Messari's latest report reveals key dynamics of the Filecoin network in Q2 2025, covering core points such as storage growth, technical upgrades, and market performance.

Written by: Armita

Compiled by: Filecoin Network

Core Insights

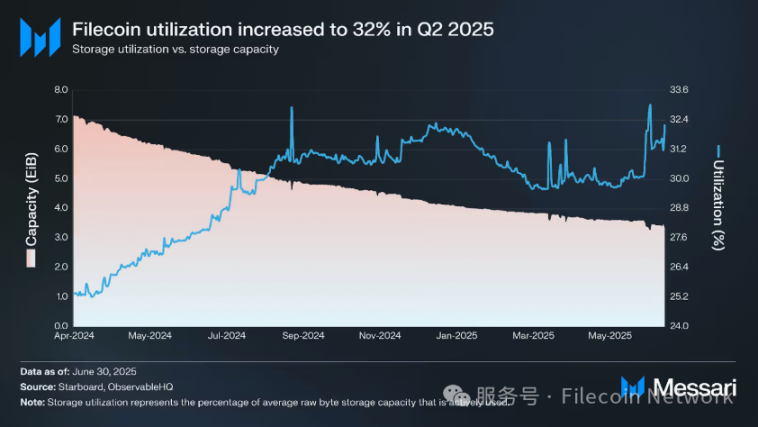

- Network utilization increased month-on-month to 32%, while total network capacity decreased by 13% due to provider attrition and storage allocations expiring.

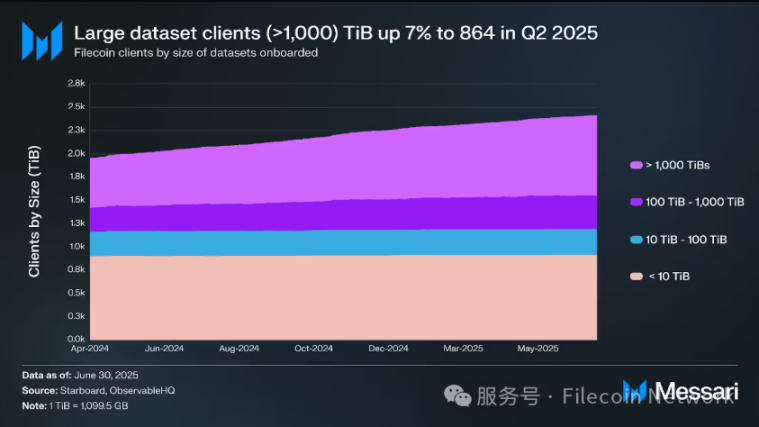

- The amount of loaded datasets grew by 3% month-on-month, with 864 datasets exceeding 1,000 TiB. The daily new storage transaction volume increased by 25% month-on-month, reaching 3.5 PiB per day, reflecting ongoing market demand for large-scale persistent storage.

- Proof of Data Possession (PoDP) went live in May 2025, adding continuous lightweight verification for stored data and introducing a hot storage layer for high-speed availability.

- The Avalanche cross-chain data bridge launched in Q2 2025, enabling the availability of Filecoin data on the Avalanche chain and expanding cross-chain use cases.

Introduction

Filecoin (FIL) is building a data service market, with its first service being data storage based on the InterPlanetary File System (IPFS). Filecoin adopts a market-driven model where users negotiate with storage providers to reach storage transactions at variable prices. Storage transactions are akin to service agreements, where users pay providers to store data for a specified period.

Filecoin employs an incentive model based on cryptographic proofs—specifically, Proof of Replication (PoRep)—to verify that storage providers reliably store customer data during the protocol period. Providers participating in storage transactions earn the network's native token, FIL, as a reward. If a storage provider fails to deliver reliable uptime or engages in malicious behavior, their staked tokens will be slashed.

To retrieve data, Filecoin users must pay retrieval providers for access. Unlike on-chain storage transactions, retrieval transactions settle off-chain using payment channels for faster retrieval speeds. In addition to storage and retrieval, Filecoin is committed to providing an open market for computing power to be contracted for data computation (compute-over-data), offering a more efficient alternative to traditional centralized systems. Key protocol upgrades for data computation services include smart contracts (Filecoin Virtual Machine - FVM) and scaling solutions (InterPlanetary Consensus - IPC).

