Setting aside profits, "market share anxiety" may be the biggest driving force behind HyperLiquid's issuance of stablecoins.

Written by: Eric, Foresight News

Just as large-scale projects were launching their own public chains or L2s two or three years ago, the stablecoin market is also being continuously segmented by major ecosystem players.

Last week, the popular derivatives DEX "star" HyperLiquid announced that it would release the USDH ticker, which will be firmly held by the protocol, to serve the HyperLiquid ecosystem first and comply with standards, allowing participants to compete for the issuance rights of this native stablecoin based on their abilities.

As of the time of writing, five institutions or projects are competing for the minting rights of USDH, including Paxos, Frax, Agora, Ethena Labs, and HyperLiquid's ecosystem protocol Native Markets. Except for Ethena Labs, which has not yet formally proposed, the other four are competing on how to maximize user benefits.

Given the compliance requirements, USDH will also be a dollar stablecoin similar to USDC. The market has generated various interpretations of HyperLiquid's approach, with some opinions suggesting that Hyper wants to break free from its reliance on USDC, while others believe that Hyper aims to leverage the platform's influence to carve out a share in the stablecoin market. Many community users also praise this action as an innovation in the way projects issue native stablecoins.

Compared to Hyper's more "offensive" rhetoric, I tend to view the issuance of stablecoins at this moment as a "defensive" action during a peak period. Allowing the community to decide who issues the stablecoin is, on one hand, entrusting professional matters to professionals, and on the other hand, letting the community comprehensively decide the most beneficial choice for users; furthermore, Hyper has not sought opinions on "whether to hand over the minting rights," which indirectly proves that the stablecoin itself is not the core of the strategy.

The strongest competitor, Paxos, emphasizes its rich experience in compliance and facilitating the integration of stablecoins into banking operations, including partnerships across various industries, meeting compliance requirements in multiple global locations, integrating stablecoins into various payment channels, and direct conversions with USDC, PYUSD, and USDG. As a veteran stablecoin service provider, Paxos's advantage lies in its ability to quickly integrate USDH into various channels, tightening the equivalence relationship between USDH and the dollar.

In the relatively weaker Web3 field, Paxos also has countermeasures. First, Paxos promises to use 95% of the interest earned from the "USDH reserves" to repurchase HYPE and redistribute it to ecosystem programs, partners, and users. A portion of the repurchased HYPE will be used to incentivize platforms that contribute to the growth of USDH, specifically measured by the amount and trading volume of USDH on the platform.

Additionally, Paxos has established Paxos Labs, aimed at accelerating the application of stablecoins in decentralized ecosystems, and has acquired Molecular Labs, which provides infrastructure for Hyper's ecosystem projects, hoping to promote USDH more within the Hyper ecosystem.

Frax began gradually converting its original algorithmic stablecoin FRAX into an over-collateralized stablecoin frxUSD at the end of last year, and its proposal states that USDH will be supported 1:1 by frxUSD, while also supporting the minting and redemption of USDT, USDC, and fiat currencies. Frax explains that its protocol has built a multi-dimensional infrastructure around frxUSD, which is already very well-developed, and USDH will inherit all existing functions of frxUSD.

Currently, frxUSD is supported by BlackRock's on-chain fund BUIDL. Unlike Paxos, which provides 95% of the earnings, Frax plans to provide all underlying earnings to Hyper users through FraxNet. Specific forms include increasing HYPE staking rewards, repurchasing HYPE to inject into community assistance funds, and rewarding active trading users or USDH holders.

Agora, which announced the completion of a $50 million Series A financing in July, is also one of the competitors. Unlike the independent operations of the first two, Agora has formed an "alliance": Agora provides institutional-level stablecoin infrastructure, Rain offers consumer cards and deposit/withdrawal channels, and LayerZero provides interoperability support. At the same time, Agora also stated that it will cooperate with Etherfi to bring USDH into consumer applications. Agora also promises to inject all earnings generated from stablecoin reserve assets into assistance funds or repurchase HYPE.

