Arbitrum ($11.2 million) have small bases but rapid growth: Base processed $22 million in the first seven months of 2025, compared to only $1 million for the entire year of 2024; Arbitrum matched its total for 2024 by July.

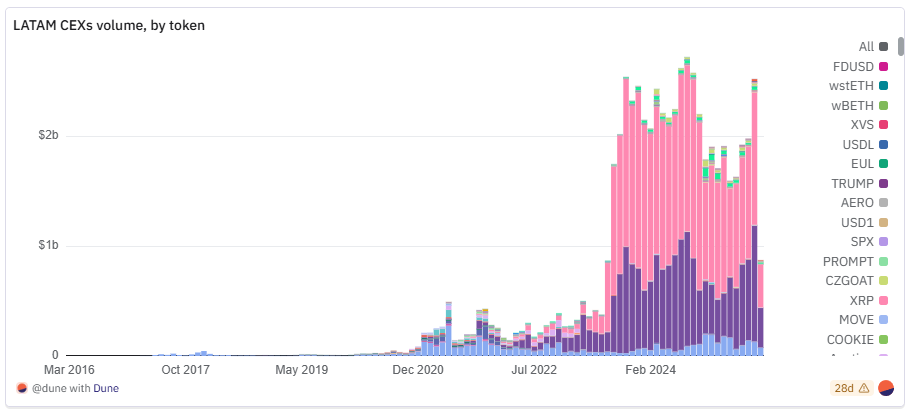

On the token level, stablecoins overwhelmingly lead: as of July 2025, USDT and USDC accounted for nearly 90% of transfer volume. From January 2021 to July 2025, USDT accumulated $32.4 billion, nearly double USDC's $18.36 billion, with the gap primarily due to Tron USDT's dominance. ETH itself ranks third with $4.74 billion; SOL accounted for about 1% in July 2025, with a cumulative total of $660 million since 2021.

Structural changes are significant: during most of 2021-2022 and 2023, ETH trading volume often competed closely with stablecoins, with the list also including BTCB, MATIC, and others. Since the end of 2023, the share of USDT/USDC has sharply expanded, indicating a shift in use cases from speculation to payments, remittances, merchant settlements, and dollar savings.

The evolution of blockchains and tokens points to the maturation of the Latin American exchange ecosystem: Ethereum remains the settlement backbone, Tron monopolizes low-cost stablecoin transfers, and Polygon steadily increases its share in payment scenarios. Exchanges are increasingly becoming platforms for payments and value transfers rather than purely speculative venues.

Lemon Cash is a typical example: reserve proof shows that it held about $100 million in assets under custody in mid-2025, with stablecoins making up the majority; over the past year, stablecoin balances have typically maintained between $20 million and $30 million, highlighting its positioning as a "retail dollar channel." Network activity shows a multi-chain pattern: the most active withdrawals are on Tron, BNB, and Ethereum; the strongest deposits are on BNB, Tron, and Stellar, with emerging L2s like Polygon and Base rapidly growing from small bases. This demonstrates how regional exchanges dynamically adapt around fees, speed, and accessibility, while regional settlement volumes remain primarily on Ethereum.

Overall, blockchain and token data reinforce a structural narrative: Latin American exchanges have achieved large-scale expansion based on "Ethereum-centric, stablecoin-driven" foundations, with occasional speculative surges temporarily reshaping rankings. Pragmatic adoption and cultural vitality coexist, defining the future of exchange activity in the region.

2.2 Key Conclusions

Exchanges have upgraded to financial infrastructure: from 2021 to 2024, the tracked annual flow increased from $3 billion to $27 billion, a ninefold growth, transitioning from fragmented OTC to large integrated platforms serving retail and institutional clients.

Bitso's flow increased from $1.96 billion in 2021 to $25.2 billion in 2024 (+1,185%), accounting for a significant portion of the tracked total in Latin America; in the first seven months of 2025, it reached $11.2 billion, 44% of last year's total.

Lemon's transaction volume nearly tripled in 2023, reaching $870 million in 2024; in the first seven months of 2025, it has processed $840 million.

From January 2021 to July 2025, Ethereum accounted for about 75% of the flow in Latin American exchanges (a total of $45.4 billion), dominating large stablecoin and token transfers; Tron accounted for $12.5 billion, monopolizing low-cost USDT remittances; Solana accumulated $1.5 billion, but by July 2025, it was surpassed by Polygon, which held an 8% share that month.

### 3. Stablecoins

Stablecoins are the financial cornerstone of crypto adoption in Latin America, with uses far beyond speculation. Throughout the region, they are used as savings tools, payment channels, remittance channels, and means to hedge against inflation, making them the most practical and widely recognized form of cryptocurrency.

Latin America currently leads the world in "real-world stablecoin implementation": Fireblocks' "2025 Stablecoin Status" report shows that 71% of surveyed institutions have used stablecoins for cross-border payments, and 100% have launched, piloted, or planned stablecoin strategies; 92% claim their wallet and API infrastructure is ready, indicating demand and technological maturity. For millions of people, stablecoins represent digital dollars that can hedge against inflation and bypass capital controls (Frontera, 2024), often being the only viable means of dollar savings.

In Argentina, Brazil, and Colombia, stablecoins have surpassed Bitcoin as the daily choice, due to their price stability and direct peg to the dollar (Fireblocks, 2025). This aligns with the previous section's exchange data: USDC and USDT account for over 90% of transfer volume. In 2024, 72% of crypto purchases on Bitso's Argentina platform were stablecoins, with Bitcoin only at 8%; in Colombia, the share was 48%, driven by restrictions on dollar accounts and exchange rate fluctuations; Brazil's local exchanges saw stablecoin transaction volumes increase by 207.7% year-on-year, leading all assets (Chainalysis, October 2024). In 2024, stablecoins accounted for 39% of regional purchase volume, up from 30% in 2023.

3.1 Local Stablecoins

A. Brazilian Stablecoins

Dollar-pegged assets still dominate, but stablecoins pegged to local currencies have seen rapid growth over the past two years. Tokens pegged to the Brazilian real and Mexican peso are increasingly used for domestic payments, on-chain commerce, and integration with local financial systems. This eliminates the need for repeated conversions between dollars and local currencies, reducing costs for merchants and users while speeding up settlements.