Key Metrics

Performance Analysis

Network Overview

Filecoin achieves decentralized data storage primarily through two types of participants:

- Demand side, i.e., users needing data storage.

- Supply side, i.e., storage providers with idle storage capacity.

The total amount of data in effective storage deals between users and storage providers is a key metric for measuring Filecoin's storage demand.

Storage Transactions

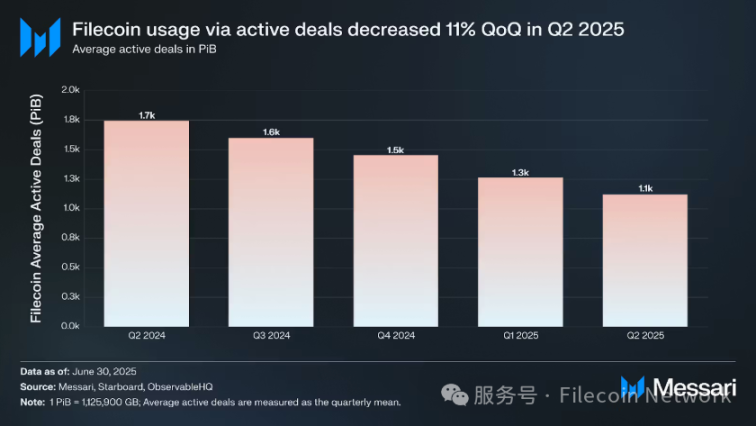

In Q2 2025, the total amount of data stored through effective storage transactions on Filecoin reached 1,100 PiB, an 11% decrease from 1,300 PiB in Q1. The number of effective transactions fell from 450 million in Q1 2025 to 430 million, a 5% decrease. This decline reflects a strategic shift in the network's focus from prioritizing total storage capacity to concentrating on high-value, enterprise-oriented workloads.

In Q2 2025, Filecoin's daily new storage transaction volume increased from 2.8 PiB to 3.4 PiB, a 25% month-on-month growth; however, the average total effective storage size decreased from 1,300 PiB to 1,100 PiB, an 11% decline. This discrepancy reflects the difference between the inflow of new transactions and the overall effective transaction stock—because the capacity removed due to the expiration of previous large contracts (especially short-term or zero-fee loaded transactions) exceeded the capacity replenished by new transactions.

The growth in new transactions may be attributed to data loading activities from Filecoin Plus, new entry integration schemes that lowered the barriers for storage providers, and an increase in enterprise and research workloads, including datasets from Cornell University (Ramo project), The Defiant (Akave project), and Humanode (via Storacha). Other demand sources include data injections related to artificial intelligence (AI) and DePIN.

The Nv25 network upgrade (codenamed "Teep") deployed in April 2025 also contributed to this, enhancing transaction efficiency, simplifying the economic model for storage providers, and preparing for "Fast Finality" (F3), which will shorten settlement times and require more timely responsive infrastructure. Overall, despite a contraction in total effective storage, these factors collectively drove more frequent transaction initiation.

Utilization and Capacity

In Q2 2025, Filecoin's storage utilization rose from 30% in Q1 to 32%. However, the total committed storage capacity decreased by 13% from 3.8 EiB (Exbibyte) to 3.3 EiB. Despite the addition of effective storage transactions this quarter, the expiration of existing contracts (especially short-term or zero-fee loaded agreements) led to a reduction in overall effective storage. The decrease in available capacity, combined with stable demand from high-value workloads, increased the proportion of used capacity, resulting in higher network utilization.

Clients

Filecoin aims to provide cold storage solutions for enterprises and developers (e.g., data archiving and recovery). Its low storage prices help attract traditional enterprises seeking cost-effective alternatives for storing large volumes of archived data.

DeStor is a service provider on Filecoin that connects clients with storage providers. It has partnered with Qamcom Decentralised Data Security (DDS). Potential data clients from this partnership include Web3 gaming studio YayPal, which has over 500,000 users, and an AI marketing analytics platform Fieldstream. Other client solution cases include:

GhostDrive: Focused on ensuring privacy and security through encryption, decentralization, and novel storage optimization techniques.

CIDGravity: Focused on enterprise-level integration with open-source platforms like Nextcloud.

In addition to cold storage, other innovations are driven by storage solution providers such as Lighthouse, Akave, and Storacha.

