Microstrategy 比特币持有量扩大,700 亿美元的投资变成了比特币的代理

一家企业能否持有如此多的比特币,以至于它几乎成为比特币本身的镜像?这是今天关于 MicroStrategy 的重大问题。迈克尔·塞勒透露,他的公司再次购买了更多的比特币,以大约 2.174 亿美元的价格增加了 1,955 枚比特币,平均每枚约为 111,196 美元。

通过这次购买,MicroStrategy 的比特币持有量扩大到创纪录的 638,460 枚——按当前市场价格计算,价值近 707 亿美元。

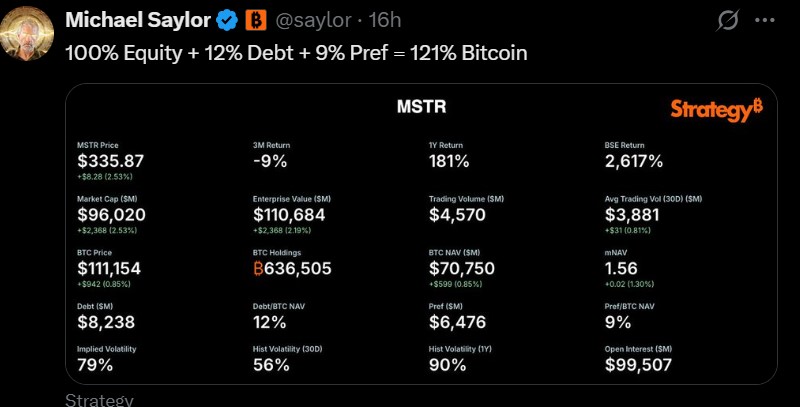

来源: 迈克尔·塞勒官方 X 账户

但这个故事不仅仅是关于数字。它还涉及到一家如何成为比特币代理,使投资者在不直接持有加密货币的情况下获得放大的投资敞口。

巨额 MicroStrategy 比特币 700 亿美元投资解析

持有总币数:638,460

收购成本:约 471.7 亿美元

当前价值:约 707 亿美元

平均购买价格:约 73,880 美元

迈克尔·塞勒购买更多比特币,并将他的软件公司转变为比特币金库。

根据 CoinMarketCap 图表,该代币的交易价格接近 112,076 美元(本周上涨 2.84%),这一举动看起来更像是一种大胆的信念投资,而不是财务管理。

为什么这不同:一个杠杆比特币代理

大多数企业用闲置现金购买这种代币。但这个策略更进一步。

资金组合:100% 股权 + 12% 债务 + 9% 优先股。

这意味着每持有 1 美元的 MSTR 股票,投资者就能获得 1.21 美元的投资敞口。

这种结构表明,投资者现在可以购买 MSTR 股票,以在比特币价格上涨时获得放大的回报。

对投资者的意义

最新的 Microstrategy 比特币新闻和塞勒的策略已经带来了显著的结果:

MSTR 一年回报:+181%,超过比特币自身的收益。

长期回报:自在 BSE 上市以来 +2,617%。

对于股东来说,利益显而易见——该公司像一个非官方代币基金。但由于它使用了杠杆,收益可能更大——如果代币下跌,损失也可能更严重。

现在的问题很简单:这个策略是否会继续超越数字黄金,还是杠杆会反过来对其不利?

更大的图景:策略成为轻松的数字资产入口

这一举动超越了资产负债表。对于无法直接购买资产的投资者来说,该公司已成为加密货币敞口的入口。

可以这样理解:

购买比特币 = 直接拥有。

购买 MSTR 股票 = 比特币敞口 + 杠杆 + 股票流动性。

这就是为什么 MSTR 638,000 的购买在金融媒体中占据主导地位。华尔街现在将该公司视为远不止一家软件公司——它是一个数字资产的强大力量。

结论:700 亿美元的赌博

迈克尔·塞勒不仅仅是在购买比特币;他正在以此建立一个帝国。随着 MicroStrategy 比特币持有量扩大 超过 638,000 BTC,该公司现在与代币的命运直接相关。

为什么称之为赌博?

如果代币价格超过 150,000 美元,该公司可能成为历史上最有价值的企业加密货币投资之一。

如果货币大幅下跌,债务支持的策略可能会放大损失。

因此,70 亿美元的赌注新闻不仅仅是关于购买比特币,而是关于杠杆、信念,以及对数字黄金将持续上涨的信仰。现在,该公司正在全力押注全球最大的加密货币,市场在密切关注每一个动向。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。