Key Points

- The total market capitalization of cryptocurrencies is $3.84 trillion, down from $4.17 trillion last week, representing a decline of 7.92% this week. As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $54.24 billion, with a net inflow of $440 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $13.51 billion, with a net inflow of $1.08 billion this week.

- The total market capitalization of stablecoins is $287 billion, with USDT having a market cap of $168 billion, accounting for 58.54% of the total stablecoin market cap; followed by USDC with a market cap of $71.54 billion, accounting for 24.93%; and DAI with a market cap of $5.36 billion, accounting for 1.87%.

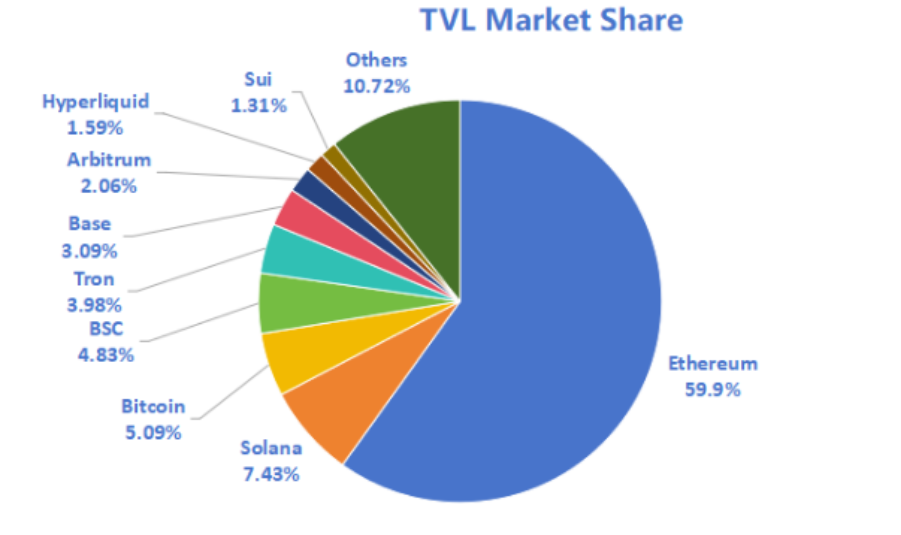

- According to data from DeFiLlama, the total TVL of DeFi this week is $154.5 billion, down from $159 billion last week, representing a decline of 2.83%. By public chain, the top three chains by TVL are Ethereum with a share of 59.9%; Solana with a share of 7.43%; and Bitcoin with a share of 5.09%.

- On-chain data shows that daily transaction volumes across public chains are generally on a downward trend, with Ethereum down 20.98%, Sui down 32.26%, Solana down 31.93%, BNBChain down 16.66%, Aptos down 24.05%, and Toncoin down 33.33%. In terms of transaction fees, except for Ethereum and Solana, which both increased by 100% compared to last week, the other public chains showed little change; regarding daily active addresses, this week, except for BNBChain which increased by 6.28% compared to last week and Toncoin which increased by 16.03%, all other public chains are on a downward trend, with Solana showing the most significant decline at 19.66% compared to last week. In terms of TVL, except for Solana which increased by 1.1% compared to last week, all other public chains are on a downward trend, with Ethereum down 4.01%, BNBChain down 2.23%, and the declines of other public chains being minor.

- Innovative projects to watch: PrivacyCash is a privacy protocol built on Solana; Predictly is a decentralized prediction market platform built on MegaETH; Gondor aims to build a decentralized finance layer for prediction markets, allowing users to use their positions on Polymarket as collateral for lending.

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Share

The total market capitalization of cryptocurrencies is $3.84 trillion, down from $4.17 trillion last week, representing a decline of 7.92%.

Data Source: cryptorank

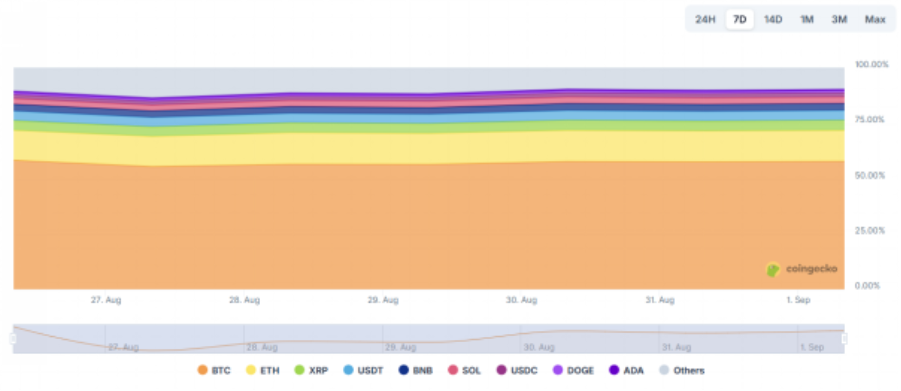

As of the time of writing, Bitcoin's market cap is $2.15 trillion, accounting for 56.17% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $287 billion, accounting for 7.49% of the total cryptocurrency market cap.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is at 47, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $54.24 billion, with a net inflow of $440 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $13.51 billion, with a net inflow of $1.08 billion this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