As of the end of Q2 2025, Filecoin hosted 2,416 loaded datasets, a 3% increase from 2,340 in Q1. Among these, 864 datasets exceeded 1,000 TiB, up 7.5% from 804 previously, highlighting the market's ongoing adoption of large-capacity, persistent storage. This growth is attributed to continuous data loading activities from Filecoin Plus, the increase in new entry integration schemes that lowered the barriers for dataset injection, and the rise in enterprise and research workloads.

Momentum of FVM Development

The Filecoin Virtual Machine (FVM) supports running Ethereum-style smart contracts directly on top of the Filecoin storage layer, enabling developers to build applications that automate data loading, pricing, retrieval, and computation coordination.

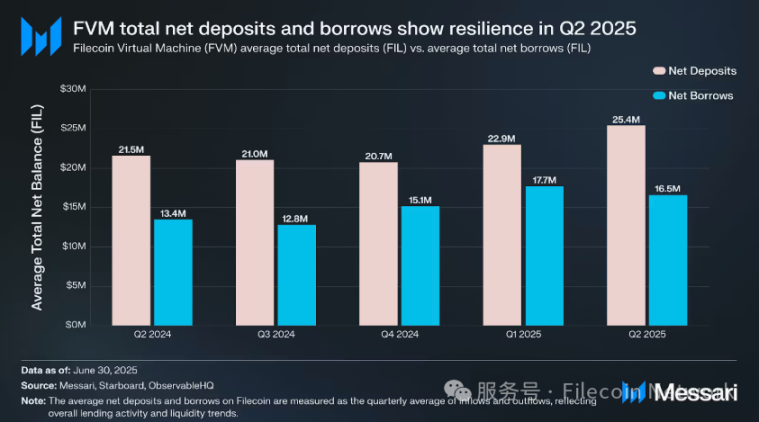

In Q2 2025, Filecoin recorded a total inflow of $67 million (net deposits), a 23% decrease from $88 million in Q1. During the same period, total outflows and borrowing decreased from $68 million to $43 million, a 36% decline.

When measured in FIL, token activity showed the opposite trend. Inflows increased by 11% month-on-month from 23 million FIL to 25 million FIL, while outflows decreased by 6% from 18 million FIL to 17 million FIL. Despite a 44% drop in FIL's price (from $3.20 to $2.78) this quarter, leading to a decrease in dollar-denominated transaction volume, activity measured in FIL still achieved growth.

The growth in token-based activity may be attributed to several developments in Q2, such as: the implementation of the FIP-81 proposal, which increased collateral requirements for storage providers, thereby locking more FIL in the network; the preliminary impact of the FIP-100 proposal, which destroys a portion of protocol revenue in FIL; and enterprise loading incentives settled directly in FIL. These factors collectively maintained on-chain token liquidity even amid declining market prices and dollar transaction volumes.

Financial Overview

Filecoin's revenue model is similar to Ethereum's, as it employs a gas system inspired by EIP-1559, where a portion of network fees is burned to regulate network congestion. However, unlike Ethereum, Filecoin's economy is storage-driven, where storage users pay fees, and storage providers earn revenue while managing collateral and penalties.

