作者:Arthur Hayes,BitMEX 创始人

编译:BitpushNews

(本文所表达的观点仅代表作者个人意见,不应作为投资决策的依据,也不得被视为进行投资交易的推荐或建议。)

美国财政部长斯科特·贝森特应该有一个新的绰号。我曾经给他起过一个,叫“BBC”,即“Big Bessent Cock”。虽然他的激进操作正在重塑全球金融体系,但这个称呼仍不足以全面概括他所带来的影响。我认为,需要一个更贴切的称号来描述他将对两大关键领域造成的冲击:欧元美元银行体系以及外国央行。

就像电影《沉默的羔羊》中的连环杀手一样——这部经典作品值得任何新手深夜观看——斯科特·“布法罗比尔”·贝森特正准备重塑欧元美元银行体系,并掌控外国非美元存款。在古罗马时期,奴隶和精锐军团维持了“罗马和平”;而在现代,美元的霸权维系着“美利坚和平”。美利坚和平中的“奴役”并非仅指历史上被运送至美洲的非洲奴隶,如今的形式是每月偿还债务——几代年轻人自愿承担沉重债务,只为获得毫无实际价值的学历证书,希望进入高盛、沙利文与克伦威尔或麦肯锡等顶级机构工作。这种控制方式更广泛、隐蔽且有效。遗憾的是,随着人工智能的发展,这些背负沉重债务的人群可能面临失业风险。

我先打个岔。

本文将讨论“美利坚和平”下美元对全球储备货币的控制。历任美国财政部长在运用美元这一金融杖时,成效各异。其中最显著的失败,是未能阻止欧元美元体系的形成。

欧元美元体系在20世纪50至60年代出现,初衷是规避美国的资本管制(如《Q条例》)、规避经济制裁(苏联需要一个存放美元的渠道),并为全球经济在二战后复苏过程中处理非美国贸易流提供银行服务。当时的货币管理当局本可以意识到向外国提供美元的需求,并允许美国本土的主要金融机构承担这一业务,但国内政治与经济考量迫使其采取强硬立场。结果,欧元美元体系在随后的几十年里不断扩张,发展成为一个不可忽视的金融力量。据估计,全球非美国银行分行中流通的欧元美元存款规模在10至13万亿美元之间。这些资本的流动引发了战后多次金融危机,每次都需要印钞救市。2024年8月,亚特兰大联储发表的论文《离岸美元与美国政策》就对这一现象进行了分析。

对“布法罗比尔”贝森特来说,欧元美元体系存在两个主要问题。第一,他对欧元美元的规模以及这些资金的用途几乎一无所知。第二,也是更为关键的一点,这些欧元美元存款并未被用于购买他手里的低质量美国国债。那么,贝森特有没有办法同时解决这两个问题呢?在回答之前,我们先简单回顾一下非美国零售存款者的外汇持有情况。

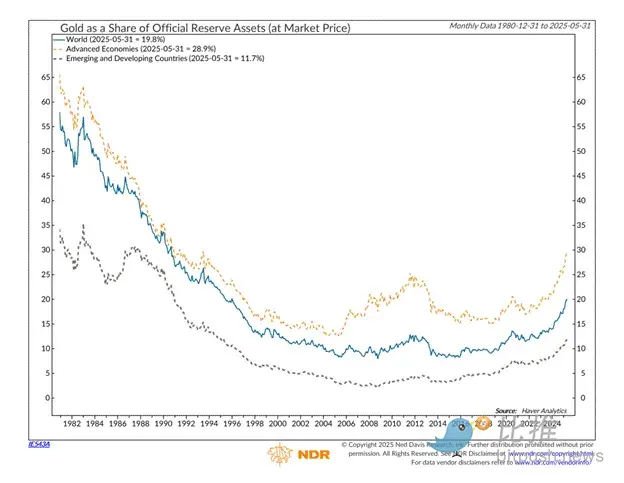

去美元化确实存在。它在2008年开始显著加速,当时美国金融掌门人选择了用无限量量化宽松(QE Infinity)救助因错误押注而面临倒闭的银行和金融机构,而非让它们自然倒闭。一个衡量全球央行对持有数万亿美元美元计价资产反应的有效指标,是其外汇储备中黄金所占比例。储备中黄金比例越高,说明对美国政府的信任越低。