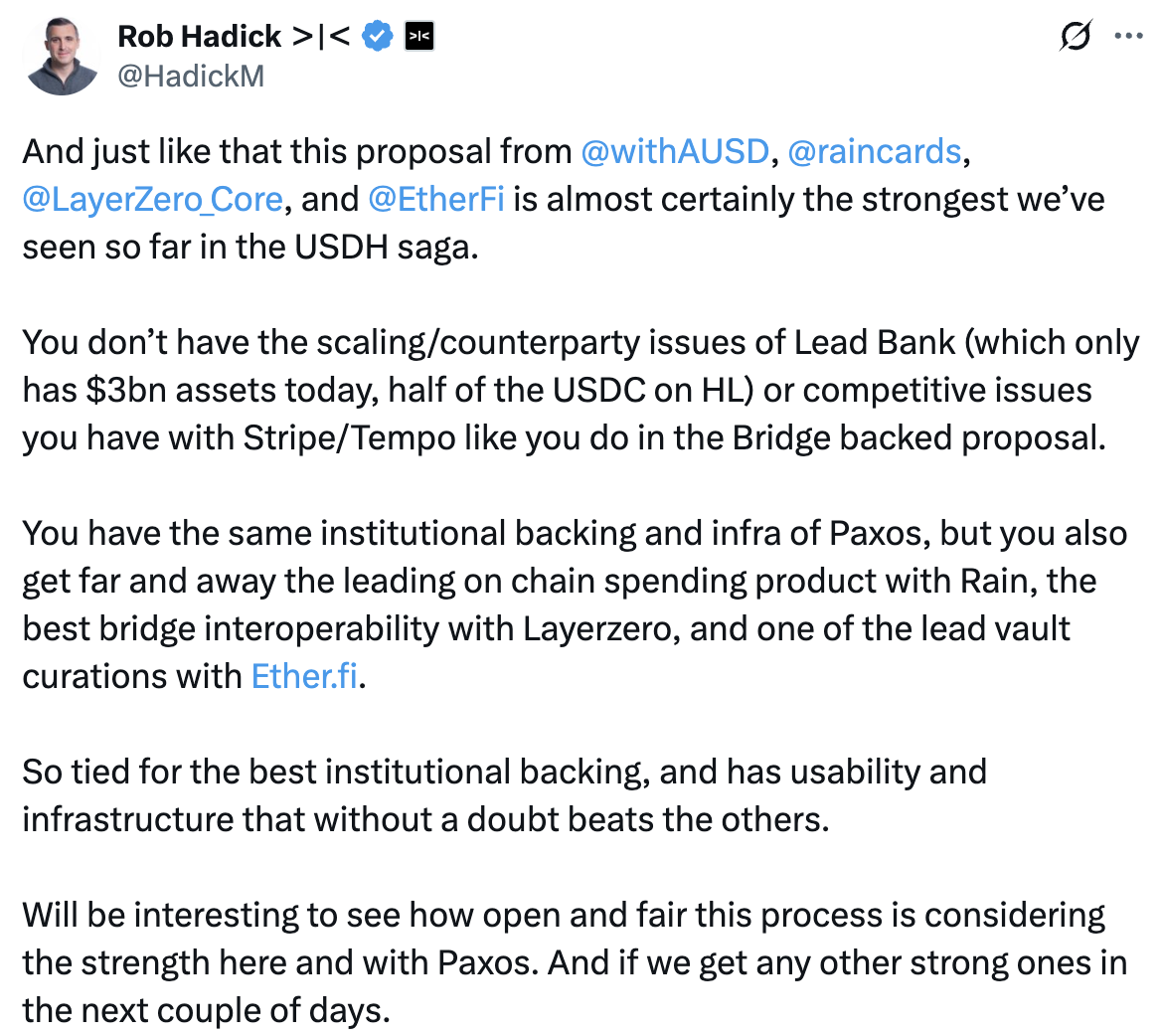

Agora particularly emphasizes that its solution benefits from Agora's white-label architecture, which can maintain the brand independence of USDH within HyperLiquid while providing solutions, leaving the choice of how to operate USDH to Hyper, with Agora only providing underlying support. Dragonfly's general partner Rob Hadick seems to be particularly fond of Agora, calling it the "strongest solution" he has seen so far.