Network Fees

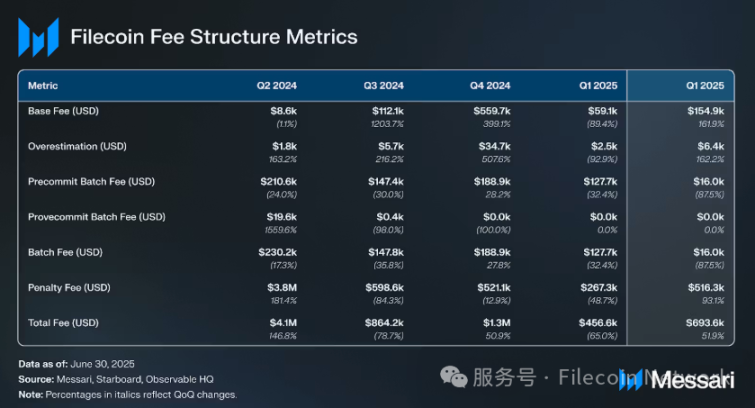

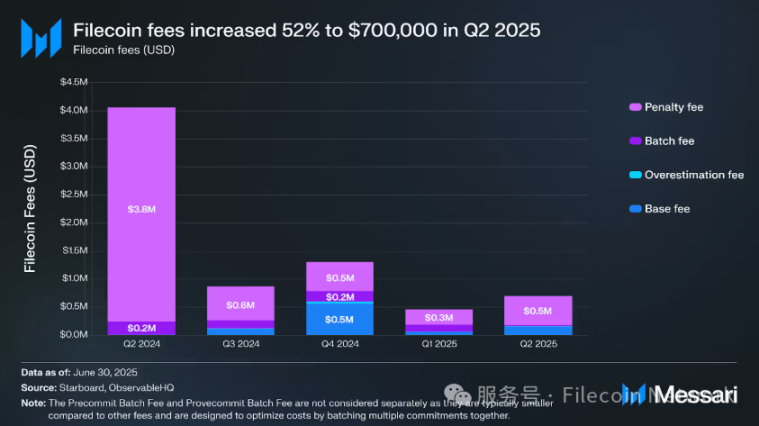

According to Messari's revenue analysis, the fee structure of Filecoin is as follows:

- Base Fees: Determined by the congestion level of block space, these are the fees that all storage proofs must pay.

- Batch Fees: Used to bundle (package) storage proofs to optimize costs.

- Overestimation Fees: Fees incurred to optimize Gas usage.

- Penalty Fees: Fees charged due to storage provider failures.

- Base Fees: Increased by 162% month-on-month to $155,000, reflecting higher on-chain transaction activity and improved network utilization, despite an overall decline in storage capacity.

- Batch Fees: Decreased by 88% month-on-month to $16,000, reflecting a reduction in large sector loading activities per transaction, consistent with the downward trend in total effective storage.

- Overestimation Fees: (Penalties incurred due to overestimating Gas) also increased by 162% month-on-month to $6,400, which may be related to Gas price fluctuations and increased activity from developers or providers.

- Penalty Fees: Increased by 93% month-on-month to $520,000, accounting for approximately 74% of total network fees. This indicates an increase in slashing events, possibly related to transaction expirations, capacity reductions, or providers failing to comply under stricter participation requirements.

The fee structure for Q2 2025 indicates that the network is undergoing a transformation. While the growth in base fees reflects more frequent on-chain activity (possibly related to new transaction initiations, smart contract usage on FVM, and data loading from Filecoin Plus), the significant drop in batch fees aligns with a strategic shift in the network—from a model of large-volume, short-term, or zero-fee loading to fewer but higher-value transactions.

The surge in penalties indicates that some storage providers are facing operational challenges under the stricter performance standards following the v25 network upgrade. This may have led to a decline in capacity, but it also increased the proportion of fees from the penalty mechanism (rather than new storage expansion).

Market Capitalization

In Q2 2025, the circulating market capitalization of FIL (in USD) decreased by 13.1% month-on-month, from $1.8 billion in Q1 2025 to $1.6 billion. This decline was due to a 17% drop in the price of FIL tokens (from $2.78 to $2.30), while the circulating supply increased by 4.9% to 677.7 million FIL, consistent with previous issuance rates.

DeFi Ecosystem

In Q2 2025, the total amount of staked FIL continued to decline steadily, decreasing by 6.2% from 155.1 million FIL in Q2 2024 to 127.6 million FIL. In USD terms, the staked value fell by 22.3% to $29.38 million, a decline driven by both the reduction in the number of staked tokens and a 17.1% price drop during the quarter.

The staking rate of qualified supply decreased from 19% in Q1 2025 to 17%, although the annualized nominal yield rose significantly from 21% to 52%. The increase in yield is primarily due to a decrease in staking participation, which concentrated rewards among fewer participants.

