Author: J.A.E, PANews

The "permissionless" and "anonymous" genes of the crypto world seem to be two completely opposite universes compared to the stringent "compliance" and "traceability" requirements of traditional finance (TradFi). This fundamental contradiction has long been a "shackle" for the large-scale tokenization of real-world assets (RWA). Conventional token standards such as ERC-20 and ERC-1400 have their own limitations, thereby restricting the large-scale application of RWA tokenization for securities, physical assets, and more.

In this context, a token standard specifically developed to fill this "compliance gap"—ERC-3643—has emerged. It reshapes the technical components of on-chain finance by embedding compliance logic directly into the token itself, providing a "compliance engine" for RWA tokenization that ensures compliance while reducing costs and increasing efficiency. In this article, PANews introduces the characteristics, advantages, and common cases of the ERC-3643 standard.

ERC-3643: The Token Standard for Compliant RWA

On July 31, 2025, SEC Chairman Paul Atkins delivered a speech titled "America's Leadership in the Digital Financial Revolution" and announced the launch of the "Project Crypto" initiative. Among the topics discussed, ERC-3643 was explicitly mentioned as the only standard publicly cited during the speech. Paul Atkins stated that when the SEC builds an innovative exemption framework, it will prioritize token standards with "built-in compliance." ERC-3643 integrates functions such as identity verification, permission control, and transaction restrictions, directly meeting the requirements of the Securities Act for KYC/AML and accredited investors.

ERC-3643 evolved from the T-REX (Token for Regulated EXchanges) protocol, which is a set of technical standards specifically designed for regulated assets, enabling the issuance, management, and transfer of "permissioned tokens."

Before the rise of RWA tokenization, ERC-20 was the most widely adopted token standard on Ethereum, prioritizing simplicity and interoperability, operating in a "trustless" environment that allowed for free and anonymous transfers between any wallets.

However, the inherent permissionlessness of ERC-20 makes it unsuitable for RWA tokenization. RWA requires compliance with jurisdictional restrictions, identity verification (KYC/AML), and investor checks. ERC-20 grants holders personal sovereignty over assets, allowing them to manage, hold, or transfer to other anonymous users, which is incompatible with compliance logic.

In contrast, ERC-3643 can be seen as the "compliant version" of ERC-20, retaining compatibility while incorporating unique features such as token identity verification, conditional transfers, and compliance checks through smart contracts.

Another compliance token standard, ERC-1400, appeared even earlier than ERC-3643, specifically targeting security tokens by adding transfer restrictions and including transaction regulatory documentation.

ERC-3643 is also an "upgraded version" of ERC-1400. In terms of compliance management, ERC-3643 focuses more on global dynamic compliance; in terms of asset class support, ERC-3643 is compatible with a broader range of asset classes; in terms of technical efficiency and scalability, ERC-3643's storage mechanism is more efficient, helping to reduce gas fees and making it easier to expand to add new features.

The evolution from ERC-20, ERC-1400 to ERC-3643 reflects that the crypto industry has initiated a "compliance token arms race," continuously optimizing standards to meet increasingly complex regulatory requirements. ERC-20 exposed limitations in RWA tokenization; ERC-1400 responded to the compliance needs of security tokens; ERC-3643 addresses the need for global dynamic compliance and compatibility with a wider range of asset classes. The historical evolution of token standards proves that the market is actively developing solutions to bridge the gap between technological innovation and regulatory compliance, with ERC-3643 marking an important milestone in this iterative process.

Reducing Costs and Increasing Efficiency: ERC-3643 Reshapes the RWA Issuance Process

The high cost of RWA issuance has also catalyzed the crypto industry's demand for tokenization solutions, aiming to reduce costs through technological means.

The core reason for the high costs of RWA issuance lies in the contradiction between trustless on-chain transactions and real-world regulatory compliance, leading to a reliance on intermediaries and ongoing compliance expenditures. Traditional financial intermediaries, such as brokerages, ensure compliance through manual reviews, transaction monitoring, and offline processes, which are the main cost items for RWA projects.