For businesses, they can directly connect to payment systems like Brazil's PIX, enabling bank-free, instant transfers that comply with accounting and tax requirements. In high-inflation economies, they also serve as "bridging assets," allowing users to transact in stable local currencies while being able to quickly convert to dollars or other stores of value when needed.

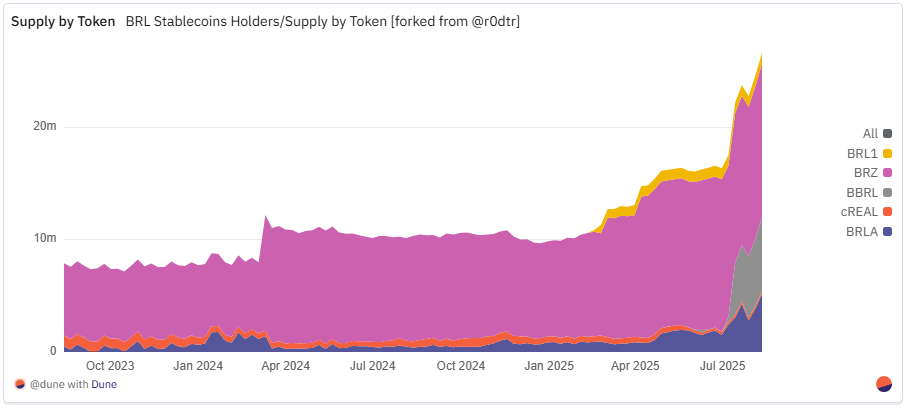

Brazil is the clearest case of this trend: the volume of BRL stablecoin transfers increased from just 5,000 transactions in 2021 to over 1.4 million in 2024, maintaining 1.2 million transactions in the first seven months of 2025, a 230-fold growth over four years; the number of unique sending addresses rose from fewer than 800 to over 90,000 by 2025, an 11-fold increase since 2023. The native transfer volume grew from about 110 million reais in 2021 (approximately $20.9 million) to nearly 5 billion reais (about $900 million) by July 2025, approaching the total for the entire year of 2024; if August is included, the total for 2025 has already surpassed last year. What began as a small-scale experiment has quickly grown into a core pillar of Brazil's on-chain economy, with transaction numbers, user counts, and transfer values achieving several-fold or even hundreds-fold increases.

As of June 2025, five different BRL-pegged stablecoins are actively circulating, indicating a decrease in concentration and marking the maturation of the ecosystem. Despite rapid growth, BRL stablecoins are still in the early stages, with a current circulation size of about $23 million. Additionally, the entire market is rapidly evolving. Iporanga Ventures' latest "BRL Stablecoin Report" notes that there is currently no absolute leader, but project-level data shows each has its leading track:

BRZ—issued by Transfero, which provides blockchain financial infrastructure for banks, fintechs, and payment institutions. In terms of native transfer volume, BRZ was far ahead until mid-2024; in the second half of that year, cREAL surged to the top position. By early 2025, Celo's volume advantage receded as BRLA steadily grew; by July, BBRL made a "dramatic" entry—after launching on XRPL, its monthly native transfer volume accounted for about 65% of the entire market, despite having relatively few active sending addresses.

cREAL—issued on the Celo chain, focusing on mobile DeFi integration. cREAL's transaction count is far ahead, showing its first-mover advantage in retail and small payment scenarios.

BRLA—launched by BRLA Digital/Avenia, focusing on compliant fiat-crypto bridging. BRLA has the most unique sending addresses, indicating its broadest retail reach.

BRL1—backed by alliances of Mercado Bitcoin, Bitso, Foxbit, etc., aiming to establish an industry-wide standard.

BBRL—issued by Braza Group, positioned for regional commerce and payment scenarios.

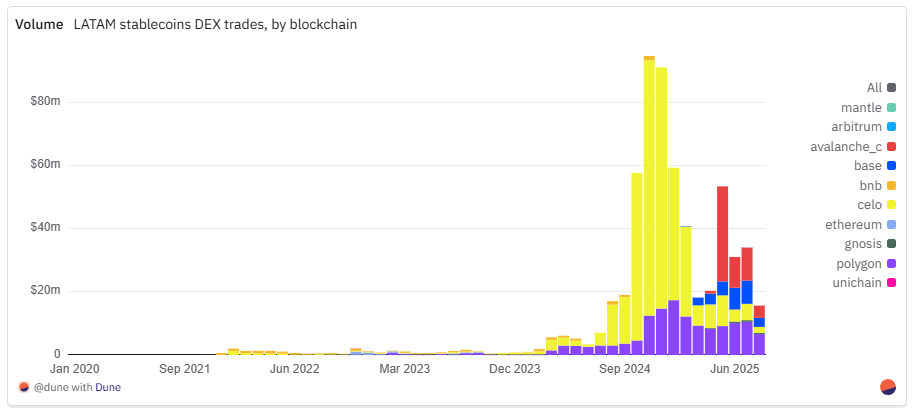

Unlike dollar-pegged stablecoins, the supply and transfers of BRL stablecoins are primarily concentrated on Layer 2 and other alternative chains, rather than the Ethereum mainnet.

Polygon is currently the most active main channel, leading in both native transfer amounts and user numbers: in July 2025, approximately 74,000 transfers occurred on this chain, from 14,000 unique users, with a monthly amount reaching 500 million reais, setting a historical record.

Celo ranks second, with the highest cumulative number of transfers: in December 2024, due to the early surge of cREAL in retail and small payments, the monthly peak reached 213,000 transfers. Entering 2025, although the number of unique sending addresses decreased, Celo's transaction volume remained substantial due to repeated large transfers through merchants, aggregators, and corporate finance.

XRPL has shown impressive performance as a new player: with the launch of BBRL, transfer volume surged from just a few hundred in May 2025 to about 3,000 in July, with native amounts skyrocketing to approximately 1.16 billion reais, indicating the emergence of a new high-value channel.