正如可以观察到的,自2008年金融危机之后,各国央行储备中黄金的占比触底反弹,并开始呈现长期上升趋势。

这是 TLT 美国 ETF,它追踪期限为 20 年及以上的美国国债,并将其价格除以黄金价格。我已将其从 2009 年开始指数化为 100。自 2009 年以来,美国国债相对黄金的价值几乎下跌了 80%。美国政府的货币政策是救助本国银行体系,同时牺牲国内外债权人。难怪外国央行开始像《唐老鸭》中斯克鲁奇那样囤积黄金。美国总统特朗普也打算采取类似策略,但他除了打击债券持有人之外,还认为可以通过关税对外国资本和贸易流征税,以“让美国再次伟大”。

贝森特实际上很难说服各国央行储备管理者购买更多国债。然而,在全球南方存在一大批美元金融服务不足的人群,他们迫切希望拥有一个正收益的美元账户。正如你所知,所有法币相比比特币和黄金都是垃圾。但在法币体系内,美元仍是最佳选择。主导全球大部分人口的国内监管者迫使其民众持有高通胀的劣质货币,并限制其进入美元金融系统的机会。这些人会购买贝森特提供的国债,只为逃离糟糕的本国债券市场。那么,贝森特有办法为这些人提供银行服务吗?

我第一次去阿根廷是在 2018 年,从那以后几乎每年都会回去。这张图显示了自 2018 年 9 月起的 ARS/USD 指数(基准为 100)。七年间,阿根廷比索兑美元贬值了 97%。现在我去那边,大多数时间是滑雪,我给所有服务人员支付的都是 USDT。

“水牛比尔”贝森特找到了一种新工具,可以解决他的问题——那就是美元挂钩稳定币。美国财政部现在推动这种稳定币的发展,帝国会支持特定的发行方,帮助他们收拢欧元美元体系以及全球南方的零售存款。为了理解这一点,我会先简要介绍“可接受”的美元挂钩稳定币的结构,再讨论其对传统银行体系的影响。最后,也是加密圈最关心的,我会说明为什么 Pax Americana 支持的美元挂钩稳定币的全球推广,将推动去中心化金融(DeFi)应用的长期增长,尤其是 Ethena、Ether.fi 和 Hyperliquid。

正如你们所知,Maelstrom 可不是免费干活的。我们有满满的包裹,一袋又一袋,永远装不完。

如果你对稳定币还不过瘾,我会先提一句我们正在顾问的一个新稳定币基础设施项目——Codex。我相信从即将启动的 TGE(Token Generation Event)到本轮周期结束,它将成为表现最出色的代币。

什么是“可接受”的稳定币?

美元挂钩稳定币类似于窄银行(narrow bank)。发行方接受美元,并将这些美元投资于无风险债券。在名义美元计价下,唯一的无风险债券就是美国国债。具体来说,由于稳定币发行方必须能够在持有人赎回时提供实物美元,他们只会投资短期国库券(T-bills),即到期时间不到一年的国债。由于几乎没有久期风险,它的交易行为几乎等同于现金。

以 Tether USD(USDT)为例:

授权参与者(Authorized Participant, AP)将美元汇入 Tether 的银行账户。

Tether 按照每存入 1 美元创建 1 个 USDT。

为了让这些美元产生收益,Tether 会购买国库券(T-bills)。

举例:如果 AP 汇入 1,000,000 美元,他们会收到 1,000,000 USDT。

Tether 用这 1,000,000 美元购买等额的 T-bills。

USDT 本身不支付利息,但这些 T-bills 实际上会支付美联储基金利率,目前大约为 4.25%~4.50%。

因此,Tether 获得了 4.25%~4.50% 的净利息差(Net Interest Margin, NIM)。

为了吸引更多存款,Tether 或相关金融机构(如加密交易所)会将一部分 NIM 支付给愿意质押(staking)USDT 的用户。质押的意思是将 USDT 在一段时间内锁定,以换取利息收益。

稳定币的赎回流程如下:

授权参与者(AP)将 USDT 发送到 Tether 的加密钱包。

Tether 按照 USDT 对应的美元金额出售相应的 T-bills。

Tether 将每个 USDT 对应的 1 美元汇入 AP 的银行账户。

Tether 销毁相应的 USDT,将其从流通中移除。

Tether 的商业模式非常简单:接收美元、发行在公共区块链上的数字代币、将美元投资于 T-bills 并赚取净利息差(NIM)。

Bessent 将确保帝国默许支持的稳定币发行方只能将美元存放在拥有特许的美国银行或投资于国库债券。不会有任何“花里胡哨”的操作。

欧元美元体系的影响

在稳定币出现之前,美国联邦储备系统(美联储)和财政部总是在欧元美元银行机构出现问题时进行救助。一个运作良好的欧元美元市场对于帝国的整体健康至关重要。然而现在,Bessent 有了一个新工具,可以吸收这些资金流。在宏观层面上,他必须为欧元美元存款上链提供合理动机。

