Author: Aylo

Compiled by: Bernard, ChainCatcher

02 Airdrop Opportunity Tier Assessment

Tier B: Hyperlend, Felix, Project X, Ventuals

Functionality: A lending protocol built on Hyperliquid, officially recognized by the Aave governance committee as a friendly fork project.

Products:

Lending: Used for borrowing assets on HyperEVM (HYPE, uBTC, and even PT-KHYPE, etc.).

HLP Vault: HLP is an open Hyperliquid vault for everyone, participating in market making and liquidation processes, earning a portion of transaction fees (returns are usually high). The HLP vault can also issue transferable and DeFi-compatible IOUs.

Hyperloop: One-click leverage loop positions using any two tokens: one supplied, one borrowed.

Participation: There are many lending strategies worth exploring on Hyperlend, the most prominent being the PT-kHYPE loop, which can utilize HYPE for maximum returns (but will lose airdrop eligibility).

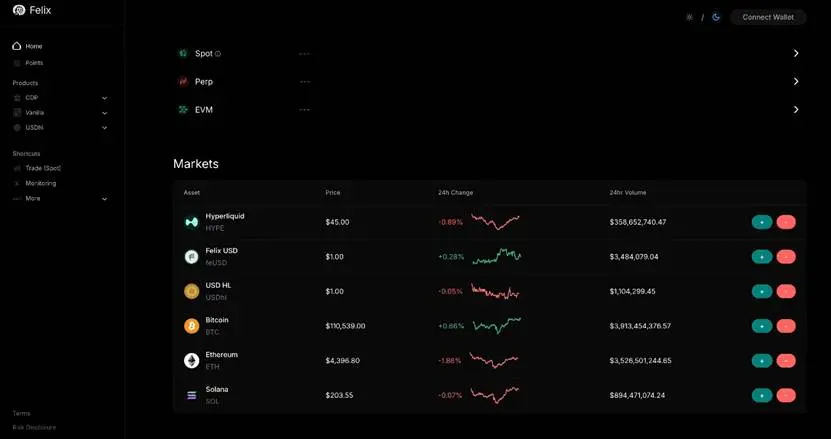

Functionality: A protocol offering a full suite of lending products, very similar to Hyperlend but with some adjustments.

Products:

CDP System: Deposit HYPE/kHYPE/uBTC, borrow feUSD, and there is also a native model built on the Morpho stack.

- hUSDL: A stablecoin backed by the treasury, customized for the trading environment of Hyperliquid, serving as collateral for lending, trading settlement, and future HIP-3 markets. The yields generated by hUSDL can be used to purchase spot HYPE and promote the growth of HyperEVM through a reward redistribution mechanism.

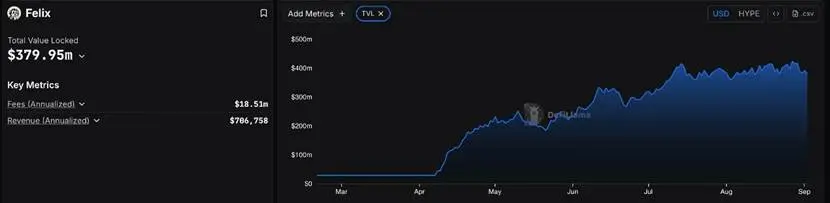

- Key Data: TVL of $380 million, expected annual fees of $18.5 million, with lower participation compared to Hyperlend.

