Author: imToken

If you are an on-chain Degen, you are likely familiar with the following scenarios:

Transferring ETH from the mainnet to Arbitrum to interact with DeFi at lower gas fees; exchanging USDT on Polygon for USDC on Base; or diversifying assets across different chains to connect with specific applications for optimal strategies.

These operations point to one of the core propositions of the blockchain world—cross-chain interoperability. This article aims to outline the evolution of cross-chain technology and how Web3 is moving from a single "cross-chain bridge" to a state of "seamless interoperability."

1. Rollup and the Fragmentation of Multi-Chain Ecosystems

If you are a veteran of the Ethereum ecosystem, how many L2s have you used at most? 5, 10, or 20 or more?

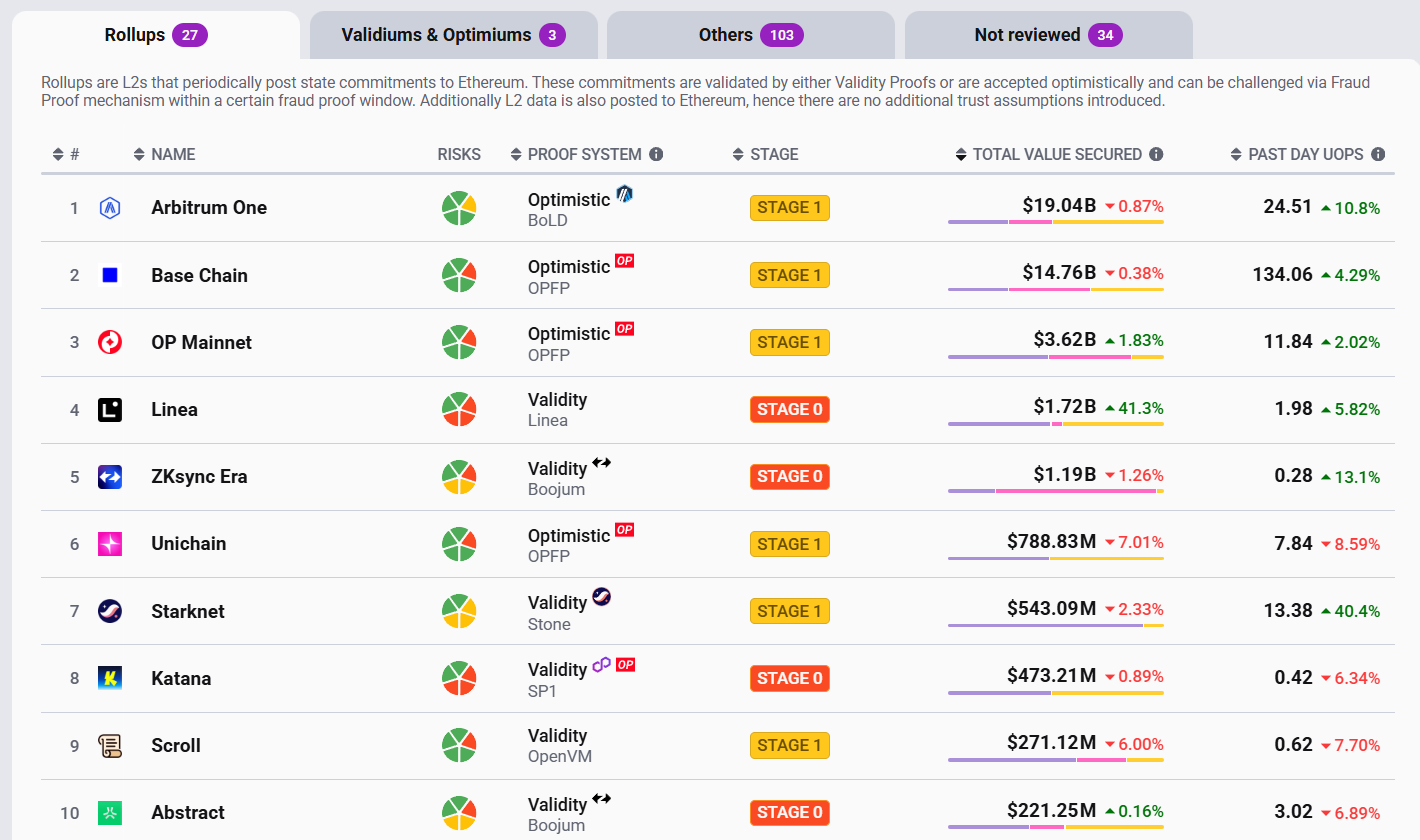

In fact, compared to the total number, the vast majority of players may have only explored a small part of the L2 landscape. According to incomplete statistics from L2BEAT, the number of L2s in the Ethereum ecosystem has approached a hundred, not including other independent L1 public chains. We are in an unprecedentedly prosperous multi-chain era.