例如,在 2008 年全球金融危机期间,美联储秘密向那些因次贷及其相关衍生品崩盘而缺美元的外国银行提供了数十亿美元的贷款。因此,欧元美元存款者普遍认为美国政府在默示上保证了他们的资金,尽管从技术上讲,他们处于美国监管体系之外。如果宣布非美国银行分行在未来金融危机中将不会得到美联储或财政部的援助,欧元美元存款将被引导进入稳定币发行方的怀抱。如果你觉得这夸张,德意志银行的一位策略师曾公开质疑,美国是否会利用美元掉期工具迫使欧洲执行特朗普政府的要求。可以肯定,特朗普非常希望通过实际上“去银行化”欧元美元市场来削弱它——这些机构在他第一任期后曾“去银行化”了他的家族企业,现在正是报复的时候。因果报应,确实残酷。

没有了保障,欧元美元存款者会出于自身利益,将资金转入美元锚定稳定币,如 USDT。Tether 的资产全部以美国银行存款或国库债券(T-bills)形式存在。法律上,美国政府保证八大“过大而不能倒”(TBTF)银行的所有存款;在 2023 年区域银行危机之后,美联储和财政部实际上保证了所有美国银行或分行的存款。T-bills 的违约风险几乎为零,因为美国政府永远不会主动破产——它始终可以印制美元偿还债券持有人。因此,稳定币存款在名义美元上是无风险的,而欧元美元存款则不再如此。

很快,美元锚定稳定币发行方将迎来 10 至 13 万亿美元的资金流入,并随后购买 T-bills。稳定币发行方将成为 Bessent 所发行国债的大量、价格不敏感的买家!

即便美联储主席鲍威尔继续阻碍特朗普的货币议程,不愿降低联邦基金利率、结束缩表或重新启动量化宽松,Bessent 仍可以低于联邦基金利率的利率提供 T-bills。他之所以能做到,是因为稳定币发行方必须以所给利率购买他的产品以获得利润。几步之内,Bessent 就掌控了收益率曲线的前端。美联储继续存在已毫无意义。也许华盛顿某个广场上,会矗立一座 Bessent 雕像,风格仿照切利尼的《珀尔修斯斩美杜莎首》,命名为“Bessent 与杰基尔岛怪物之首”。

全球南方的影响

美国社交媒体公司将成为特洛伊木马,削弱外国央行控制本国普通民众货币供应的能力。在全球南方,西方社交媒体平台(Facebook、Instagram、WhatsApp 和 X)的渗透率几乎全面覆盖。

我在亚太地区生活过半辈子。在当地,将存款人的本币兑换成美元或美元等值资产(例如港元),以便资金可以获得美元收益率和投资美股,是该地区投资银行业务的重要组成部分。

当地货币管理机构对传统金融机构(TradFi)实施“打地鼠”式监管,封堵资本外流的方案。政府需要掌握普通民众和一定程度上非政治关系密切的富人资金,以便通过通胀税吸收资金、支撑表现不佳的国家级企业、并向重工业提供低息贷款。即便 Bessent 想利用美国大型金融中心银行作为切入点,为这些急需资金的人提供银行服务,当地监管也禁止了这一做法。但还有另一种更有效的途径可以触达这些资金。

除了中国大陆以外,每个人都在使用西方社交媒体公司。如果 WhatsApp 为每个用户推出加密货币钱包呢?在应用内,用户可以无缝收发获批准的美元锚定稳定币(如 USDT)。如果这个 WhatsApp 稳定币钱包还能向不同公链上的任何钱包转账,会发生什么?

举一个虚构案例来说明 WhatsApp 如何为全球南方数十亿用户提供数字美元账户:

费尔南多是菲律宾人,在农村经营一个点击农场,为社交媒体网红制造虚假粉丝和浏览量。由于他的客户都在菲律宾之外,收款既困难又昂贵。WhatsApp 成为他的主要支付工具,因为它提供了发送和接收 USDT 的钱包。他的客户同样使用 WhatsApp,也乐意停止使用低效银行系统。双方都对此感到满意,但这实际上绕过了当地菲律宾银行体系。

一段时间后,菲律宾中央银行注意到大量银行资金流失。他们意识到,WhatsApp 已经在国内广泛推广美元锚定稳定币,中央银行实际上失去了对货币供应的控制。然而,他们几乎无能为力。阻止菲律宾人使用 WhatsApp 的最有效方法是切断互联网。即便尝试施压当地 Facebook 高管,也无济于事。马克·扎克伯格在夏威夷的避难所统治着 Meta,并得到特朗普政府批准,在全球范围内为 Meta 用户推广稳定币功能。任何对美国科技公司的互联网法律限制,都会招致特朗普政府提高关税的威胁。特朗普已明确威胁欧盟,如果其不撤销“歧视性”互联网立法,将征收更高关税。

