Hyperliquid rings the bell at the gates of the old stablecoin city.

Written by: Yanz

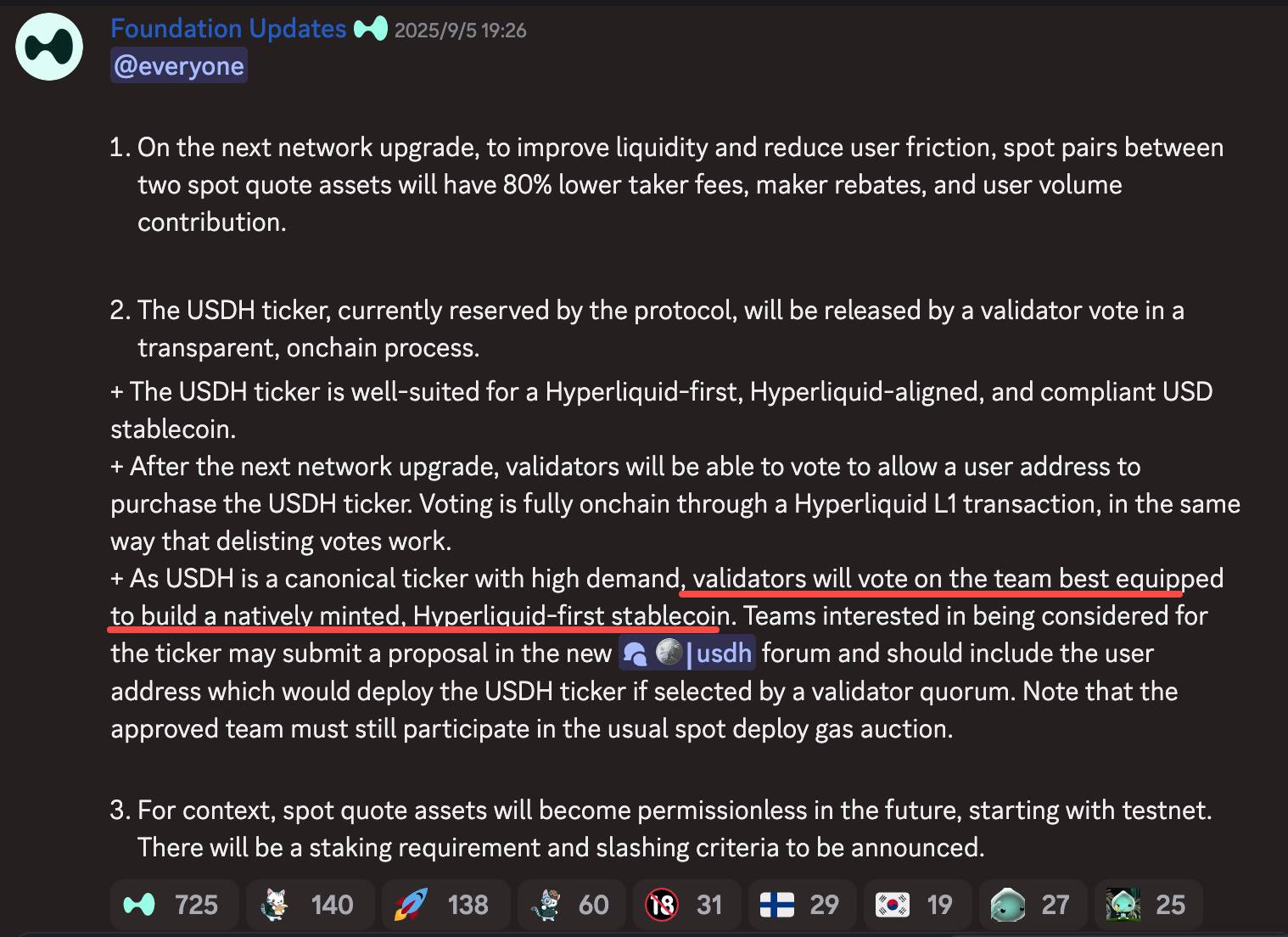

On September 5, 2025, Hyperliquid announced its plan to launch its native stablecoin USDH, governed by a community-driven model, during the next network upgrade.

