Original Title: WLFI: Bridging Traditional Capital Markets

Source: Alea Research Daily Newsletter

Translation: Zhou, ChainCatcher

World Liberty Financial (referred to as "WLFI," brand name "WorldFi," collectively referred to as "WLFI") positions itself as a next-generation financial infrastructure platform aimed at integrating stablecoins with capital markets.

In addition to USD1, WLFI has also incubated related projects such as Blockstreet (an ecological issuance platform/Launchpad) and Dolomite (a lending protocol). WLFI's direct impact primarily comes from its on-chain activities surrounding USD1 on BSC (BNB Chain), Ethereum, and Tron.

This article will outline WLFI's mission and on-chain products, the USD1 stablecoin, and its cross-chain expansion.

What is WLFI

Essentially, WLFI seeks to find a hybrid positioning between "stablecoin issuer + DeFi service platform" and plans to offer functions such as payments, lending, and token issuance through its flagship product:

USD1 Stablecoin: Pegged to the US dollar, fully backed by short-term US Treasury bills, cash, and dollar deposits, and held in custody by BitGo Trust Company.

WLFI Governance Token: A functional token used for protocol governance, token release, and fee income capture.

WLFI's value proposition lies in combining regulated on-chain dollars with governance tokens that can guide protocol revenue distribution and influence treasury policy. The platform targets both retail and institutional users—retail users can complete deposits, payments, and stablecoin transfers through a mobile application; institutional users can utilize on-chain settlement for trade finance and RWA issuance.

USD1: A Secure, Institutional-Grade Stablecoin

Its flagship product, USD1, is a fiat-backed stablecoin. USD1 is positioned as a "fully collateralized" stablecoin, with reserves consisting of cash and US Treasury bills. WLFI claims that its reserves are held in custody by BitGo Trust Company, allowing for on-demand minting and redemption of USD1, enabling direct conversion between the stablecoin and the US dollar. Currently, USD1 has a circulation of approximately $2.4 billion, ranking as the sixth-largest stablecoin.

USD1 serves both retail and institutional users: retail users can hold predictable value on-chain dollar assets; institutional users can use it for cross-border settlements, trade finance, and yield-generating DeFi strategies. WLFI's ultimate goal is to enable regulated on-chain securities and RWAs to settle against USD1, thereby building a unified market between digital finance and traditional finance.

To enhance portability, WLFI has integrated USD1 with Chainlink's Cross-Chain Interoperability Protocol (CCIP), supporting secure cross-chain transfers between Ethereum and BNB Chain, with plans to support more networks. The multi-chain design aims to establish USD1 as a settlement asset usable across diverse ecosystems.

WLFI Token Sale, Unlocking, and Governance

WLFI's governance token has undergone one of the largest presales to date: a total of 25 billion tokens were sold, raising $550 million; over 85,000 participants demonstrated strong retail and institutional demand.

WLFI will go live for trading on September 1, 2025. Early purchasers will initially receive 20% of their allocation, with the remainder gradually unlocked according to a schedule determined by community governance votes. This design aims to balance early liquidity for participants with long-term consistency. Tokens allocated to the team, founders, and advisors remain locked at the Token Generation Event (TGE).

ALT5 Sigma Treasury Company

The partnership with ALT5 Sigma (a Nasdaq-listed company) is a hallmark of WLFI's strategy. According to its latest S-1 filing, ALT5 has raised $1.5 billion to purchase WLFI tokens and announced a treasury plan to hold approximately 7.5% of the total token supply. As part of the transaction, they received WLFI tokens valued at $750 million.

This arrangement is similar to the MicroStrategy (MSTR) model of corporate treasury holdings, indicating WLFI's attempt to anchor its tokens to a publicly listed company. Eric Trump joined the ALT5 board, and Zach Witkoff was appointed chairman, further solidifying cross-company synergies and connections.