However, this has also led to a new dilemma of increasingly fragmented liquidity and yield opportunities—the traffic that was originally concentrated on Ethereum is gradually being divided, forming isolated value islands. As the number of public chains and L2s increases, the degree of liquidity fragmentation is bound to intensify.

What does this mean for ordinary users? When you need to perform a cross-chain operation from Chain A to Chain B, it feels like planning a complex international trip, fraught with difficulties.

After all, from Chain A to Chain B, each route has different travel times (bridge times), tolls (cross-chain costs), and fuel consumption (gas), and each trip's travel time, toll, and fuel consumption may vary, making it hard to find the best route:

- Some routes may only support specific tokens;

- The tolls on certain routes may vary based on the token amount, making them less ideal for large transactions;

- Or the contract interactions on some routes may consume a lot, leading to increased travel time and fuel consumption;

This process is not only cumbersome, but each step may incur additional slippage and fees. Therefore, just as DEX aggregators like 1inch have become a necessity in the wake of the flourishing of DEXs like Uniswap and SushiSwap, cross-chain bridge aggregators have also become a primary direction for evolution in the context of an increasing number of bridges in the market.

Moreover, the idea of cross-chain (layer) aggregation not only achieves direct aggregation transfer of assets between different blockchain networks but also includes the aggregation of DEXs and DEX aggregators, such as Uniswap and 1inch, allowing users to complete exchanges between different assets while performing cross-chain (layer) operations.

This means that you only need to input the starting point (DAI on Arbitrum) and the endpoint (ETH on Optimism), and the system will instantly calculate the optimal solution based on the current market conditions. The user only needs to confirm once, and the backend will complete the entire process of cross-chain + exchange.

This marks the evolution of the cross-chain experience from "manual" to "automatic," significantly lowering the user threshold.

2. The Evolution from "Cross-Chain" to "Aggregation"

In short, the core value of cross-chain aggregators lies in becoming a smart navigation system for users, simplifying complex multi-step operations into a one-click process.

This has also been the focus of development for cross-chain aggregators in recent years. In this process, the system automatically finds all available routes and ranks them based on the following three criteria—maximum asset output on the target chain, lowest gas fees, and shortest time. Users only need to choose from the paths provided by the aggregator to complete the optimal cross-chain exchange operation.

We can intuitively feel the advantages of this cross-chain (layer) aggregation exchange by comparing it with traditional cross-chain exchange paths. Suppose a user has DAI on Arbitrum and wants to exchange it for ETH on Optimism. Under traditional cross-chain (layer) projects, various paths can be used to achieve this:

- First, use 1inch on Arbitrum to exchange DAI for ETH, then use a cross-chain bridge to transfer ETH from Arbitrum to Optimism;

- Or first use a cross-chain bridge to transfer DAI from Arbitrum to Optimism, then use Uniswap on Optimism to exchange DAI for ETH;

Although different paths have their own advantages in terms of cost and experience, the implementation logic is largely the same, breaking down into two logics: cross-chain (layer) transfer of the same asset and exchange of different assets, and then performing optimal selection operations based on factors such as the size of the exchange funds, slippage, network liquidity, and speed.

However, in the idea of cross-chain (layer) aggregation, the aforementioned trade-offs and considerations do not need to be made by the user. The system automatically finds all available routes and helps users move funds between different blockchains in the most optimal way based on factors such as maximum output on the destination chain, minimum gas fees for transactions and transfers, and minimum bridging time.

Beyond the intuitive evolution path of the "aggregation" idea from the user experience perspective, on the technical level, to break down the isolation walls, the cross-chain track has been exploring various more diverse technical solutions over the years:

- Message layer interoperability: For example, LayerZero, IBC (Cosmos), achieving data interoperability through cross-chain message verification.

- State layer synchronization: Allowing different chains to share states directly without intermediaries.

- Zero-knowledge (ZK) cross-chain: Utilizing zero-knowledge proofs to make cross-chain verification more efficient and secure.

These solutions collectively point to a goal of making the blockchain world truly "seamlessly interconnected," allowing users to feel no boundaries between chains.

On August 29, the Ethereum Foundation also released "Protocol Update 003 — Improve UX," focusing on improving user experience (Improve UX) as one of the three major strategies after restructuring the development team (Scale L1, Scale Blobs, Improve UX).