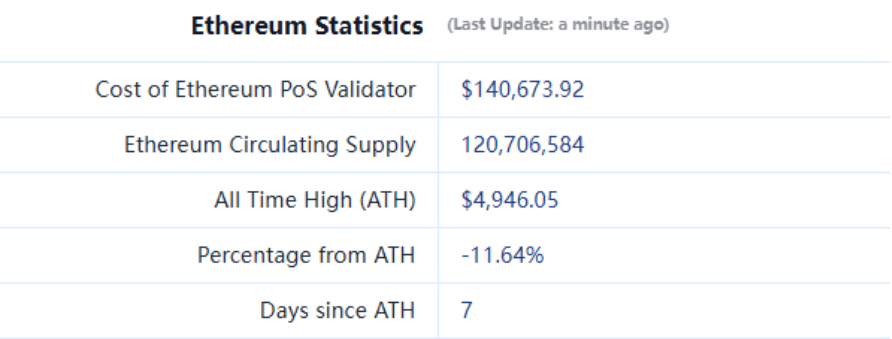

ETHUSD: Current price is $4,397, with a historical high of $4,946, representing a decline of approximately 11.64% from the highest price.

ETHBTC: Currently at 0.040645, with a historical high of 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

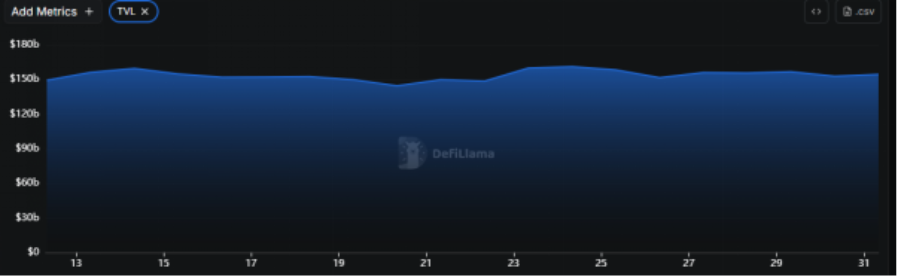

According to data from DeFiLlama, the total TVL of DeFi this week is $154.5 billion, down from $159 billion last week, representing a decline of 2.83%.

Data Source: defillama

By public chain, the top three chains by TVL are Ethereum with a share of 59.9%; Solana with a share of 7.43%; and Bitcoin with a share of 5.09%.

Data Source: CoinW Research Institute, defillama

Data as of August 31, 2025

6. On-Chain Data

Layer 1 Related Data

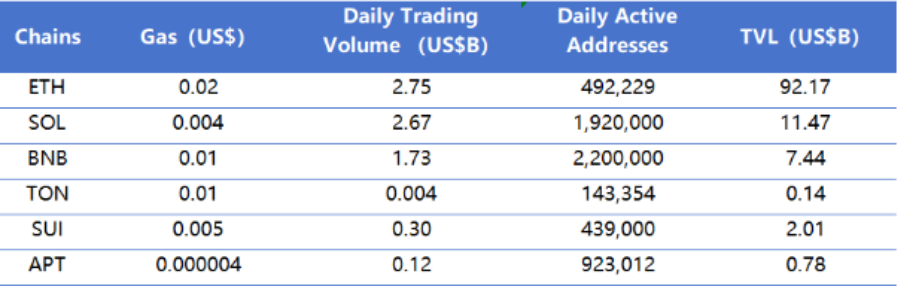

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for the main Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of August 31, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, daily transaction volumes across public chains are generally on a downward trend, with Ethereum down 20.98%, Sui down 32.26%, Solana down 31.93%, BNBChain down 16.66%, Aptos down 24.05%, and Toncoin down 33.33%. In terms of transaction fees, except for Ethereum and Solana, which both increased by 100% compared to last week, the other public chains showed little change.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, this week, except for BNBChain which increased by 6.28% compared to last week and Toncoin which increased by 16.03%, all other public chains are on a downward trend, with Solana showing the most significant decline at 19.66% compared to last week. In terms of TVL, except for Solana which increased by 1.1% compared to last week, all other public chains are on a downward trend, with Ethereum down 4.01%, BNBChain down 2.23%, and the declines of other public chains being minor.