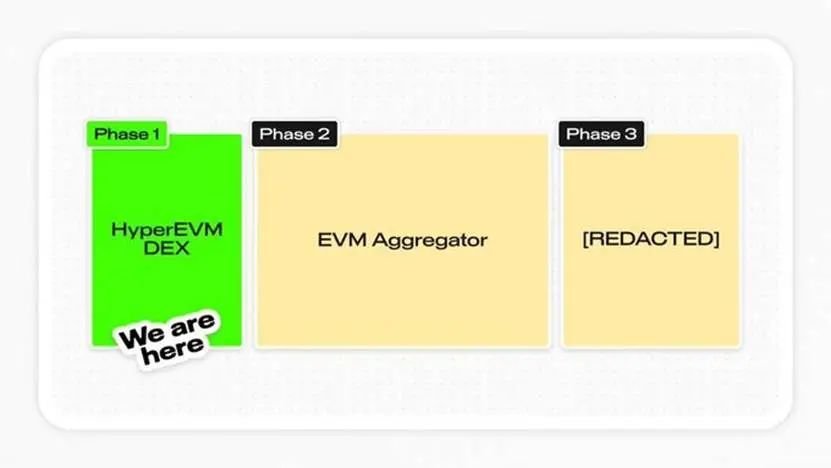

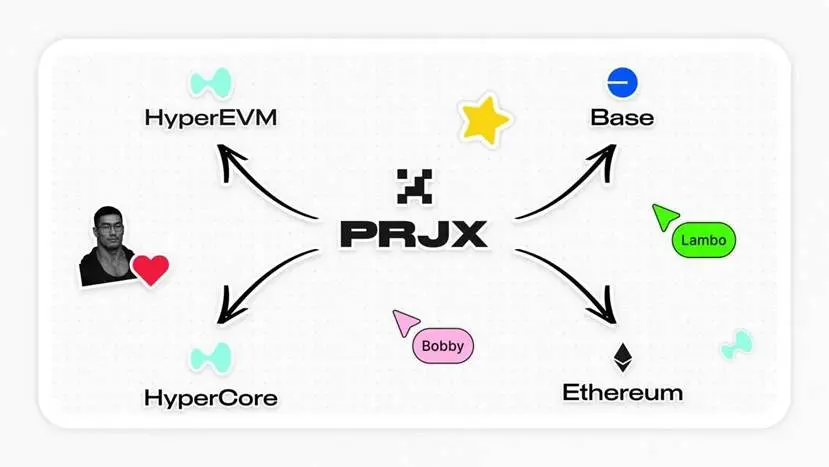

- Functionality: A leading DEX aggregator across the entire EVM ecosystem. As a first step, Project X has just launched its own DEX on Hyper EVM. The next step is to develop into a DEX aggregator within the EVM.

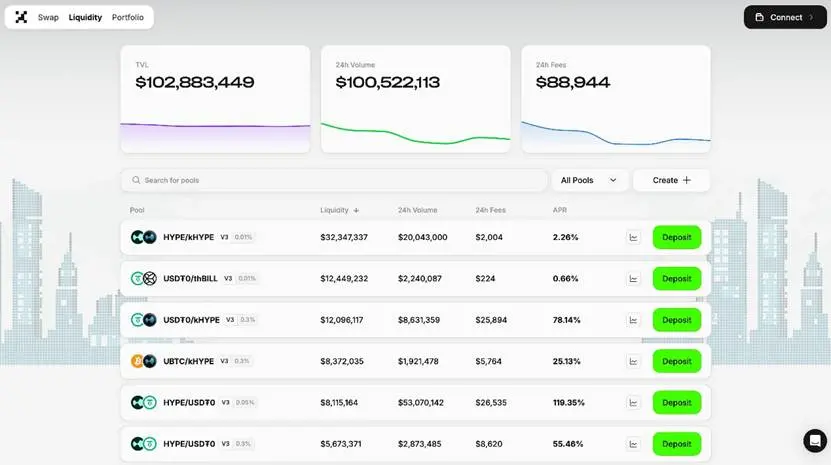

- Market Position: Currently the largest DEX on HyperEVM, with a TVL exceeding $100 million.

- Participation: A points program has been launched; if HYPE has been staked into kHYPE, it can be deployed into the kHYPE-HYPE pool (currently the largest pool in Project X). Below are several other major pools:

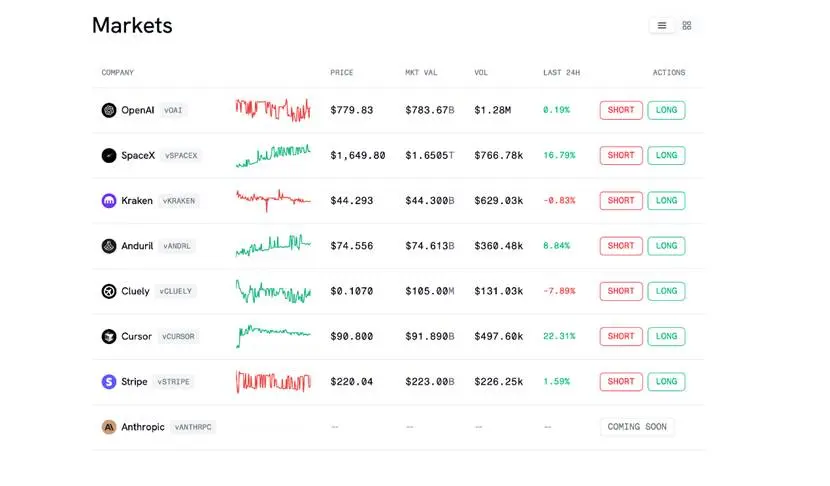

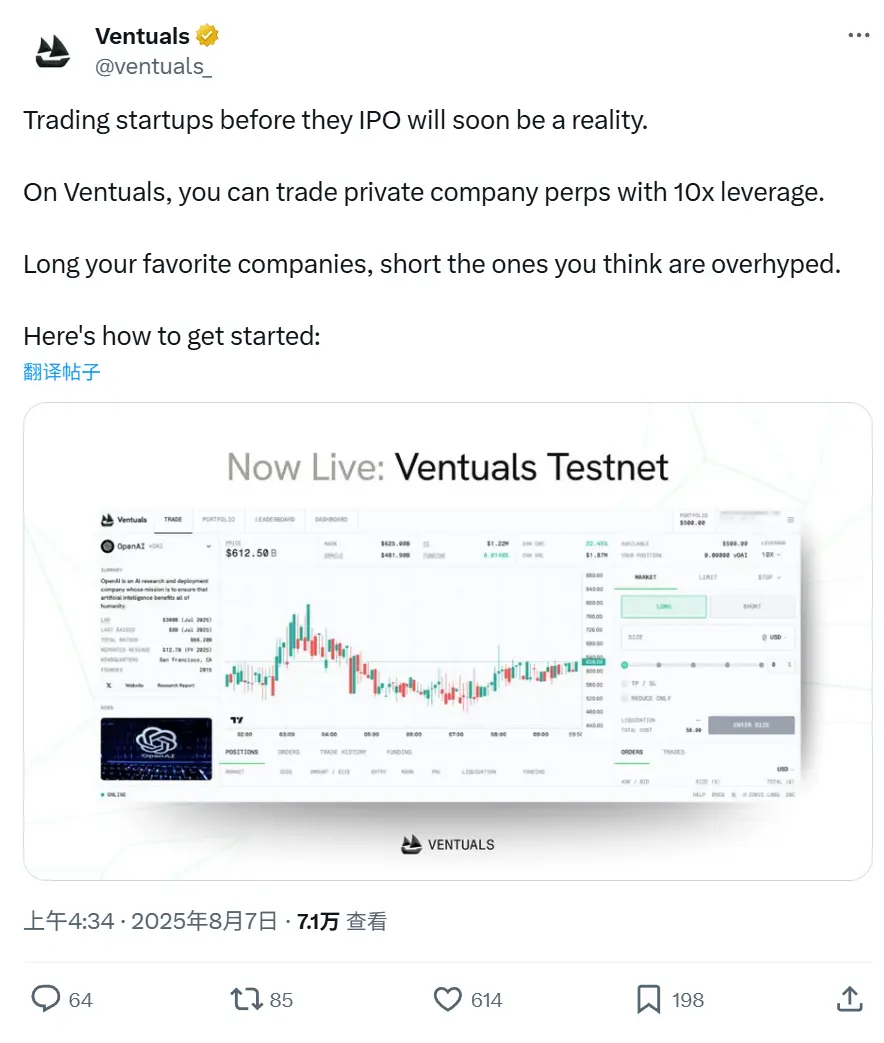

- Functionality: Valuing startups as perpetual contract trading through HIP-3, meaning it will be possible to leverage long or short pre-IPO companies and tokenize their investment opportunities.

- Current Status: Only on the testnet, waiting for the HIP-3 mainnet launch.