Base maintained steady growth in 2025, peaking in June; the BNB chain has seen a significant decline in both transfer numbers and sending addresses since 2022, leading to a reduced share. The Ethereum mainnet has limited utility, used only occasionally for large, low-frequency transfers, although BRZ briefly led on this chain from late 2023 to early 2024.

Iporanga Ventures' report indicates that actual adoption is driven by pragmatic and high-value use cases: B2B payments dominate, with businesses using them to pay overseas suppliers or employees, then settling locally through PIX; inbound flows convert dollars into BRL stablecoins for domestic distribution. They are becoming key infrastructure for Brazil's tokenized asset ecosystem, enabling on-chain settlements without bank custody. In the gig economy and small to medium-sized enterprises, stablecoins are used for remittances, hedging, and capital protection; merchant integrations like CloudWalk's BRLC and Mercado Pago's dollar stablecoin further expand mainstream reach.

B. Mexican Stablecoins

Brazil has the most diverse and mature local currency stablecoin ecosystem, while Mexico's peso-pegged market is also taking shape, currently featuring two main projects: Juno/Bitso's MXNB and Brale's MXNe, each following different adoption paths. Among them, MXNB initially exhibited "one-time issuance scale" usage at the end of 2024, but by 2025, it has evolved into a more sustained and decentralized daily circulation.

In 2025, MXNB's growth shows a clear shift towards "everyday" usage. In July 2025, the token recorded 179 transfers from 70 unique senders, far exceeding the 46 transfers and 21 senders from a year earlier, representing year-on-year increases of 339% and 290%, respectively. Although transaction volume peaked in January 2025 at 14.5 million Mexican pesos (approximately $750,000), the number of transactions was low; in contrast, July's 480,000 pesos (about $25,000) consisted of more, smaller payments. The average single transaction amount dropped from about 28,700 pesos in July 2024 to 3,600 pesos. Accompanying this change was a decisive migration to Arbitrum: approximately 99% of transfers occurred on the Ethereum mainnet in 2024, but by the second quarter of 2025, about 94% had shifted to Arbitrum, with the low-fee Layer-2 track becoming the default choice.

Brale's MXNe has taken a different path: it has become the largest peso-pegged stablecoin in Mexico, operating entirely on the Base chain. In March 2025, its activity peaked with 3,367 transfers from 274 senders; although the number of transfers subsequently declined, transaction volume continued to rise, reaching approximately 637.7 million pesos by July 2025, from 2,148 transfers and 158 senders, with an average single transaction amount close to 297,000 pesos, indicating characteristics of high-value transactions and even institutional-level use.

In contrast, the landscape is now clear: MXNB currently dominates small, retail-style payments; MXNe focuses on large settlements. Compared to Brazil's diverse, multi-chain real ecosystem, the Mexican market remains concentrated around two issuers and fewer chains, but this has not hindered liquidity growth. Since mid-2025, peso trading pairs have rapidly entered the top ranks of decentralized exchange volumes, marking a maturation of market structure.

3.2 Decentralized Exchanges (DEX)

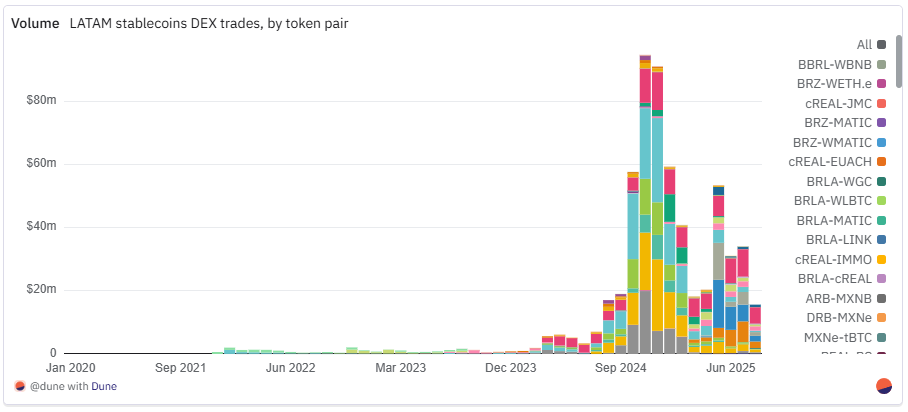

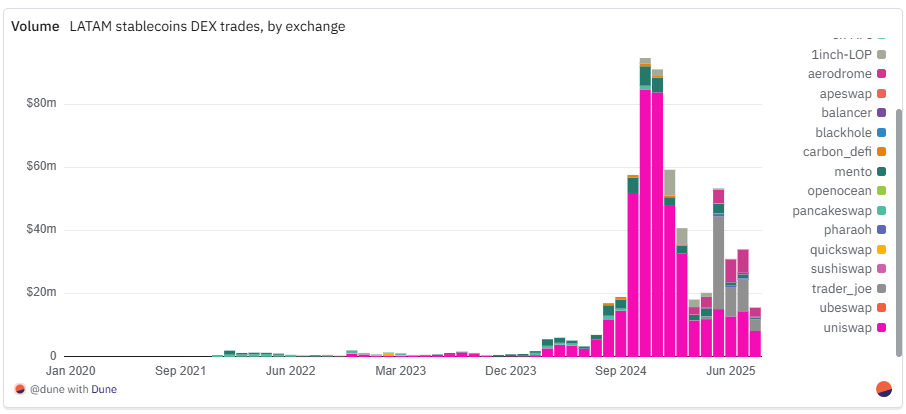

The rise of BRL and MXN pegged stablecoins in Latin America has transcended the "payment" category, beginning to provide substantial liquidity for decentralized exchanges (DEX) and forming an on-chain forex corridor between local currencies and global stablecoins.

BRL Assets

cREAL remains the trading hub. Its largest trading pair, CELO–cREAL, has accumulated approximately $126 million in transactions, relying on the deep liquidity of Celo's native DEX; it also serves as a "benchmark currency" for multi-currency swaps, with significant cross-currency trading pairs like cREAL–USDT ($87.7 million), cREAL–cUSD ($59.1 million), cEUR–cREAL ($48.6 million), and cKES–cREAL ($24.9 million). However, cREAL's monthly DEX transaction volume peaked at $80 million in November 2024 (accounting for 85% of the total stablecoin volume that month) and has since declined, reaching only $5 million in July 2025, returning to levels seen in the same period last year.

