Hyperliquid Community Vote Decides USDH Ownership, $5.6 Billion Profit Sparks Intense Competition.

Author: Tristero Research

Translation: Baihua Blockchain

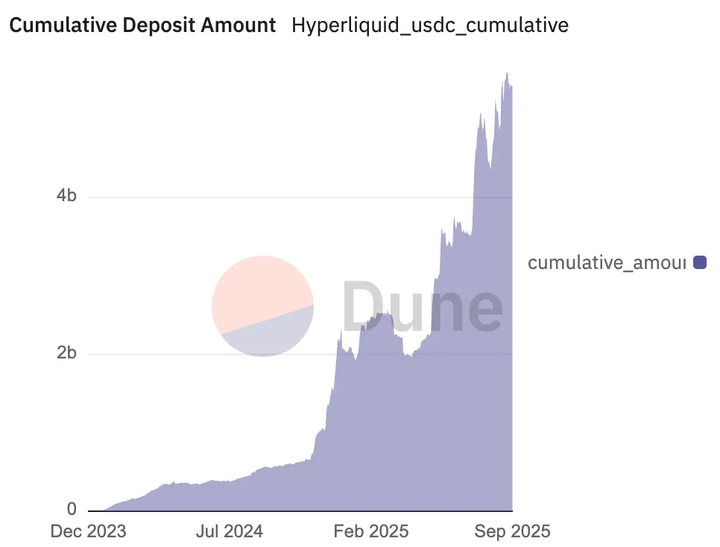

A treasure worth billions of dollars is hidden deep within Hyperliquid—one of the fastest-growing perpetual contract trading platforms in the decentralized finance (DeFi) space. With a smooth user experience and a rapidly expanding user base, Hyperliquid has become a leading platform for on-chain derivatives trading, currently powered by over $5.6 billion in stablecoins, the vast majority of which is USDC issued by Circle.

These funds have brought significant revenue streams to the platform, but currently, these profits are flowing to external third parties. Now, the Hyperliquid community is working hard to regain control of this wealth.

Key Showdown on September 14

On September 14, Hyperliquid will face a crucial vote that will determine its future. The platform's validators will cast a decisive vote to choose who will control USDH—Hyperliquid's first native stablecoin. This is not just a battle over the ownership of a token, but a game concerning the distribution rights of billions of dollars in profits. This vote is akin to a multi-billion dollar public tender or government bond auction, but unlike those, it will be conducted completely transparently on the blockchain. Validators maintain network security by staking HYPEToken; they are not only decision-makers but also key figures determining the issuer of USDH and the future flow of profits. The participants in this competition have vastly different styles: one side consists of a local team well-versed in the crypto world, committed to aligning closely with the platform; the other side comprises traditional financial institutions with ample funding and mature systems.

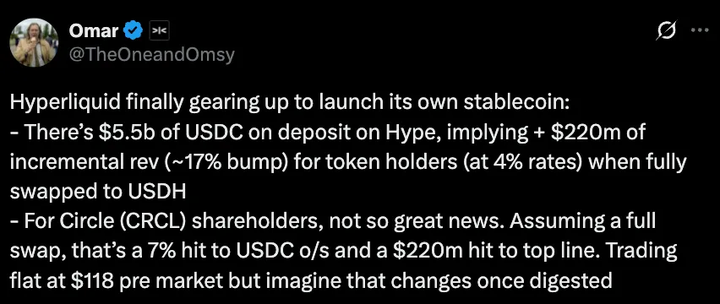

$220 Million Annual Opportunity

To understand the significance of this game, one only needs to follow the flow of funds. Currently, USDC is Hyperliquid's flagship stablecoin, and its issuer, Circle, quietly earns huge profits by investing reserve assets in U.S. Treasury bonds, amounting to as much as $658 million in just one quarter. Hyperliquid's goal is to replicate this business model. By launching its own native stablecoin USDH, Hyperliquid hopes to redirect these profits back into its own ecosystem.