In response to this challenge, ERC-3643 provides a new approach to RWA tokenization, aiming to reduce long-term compliance expenditures and enhance overall efficiency through automation and standardization.

Therefore, ERC-3643 may become a key technology connecting TradFi and crypto assets, introducing a paradigm shift, with the core mechanism summarized as: permissioned tokens + on-chain identity (ONCHAINID). The essence of ERC-3643 is that its tokens cannot be freely transferred; each transfer requires mandatory verification of the "identity and qualifications" of both the sender and receiver at the protocol level, ensuring that both parties meet necessary compliance on-chain, thus endowing assets with the advantages of blockchain (such as instant settlement, programmability, etc.) without sacrificing regulation.

Developing "permissioned tokens" on-chain not only meets compliance requirements but also balances the transparency and efficiency of distributed ledgers. While permissionless systems adhere to pure decentralization ideals, they often conflict with actual regulatory frameworks. ERC-3643 offers a hybrid model: the underlying public chain remains decentralized, providing transparency and consistency, while access to specific assets on-chain is controlled. This design allows qualified investors to participate in a broader crypto ecosystem, benefiting from ample liquidity while fulfilling necessary compliance obligations. This model may also become a key driving force for blockchain integration into TradFi.

The built-in decentralized identity (DID) framework ONCHAINID in ERC-3643 is a key module for achieving compliance, ensuring that only permitted users who meet predefined conditions can become token holders. Investors complete KYC/AML verification off-chain, and their identity information is mapped on-chain and associated with specific wallet addresses. This system is the foundation of "compliance native," preventing non-compliant entities from obtaining or holding tokens from the outset.

The ONCHAINID framework can also be associated with token smart contracts to represent the "identity" of assets, effectively serving as an "on-chain copy" of the asset, and adding any declarations throughout the token's lifecycle. Its high transparency and immutable log entries enhance auditability and trust, reducing the trust risk of delegated intermediaries.

The ONCHAINID contract is not bound to specific tokens, meaning each user only needs to deploy it once, and their identity can be reused for the issuance of various asset classes. Its reusability is an important design choice, significantly improving the user experience for investors and accelerating the development of the ecosystem. In TradFi, each new investment tool typically requires restarting the KYC/AML process, leading to a cumbersome user experience for investors. By allowing a single verified ONCHAINID to be used across various issuances based on the same standard, ERC-3643 simplifies the onboarding process for investors. This "one-time verification, multiple reuse" model encourages investors to participate in a broader range of RWA issuances, thereby increasing liquidity and market depth across the entire ecosystem.

Compliance logic is automatically enforced at the smart contract level. The transfer of ERC-3643 tokens must simultaneously meet investor rules and issuance rules to be executed, effectively preventing tokens from flowing into unauthorized wallets. It also means that the issuer can set and update transfer rules at any time, such as setting transaction whitelists, freezing specific accounts, or enforcing transfers.

The value proposition of ERC-3643 lies in transforming off-chain regulatory requirements into on-chain automatically executed "compliance logic" through code, fundamentally changing the compliance mechanism for RWA. Traditional compliance processes are complex and costly, while ERC-3643 achieves real-time, automated, and tamper-proof compliance checks by embedding compliance logic within the token contract, not only reducing audit and legal costs in long-term operations but also enhancing transparency and transaction efficiency.

From Traditional Assets to Emerging Assets: The Diverse Use Cases of ERC-3643

As a compliance-native token standard, ERC-3643 has a wide range of application scenarios, and its programmability can provide tokenization solutions for various asset classes.