BRLA is becoming the main channel for dollar exchanges, with BRLA–USDC ($97.5 million) and BRLA–USDT ($21.3 million) as core trading pairs. Since March 2025, BRLA–USDC has consistently ranked as the largest USD-denominated trading pair in the data set (only briefly surpassed by the MXNB trading pair in May). Although BRLA has not reached cREAL's peak, its total trading volume in July 2025 was $9 million, nearly double that of cREAL for the month and three times its volume in July 2024.

BRZ has the broadest liquidity distribution, with trading pairs like BRZ–USDC ($15.1 million), BRZ–USDT ($14.7 million), and BRZ–BUSD (approximately $9.1 million) spread across multiple chains; although the transaction volume is small, it has steadily increased from $26,000 in July 2024 to $3 million in July 2025, peaking at $477,000 in April.

MXN Assets

The largest trading pairs for MXNB are MXNB–WAVAX ($29.7 million) and MXNB–USDC ($18.6 million), with a spike in May 2025 due to large transactions and liquidity inflows; since then, peso trading pairs have remained strong, with the three major MXN trading pairs consistently ranking among the top in local stablecoin DEX volumes, indicating that growth is not "transitory."

MXNe operates solely on Base, focusing on trading MXNe–USDC (approximately $18.3 million). DEX transactions have steadily increased from $1.13 million in March to $6.6 million in July, aligning with Base's strategy of "integrating local stablecoins into deep USD pools." Interestingly, while MXNe's on-chain transfer volume leads MXNB, MXNB's DEX transaction volume is higher, indicating that MXNe is more inclined towards high-value transfers and dollar integration, while MXNB is better suited for active on-chain trading.

Transaction volumes are concentrated in a few decentralized exchanges, each deeply tied to different local stablecoin ecosystems. Uniswap remains the liquidity giant, with a total transaction volume of $426 million, dominating the BRL and MXN pegged stablecoin markets on Ethereum and its Layer 2. Chain-native DEXs hold decisive shares of their respective stablecoins: Avalanche's Trader Joe ($52.8 million) and BNB Chain's PancakeSwap ($13.3 million) capture the vast majority of BRZ liquidity; Mento on Celo ($50.8 million) is the exclusive main venue for cREAL. The 1inch Limit Order Protocol operates differently, functioning more like an aggregation settlement layer, often appearing in one-time large swaps rather than maintaining deep pools.

A noteworthy new trend in 2025 is the rise of Aerodrome: with the MXNe–USDC trading pair, its cumulative transaction volume has reached $25.8 million, almost entirely from the second quarter onward. As a core anchor for local stablecoins on the Base chain, Aerodrome's role is comparable to that of Mento in the Celo ecosystem. Smaller but noteworthy are Carbon DeFi ($4.8 million), Pharaoh ($1.95 million), and Balancer (approximately $1.8 million), which serve fragmented or niche cross-asset pools.

Overall, the absolute value of local stablecoin liquidity continues to expand, increasingly relying on chain-native DEX infrastructure, with Aerodrome's rapid ascent being the most striking example of 2025.

The liquidity landscape remains deeply tied to the "home" blockchain of each stablecoin and its leading DEX.

Celo leads with a total transaction volume of $363 million, almost entirely driven by the cREAL–cUSD/USDC trading pair on Mento, which consistently topped dollar-denominated transaction volumes from July 2024 to February 2025.

Polygon follows closely with $136 million, aggregating various real stablecoins like BRLA and BRZ through Uniswap and QuickSwap, catering to both transfer and DeFi/payment scenarios.

Avalanche ranks third with approximately $54.8 million, experiencing a spike in the MXNB–WAVAX trading pair on Trader Joe in May 2025 due to large inflows, alongside Uniswap, Pharaoh, and 1inch Limit Order Protocol providing depth for the BRL and MXN markets.

Base has around $26.2 million, almost entirely contributed by the MXNe–USDC trading pair on Aerodrome, aligning with Base's push for local stablecoins in 2025.

Core conclusion: The DEX liquidity of local stablecoins is "ecosystem as home," with each mainstream public chain deeply pairing flagship assets with a few dominant exchanges. The two breakout cases of 2025—Avalanche's Trader Joe for MXNB and Base's Aerodrome for MXNe—illustrate that when a local stablecoin is elevated to a strategic level, on-chain adoption and exchange dominance mutually reinforce each other.

Beyond Brazil and Mexico, other Latin American countries are also experimenting with local currency stablecoins, but most remain in early or pilot stages:

Argentina's peso is highly volatile, making it difficult for Transfero's ARZ and Num Finance's nARS to gain sustained traction.

Colombia has launched several options like nCOP (Num Finance), cCOP (Celo/Mento), COPM (Minteo), and COPW (Bancolombia), targeting remittances and local payments, but adoption remains moderate.

Chile's CLPD (Base) and Peru's nPEN (Num Finance), sPEN (Anclap, Stellar) are also niche, primarily used for pilot projects or specific payment channels.

These projects reflect a growing regional interest, but transaction volumes are limited, once again highlighting the decisive role of currency stability and regulatory clarity in the potential scaling of local stablecoins.

3.3 Key Conclusions

Stablecoins are the "backbone" of the on-chain economy in Latin America. Dollar-pegged and local currency-pegged stablecoins have replaced high-volatility assets, becoming central to crypto applications, and continue to maintain double-digit and even triple-digit growth.

In July 2025, USDT and USDC accounted for over 90% of exchange transfer volumes, compared to only about 60% in the same period of 2022.

Brazil leads in both the number of active local currency stablecoins and total activity. In the first seven months of 2025, BRL stablecoins processed $906 million, nearly matching the total for the entire year of 2024 ($910 million), translating to approximately $1.5 billion on an annualized basis.

In Mexico, peso-pegged stablecoins (MXNB + MXNe) totaled about $34 million in July 2025, compared to only 1 million pesos (approximately $53,000) in July 2024, representing a year-on-year increase of about 638 times.