即便菲律宾政府将 WhatsApp 从 Android 和 iOS 应用商店下架,有决心的用户仍可通过 VPN 轻松绕过封锁。当然,任何摩擦都会影响使用,但社交媒体对大众来说基本上是一种成瘾药物。经过十多年的持续多巴胺刺激,普通民众会找到任何办法继续使用平台。

最后,Bessent 可以运用制裁这一手段。亚洲精英将财富存放在海外美元银行中心,自然不希望通过本国货币政策让财富贬值。做我说的,不做我做的。假设菲律宾总统邦邦·马科斯威胁 Meta,Bessent 可以立即反击,对他及其亲信实施制裁,冻结他们在海外的数十亿美元财富,除非他们屈服,允许稳定币在本国扩散。他的母亲伊梅尔达深知美国法律之手有多长,当年她和已故独裁者丈夫费迪南德·马科斯因挪用菲律宾政府资金购买纽约地产而面临 RICO 指控。可以确定,邦邦·马科斯并不想再经历第二轮折腾。

如果我的论点正确,即稳定币是 Pax Americana(美霸货币政策)用以扩展美元使用的核心工具,那么帝国将保护美国科技巨头免受本地监管报复,同时为普通民众提供美元银行服务。而这些国家政府对此几乎无可奈何。

假设我的判断成立,那么来自全球南方的潜在稳定币存款总可寻址市场(TAM)有多大?全球南方最先进的国家集团是金砖国家(BRICS)。排除中国,因为它禁止了西方社交媒体公司。问题在于,本地货币银行存款规模大约有多少。我咨询了 Perplexity,它给出的答案是 4 万亿美元。我知道这可能有争议,但如果把使用欧元的“欧元贫困区”国家也算进去,我认为合理。欧元在德国优先、法国优先的经济政策下已经是“行将就木”,欧元区迟早会被分裂。随着未来的资本管制,到本世纪末,欧元唯一的实际用途可能就是付 Berghain 的门票和 Shellona 的最低消费。

把欧洲银行存款 16.74 万亿美元加入计算,总额接近约 34 万亿美元,这意味着潜在稳定币存款市场极其庞大。

大干一场,或者被民主党干掉

Buffalo Bill Bessent 面临选择:要么大干一场,要么让民主党胜出。他想让红队在 2026 年中期选举获胜,更重要的是在 2028 年总统大选中获胜吗?我相信他希望如此,而要达成这一目标,唯一的途径就是支持特朗普为普通民众提供比 Mamdanis 和 AOC 们更多的福利。因此,Bessent 需要找到一个不在意价格的国债买家。显然,他认为稳定币是解决方案的一部分,这从他公开支持这项技术的表态中可以看出。但他必须全力以赴。

如果全球南方、欧元贫困区以及欧洲的 Eurodollars 不流入稳定币,他就必须用自己的“重磅手段”来迫使资金流入。这意味着,要么按要求流入美元,要么再次面临制裁。

通过拆解 Eurodollar 系统产生的国债购买力:10–13 万亿美元

全球南方和欧元贫困区的零售存款购买力:21 万亿美元

总计约 34 万亿美元

显然,不是所有资金都会流向美元挂钩的稳定币,但至少我们可以看到巨大的潜在可寻址市场。

真正的问题是,这多达 34 万亿美元的稳定币存款如何推动 DeFi 使用量达到新高度?如果有充分理由认为 DeFi 使用量会增长,那么哪些加密项目会受益最大?

稳定币流入 DeFi 的逻辑

第一个需要理解的概念是 staking(质押)。假设这 34 万亿美元的一部分已经以稳定币形式存在。为了简化,我们假设所有流入都进入 Tether 的 USDT。由于 Circle 等其他发行方以及大型 TBTF 银行的竞争激烈,Tether 必须将部分净息差(NIM)分给持有者。他们通过与一些交易所合作,让质押在交易所钱包中的 USDT 获得利息,利息以新增 USDT 的形式支付。

举个简单例子:

菲律宾的 Fernando 拥有 1,000 USDT。菲律宾交易所 PDAX 提供 2% 的质押收益。PDAX 在以太坊上创建一个质押智能合约。Fernando 将 1,000 USDT 发送到智能合约地址,然后发生以下情况:

他的 1,000 USDT 变成 1,000 psUSDT(PDAX 质押 USDT,PDAX 的负债)。最初 1 USDT = 1 psUSDT,但随着每天利息累积,psUSDT 逐渐升值。例如,使用 2% 年利率和 ACT/365 简单利息计算,每天 psUSDT 约增长 0.00005。1 年后,1 psUSDT = 1.02 USDT。

Fernando 收到 1,000 psUSDT 到他的交易所钱包。

发生了一件强大的事情:Fernando 将 USDT 锁定在 PDAX,换取了一个可产生利息的资产 psUSDT。psUSDT 现在可以在 DeFi 生态中作为抵押品使用,可以兑换其他加密货币、抵押借贷、在 DEX 上做杠杆衍生品交易等。

一年后,如果 Fernando 想把 psUSDT 兑换回 USDT,他只需在 PDAX 平台上取消质押,psUSDT 被销毁,他收到 1,020 USDT。额外的 20 USDT 利息来自 Tether 与 PDAX 的合作。Tether 利用国债投资组合赚取的 NIM 创造额外 USDT,支付给 PDAX 满足合约义务。

因此,USDT(基础货币)和 psUSDT(收益型货币)都成为 DeFi 生态中可接受的抵押品。这样,总体稳定币流量的一部分将流入 DeFi 应用(dApps)。Total Value Locked(TVL,锁仓总额)用来衡量这种交互。用户在 DeFi dApp 中操作时必须锁定资金,这部分资金体现为 TVL。TVL 是交易量和未来收入的前端指标,也是预测 DeFi dApp 未来现金流的重要依据。

在分析 TVL 如何影响项目未来收益之前,我先说明接下来金融模型使用的主要假设。

模型假设

接下来我将展示三个简单但强有力的金融模型,用于估算 Ethena(代币:$ENA)、Ether.fi(代币:$ETHFI)和 Hyperliquid(代币:$HYPE)到 2028 年底的目标价格。我选择预测到 2028 年底,因为那是特朗普离任的时间。我的基准假设是,蓝队(民主党)总统当选的概率略高于红队(共和党)。原因在于,特朗普在不到四年的时间里,无法彻底纠正其支持者长期受半个世纪货币、经济和外交政策累积影响所造成的损失。更糟糕的是,没有政治家会完全兑现竞选承诺。因此,红队选民的投票率会下降。

红队基层选民对特朗普的继任者缺乏热情,不会以足够数量出现在投票中,从而被那些受特朗普妄想症(TDS)影响的无子女猫奴蓝队选民超过。蓝队上台的任何成员都会因 TDS 实施对自身不利的货币政策,仅为证明自己与特朗普不同。但最终,没有政治家能抗拒印钞,美元挂钩稳定币成为短期国债的最佳不在意价格的买家。因此,新总统虽然可能不会一开始全力支持稳定币,但很快会发现缺少这些资本将寸步难行,最终延续前述政策。这种政策摇摆将引发加密市场泡沫破裂,导致史诗级熊市。

此外,我模型中的数字非常庞大。这是全球货币体系百年一遇的变革。除非我们终生静脉注射干细胞,否则大多数投资者可能永远不会再遇到类似事件。我预测的潜在收益将远超 SBF 的安非他命习惯。在美元挂钩稳定币普及推动下,DeFi 生态的牛市将前所未有。

因为我喜欢用以零结尾的十进制数字进行预测,我估计到 2028 年,美元挂钩稳定币的总流通量至少将达到 10 万亿美元。之所以如此庞大,是因为 Bessent 必须融资的赤字极其庞大且呈指数增长。Bessent 用国债融资越多,债务堆积速度越快,因为他每年必须滚动债务。

下一个关键假设是 Bessent 和 2026 年 5 月之后的新美联储主席会将联邦基金利率设定在何水平。Bessent 曾公开表示,联邦基金利率高出了 1.50%,而特朗普常常要求降息 2.00%。考虑到政策往往会有超调,我认为联邦基金利率最终将快速落在约 2.00%。这一数字并无严格依据,就像体制内经济学家一样,我们都是即兴判断,因此我的数字和他们一样可靠。政治和经济现实要求帝国提供便宜的资金,而 2% 的利率正好符合这一需求。

最后,我对 10 年期国债收益率的预测:Bessent 的目标是实现 3% 的实际增长,加上 2% 的联邦基金利率(理论上代表长期通胀水平),得到 10 年期收益率约为 5%。我将用此收益率计算终值现金流的现值。

基于这些假设,我们可以得到累积现金流的终值。由于这些现金流可用于代币回购,因此可以作为特定项目的基本价值。这就是我估算和预测 FDV(Fully Diluted Value,全稀释市值)的方法。然后,我将模型预测结果与当前市场价值进行对比,从而清晰地显现出潜在上涨空间。