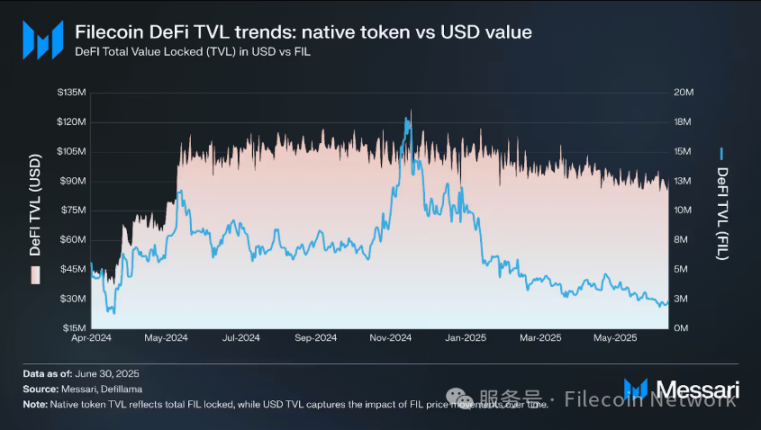

TVL Trends

The Total Value Locked (TVL) in liquid staking also exhibited a similar trend, decreasing by 16.4% month-on-month to $11.38 million; when measured in FIL, it decreased by 600,000 FIL, indicating that, in addition to price impacts, there were also small-scale withdrawals. The average daily DEX trading volume decreased by 11.4% month-on-month to $82,700, marking a second consecutive quarter of reduced on-chain trading activity. The diversity score of Filecoin's DeFi (the number of protocols constituting 90% of TVL) fell from 5 to 4, indicating an increase in the concentration of DeFi activity within the network.

DeFi metrics measured in USD declined across the board, primarily due to the 17.1% drop in FIL prices and limited on-chain capital inflows. Despite the ongoing growth of the FVM ecosystem, this situation persists, indicating that most recent contract deployment activities remain in the early stages and have yet to attract significant liquidity.

Stablecoins

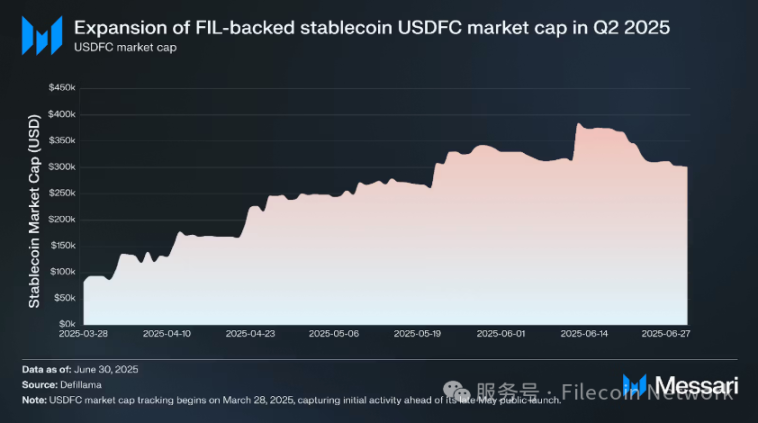

USDFC is a FIL-backed stablecoin launched by Secured Finance in early 2025, designed to increase liquidity within the Filecoin economy by allowing FIL to be collateralized and reducing selling pressure on FIL. It provides the network with a native, USD-pegged asset that can be used for trading, lending, and DeFi applications without leaving the Filecoin network.

In Q2 2025, the market capitalization of USDFC rose from $93,000 at the end of March to a peak of over $384,000 in mid-June, closing the quarter at $301,000. This growth reflects the slow increase in native lending and trading within Filecoin, as well as a greater willingness among storage providers and DeFi participants to hold value in a FIL-collateralized, USD-pegged asset.

In the long term, as the economic model of the Filecoin token tightens, the role of USDFC may be strengthened. The token release plan is set to complete in October 2026, while the demand consumption mechanisms at the protocol level—such as higher collateral requirements for storage providers under the FIP-81 proposal and the destruction of fees denominated in FIL under the FIP-100 proposal—are reducing circulating supply. In such an environment, USDFC can deepen liquidity and lay the foundation for Filecoin's DeFi ecosystem.

Qualitative Analysis

Protocol Upgrades

Network v25 Upgrade (codenamed "Teep"): The v25 network upgrade, codenamed "Teep," was deployed on April 11, 2025. This version introduced changes at the protocol level to improve the efficiency of storage providers, enhance developer capabilities, and prepare the network for "Fast Finality" (F3).

This upgrade implemented three core Filecoin Improvement Proposals (FIPs):

- FIP-0097 added ephemeral storage support (EIP-1153) to the Filecoin EVM, allowing temporary on-chain data storage during transaction execution to improve compatibility with Solidity and support common Ethereum patterns, such as reentrancy guards.

- FIP-0098 revised the calculation method for termination fees, introducing a fixed percentage model (8.5% of the initial staked amount) to replace variable fees, providing storage providers with a more predictable economic model.