The main on-chain corridors for local currency stablecoins are: Polygon (BRLA, BRZ), Celo (cREAL), Base (MXNe), and Arbitrum (MXNB).

4. Inflow and Outflow Channels

The coexistence of centralized and peer-to-peer inflow and outflow channels serves as the most critical "connective tissue" between the crypto economy and traditional finance in Latin America. In countries like Argentina, Brazil, and Mexico, users often convert their salaries into stablecoins on payday—treating crypto as a "buffer" rather than a gamble to hedge against local currency volatility.

Brazil: The government-backed Pix payment system has become the main entry point for fiat to crypto, offering instant transactions with almost zero fees.

Argentina: Due to capital controls and economic uncertainty, informal "cuevas" (underground exchange houses) remain the primary outlet, even as formal platforms have grown significantly.

Behavioral data from Bitso (2024) shows that on-chain activity spikes on specific days and times each week, closely aligning with pay cycles, further proving that crypto is a "store of value" rather than a speculative toy.

New players at the infrastructure level—such as PayDece, zkP2P, and Takenos—are launching non-custodial, mobile-first solutions aimed at groups overlooked by traditional finance, enhancing financial autonomy and marking a shift towards "decentralization and censorship resistance."

For the growing number of freelancers and remote workers in Latin America, crypto outflows have become an essential part of their tech stack: they receive international salaries in stablecoins, bypassing volatile local currencies and bank account barriers (Frontera, 2024).

4.1 ZKP2P

ZKP2P is a decentralized, minimal-trust P2P inflow and outflow protocol that utilizes advanced cryptographic proofs like zkEmail and zkTLS to enable direct exchanges between fiat and crypto assets without intermediaries, additional verification, or fees. Launched at the end of 2023 and upgraded to V2 in 2024, it now supports multiple chains (Ethereum, Solana, Base, Polygon) and various assets, from USDC and ETH to popular local tokens and even meme coins.

In Argentina: ZKP2P integrates with Mercado Pago, allowing for near real-time exchanges between Argentine pesos (ARS) and USDC.

The dedicated Latin American channel has completed over 100 inflows, totaling more than 3,000 USDC, with an average single transaction of $30, ranging from $1 for small amounts to $356 for larger transactions.

In the past week, the median settlement time was about 30 minutes, which is considered "fast" by P2P standards.

Global data:

V2 has recorded a total of 4,861 inflows, amounting to over $1.9 million (combined V1+V2 totals $2.08 million).

The total liquidity across all payment channels is $114,000; leading corridors include Venmo ($559,000), Revolut ($470,000), Wise ($390,000), and Cash App ($327,000).

The global average single transaction is $385, which is 12 times the average in Latin America, indicating significant room for growth in the latter.

Next steps: More local tracks, such as Brazil's PIX, will soon be integrated to broaden low-threshold, high-frequency scenarios. A typical case—Daimo Pay × ZKP2P × World Account: users can seamlessly convert Worldcoin's $WLD to pesos within the World App, with the entire process on-chain, non-custodial, and arriving in 15 minutes, truly transforming "UBI airdrops" into "disposable income."

"ZKP2P makes stablecoins everyday pocket money, allowing USDC to be converted into Argentine pesos in minutes, all on-chain, transparent, and without the friction of traditional banks." — Ben, Growth Lead at ZKP2P

4.2 PayDece

PayDece is a P2P crypto inflow and outflow platform built on Web3 core principles (decentralization, privacy, self-custody). Utilizing smart contracts, it enables secure and anonymous transactions without centralized intermediaries or mandatory identity verification (KYC).

Currently, PayDece has processed over 44,000 transfers across all supported chains, estimated to involve 15,000 unique users. Activity is highly concentrated in stablecoins: $19.17 million in USDT and $7.74 million in USDC. The on-chain distribution is led by BNB Chain ($19.5 million), followed by Polygon ($6.3 million), Avalanche ($1.68 million), and Base ($830,000).

Since the end of 2023, PayDece has shown strong early growth: monthly transaction volume increased from less than $300,000 in November 2023 to $1.79 million in July 2025, with a peak exceeding $2.4 million at the end of 2024. The number of transfers and users has risen in tandem, with notable spikes in April 2024, November-December 2024, and June-July 2025. Current transaction volumes remain above early adoption levels, indicating a stable base of repeat customers and ongoing transaction flow.

With a privacy-first design, multi-chain support, and growing on-chain liquidity, PayDece is emerging as a major decentralized alternative platform for Latin American users seeking censorship-resistant, self-custody inflow and outflow solutions.

4.3 Capa

Capa is a financial infrastructure provider focused on "seamlessly integrating crypto into Latin America." Through a set of APIs, it allows fintechs, enterprises, and payment applications to directly embed stablecoin tracks, complete fiat-crypto exchanges, and drive cross-border transactions. By emphasizing liquidity, compliance, and multi-chain networks, Capa addresses the pain points of fragmented payment systems and high costs of cross-border remittances in Latin America.

User on-chain distribution:

- As of July 2025, Capa has accumulated over 900 unique addresses, with transactions highly concentrated on "low-cost + fast settlement" chains: Polygon accounts for 68%, Base 10%, Arbitrum 7%, Ethereum 4%, and Solana 4%. This shows a clear migration trend compared to December 2024 (Solana 20%, Polygon 33%).

Funding flow:

Retail (B2C) has seen a total of 1,173 inflows and 809 outflows; both types of demand have significantly expanded since 2025.

Monthly retail inflows increased from an average of $200 in July 2024 to $1,300 in July 2025; outflows rose from $336 to $1,200, reflecting a growing demand for stablecoin exchanges and withdrawals as the platform connects with more regional partners.

Total volume and chain breakdown:

- Since launch, there have been a total of 5,501 transactions, amounting to $29.9 million. – Polygon: $14.1 million – Solana: $6.95 million – Tron: $2.73 million – Optimism: $2.52 million – Arbitrum: $1.26 million – Base: $1.11 million – Ethereum: $1.06 million – the remainder from BNB Chain and others.

