DeFi Development Corp Strengthens Solana Bet Amid SOL Price Swings

DeFi Development Corp (Nasdaq: DFDV) has taken another big step into crypto . The company bought 196,141 Solana (SOL) coins at an average price of $202.76.

After this purchase, its total holdings have reached 2,027,817 SOL, worth about $427 million.

Source: Wu Blockchain

Source: Wu Blockchain

With 25.5 million shares available, each share now represents 0.0793 SOL, or about $16.70 in value. This makes DeFi Development Corp one of the largest public companies with such a strong focus on this digital currency.

The move also shows how the company wants to act as a bridge for traditional investors to enter the crypto space.

Earlier Purchases and Market Reaction

This isn’t the first time DeFi Development Corp invested in Solana . Not long ago, the company bought 407,247 SOL for $77 million at an average price of $188.98.

That purchase boosted its total holdings to 1,831,011 SOL, valued at $371 million at the time.

The stock market reacted quickly. DFDV shares jumped from $15.60 to $16.47, almost an 8% increase, and later climbed to $16.78 overnight.

Investors really depicted confidence in the company’s SOL strategy.

Solana Price Movement

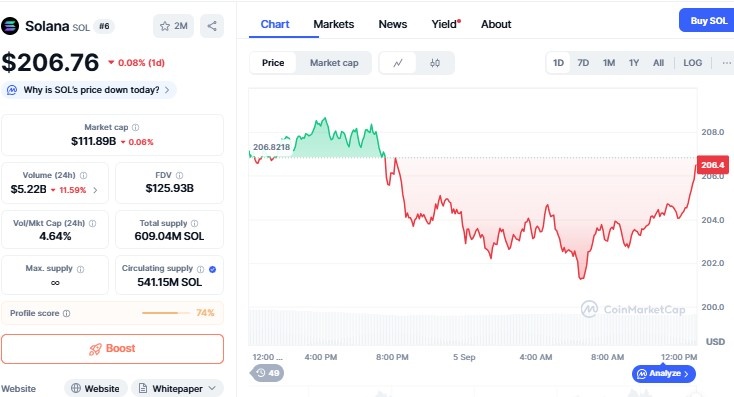

The coin has been fluctuating between $202 and $208, both reflecting demand as well as trader caution.

Crypto's market capitalization exceeds $110 billion and trading volumes of over $5 billion on a daily basis, making it remain one of the most active tokens in the market. The coin is currently at $206 as it has recovering after this news, trading volume is down 15% in the past 24 hours as per the CoinMarketCap .

Source: CoinMarketCap

Key Levels

-

SOL price is encountering resistance at its 24-hour pivot point at $205.49.

-

The 23.6% Fibonacci retracement level at $204.52.

-

These considerations make the buyers nervous, particularly following a robust 24% rise in one month.

-

The MACD is neutral with a reading of +0.001 on the histogram, it showcases slowed momentum.

-

On the downside, the 200-day EMA at $172 remains a distant support level.

Due to this, there isn't an immediate need for traders to buy dips yet.

Still, most think Sol's high demand and expanding ecosystem will maintain long-term sentiment in the green. DeFi Development Corp still views Solana as a solid long-term bet.

Increasing Competition

DeFi Development Corp's significant holdings are making other companies compete with it.

Upexi Treasury, another large player, holds slightly over 2 million SOL. With DFDV now also breaking the 2 million mark, the two companies may compete with each other to hold the largest Solana treasury.

If Upexi continues to purchase more, it may fuel even further altcoin's demand and price.

Investor Confidence and Risks

Investors currently view DeFi Development Corp as a stock that is directly tied to this cryptocurrency.

This provides conventional shareholders with the ability to profit from crypto expansion without necessarily purchasing tokens for themselves.

Yet the strategy carries risks as well. Since the stock price of the company now represents Solana, profits and losses will be more acute.

Conclusion

Through its investment of nearly half a billion dollars in this altcoin, DeFi Development Corp is exercising its deep faith in the future of the blockchain.

If the large purchases continue, both Solana and DFDV stock may see further significant jumps over the next few months.

Also read: QCP Group Expands into Abu Dhabi Crypto Hub with Full License免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。