Native Markets appears slightly weaker among the competitors and does not showcase any unique characteristics in its proposal. Although it aligns with the first two in terms of full return of earnings, its compliance and fiat deposit/withdrawal solution partner Bridge has raised some questions about conflicts of interest. This is due to Bridge's previous acquisition by Stripe, which is currently planning to develop a stablecoin chain, Tempo.

Native Markets' only advantage may lie in its deep engagement with the Hyper ecosystem, as it clearly states in its proposal that USDH will be minted directly on HyperEVM and will support transfers to HyperCore from the outset.

As for the emerging stablecoin player Ethena Labs, it has not formally submitted a proposal. It stated on Twitter that it had submitted two proposals regarding USDH but received no response.

In an interview with Altlayer, I once asked why they believe projects would be motivated to launch their own public chains or L2s.

The other party explained that Web3 users have no psychological loyalty to the projects themselves; often, the core of decision-making is who can offer more benefits. If many projects continue to develop on existing public chains or L2s, they may one day be replaced by a similar new project. Building a self-owned public chain allows projects to place their core assets in a space they can control, providing more room for offering benefits and locking users onto a specific chain. To some extent, the risks and complexities of asset transfer can lead some users to "let their wallets decide," choosing to operate on the project's own chain.

All of this stems from projects' anxiety about users and traffic. In the rapidly changing Web3 market, HyperLiquid, which achieved nearly $400 billion in contract trading volume last month, capturing 70% of the on-chain market share, is about to face the challenge of "easy to attack, hard to defend."

The on-chain contract market seems to always be a winner-takes-all situation. dYdX leveraged the high-speed, low-cost advantages of L2 to bring order books on-chain, once considered a challenger to exchanges, but later overshadowed by GMX, which used Vault on Arbitrum to bet against trading users. Now the baton has been passed to HyperLiquid, which currently seems unstoppable, but could also be dethroned overnight by a new challenger.

Not only in the on-chain contract market, similar situations have occurred in other Web3 sectors. Circle, Tether, and the aforementioned Stripe are all testing the waters with stablecoin public chains. Perhaps one day in the future, a "new Hyper" will suddenly emerge on these public chains, allowing stablecoin holders to trade without complex cross-chain actions. Circle and Tether could even step in and generously eliminate trading fees, purely to increase stablecoin minting volumes and recoup income from U.S. Treasury interest.

Faced with such potential pressure, Hyper must find a way to keep users within the protocol, and issuing stablecoins is indeed the best method to ensure fee income.

If Hyper were simply to add stablecoins to its ecosystem, it would not need to publicly select suppliers; it could privately reach agreements with certain service providers and return 50% of the U.S. Treasury interest income to users, achieving widespread acclaim while significantly increasing protocol revenue. The core motivation is to let various parties compete, maximizing benefits for users, even "losing money to gain popularity," thereby retaining users within the protocol. From this perspective, it is understandable that Hyper did not heed the olive branch extended by Ethena, as Ethena excels at productizing stablecoins, while Hyper's ambitions lie elsewhere.

According to the "2024 Third-Party Payment Industry Research Report" released by Qianji Investment Bank, data from Analysys shows that in 2023, Alipay, WeChat Pay, and UnionPay Business ranked the top three in China's third-party payment institution comprehensive payment market share with 34.5%, 29%, and 10.2% respectively, while JD Pay only accounted for 5.8%. In the same year, JD's e-commerce market share was 14%.

With the above data, the point I want to express is that Hyper cannot shake Circle's foundational base. The supply chain and ecosystem that Circle has built for USDC over the years are difficult to surpass overnight. The issuance of stablecoins by Hyper is an issue that Circle will eventually have to face, just as JD's development of third-party payment products is a challenge Tencent will have to confront sooner or later.

Even if it loses HyperLiquid, Circle can still choose to support other protocols and can sacrifice some income to gain distribution channels, similar to its collaboration with Coinbase. Perhaps the emergence of USDH will bring some short-term pain to Circle, but in the long run, it remains to be seen whose influence and ecosystem coverage, along with the full return of U.S. Treasury interest income, will be more attractive.

The unveiling of the long-held USDH ticker may not be HyperLiquid's intention to push into stablecoins; rather, the genius legislation requiring stablecoins to purchase U.S. Treasuries with reserve assets brings natural interest income, which just happens to become a means to retain users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。