The protocol describes USDH as a "Hyperliquid priority and compliant" asset pegged to the US dollar, aiming to replace external stablecoins like USDC and create a self-sufficient DeFi ecosystem.

Unlike traditional stablecoins (such as USDT and USDC) that are issued by centralized entities and monopolize profits, Hyperliquid has implemented an innovative decentralized voting mechanism:

It opens the issuance rights of the $USDH stablecoin to ecosystem teams rather than issuing it independently, integrating a community-driven model into stablecoin issuance.

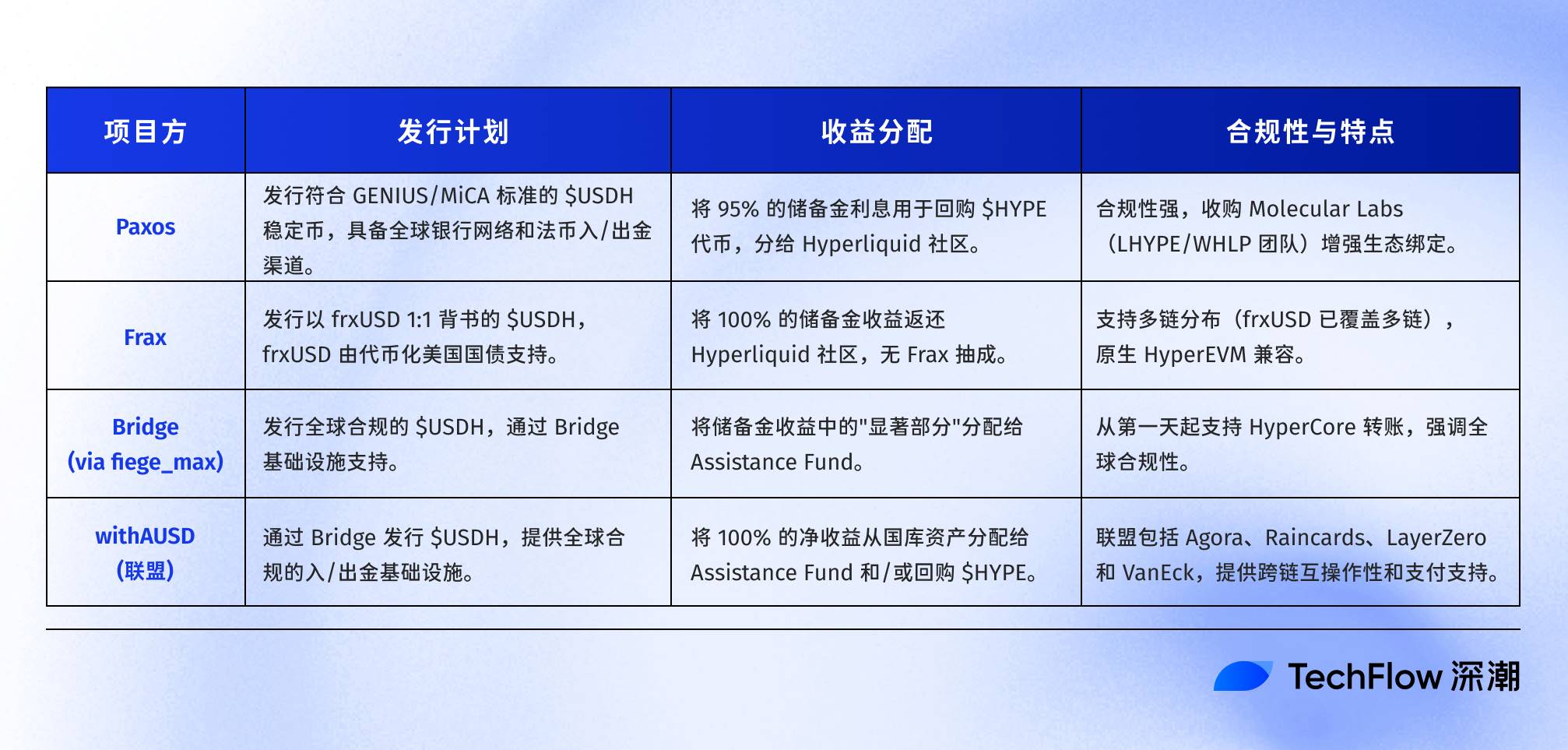

This move has immediately sparked intense competition, with Frax and Paxos submitting proposals, and Ethena Labs also seen as a potential contender. The voting, expected to conclude by September 10, could not only reshape the Hyperliquid ecosystem but also hide the risk of a reshuffle in the stablecoin landscape.