- FIP-0100 removed the batch balancer and Gas limits, replacing the previous batch processing mechanism with a daily per-sector charging model. This simplified operations, reducing the Gas costs of data loading by up to 30% and eliminating batch size restrictions.

The upgrade also included updates to consensus parameters to support the upcoming F3 activation. These changes prepare for shorter transaction finality times, simplify network operations, improve developer tools, and address scalability limitations.

Filecoin Fast Finality (F3): The "Fast Finality" (F3) upgrade will reduce transaction finality on the Filecoin network from approximately 7.5 hours (900 epochs) to a few minutes (2 epochs). F3 was initially announced in Q3 2024, completed passive testing by the end of Q4 2024, and underwent further optimization in Q1 2025 after issues were discovered during steady-state testing (including progress inconsistencies and bandwidth limitations).

F3 was launched on April 29, 2025, in conjunction with the v25 network upgrade (codenamed "Teep"). This version integrated the GossiPBFT consensus mechanism, achieving approximately 100 times reduction in finality time at launch. Key technical changes include support for the MCOPY opcode (EIP-5656) to improve Solidity contract efficiency and the addition of historical randomness retrieval features to enhance the security of decentralized applications (dApps).

For storage providers, F3 shortens transaction finalization times, enabling faster transaction settlements and more predictable service level agreements (SLAs) without additional hardware requirements. It also improves node efficiency, making resource efficiency higher for light clients and easier for new network participants to use.

Proof of Data Possession (PDP): After completing final contract optimizations, external audits, and integration testing with early adopters such as Storacha and Akave, Proof of Data Possession (PDP) went live on the mainnet on May 6, 2025. PDP is a cryptographic verification system that periodically checks whether storage providers still hold customer data without requiring complete retrieval or decoding of files.

PDP enhances Proof of Replication (PoRep), supporting variable sets, high-speed data availability, and lightweight verification. The accompanying PDP SPX program has also been launched, which began data loading and stress testing for storage providers and customers under real-world conditions from May to June 2025.

Ecosystem Growth and Applications

Layer-2 Scaling and Cross-Chain Storage: The Layer-2 (L2) solutions launched at the end of 2024—Basin, Akave, and Storacha—continued to provide promising entry points for use cases such as AI workloads, hot object storage, and multi-chain interoperability in early 2025. With the launch of PDP in May 2025, these L2 solutions gained access to a new hot storage data layer, enabling higher data availability without the need for complete file retrieval.

Cardano (Blockfrost): The leading Cardano developer API service Blockfrost has integrated Filecoin as a decentralized backup layer for its IPFS node cluster. This allows dApps on Cardano to store application data in a verifiable, redundant, and censorship-resistant manner, enhancing their resilience against node outages and centralized infrastructure risks.

Avalanche Cross-Chain Data Bridge: On May 27, 2025, the Filecoin Foundation and Ava Labs jointly launched a native bridge based on FEVM, allowing smart contracts on the Avalanche C chain to archive and retrieve verifiable data on Filecoin. This integration enables Avalanche developers to offload large datasets to Filecoin while retaining their data proofs on-chain, combining Avalanche's high throughput with Filecoin's tamper-proof storage capabilities.

Ideal Customer Profiles (ICPs) and Demand Generation: Filecoin's demand strategy in Q2 2025 primarily revolves around four verticals of "Ideal Customer Profiles" (ICP):

- Large-scale Web2 Data Archiving: Handling EB-level datasets with a longer tolerance for retrieval times.

- Web2 Object Storage: Providing S3-like services with features such as fast access, integration with Snowflake, and data locality control.

- Web3 Object Storage: Supporting decentralized applications (dApps), NFTs, AI agents, and data DAOs.

- Web3 On-Chain Storage: Used for storing blockchain data from networks like Solana and Cardano.

- Emerging growth areas include DePIN networks that collect large-scale consumer data, as well as AI/edge computing workloads. Notable paid transaction cases include: astrophysics simulation data from Cornell University (Ramo project), media archives from The Defiant (Akave project), AI agent data storage (Recall project), and identity data (Humanode project, stored via Storacha).