With the current scale of funds, USDH's reserve assets could generate approximately $220 million in annual profits. This means Hyperliquid will transition from being a "tenant" to a "landlord," no longer relying on external stablecoins but becoming the master of its own financial system. For Circle, losing Hyperliquid's pool of funds could directly lead to a 10% drop in its revenue, exposing its high dependence on interest income.

The only question facing the community is not whether to chase this pie, but whom to trust to build it.

Circle's Strong Counterattack

Circle is clearly unwilling to give up ground easily. Even before the USDH plan was announced, Circle had fortified its defenses on Hyperliquid, announcing the launch of native USDC and the CCTP V2 upgrade. This upgrade will enable seamless transfers of USDC across multiple blockchains, enhancing capital efficiency and discarding traditional wrapped token and cross-chain bridge models. Circle also provides institutional-level funding access through Circle Mint, making it clear: as a publicly traded company, Circle will never easily hand over Hyperliquid's liquidity to competitors.

Different Visions from Competitors

Surrounding the issuance of USDH, multiple teams have proposed vastly different plans, each representing a different path for Hyperliquid's future.

Native Markets

This native team of Hyperliquid quickly joined the fray after the USDH plan was announced, proposing to create a stablecoin compliant with the GENIUS Act regulations, tailored specifically for the platform. Their plan includes integrating fiat channels to optimize capital inflow and outflow, and they promise to share profits with the Hyperliquid assistance fund. The team includes seasoned professionals like former Uniswap Labs president MC Lader, but the community has raised some questions about their fundraising capabilities and timing. Their advantage lies in their high alignment with the Hyperliquid ecosystem, promising compliance and profit return; however, their disadvantage is whether their resources are sufficient to support large-scale implementation.