Benchmark cases

- Capa, as the only platform providing 1:1 Mexican Peso ↔ MXNe (Base chain peso stablecoin) inflow and outflow services that is fully compliant, supports the MXNe issued by Etherfuse, with infrastructure provided by Brale and launched on Coinbase Wallet, setting a model for "local-first" financial tools.

Positioning

- Capa does not directly target end users but has become a key underlying component of the Latin American crypto economy through its dual engine of inflow and outflow + real-time settlement, delivering compliant, efficient, and scalable crypto capabilities to wallets and fintech across the region.

"For Latin America, crypto means opportunity. Capa connects fragmented economies, allowing people to seamlessly access the global financial system." — Jonathan Herrera, Head of Capital Markets at Capa

4.4 Key Conclusions

Inflow and outflow channels are narrowing the "gaps" between on-chain and local economies. Permissionless protocols and compliant infrastructure are advancing in parallel, making the flow between Latin American fiat and crypto assets faster, cheaper, and simpler.

ZKP2P opens up new inflow and outflow paths with a non-custodial, cryptographic solution, allowing stablecoins and local currencies to be exchanged almost instantly. The global V2 version has surpassed $1.87 million, but only about $3,000 in the Latin American region, indicating significant growth potential as integrations like Brazil's PIX are implemented; the median settlement time is about 41 minutes, making frictionless P2P fiat ⇄ crypto exchanges a reality.

PayDece is growing into a decentralized, reusable stablecoin transfer platform: 15,000 users have cumulatively transacted $27.8 million, with a sixfold increase in volume since the end of 2023, maintaining a stable monthly flow of $1–2 million, indicating a maturing demand for "censorship-resistant entry points" in Latin America.

Capa has completed $29.9 million in inflow and outflow and cross-border stablecoin settlements via API, with rapid growth on Polygon and Solana, highlighting its role as a key enabler for "cross-border expansion of fintech and B2B applications in a compliant environment."

5. Payment Applications

Crypto-powered payment applications and "crypto-native digital banks" are becoming one of the most effective distribution channels in Latin America. Exchanges like Lemon, Belo, Buenbit, and Ripio issue both physical and virtual cards for everyday spending; platforms like Picnic, BlindPay, and Exa offer dollar-denominated balances, yield features, and stablecoin payments within the same app, positioning themselves as "crypto-native neobanks." Demand is accelerating: according to Lemon data, downloads of crypto apps in Latin America doubled year-on-year in Q2 2024, indicating a shift in user motivation from "speculation" to "necessity."

Argentina: Lemon Cash's crypto card allows users to spend with stablecoins, settle bills in pesos, and earn Bitcoin cashback, integrating savings and spending into the same incentive loop.

Unbanked populations: In rural or traditionally overlooked areas, crypto apps are not a supplement but a direct replacement for traditional finance.

5.1 Picnic

Picnic is a decentralized investment platform on the blockchain aimed at simplifying access to digital assets. Its Smart Wallet uses Safe contracts and ERC-4337 account abstraction, allowing users to open accounts with just an email while maintaining self-custody. In addition to investing in selected crypto asset portfolios, Picnic extends its reach into real-world payments through "Picnic Pay," launching Brazil's first stablecoin debit card in partnership with Gnosis Pay.

Users can recharge their Gnosis Pay card using Pix (Brazil's instant payment system), with BRL automatically converted to USD and settled on-chain.

The card supports online and offline spending and can be linked to Apple Wallet / Google Wallet.

Picnic Pay connects directly to DeFi protocols, allowing users to use Aave funds or interest-earning BRL stablecoins for card transactions.

All USDC.e activity generated by Picnic comes from Gnosis Pay's operations in Brazil, currently accounting for about 7% of Gnosis Pay's total weekly transaction volume but nearly 15% of total weekly payment counts, indicating a low average transaction value but very high transaction frequency.

Since its launch, Picnic has surpassed 350 daily active users, processing 45,000 payments weekly, with a weekly transaction volume exceeding $150,000. Activity levels remain high following its debut at the 2025 Rio Web Summit in April: daily transactions range from 800 to 1,000, peaking above 1,100. By the end of July, user balances stood at $80,000, down from a monthly peak of $200,000, indicating that funds are actively circulated rather than held long-term, aligning with its positioning as a "spending tool" rather than "long-term savings."

Picnic has partnered with Avenia to launch a BBRL yield product, expanding its savings offerings from BRLA to interest-bearing versions stBRLA and yBRLA, with an annualized yield of about 12%, linked to Brazil's CDI rate. In addition to savings, Picnic also connects with mainstream DeFi platforms like Aave and Morpho, enabling users to borrow BTC in Brazil, further expanding the multiple use cases of local stablecoins for "earning, trading, and credit."

With the integration of Picnic Pay and DeFi yields, the platform spans asset management and everyday payments. Embedding stablecoin debit cards into investment apps and directly linking interest-earning, self-custodied assets to spending is an emerging model in Latin America—where the local payment track Pix serves as a bridge between fiat and on-chain settlements.

"Picnic allows Brazilians to spend foreign currency at a rate 4% cheaper than Wise, while also providing non-custodial token purchases, yields, and free BRL inflow and outflow (Pix) integrated through BRLA." — João Ferreira, Co-founder and CEO of Picnic

5.2 Exa App

Exactly Protocol is a decentralized, non-custodial interest rate market offering both floating and fixed borrowing rates, determined by the utilization rates of multi-term pools.

Exa App brings this model to mobile: users can deposit assets like USDC, ETH, wstETH, WBTC, and OP, maintaining self-custody while continuously earning floating yields until spent. After completing KYC (to meet Visa compliance), users can obtain the Exa Card—a blockchain payment card supporting two consumption modes:

Pay Now: Directly deducts from the interest-earning balance.

Installments: Allows borrowing from Exactly's lending pool at a fixed rate during consumption, repayable in up to 6 installments.

Recent data shows Exa App users have a balance of $1.62 million (with a TVL of about $1.08 million), with ETH and USDC each accounting for about $650,000, and WBTC being about half of the former, while other tokens make up a smaller proportion.