The EF article emphasizes interoperability (interop) as the core, aiming for a seamless, secure, and permissionless Ethereum ecosystem experience.

3. The Latest Cross-Chain Thoughts on Ethereum

In this context, there are two new paths worth noting in the academic and developer communities that may determine the future shape of cross-chain in the Ethereum ecosystem.

1. SCOPE: Rebuilding Ethereum's "Synchronous Composability"

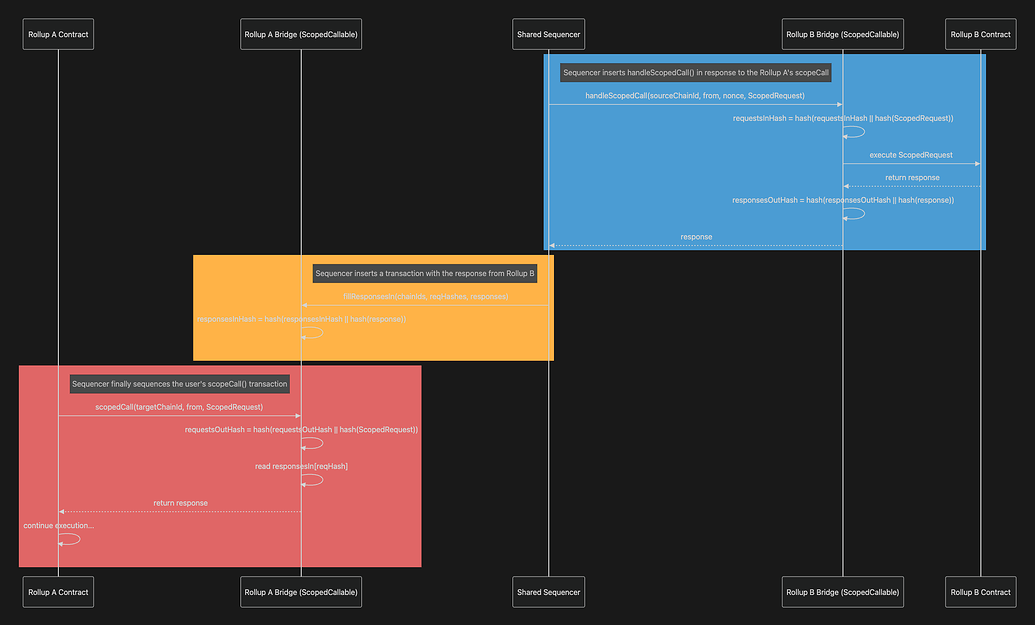

The first is the SCOPE (Synchronous Composability Protocol) idea recently proposed by Ethereum researcher jvranek, aimed at achieving synchronous composability between Ethereum L1 and L2, as well as between L2s, supporting atomic execution of cross-domain contracts.

In simple terms, it allows interactions between different Rollups and between Rollups and the Ethereum mainnet to be executed "atomically" as if they were on the same chain—all operations within a transaction either succeed entirely or fail entirely, with no intermediate states. However, previously, due to the barriers of cross-chain interoperability, it was challenging to achieve this once cross-chain operations were involved.

For example, with SCOPE, you could execute a comprehensive strategy transaction involving Swap and Lend, simultaneously calling the Aave protocol on Arbitrum and the Uniswap protocol on Optimism. Either both succeed or both fail, without getting stuck halfway, wasting gas and opportunity costs.

The potential value is evident; this will unlock complex DeFi strategy combinations such as cross-L2 flash loans and one-click liquidations. Although SCOPE is still in the PoC stage, it is widely regarded as a key piece to solve the fragmentation of L2 composability.

Once mature, the aggregation experience at the application layer and the atomic interoperability at the underlying layer will complement each other: the former lowers the threshold, while the latter ensures safety and consistency.

2. ZK Accelerated Interoperability: Replacing "Trust" with Mathematics

Another direction is to leverage zero-knowledge proofs (ZK Proof) to make cross-chain verification no longer reliant on a group of trusted intermediaries (verification nodes), but purely dependent on mathematics.

The state changes on the source chain can generate a concise ZK proof. The target chain verifies the source chain events through mathematical proofs, thus confirming their truth within a security model. Proposed solutions include the native Interop mechanism suggested by ZKsync, among others.