Securities assets are the most mature and common application scenario for ERC-3643, applicable to the issuance and transfer of traditional financial instruments such as stocks, bonds, and funds. Through ERC-3643, issuers can embed governance rules such as dividend distribution and voting rights with on-chain compliance logic in smart contracts, ensuring that only qualified investors can hold and trade the tokens. For example, the Dutch Bank issued €5 million in green bonds on Polygon in 2023 using the ERC-3643 standard, directly demonstrating the practicality of issuing regulated assets on public chains. Additionally, ERC-3643 can play a role in reducing costs, improving liquidity and transparency, and expanding the investor base.

ERC-3643 also makes it possible to bring physical assets on-chain, enabling fractional ownership, automated asset management, and simplified transactions of physical assets. Physical assets mainly include real estate, commodities (such as precious metals, agricultural products, crude oil), and artworks (such as collectibles and luxury goods). ERC-3643 allows for "fractional ownership" by dividing high-value physical assets into smaller tokens and encoding transfer rules, significantly lowering the investment threshold, providing higher liquidity, and addressing the inherent challenges of identity verification and jurisdictional restrictions for physical assets. For instance, Inveniam Capital Partners tokenized $260 million worth of U.S. commercial real estate using ERC-3643, granting investors fractional ownership and access to the secondary market.

Moreover, ERC-3643 is exploring applications in the emerging asset space. Carbon credits, as a green asset, typically require strict traceability and transaction management. ERC-3643 can be used to issue and manage carbon credit tokens, ensuring that their transactions comply with specific regulatory requirements. ERC-3643 will provide a transparent, traceable, and regulatory-compliant on-chain infrastructure for the global carbon market. ERC-3643 can also enable the tokenization of intellectual property, allowing creators and inventors to commercialize their works or rights. Smart contracts automatically allocate royalties or revenues to token holders, thereby reducing significant labor costs and operational errors while ensuring fair and immediate distribution of returns.

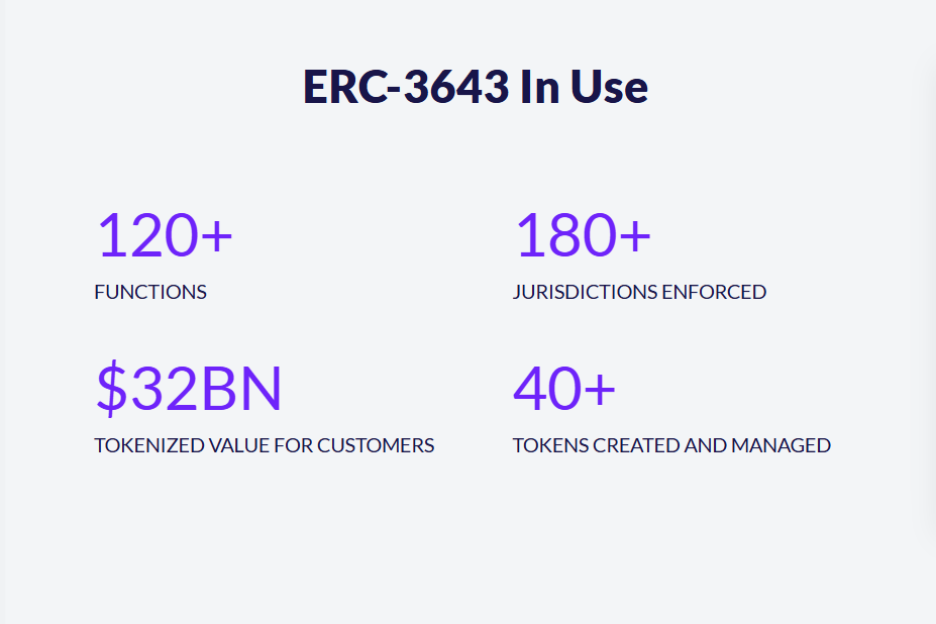

As of now, ERC-3643 has demonstrated significant appeal, supporting over 120 functions, complying with regulations in over 180 jurisdictions, tokenizing over $32 billion in assets, and creating and managing over 40 types of tokens, laying a solid foundation for large-scale adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。