The Exa Card has processed a total of $5.04 million in payments, with the vast majority being Pay Now transactions, while installments (Pay Later) account for $793,000. In contrast, lending activity remains relatively small: a total of 69 loans with 30 borrowers, amounting to $47,400.

Overall, current usage is primarily card-based, with a limited proportion of loan volume. The combination of "interest-earning deposits + fixed-rate borrowing for consumption" forms a unique on-chain payment model—where the user's net cost or net yield depends on the spread between deposit yields and borrowing rates.

"Latin America's adoption of crypto is not a trend but a necessity. Exa App is building tools to make this adoption useful, accessible, and real." — Gabriel Gruber, Founder and CEO of Exa App

5.3 BlindPay

BlindPay provides API infrastructure that enables businesses to make and receive payments globally in fiat and stablecoins. It encapsulates compliance, regulatory requirements, and integration with diverse payment tracks (such as Pix, SPEI, PSE in Latin America, and ACH, Wire, RTP, SWIFT in the U.S.) at the core, while supporting Ethereum, Arbitrum, Base, Polygon, and Tron on the blockchain side for settlement interoperability between crypto and local fiat systems. Core features include:

API-first integration: Developer-facing endpoints that allow global payments to be embedded in any application.

Compliance at the infrastructure layer: Built-in KYC/KYB, anti-fraud, and regulatory alignment.

Local + cross-border payments: Supporting both regional instant payment systems and stablecoin transfers.

Settlement speed: Significantly faster compared to traditional channels.

Since its launch, BlindPay has processed $93 million across all operational regions (the U.S., Brazil, Mexico, Argentina, Colombia), with most concentrated in Latin America; according to data from June, the team revealed an additional $70 million in July-August. On-chain, Polygon accounts for $91.86 million (≈99%), Arbitrum $7.56 million, and Base $4.26 million; monthly volumes have grown from several million dollars in mid-2024 to tens of millions in 2025, indicating expanding API adoption rates and payment corridors.

By stitching together stablecoin tracks and local payment infrastructure, BlindPay fills the operational gap between blockchain settlements and physical distributions, particularly suitable for Latin American businesses that need to navigate multiple currencies, banking systems, and jurisdictions.

"We've reduced the cost of cross-border remittances in Latin America from 1.5% to 0.1%, and shortened settlement times from 2-3 business days to real-time payment levels in seconds; at the same time, we've democratized access to dollar usage through virtual dollar accounts, allowing any individual or business to hold and trade dollars without a U.S. bank account." — Bernardo Simonassi Moura, CEO of BlindPay

5.4 Key Conclusions

Payment applications are transforming into "crypto-native digital banks." Savings, yields, and everyday payments are integrated into a one-stop solution, mobile-first, and driven by stablecoins, serving both banked and unbanked populations.

Picnic processes 45,000 payments weekly through Gnosis Pay, offering an interest-bearing local stablecoin product with an annualized yield of about 12%.

Exa App card payments have totaled $5.04 million, with 85% in "Pay Now" mode, allowing funds to continue earning interest.

BlindPay has accumulated $93 million, with 99% on Polygon, connecting to Pix (Brazil), SPEI (Mexico), and PSE (Colombia) for compliant, real-time distribution.

Lemon Cash, Nubank, Mercado Pago, and others are directly embedding crypto into consumer banking stacks—such as Lemon's stablecoin card offering BTC cashback and Mercado Pago's self-developed dollar stablecoin Meli Dólar.

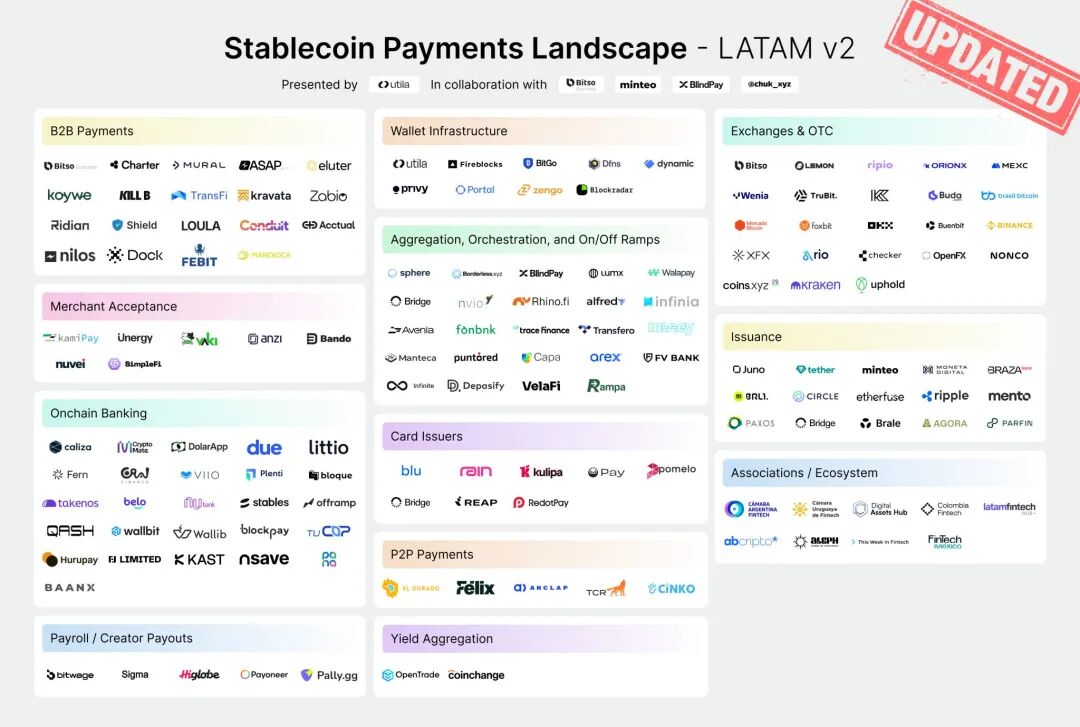

6. The Crypto Financial Ecosystem Beyond On-Chain Reports

This report focuses on projects with verifiable on-chain data on Dune, but the breadth of the Latin American crypto ecosystem far exceeds the current coverage. Numerous mature and innovative platforms are active in the region that we cannot yet track with verifiable on-chain metrics.

