Ethereum carries a more complex and grand vision.

Written by: David, Deep Tide TechFlow

In recent days, the hottest debate on crypto Twitter in the English-speaking world has been about Ethereum's revenue.

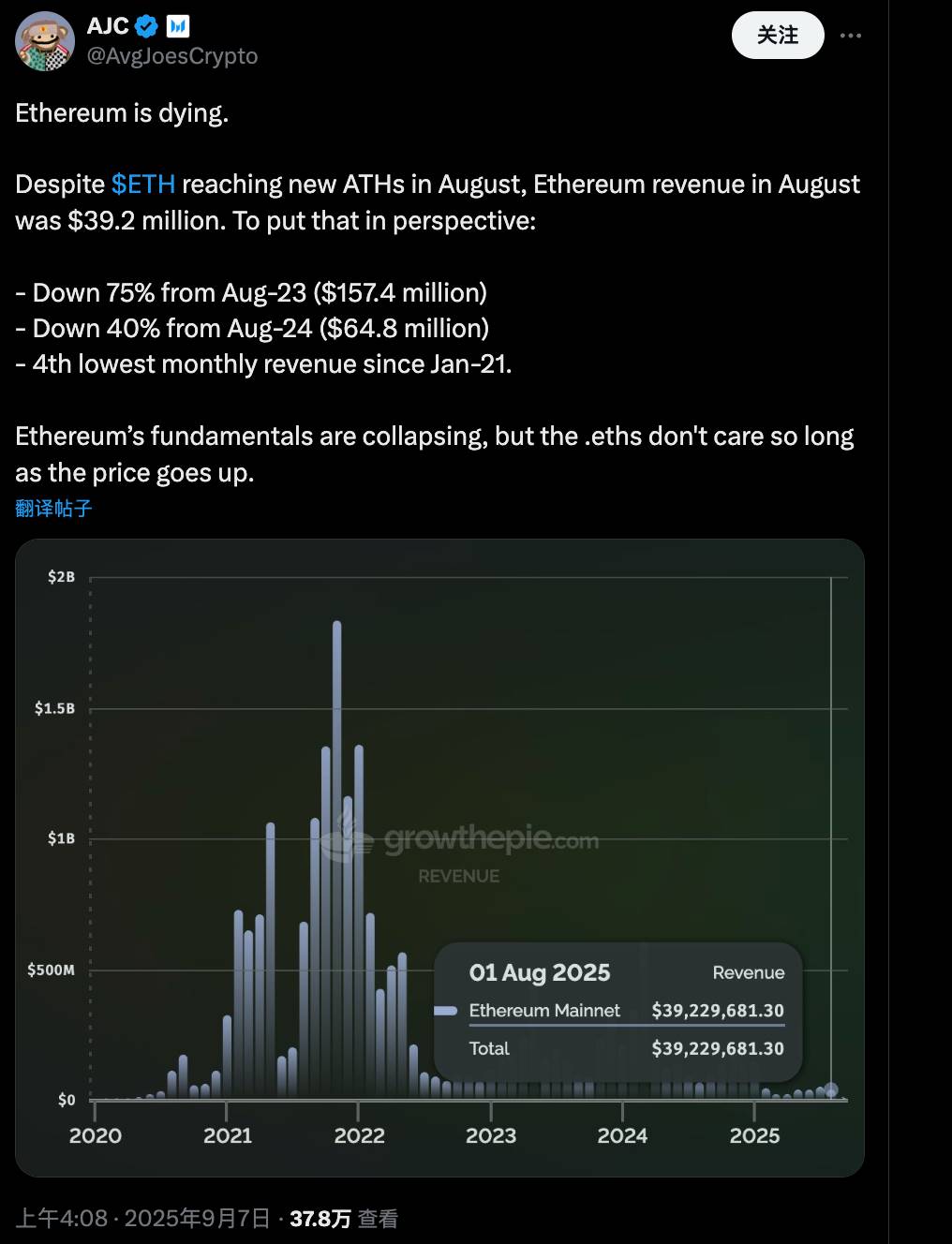

On September 7, Messari's enterprise research manager AJC posted a message pointing out that the Ethereum network is falling into "death." He stated that despite ETH reaching a new high in August, Ethereum's revenue for that month was only $39.2 million.

This figure represents a 75% decrease compared to $157.4 million in August 2023, and a 40% decrease compared to $64.8 million in August 2024. Additionally, this is the fourth lowest monthly revenue level in Ethereum's history since January 2021.

