SEC ETF decision on Bitwise Dogecoin and Grayscale Hedera extended to

The U.S. Securities and Exchange Commission (SEC) has extended its review of two major crypto exchange traded fund (ETF) proposals, the Bitwise Dogecoin ETF and the Gryscale Hedera-ETF, until November 12, 2025.

Source: X

Both applications were first submitted in March and entered the official review period on March 17. SEC ETF decision is the most awaited one, but the organisation said it needs more time to study public comments and analyze concerns such as volatility, liquidity, and the risk of market uncertainties.

Delay Powers: What’s Making Use of It?

In the SEC ETF decision, the delays are the result of the maximum review period allowed under law. For the Dogecoin traded funds, the agency has already extended the deadline in June and again in September. The Grayscale Hedera faces a similar path. The Exchange board set the same November 12 deadline for its final outcome.

Other major funds under same circumstances include:

-

21Shares Solana-ETF – due Oct. 16

-

21Shares Core XRP Trust – due Oct. 19

-

WisdomTree XRP Fund – Due Oct. 24

Many concerned responses raised from the public about high price swings, may be the reason for SEC ETF decision delays. The question that is pulling back the authority is whether it is suitable for a regulated investment product.

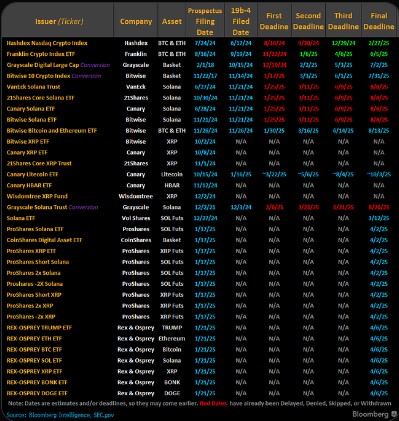

A Backlog of Altcoin-ETF Applications

Interest in crypto-ETFs has gained momentum in 2025 and started a new wave of filings. By the end of July, at least 31 altcoin spot-ETF applications had been registered for the permission. And until last month (August), the SEC had 92 crypto-based ETF products under review . In all the applications, Solana is leading the space with eight applications and then XRP with seven.

Source: James Seyffart

Grayscale Expands ETF-Strategy

Grayscale, which got approval in 2024 to convert its Bitcoin Trust into the first U.S. spot Bitcoin ETFs, is now trying to do the same with Litecoin (LTC) and Bitcoin Cash (BCH). Moving these trusts to ETFs would allow daily creation of shares and existing ones redeemed every day, reducing price gaps seen in over-the-counter (OTC) trading.

Dogecoin-ETF Listing Still on Track, Price Held Steady

While the SEC delays Bitwise’s proposal, another Dogecoin-ETF is preparing to launch. REX Shares and Osprey Funds are set to list their Dogecoin-ETF under the ticker DOJE this week Unlike Bitwise’s proposal, this product is being launched under the Investment Company Act of 1940, a different regulatory path.

Despite the regulatory delay, Dogecoin (DOGE) showed great potential and held steady. As it is currently trading around $0.2407 with a 14% weekly gain and a significant 150% up year on year. The traders’ confidence in the meme token keeps it in the spotlight.

Source: CoinMarketCap

Decision On Centre

The SEC’s November decision will be a hotspot topic. If the Bitwise-Dogecoin Traded Funds are approved, it would mark the first U.S. listed dedicated to a meme cryptocurrency ,potentially opening the door for other altcoin ETFs.

As for now the crypto industry is in its boom with exchanges traded funds trend , with nearly 100 proposals waiting in line.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。