Layer 2 Related Data

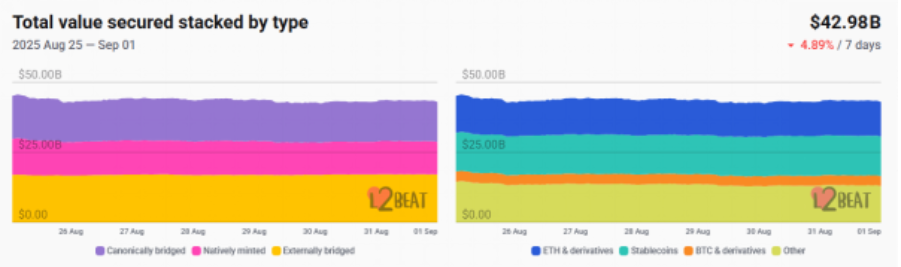

● According to L2 Beat data, the total TVL of Ethereum Layer 2 is $42.98 billion, down from $45.19 billion last week, representing an overall decline of 4.89%.

Data Source: L2 Beat

Data as of August 31, 2025

- Base and Arbitrum hold 38.26% and 35% of the market share respectively, with Base still ranking first in TVL among Ethereum Layer 2 this week.

Data Source: footprint Data as of August 31, 2025

Data Source: footprint Data as of August 31, 2025

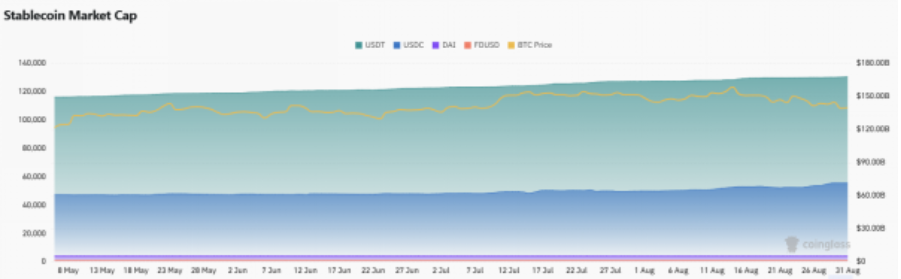

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $287 billion. Among them, USDT has a market cap of $168 billion, accounting for 58.54% of the total stablecoin market cap; followed by USDC with a market cap of $71.54 billion, accounting for 24.93%; and DAI with a market cap of $5.36 billion, accounting for 1.87%.

Data Source: CoinW Research Institute, Coinglass

Data as of August 31, 2025

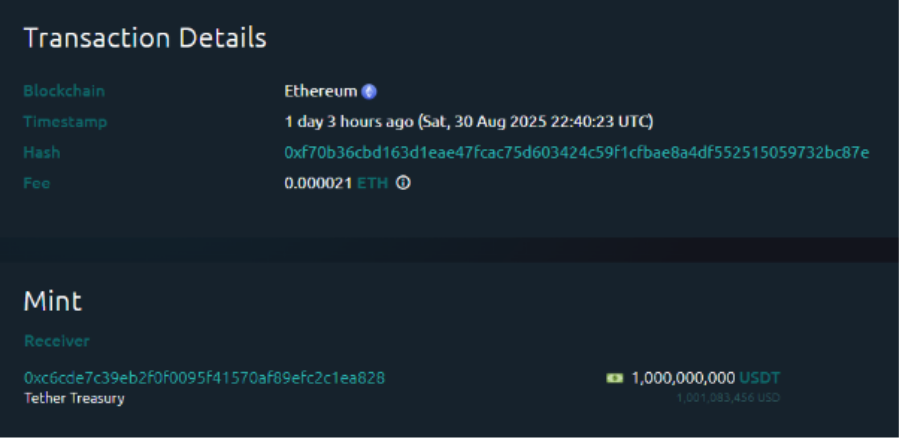

According to Whale Alert data, this week, USDC Treasury issued a total of 3.98 billion USDC, and Tether Treasury issued a total of 3 billion USDT, with a total issuance of stablecoins this week amounting to 6.98 billion, compared to last week's total issuance of 2.842 billion, representing an increase of approximately 145.6% in stablecoin issuance this week.

Data Source: Whale Alert

Data as of August 31, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Growth This Week

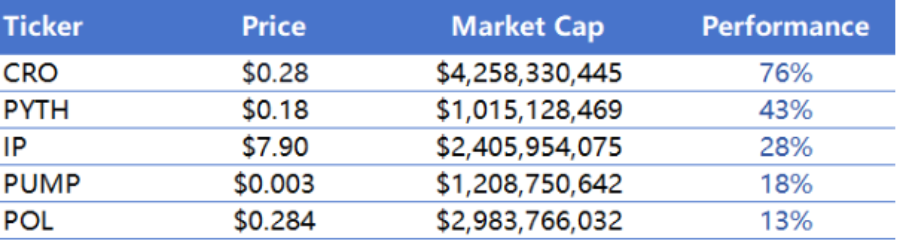

Top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 31, 2025

Top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 31, 2025

2. New Project Insights

- Privacy Cash is a privacy protocol built on Solana that allows users to deposit SOL into a privacy pool and withdraw funds to any receiving address, thereby anonymizing transaction paths and fund flows, enhancing the privacy and security of asset transfers.