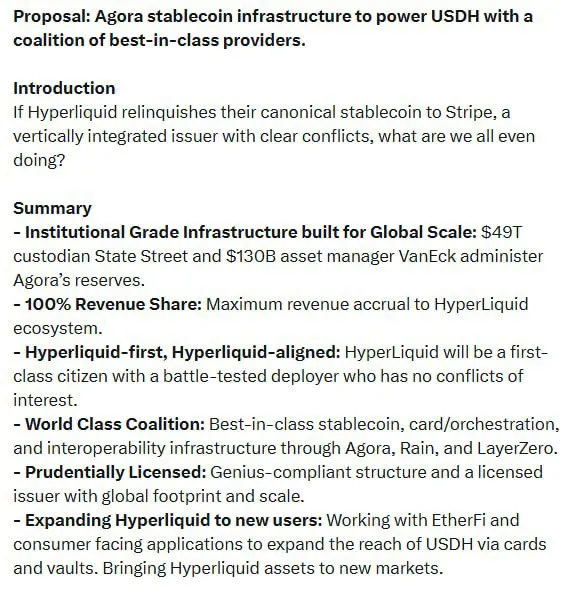

Agora Alliance

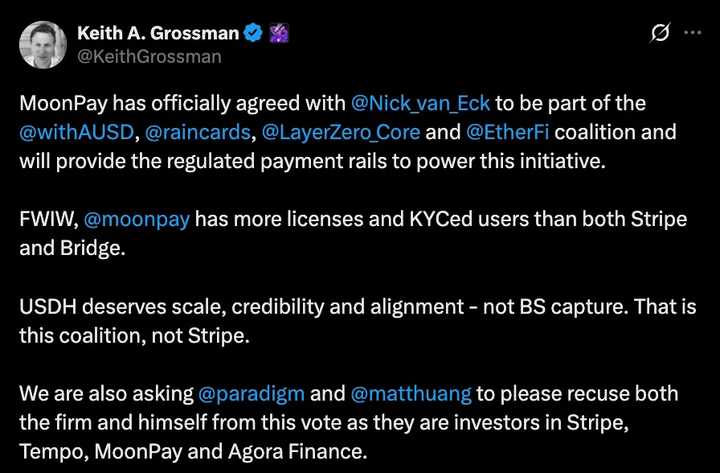

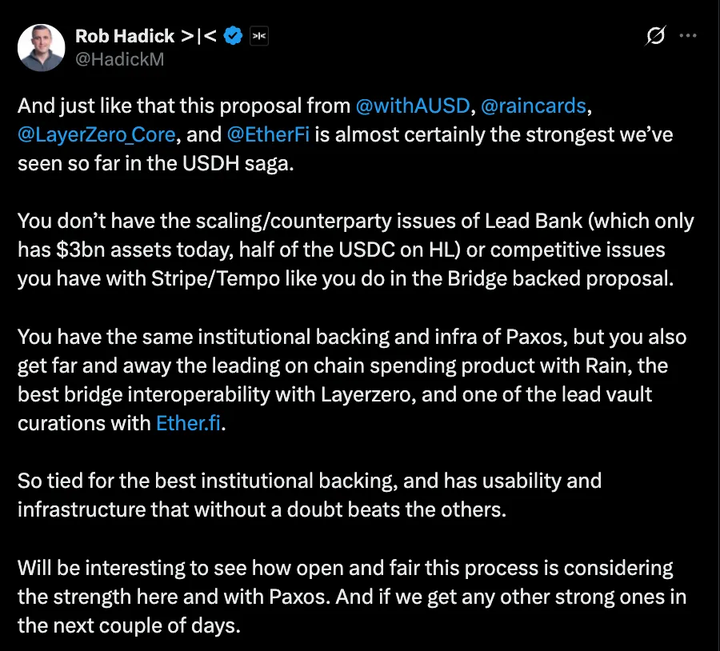

Agora is a stablecoin infrastructure provider that has formed a strong bidding coalition with partners like MoonPay, Rain, and LayerZero.

Agora recently secured $50 million in funding led by Paradigm, emphasizing compliance through State Street custodial assets, VanEck managing reserves, and Chaos Labs providing reserve proof. They promise to provide at least $10 million in initial liquidity for USDH and return all net reserve profits to the Hyperliquid ecosystem. This means that the growth of USDH will directly benefit HYPE holders. Their advantages include institutional backing, strong funding, and a wide channel network, but their reliance on banks and custodial institutions may reintroduce off-chain risks, slightly deviating from USDH's original intent.

Stripe and Bridge

By acquiring Bridge for $1.1 billion, Stripe proposes to make USDH the core of a global stablecoin payment network. Bridge's existing infrastructure already supports businesses in over 100 countries to accept and settle stablecoin payments like USDC at low cost and almost in real-time. Once integrated into Stripe, USDH will gain regulatory credibility, developer-friendly APIs, and seamless payment connections. Stripe has also launched its own stablecoin USDB within its ecosystem, attempting to bypass external blockchain costs and establish a moat. Stripe's scale and brand influence will undoubtedly help USDH enter mainstream commerce, but its vertically integrated model may pose a risk of Hyperliquid being controlled at the currency level.

Paxos

As a regulated trust company in New York, Paxos offers the most conservative plan, promising to use 95% of USDH reserve interest to repurchase HYPE and list HYPE on its supported networks (such as PayPal, Venmo, and MercadoLibre). Under the Trump administration's crypto-friendly regulatory environment, Paxos's compliance and durability are highly attractive, but its complete reliance on fiat custody exposes it to risks within the U.S. banking system and regulatory challenges, potentially repeating the predicament faced by BUSD.

Frax Finance

Frax Finance brings a DeFi-native solution, emphasizing on-chain mechanisms, community governance, and high yield distribution. Its USDH will be 1:1 backed by frxUSD and U.S. Treasury bonds managed by BlackRock, seamlessly exchangeable for USDC, USDT, frxUSD, or fiat, with 100% of profits going to Hyperliquid users and governance fully handed over to validators. Frax's model aligns with the decentralized ethos of the crypto community, but its reliance on frxUSD and off-chain Treasury bonds may introduce external risks, and it may not achieve mainstream adoption as effectively as fiat-backed competitors.