Ecological Projects

To establish liquidity and use cases for USD1 and WLFI, WLFI is integrating with established DeFi protocols:

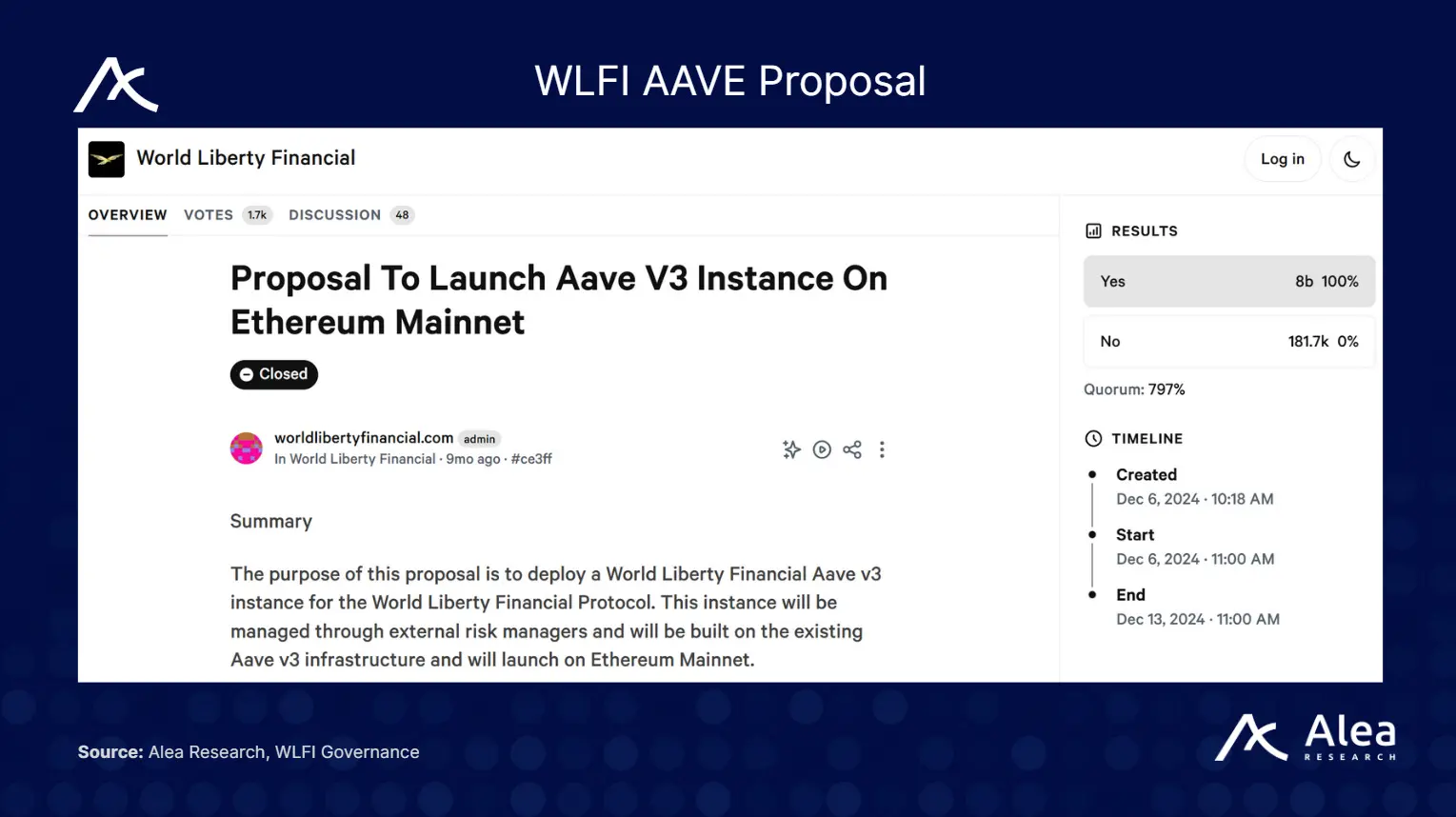

Aave v3 Deployment: WLFI proposed launching a USD1 lending pool on Aave v3. The proposal aims to allocate 20% of protocol fees and 7% of WLFI supply (reserved for governance and liquidity mining) to the Aave DAO. This dedicated instance will support ETH and WBTC lending markets, helping to solidify USD1 liquidity and attract users. This integration highlights WLFI's intention to connect with leading money markets. (However, there are some controversies regarding the validity of this proposal and whether it will be realized.)

Dolomite: Dolomite is a lending protocol whose founder also serves as WLFI's CTO. Dolomite was an early supporter of USD1 integration and has launched corresponding lending pools.

Blockstreet: Blockstreet is WLFI's Launchpad and token issuance platform, aimed at providing infrastructure for new projects, using USD1 and WLFI as core settlement assets for minting, distribution, and listing. Its roadmap includes cross-chain issuance and compliance tools, but details remain relatively broad at this stage.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。