Developer Programs and Community Growth

FIL ProPGF Launch: The FIL ProPGF from the Filecoin Foundation is an on-chain funding mechanism launched in March 2025 to support public goods across the Filecoin ecosystem. While the application channel opened in Q1, Q2 2025 marked the first funding decisions and the arrival of the first grantees. This round of support primarily focused on tool development, research, governance, user experience (UX) improvements, and customer success, reflecting the program's goal of promoting sustainable, community-driven development.

Filecoin AI Blueprints Hackathon: This global hackathon, co-hosted with Encode Club, focused on building decentralized AI infrastructure, emphasizing data provenance, storage, and integrity. The event took place from March 17 to April 14, 2025, receiving 86 project submissions and awarding $77,000 in prizes. Participating solutions explored verifiable AI data pipelines, decentralized computing coordination, and dataset management supported by Filecoin.

6th FIL Developer Summit: The 6th Filecoin Developer Summit was held in Toronto on May 12-13, 2025, following an online kickoff event from April 23-30. The summit brought together developers, storage providers, and ecosystem contributors to discuss protocol advancements in storage, retrieval, governance tools, and new features such as PDP and F3.

Hackathons and Developer Bounties: In Q2, the PL_Genesis: Modular Worlds hackathon hosted by Protocol Labs offered over $250,000 in prizes and access to the Founders' Forge early-stage accelerator, aimed at supporting builders engaged in modular, composable tech stack development.

FIL Europe Tour: This is a series of independent community events held in multiple cities across Europe, aimed at strengthening regional engagement, expanding ecosystem influence, and connecting local developers and storage providers.

Key Governance Progress

FilPoll V2: Following its launch in February 2025, FilPoll V2 remained the primary governance coordination tool in Q2, supporting intention voting, tracking Filecoin Improvement Proposals (FIPs), and reviewing community proposals. In Q2, it was used to facilitate broader community feedback on ongoing Filecoin improvement proposals, including those related to the v25 network upgrade (codenamed "Teep") and F3 activation. The tool underwent minor interface optimizations to improve proposal categorization and make voting results more user-friendly for non-technical participants. Three notable FIPs made progress this quarter:

- FIP-0101 has been accepted, removing redundant ProveCommitAggregate methods from miner actor logic to simplify code paths and reduce maintenance overhead.

- FIP-0077 has entered the "Last Call" phase to solicit final community feedback, proposing adjustments to miner deposit requirements.

- FIP-0082 has been accepted, implementing a single proof for multiple sector updates through Groth16 aggregation technology, thereby reducing proof generation costs and improving the efficiency of storage providers managing large sector updates.

FIDL Reporting Program: Launched at the end of Q1 2025, the Filecoin Incentive Design Lab (FIDL) saw broader adoption in Q2, with more clients, storage providers, and allocators beginning to use it to monitor retrieval performance, transaction execution rates, and allocation efficiency. Updates in Q2 focused on optimizing metric definitions, improving retrieval latency tracking, and adding export features for deeper analysis by ecosystem researchers.

Filecoin Plus (Fil+) Improvements

Several updates aimed at improving Datacap allocation efficiency and governance transparency in Q2:

- The Experimental Path Meta Allocator (EPMA) launched a 1 PiB sandbox project to test innovative Datacap allocation models under the supervision of the Filecoin Incentive Design Lab (FIDL).

- The sixth round of allocator applications opened from June 12 to July 11, adopting updated KYC requirements, strengthened compliance processes, a smart contract-based allocation mechanism with on-chain revocation support, and improved auditing tools to enhance accountability in the data loading process.

Summary

In Q2 2025, Filecoin's circulating market capitalization decreased by 13% to $1.6 billion, reflecting a 17% drop in FIL price to $2.30, while the token supply increased by 4.9%. Core network activity saw an increase, with daily new storage transaction volume growing by 25% to 3.5 PiB; despite a 13% decline in total network capacity, utilization rose to 32%.

Driven by enterprise and research demand, the network added 2,416 datasets (up 3% month-on-month), including 864 large datasets exceeding 1,000 TiB (up 7.5% month-on-month). PoDP has gone live on the mainnet, achieving continuous lightweight verification and a hot storage layer; integration with the Avalanche subnet has expanded the availability of cross-chain data. The market capitalization of USDFC grew from $93,000 to $301,000, marking further deepening of DeFi integration.

Overall, the second quarter highlighted the ongoing growth of on-chain activity, the launch of new products, and the expansion of the ecosystem, laying the foundation for further applications and diversification of use cases for Filecoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。