所有模型输入以蓝色显示,输出以黑色显示。

花出去

新稳定币用户最重要的行为就是用它们购买商品和服务。如今大家已经习惯用手机或者借记/信用卡在收银系统上轻触支付。稳定币也必须同样方便易用。有哪个项目允许用户将稳定币存入去中心化应用(dApp),并像使用 Visa 借记/信用卡一样消费?当然有,它叫 Ether.fi Cash。

全球用户只需几分钟即可注册,完成入驻流程后,即可获得自己的 Visa 支持的稳定币消费卡。你可以在手机上使用,也可以通过实体卡使用。将稳定币存入 Ether.fi 钱包后,就能在任何接受 Visa 的地方消费。Ether.fi 甚至可以根据你的稳定币余额提供信用额度,让你的消费能力“加速”。

我既是 Ether.fi 项目的顾问,也是投资人,所以显然有偏见,但我已经等待一个低手续费的线下加密消费解决方案超过十年了。无论我使用 Amex 还是 Ether.fi Cash 卡,客户体验几乎相同。这一点非常重要,因为这是全球南方地区很多人首次能够使用稳定币和 Ether.fi 支付全球范围内的商品和服务。

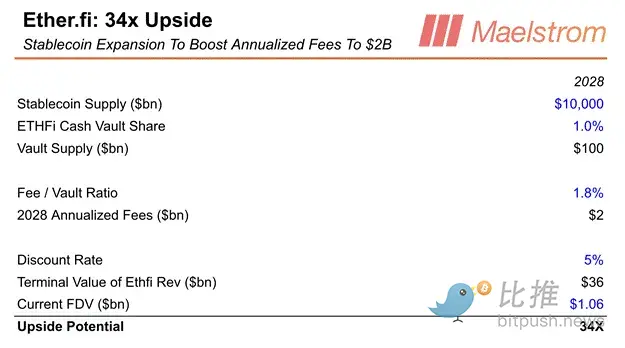

核心亮点在于将其打造为金融超市,提供传统银行的多种产品。随后,Ether.fi 可以为存款人提供更多增值产品。我预测未来现金流的关键比率是“费用/存量比”(Fee / Vault Ratio):每存入一美元稳定币,Ether.fi 能获得多少收入?为了得出可辩护的数字,我查阅了全球管理最优的商业银行——摩根大通的最新年度财报。在 1,0604 亿美元的存款基础上,他们实现了 188 亿美元的收入,即费用/存量比为 1.78%。

Ether.fi Cash 存款比例:这个指标表示有多少稳定币被存入现金金库。目前,该产品仅推出四个月,存入比例为 0.07%。鉴于产品刚刚上线,我认为到 2028 年,这一比例有望增长到 1.00%。

基于此,我认为 $ETHFI 相较于当前价格有可能上涨 34 倍。

现在普通用户(plebes)可以用稳定币消费,那么是否有办法获得比联邦基金利率更高的收益呢?

借贷机会

当更多人开始用稳定币去买咖啡消费时,他们自然也希望赚取利息。我之前提到过,像 Tether 这样的发行方会将部分净利差(NIM)分配给持币者,但这数额不会很大;很多储户会寻求在不承担过多额外风险的情况下获得更高收益。那么,在加密资本市场内部,是否存在新的稳定币用户可以捕捉的内生收益呢?答案是肯定的,Ethena 提供了更高收益的机会。