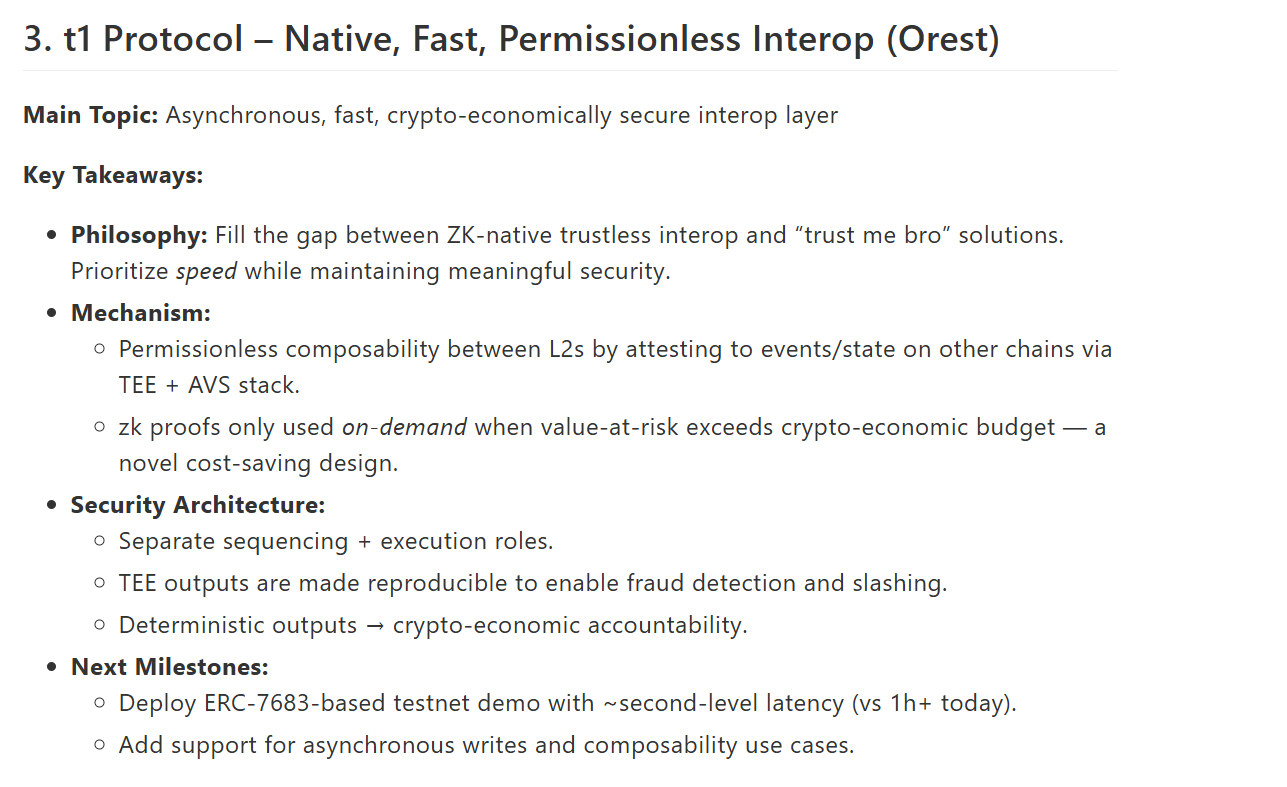

There are also some engineering-oriented routes attempting to achieve a dynamic balance between "speed" and "security costs." For example, the t1 Protocol aims to find a middle ground between "pure ZK trust minimization" and "highly trusted intermediaries," achieving asynchronous, fast, and cryptoeconomic guarantees.

It uses TEE + AVS to prove events/states from other chains, and when the risk amount exceeds the cryptoeconomic budget, it introduces ZK proofs as a safety net (saving daily costs). In terms of specific security architecture, it separates sorting and execution, allowing TEE outputs to be reproducible for fraud detection and punishment, achieving accountability through deterministic outputs in cryptoeconomics.

In short, these routes emphasize "enhancing 80% of user needs by 10 times in experience" first, and then leveraging a cost-flexible proof system at critical moments. From an engineering implementation perspective, if it can be combined with wallet intent routing, risk control, and limit mechanisms, it would be a very pragmatic direction for implementation.

Overall, whether it is cross-chain aggregation at the application layer or atomic interoperability/ZK acceleration at the protocol layer, the common trend is gradually diminishing the presence of "chains" and the perception of "cross":

For ordinary users, you may not need to remember names like SCOPE or ZK Interop; what truly matters is that cross-chain operations are becoming faster (in seconds), safer (mathematical guarantees), and more invisible (completed in one go).

This is also the vision that the ultimate cross-chain experience should achieve: allowing users to focus on the flow of value itself, rather than the barriers between chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。