AJC lamented that Ethereum's fundamentals are collapsing, yet everyone seems only concerned with the rising ETH price, regardless of whether the network is healthy. Two days after the post, it has already garnered nearly 380,000 views and close to 300 replies.

Why is the discussion about Ethereum's fundamentals receiving so much attention now?

The timing is indeed delicate. ETH is currently at the peak of a bull market, with prices hitting new highs, but the underlying network activity and Ethereum's own positioning are quietly changing.

After the Dencun upgrade in 2024, Layer 2 solutions like Base and Arbitrum have flourished, significantly reducing main chain transaction fees, leading to a shift in revenue to these scaling layers; following the popularity of coin-stock play this year, SBET and BMNR are competing to reserve ETH, and mainstream finance and Wall Street are beginning to turn ETH into a tool for increasing financial leverage.

Now, Ethereum itself seems more like a selfless banner, waving in response to market trends and guiding others, yet it is riddled with holes?

The decline in revenue is indeed an undeniable fact, but whether this is a signal of Ethereum's own decline is a matter of differing opinions within the community.

Proponents: Revenue is Lifeblood, Alarm Bells are Ringing

ACJ and other proponents' core argument is quite simple: Revenue is the correct measure for evaluating L1.

Specifically, a chain's revenue mainly comes from transaction fees and block space usage fees, which are the core manifestations of user demand for that chain.

As the largest platform in the crypto world, Ethereum's core competitiveness lies in "block space demand": it allows the network to efficiently handle smart contracts and decentralized applications, providing an advantage over Bitcoin's pure value storage, and is a significant narrative point that distinguishes it from Bitcoin.

However, the current trend of revenue approaching zero indicates a shrinking demand for the main chain, and even with the flourishing of L2, AJC believes the entire ecosystem lacks new users to support the usage of so many L2s.

You might ask, why is revenue linked to Ethereum's fundamentals?

The logic of the original poster and proponents is that revenue is collected and burned in the form of ETH, which directly drives ETH's deflationary mechanism. If revenue collapses, the amount burned decreases, increasing supply pressure on Ether, making it difficult to maintain long-term value.

More importantly, during the last bull market cycle, the Ethereum community boasted about high on-chain revenue to showcase "block space premium," proving strong network demand. Now that the situation has reversed, this is not a coincidence but a real collapse of demand drivers.

Although somewhat pessimistic, a more neutral viewpoint is that the network is the asset itself. Prices can be temporarily inflated by speculation, but divorced from fundamentals, they will eventually return to reality; this pattern has been validated countless times in other crypto infrastructure projects.

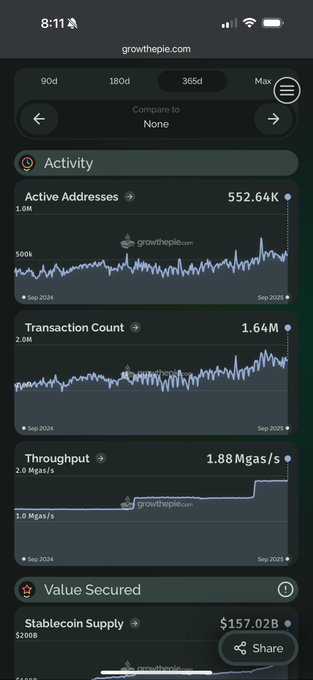

From an observer's perspective, AJC's revenue logic does make sense, at least reflecting the hidden dangers beneath the ETH bull market bubble. However, if other ecological indicators, such as on-chain activity, are ignored, this viewpoint may be somewhat biased.

Opponents Fire Back: Is Revenue Decline a Good Thing?

As AJC's viewpoint emerged, the comments section quickly turned into a battleground, with opponents vehemently disagreeing with this decline theory.

Unlike typical defenders, opponents view Ethereum through a broader narrative, with their core counterargument being:

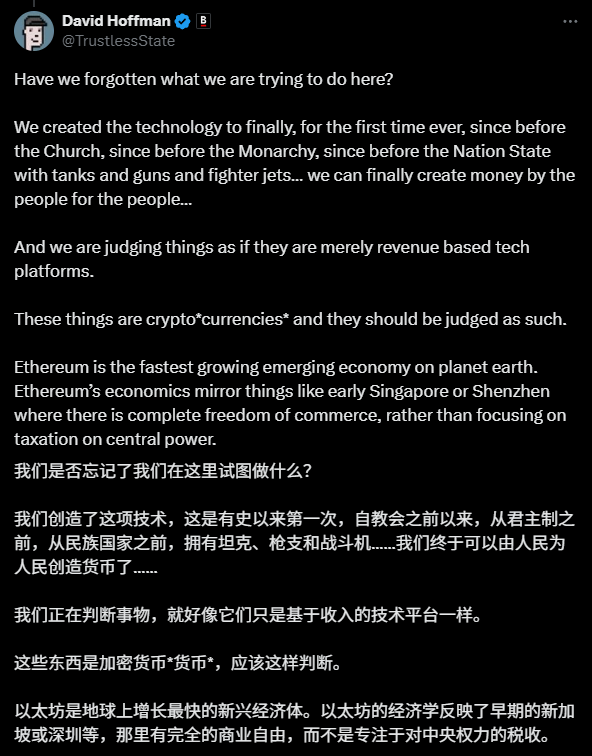

Viewing Ethereum as a tech company pursuing maximum revenue is a fundamental cognitive error. Ethereum now resembles a cryptocurrency, a commodity with inelastic supply, or an emerging economy.

From this qualitative perspective, a decline in revenue is not a problem but a positive signal of successful design, as it promotes broader user adoption and ecological growth.

Take David Hoffman, co-founder of Bankless, as an example; he compares Ethereum to early Singapore or Shenzhen, a paradise conducive to business freedom. In such an environment, the focus should not be on how much tax the city can collect, but whether the city is driving infrastructure and economic growth.

Former Wall Street trader and Etherealize founder Vivek Raman stated that Bitcoin has almost no revenue and is not considered in decline, so why should Ethereum be judged by its revenue?

Their logic actually stems from Ethereum founder Vitalik Buterin's early vision, which posits that Ethereum is a commodity with inelastic supply, valued based on supply-demand dynamics rather than quarterly reports. Excessively high revenue can lead to negative network effects, as charging too much gas can scare away users.

In fact, these opposing viewpoints can be traced back to Vitalik's early vision.

In the white paper, Vitalik described ETH as the "crypto fuel" of the network, often compared to digital oil, with its value relying on supply-demand dynamics rather than quarterly financial statements like a company.

High fees (revenue sources) have been proven to hinder user adoption, creating a negative feedback loop that the community views as a counter-network effect.

Therefore, the decline in Ethereum's mainnet revenue is, to some extent, seen as a good thing in their eyes.

After the Dencun upgrade in 2024, L2 solutions shifted the main chain's load, leading to a reduction in revenue. However, this translates to a lower fee threshold, attracting mainstream users to engage with DeFi, NFTs, and even institutional-level applications.

In the comments section, Tom Dunleavy, a venture capital director at Varys Capital, bluntly stated that L1 revenue is a stumbling block to ecological growth;

Ethereum community cycle trader Ryan Berckmans threw out data: with 60% of stablecoin market cap on Ethereum, and being highlighted by the U.S. Treasury Secretary, while various on-chain activity indicators are improving, how is this a decline?

Ethereum's Next Crossroads

This debate, while lively, actually touches on a fundamental question: how should we value Ethereum?

From the comments section, most opponents believe that Ethereum is transitioning from a busy execution layer to a stable global settlement layer. If you are using tech stock logic to value it based on revenue, that seems a bit rigid.

From the perspective of tech stocks, revenue is clearly the most important factor. If revenue collapse is indeed a signal of weak demand, then the risk of a short-term bull market bubble bursting is significant.

The various counterarguments in the comments section actually represent a multi-indicator narrative, emphasizing Ethereum's ecological health and long-term transformation, where revenue itself is not very important; its valuation comes from the recognition of various parties and the entire crypto ecosystem's reliance on Ethereum.

The debate may end here, but Ethereum's story is far from over.

The transition from a crypto tech platform to a global economy will undoubtedly involve growing pains, such as declining revenue and L2s eating into market share;

But this transformation may be the necessary path for Ethereum to mature.

Just as the internet evolved from the early paid dial-up era to the widespread adoption of free broadband, it may seem that the operators' revenue per user has declined, but the scale of the entire digital economy has achieved exponential growth.

Ethereum is currently at a similar turning point: the decline in mainnet revenue may precisely create space for larger-scale ecological prosperity. The rise of L2 is not "robbing" Ethereum's value but amplifying Ethereum's strategic value as a settlement layer.

More importantly, this debate itself illustrates Ethereum's unique position in the crypto world—no one would engage in heated debates over Bitcoin's "revenue decline" because everyone has already accepted its positioning as digital gold.

The reason Ethereum can spark such passionate discussions is precisely because it carries a more complex and grand vision.

If Ethereum is healthy, everyone benefits. Who knows if the next bull market turning point will start from here?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。