Issuance Bidding

The fierce competition for the issuance of the $USDH stablecoin stems from its strategic value and potential economic returns within the Hyperliquid ecosystem.

Hyperliquid currently holds approximately $5.72 billion in stablecoins, with 95% being USDC, which has made it aware of the vulnerabilities of relying on external stablecoins, especially the risk of USDC being frozen.

Starting from September 5, 2025, the issuance rights of $USDH opened through a decentralized voting mechanism is an attempt by Hyperliquid to create a self-sufficient DeFi ecosystem.

Based on a reserve yield of 4% to 5%, the expected annual return from successfully replacing USDC is extremely substantial, potentially reaching $150 million to $220 million. This funding, through the repurchase of $HYPE or dividends returned to the community, could significantly enhance the value and ecological appeal of $HYPE, attracting major players like Paxos and Frax to compete for bids.

In the competition for the issuance of $USDH, the winning team will dominate Hyperliquid's $570 million liquidity pool, bringing long-term benefits and industry influence.

As the competition heats up and the proposal deadline of September 10 approaches, various parties are committing to increase their stakes, presenting different issuance plans and profit distribution schemes.

(For detailed table content, see: The Hyperliquid Stablecoin Bidding War Begins, Who Will Become the Issuer of USDH?)

Additionally, Ethena Labs, Circle, and Paypal are highly anticipated by the community, with potential proposals that could become dark horses.

However, the plans vary, and the community has various doubts. This bidding war is not only about technical competition but also a struggle for the future landscape of DeFi.

Stablecoin War

The competition for the issuance of $USDH is not the only change occurring on a broader scale.

Omar Kanji, a partner at Dragonfly, stated that this move could have a significant impact on Circle's USDC. USDC is currently the primary settlement currency for Hyperliquid derivatives trading, with USDC deposits on Hyperliquid reaching $5.5 billion.

Assuming a 4% yield, this migration could bring an additional $220 million in annual income to HYPE token holders while posing a risk of equivalent revenue loss for Circle, potentially reducing USDC's circulation by 7%.

For Circle and Tether, $USDH will undoubtedly impact their monopoly status, prompting them to accelerate innovation (such as Circle's CCTP V2) to respond to changes in the stablecoin landscape. The stablecoin market may shift from a duopoly (USDT, USDC) to a multipolar structure.