Konelia

Konelia is a low-profile bidder that submitted a plan for compliant issuance and reserve management, but with few details, it has garnered little community attention. Despite meeting bidding qualifications, its lack of brand recognition and community support makes it difficult to compete with mainstream contenders.

xDFi

The xDFi team, composed of senior developers from SushiSwap and LayerZero, proposes to launch a cross-chain USDH fully backed by crypto assets (ETH, BTC, USDC, AVAX, etc.), covering 23 EVM chains. They will allocate 69% of profits to HYPE governance, 30% to validators, and 1% for protocol maintenance. Its decentralized, bank-independent design strengthens Hyperliquid's position as a liquidity hub, but reliance on highly volatile crypto assets may affect stability, and the lack of regulatory support could limit mainstream adoption.

Curve

Curve proposes a collaborative rather than competitive solution, suggesting that Hyperliquid adopt a dual stablecoin system: a regulated USDH (issued through Paxos or Agora) paired with a decentralized dUSDH supported by HYPE and HLP, operating on Curve's CDP infrastructure. This model could unlock leverage, looping, and yield strategies while creating a value flywheel for HYPE and HLP. Curve's crvUSD has shown stability during market fluctuations, and its CDP model has generated annual profits of $2.5 million to $10 million at a scale of $100 million. However, a dual-token system may lead to brand and liquidity dilution, and using the platform's own assets as collateral may introduce looping risks.

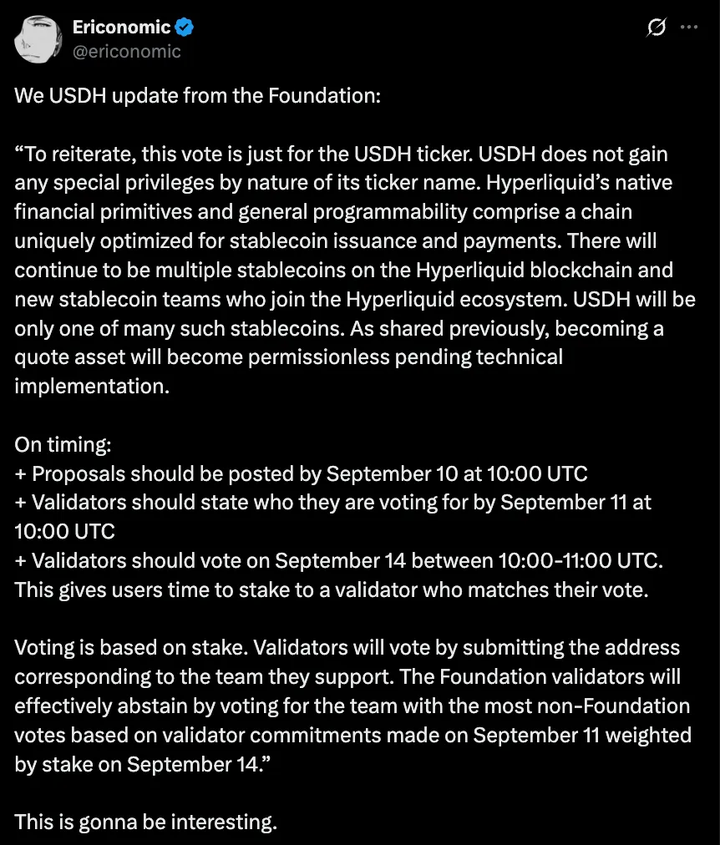

Decentralized Decision

The final decision will be made by Hyperliquid's validators through on-chain voting. The Hyperliquid Foundation has announced that it will relinquish its voting rights, choosing to side with the majority to ensure a fair and community-driven outcome.

This move alleviates concerns about centralization, indicating that the decision is entirely in the hands of stakeholders. The vote on September 14 is not only a turning point for Hyperliquid but also a significant test for DeFi governance. From discussions about symbolic fee adjustments to the distribution of billions of dollars in contracts through community voting, Hyperliquid is demonstrating the true power of decentralized governance.

Article link: https://www.hellobtc.com/kp/du/09/6022.html

Source: https://tristero.substack.com/p/the-56-billion-battle-for-hyperliquids

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。