Below is a panoramic view of the Latin American crypto financial ecosystem compiled by Chuk Okpalugo, and we will continue to organize around this map.

Abroad – An open-source payment infrastructure that connects USDC with real-time fiat networks, supporting local systems like Pix (Brazil) and PSE (Colombia) for low-cost cross-border and instant offline payments. Recently partnered with wallets like Beans and Decaf, focusing on compliance and the Latin American market.

Amero – A fintech that connects traditional payment tracks in Latin America with the digital asset ecosystem, supporting over 100 payment methods and 350,000 online cash points, integrating Circle's programmable wallet (Ethereum / Avalanche / Polygon), and soon launching a prepaid Master/Visa card that can be recharged with USDC in Mexico, collaborating with MoneyGram for remittances and self-service cash withdrawals, targeting unbanked populations, merchants, and freelancers.

Argiefy – An Argentine fintech app that helps users save money and make better financial decisions in an inflationary environment; it offers currency conversion, coupons, community-shared discounts, and integrates crypto-fiat exchanges through partners like zkp2p.

Bando – An on-chain consumption protocol that allows users to purchase real goods and services directly with cryptocurrencies/stablecoins without needing fiat conversion. It covers over 100 countries and 6,000+ merchants (including Amazon, Uber, Airbnb), supporting mobile top-ups, bill payments, and digital goods, and has integrated with wallets like MiniPay, Binance Wallet, and Base App.

Buenbit – A cross-regional platform originating from Argentina, offering trading in over 40 cryptocurrencies, daily yield savings, crypto-backed loans, and international Mastercard payments in Mexico, Peru, and other locations; it supports networks like Ethereum and Polygon, with over 700,000 users.

Coinsenda – A wallet + exchange that supports the exchange of 18 digital assets for local currency, with an active USDT OTC desk; it has over 2,900 monthly active users and a monthly transaction volume of $546,000, with 90% on the TRON network, primarily used for payroll and remittances.

El Dorado – A P2P stablecoin marketplace connecting a liquidity network of 10,000 merchants, with 180,000 monthly active users and a monthly transfer volume of $18 million, with TRON accounting for 60%, covering Brazil, Colombia, Argentina, Peru, and Bolivia.

KAST – A stablecoin payment platform that supports global credit card consumption; it has 500,000 total users and a cumulative transaction volume of about $5 billion, with TRON accounting for 55%, and a 112% month-on-month increase in consumption in Brazil in the first half of 2025.

Kripton – Since 2019, it has applied the decentralized Bitcoin philosophy to commercial payments, designating USDT (TRON) as the official digital dollar in April 2025, with a 70% TRON usage rate, serving retail, merchants, and payment platforms.

Muney App – Based on Polygon, it provides plug-and-play infrastructure connecting digital dollars with local cash networks, allowing users to deposit and withdraw cash, make P2P transfers, and comply with outflows, focusing on remittance channels from multiple countries to Venezuela.

Mural Pay – A stablecoin payment API designed for B2B, offering global payments, invoicing, virtual accounts, and compliance tools, already integrated into over 40 markets, and recently partnered with Taxbit to expand stablecoin invoicing and cross-border payments in Europe and Latin America.

Orionx – A Chilean exchange and infrastructure provider, offering trading in over 20 cryptocurrencies in Chile, Peru, Colombia, and Mexico, with a minimum purchase of 10,000 Chilean pesos; in June 2025, it received Series A investment from Tether to expand stablecoin remittances, acquiring, treasury, and inflow/outflow infrastructure.

Sphere – An "operating system" for the digital economy, focusing on inclusive finance, operating in Latin America and the U.S., with TRON accounting for 45%, and a quarterly transaction volume growth of 68%.

Swapido – A non-custodial platform based on the Lightning Network, completing BTC to Mexican Peso exchanges in seconds and transferring to any local bank account, with plans to add stablecoin support in 2025.

Takenos – An Argentine digital wallet + Web3 neobank targeting freelancers, gamers, and influencers with cross-border income, supporting USD/EUR receipts, crypto or cash withdrawals, debit cards, and global transfers.

Ugly Cash – A stablecoin financial services app offering high-yield accounts, free instant cross-border transfers to over 60 countries, and a 1% cashback Visa card, supporting virtual accounts in USD, EUR, and Mexican Pesos.

Traditional Fintech "Crypto-ization"

Local "super apps" in Latin America like Nubank, Mercado Pago, PicPay, and RappiPay have emulated Revolut and PayPal by directly embedding crypto assets into their banking stacks, serving hundreds of millions of users:

Mercado Pago launched Meli Dólar (2024), pegged 1:1 to the dollar, and integrated e-commerce payment processing;

PicPay added BTC, ETH, and USDP trading, planning to issue a BRL stablecoin and integrate with Binance;

RappiPay launched crypto payments, adding wallets, credit cards, and savings accounts;

Nubank offers BTC and ETH purchases with interest-bearing accounts.

By embedding crypto capabilities into familiar compliant apps, these giants provide hundreds of millions with low-friction, trustworthy access to digital assets in highly volatile economies.

7. Conclusion

As shown in the Dune report, the crypto narrative in Latin America is "building a parallel financial infrastructure that people will actually use." From Mexico to Argentina, the driving force behind on-chain adoption is not a concept but a necessity: combating inflation, cross-border remittances, settling with suppliers, paying salaries, and everyday shopping.

Over the past four years, the region has developed a multi-chain parallel financial system centered around stablecoins, deeply integrated with local payment tracks like Pix/SPEI. It can perform most functions of traditional banks, often doing so faster, cheaper, and with lower barriers to entry.

Challenges remain: data gaps, inconsistent regulations, and insufficient liquidity for local stablecoins. But the trajectory is clear: starting from speculative trading, it is evolving into a multi-layered resilient ecosystem—crypto is no longer an "investment target," but a "default method for saving, transferring, and spending."

If the past decade was about proving the feasibility of crypto, the next decade will amplify those validated practices. The next chapter of the on-chain economy in Latin America will be co-written by builders, analysts, and the community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。