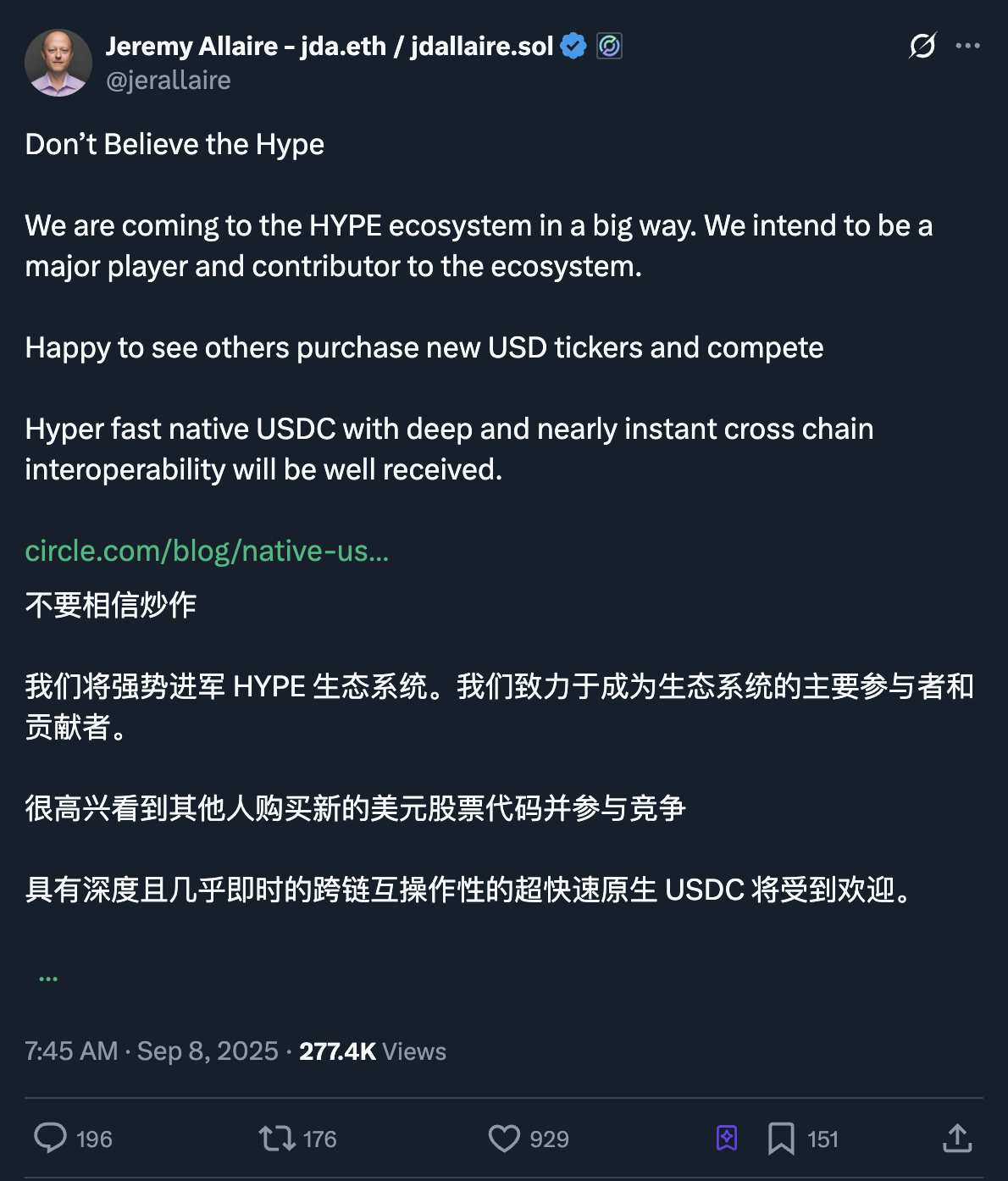

It is evident that Circle's CEO is already restless; on September 8, he stated that they would aggressively enter the HYPE ecosystem, mentioning the deployment of native USDC and CCTP V2 on HyperEVM as a breakthrough strategy.

(Original post source)

However, this is not convincing. After all, this blog post was published on July 31, and Circle claimed that a forthcoming plan was on the way, yet there has been no clear progress since then. Many users have expressed skepticism, with a highly upvoted comment stating, "You should do better and act faster."

Overall, the latest data shows that the global stablecoin market has surpassed $286 billion, with $USDT (59%) and $USDC (25.2%) combined accounting for nearly 85% of the market share.

As of September 8, Tether's USDT leads with a circulating market cap of $168.8 billion, attracting a large number of traders and retail investors due to its widespread circulation on centralized exchanges (CEX) and low transaction costs, while Circle's USDC follows closely with a market cap of $72.5 billion, appealing to institutional users.

Not only does this directly impact the current duopoly in the stablecoin sector, but Hyperliquid's attempt is also providing a model for other DEXs, stimulating platforms like Arbitrum and Optimism to explore similar paths, pushing the stablecoin sector towards a multipolar transformation.

This challenge and disruption to the traditional order evoke the classic metaphor in financial history — "the barbarians at the gate."

In the 1989 book "Barbarians at the Gate: The Fall of RJR Nabisco," "the barbarians at the gate" symbolize the challenge posed by emerging forces to the traditional order.

Today, this metaphor aptly reflects the stablecoin industry, with Hyperliquid as the "barbarian" ringing the bell at the gates of established powers with its innovative $USDH.

$USDH has ignited short-term price volatility, with the price of $HYPE rising by 12.27% within a week. While establishing new standards and forcing established powers to adjust their strategies, the concentration of voting power held by the Hyperliquid Foundation and its CEO Jeff has also sparked discussions about market fairness, as the decision-making power is highly centralized, leading to controversies over centralization.

The wave of change is surging, and regardless of where $USDH ends up, the benefits to the community will remain the core constant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。