- Predictly is a decentralized prediction market platform built on MegaETH, where users can create or participate in prediction contracts around various events, aggregating collective intelligence and pricing future outcomes in a market-driven manner.

- Gondor aims to build a decentralized finance layer for prediction markets, allowing users to use their positions on Polymarket as collateral for lending. By financializing prediction market positions, the project not only improves capital utilization efficiency but also provides participants with more flexible liquidity management and risk hedging options.

III. Industry News

1. Major Industry Events This Week

- The Ethereum NFT and gaming project CyberKongz announced that 2% of its total token supply of KONG will be airdropped to OpenSea users who have been active since 2023. Addresses that have purchased a total of $10,000 worth of Ethereum NFTs on OpenSea since January 1, 2023, are eligible for the airdrop.

- The Ethereum Layer 2 project Ronin announced the launch of a developer revenue sharing program, allowing developers to increase their income whether they are developing games, applications, or migrating projects to Ronin. The developer revenue sharing program will return a portion of Sky Mavis's total revenue to developers. Referrers can mint NFTs on the Ronin Launchpad, trade on the Ronin market, make purchases through the Ronin store and in-game, and receive rewards for paying Ronin wallet exchange fees when referred users conduct any of the following transactions.

- The PayFi network HumaFinance announced the launch of its first season airdrop. 2.1% of the total supply of HUMA tokens will be used for the airdrop, with 68% allocated to liquidity providers and HUMA stakers, 22% to ecosystem partners, and 10% to the community and Yappers. The first season will be divided into two parts: Part 1 starts on August 26, Beijing time, and Part 2 starts on September 26. The claim deadline is October 26. Withdrawing locked PST and mPST during the claim period will reduce the allocation for Part 2.

- Bitlayer announced the details of the BTR token airdrop, which opened for claims on August 27, with each unlocking period lasting one month. According to the official introduction, this airdrop is intended to reward community contributors and early supporters, with 10% of the total allocation as ecosystem incentives and 2.66% of the total allocation for Binance Booster and pre-TGE activities.

- The Solana liquidity management platform Meteora announced that the first season points have been finalized, having reviewed and manually verified all appeals, most of which have been approved. The specific distribution status of the first season points is as follows: total points for 2024 are 32.77 billion, distributed across 328,976 wallets; total points for 2025 are 56.53 billion, distributed across 287,687 wallets; total points for the launch pool are 30.77 billion, distributed across 24,929 wallets.

2. Major Upcoming Events Next Week

- WLFI announced that its token will go live on the Ethereum mainnet on September 1, with early supporters (rounds at $0.015 and $0.05) unlocking 20%, while the remaining 80% will be decided by community vote. Tokens for the founding team, advisors, and partners will not unlock, and trading and the first claims will start on September 1.

- The claim deadline for COOK rewards in the second season Methamorphosis event of mETHProtocol is September 2, 2025.

- The dYdX Foundation announced that Season 5 of Surge ended on August 31, and Season 6 of Surge will launch on September 1.

- Play Solana announced that its first-generation handheld gaming device PSG 1 will start shipping on October 6, and the device will come with a built-in Solana wallet.

- Last week’s significant financing events:

- Rain completed a $58 million Series B financing round, with investors including Sapphire Ventures, Dragonfly, Samsung Next, and Galaxy Ventures. Rain is an infrastructure platform that integrates blockchain and payment networks, focusing on stablecoin interoperability and card issuance. The platform connects crypto assets with real-world payment networks through Visa's card issuance qualifications, meeting the needs of businesses and users in cross-border, consumption, and diverse application scenarios. (August 28, 2025)

- M0 completed a $40 million Series B financing round, with investors including Polychain, Ribbit Capital, Pantera Capital, and Bain Capital Crypto. M0 is a decentralized currency middleware for the digital age, designed with high-quality collateral to support institutions in issuing crypto dollars and distributing profits to yield participants and governance token ZERO holders. (August 28, 2025)

- Amdax completed a $23.4 million Series B financing round, with investors yet to be disclosed. Amdax is a comprehensive cryptocurrency service provider offering integrated solutions for investment, custody, and trading, dedicated to creating a secure, compliant, and efficient digital asset management experience for individual and institutional users. (August 29, 2025)

Reference Links:

- Privacy Cash

- Predictly

- Gondor

- Rain

- M0

- Amdax

- https://x.com/theprivacycash

- https://x.com/PredictlyX

- https://x.com/gondorfi

- https://x.com/raincards

- https://x.com/m0

- https://x.com/AmdaxNL

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。