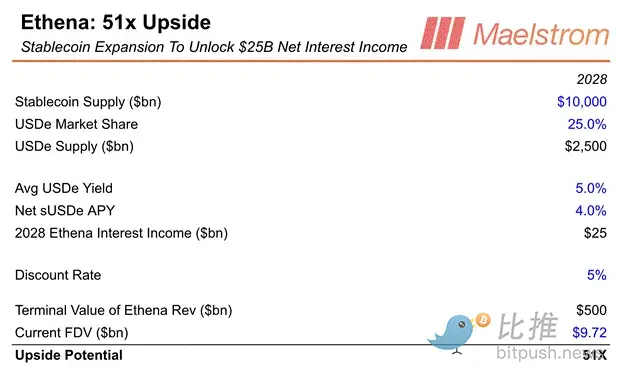

在加密资本市场中,安全地借贷资金只有两种方式:借给投机者做衍生品交易,或者借给加密矿工。Ethena 专注于借贷给投机者,通过做空加密/美元期货和永续合约(perpetual swap),对冲多头加密资金。这是我在 BitMEX 推广时称作“现金套利(cash and carry)”的策略。我后来写了一篇名为《Dust on Crust》的文章,呼吁创业者将这一交易打包成合成美元、高收益的稳定币。Ethena 创始人 Guy Young 读了文章后,组建了顶尖团队将其付诸实践。Maelstrom 随后成为创始顾问。Ethena 的 USDe 稳定币在 18 个月内迅速积累约 135 亿美元存款,成为增长最快的稳定币,目前流通量位居第三,仅次于 Circle 的 USDC 和 Tether 的 USDT。Ethena 的增长如此迅猛,到明年圣帕特里克节时,它将成为仅次于 Tether 的第二大稳定币发行方,让 Circle CEO Jeremy Allaire 饮下一杯吉尼斯以解愁。

由于交易所的对手方风险,投机者借美元做多加密资产的利率通常高于国债利率。我在 2016 年与 BitMEX 团队创建永续合约时,将中性利率设定为 10%。这意味着如果永续合约价格等于现货价格,多头将向空头支付 10% 的年化利率。每家仿照 BitMEX 设计的永续合约交易所都采用了这一 10% 中性利率。这一点重要,因为 10% 远高于当前联邦基金利率上限 4.5%。因此,质押的 USDe 收益几乎总是高于 Fed Funds,为愿意承担少量额外风险的新稳定币储户提供了平均翻倍于 Buffalo Bill Bessent 提供收益的机会。

部分(但绝非全部)新稳定币存款将通过 Ethena 进行储蓄,赚取更高收益。Ethena 从利息收入中抽取 20% 作为手续费。下面是一个简单模型:

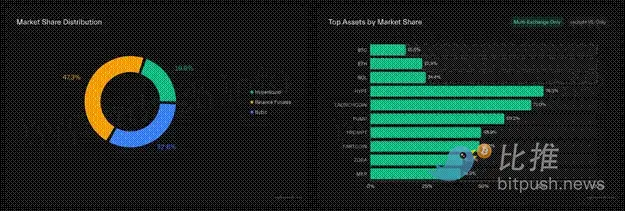

USDe 市场份额:目前,Circle 的 USDC 在流通稳定币中的市场份额为 25%。我认为 Ethena 将超过 Circle,随着时间推移,我们看到在边际上 USDC 的存款流出正好被 USDe 吸收。因此,我的长期假设是,USDe 将在 Tether 的 USDT 之后,占据 25% 的市场份额。

USDe 平均收益率:在我预测的长期情景下,USDe 供应量为 2.5 万亿美元,这将对衍生品与现货之间的基差产生下行压力。随着 Hyperliquid 成为最大型的衍生品交易所,他们将降低中性利率以增加杠杆需求。这也意味着加密衍生品市场的未平仓合约(OI)将大幅增长。如果数百万新的 DeFi 用户拥有数万亿美元的稳定币存款可支配,他们完全有能力将未平仓合约推升至万亿美元级别。

基于此,我认为 $ENA 的价值有可能比当前水平上涨 51 倍。

现在,平民们可以赚取更多利息收入,问题是:他们如何通过交易走出通胀带来的贫困?

交易它

全球货币贬值最恶劣的影响之一,就是迫使每个人都必须成为投机者,以维持生活水平——如果他们手里还没有一大堆金融资产的话。随着更多长期受法币肆意贬值影响的人开始通过稳定币在链上储蓄,他们将交易唯一能够让他们有机会通过投机摆脱贫困的资产类别——加密货币。

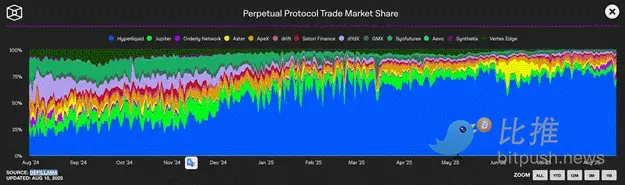

目前链上交易的首选平台是 Hyperliquid(代币:$HYPE),其在去中心化交易所(DEX)市场份额已达 67%。Hyperliquid 的变革性极强,其增长速度甚至超过了中心化交易所(CEX)如 Binance。截至本周期结束,Hyperliquid 有望成为最大型的加密交易所,而 Jeff Yan 可能比 Binance 的创始人兼前 CEO CZ 更富有。

王已逝,王当立!