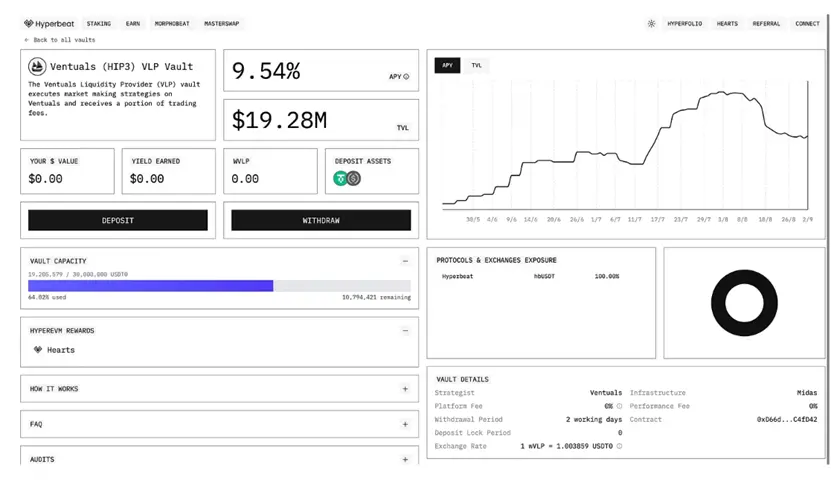

- Participation: Launch on the testnet (the testnet may count as an airdrop), or deposit into the Ventuals vault on Hyperbeat (to earn Hearts points).

Tier C: Hypurrfi, Hyperswap

Functionality: A non-custodial lending protocol native to HyperEVM.

Products:

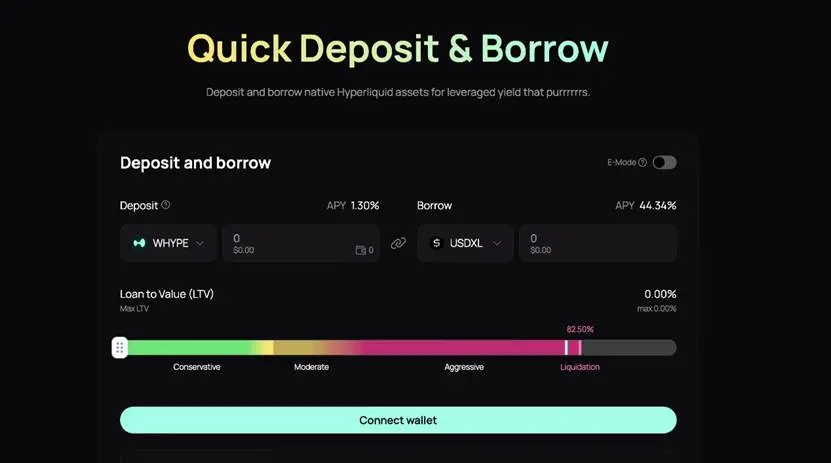

Quick Deposit and Borrow: Quickly establish leveraged positions through collateralized lending, borrowing more funds by collateralizing assets, purchasing more assets, and depositing again to achieve a leveraged long strategy.