DEX 将吞噬所有其他类型交易所的理论并不新鲜,但 Hyperliquid 的不同之处在于团队的执行力。Jeff Yan 组建了一支约十人的团队,其产品迭代速度和质量超过了行业内任何中心化或去中心化团队。

最简单的理解方式是把 Hyperliquid 看作去中心化版的 Binance。由于 Tether 及其他稳定币主要支撑了 Binance 的资金通道,可以将 Binance 看作 Hyperliquid 的前身。Hyperliquid 同样完全依赖稳定币基础设施进行存款,但提供的是链上交易体验。随着 HIP-3 的推出,Hyperliquid 正迅速转型为一个无许可的衍生品及现货巨头。任何希望拥有高流动性限价订单簿并实现实时保证金管理的应用,都可以通过 HIP-3 集成所需的衍生品市场。

我预测,到本周期结束时,Hyperliquid 将成为最大型的加密交易所,而稳定币流通量达到 10 万亿美元的增长将进一步加速这一发展。以 Binance 为例,我们可以根据稳定币供给水平预测 Hyperliquid 的日均交易量(ADV)。

目前,Binance 的永续合约日均交易量为 730 亿美元,总稳定币供给为 2,770 亿美元;比例为 26.4%。在模型中,这一比例将表示为 Hyperliquid 的 ADV 市场份额。

我认为 $HYPE 相较当前水平有潜力上涨 126 倍。

最后,我想介绍一个我最期待的稳定币项目,它即将进行代币发行。

稳定币的企业应用

随着数百万甚至数十亿用户开始使用稳定币,企业如何利用这一支付方式?全球大部分企业在支付上仍面临高额费用和银行限制。当更多用户持有稳定币时,企业可以绕过传统银行,实现便捷支付,这需要一个易用的技术系统,让企业能够接受稳定币支付、支付供应商、缴税,并管理现金流。

Codex 就是这样一个项目,它推出了专为稳定币设计的区块链。Codex 本身不是发行方,但提供企业间的稳定币及法币支付解决方案,实现稳定币和法币的无缝转换。回到 Fernando 和他的点击农场,他需要支付员工比索到本地银行账户。通过 Codex,他可以将客户支付的稳定币部分兑换为比索,并直接存入银行账户。Codex 已经实现这一功能,其首月交易量就达到 1 亿美元。

更重要的是,Codex 有潜力为中小企业提供信贷支持。当前它只向最安全的支付服务提供商提供短期信贷,但未来,它可以向中小企业提供长期贷款。如果企业完全上链,并使用 Codex 处理支付,就能实现“三重簿记”——收入和支出全部上链,使得贷款机构能够实时、可靠地评估企业财务状况,从而放心提供贷款。目前,传统银行通常只向大企业或有政治关系的富人提供贷款,中小企业往往难以获得融资。

在我设想中,Codex 将首先服务全球南方市场,然后扩展到除美国外的发达国家。通过稳定币基础设施为中小企业提供贷款,Codex 有望成为首个真正意义上的加密银行。

Codex 仍处于初期,但如果成功,它将让用户和代币持有者受益巨大。Maelstrom 担任顾问前,我确保创始团队准备好采用类似 Hyperliquid 的代币经济策略,让收入直接回流给代币持有者。Codex 已经有真实交易量,并即将进行代币发行,是进入稳定币基础设施领域的好机会。

Buffalo Bill Bessent 的策略

Buffalo Bill Bessent 对全球 Eurodollar 和非美元存款的掌控力,取决于美国政府的财政政策。我相信,Bessent 的老板——美国总统特朗普——无意削减支出或平衡预算。他的目标只是赢得选举。政治赢家在晚期资本主义民主制度中,会通过分发福利获取选票。因此,Bessent 将在财政与货币领域大举行动,没有人能阻止他。

随着美国赤字持续扩大,而 Pax Americana 的全球霸权减弱,市场不愿持有弱势美元债务。Bessent 利用稳定币吸收国债成为必然手段。

他将广泛使用制裁手段,确保美元稳定币吸收从 Eurodollar 和非美国零售银行流出的资金。同时,他会动员科技巨头(如 Zuckerberg 和 Musk)推广稳定币,向全球用户普及,即便当地监管不允许,也会被美国政府保护。

可能的趋势

如果我的判断正确,我们可能会看到以下趋势:

离岸美元市场(Eurodollar)受到监管关注

美联储与财政部的美元掉期额度,与美国科技公司进入数字市场挂钩

稳定币发行方需持有美元或国债

鼓励稳定币发行方在美国上市

美国科技公司在社交媒体应用中增加加密钱包功能

特朗普政府正面支持稳定币使用

Maelstrom 将继续重仓稳定币领域,持有 $ENA、$ETHFI 和 $HYPE。同时,Codex 将成为稳定币基础设施的核心项目。

最后一句:快把美元“乳液”递过来,我有点干裂。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。