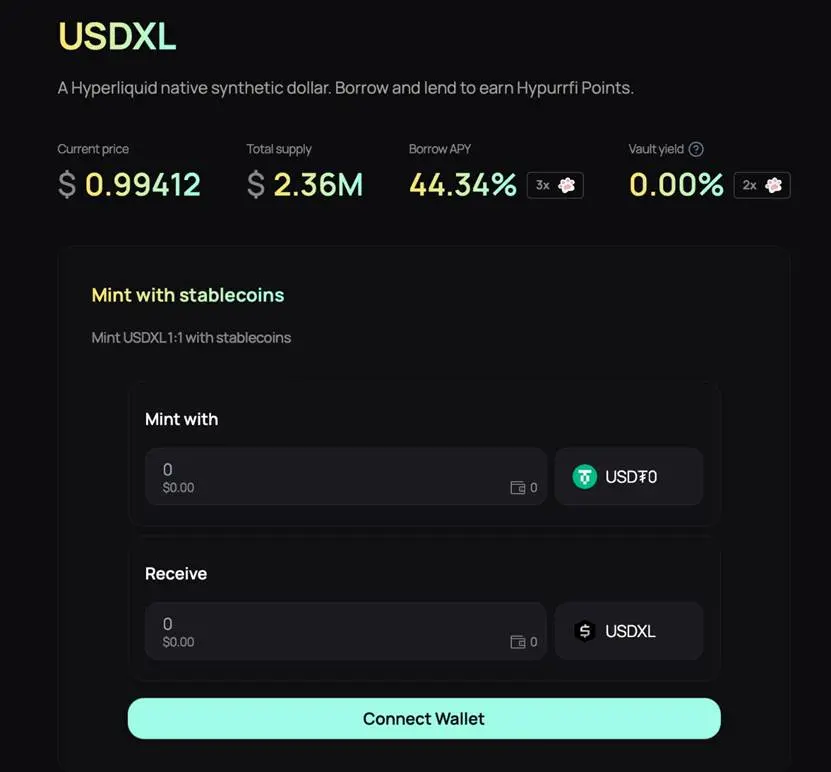

- USDXL: A synthetic dollar stablecoin backed by a mix of assets, with protocol revenue used to purchase treasury assets to enhance the overall security of the protocol.

- Crypto Card in collaboration with BrahmaFi: In collaboration with BrahmaFi, a crypto card has been launched for specific users based on their points ranking on HypurrFi.

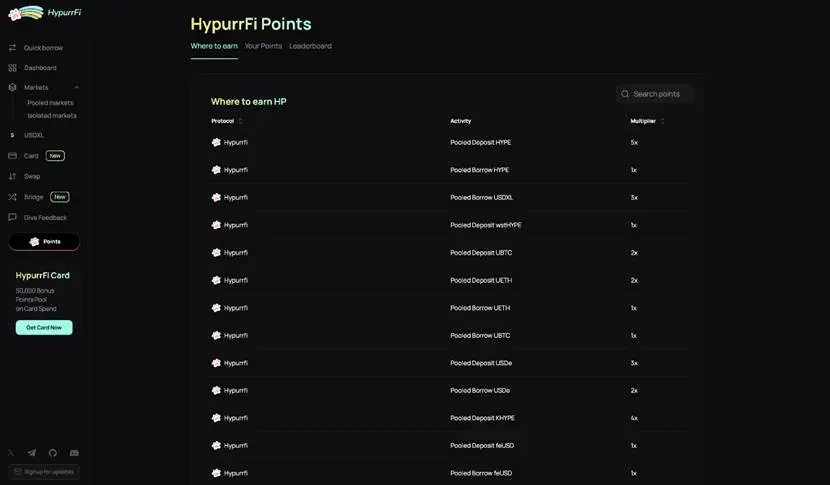

- Participation: The points program has been launched.

- Functionality: The native AMM DEX of Hyperliquid, allowing direct asset swaps on HyperEVM. It was the first native automated market maker (AMM) launched and received significant early attention. However, with the emergence of Project X, Hyperswap's market share has gradually declined.

03 Practical Airdrop Strategy Example

Here is a specific participation plan:

- Trade spot on Unit → Convert the portfolio into Hyperliquid assets

- Stake HYPE liquidity as kHYPE → Deploy to Kinetiq vault or other DeFi protocols (Hyperbeat, Hyperlend, Felix)

- Participate in DeFi using Unit spot assets → Borrow using uBTC or other mainstream tokens

- Allocate stablecoins → Distribute between Liminal (institutional mode) and Hyperbeat stablecoin vault

04 Conclusion

The HyperEVM ecosystem is on the brink of explosion, with its unique economic model, strong technological foundation, and rapidly growing ecosystem providing significant opportunities for early participants. By systematically engaging with these projects, users can maximize potential returns while controlling risks.

Remember: Only risk amounts you can afford to lose, and ensure you understand what you are doing. If funds are limited, it is usually best to focus on 3-4 projects with the strongest synergies rather than spreading efforts across too many protocols. As GCR said, "He who chases two rabbits catches neither," which is a philosophy to follow when engaging in airdrop mining.

This is your alpha.

Click to learn about job openings at ChainCatcher

Recommended Reading:

Pantera Capital Deep Dive: The Value Creation Logic of Digital Asset Treasuries (DATs)

Backroom: Tokenization of Information, a Solution to Data Overload in the AI Era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。