🔁 Buybacks can create scarcity—but scarcity does not equate to attractiveness.

Author: RichKing | RPS AI

Translation: Deep Tide TechFlow

During discussions with developers, we found that there are very few simple guides on on-chain liquidity management for early teams. As liquidity providers (LPs) and on-chain market makers, we often see common mistakes overlooked until they evolve into costly problems. Moreover, most centralized exchange (CEX) market makers seem to provide little guidance on how to manage on-chain liquidity.

Heavendex AMM (Automated Market Maker) has established a mechanism where all trading fees are used to buy back tokens. Heavendex's token $LIGHT also participates in these buyback systems.

TLDR: Scarcity ≠ Attractiveness

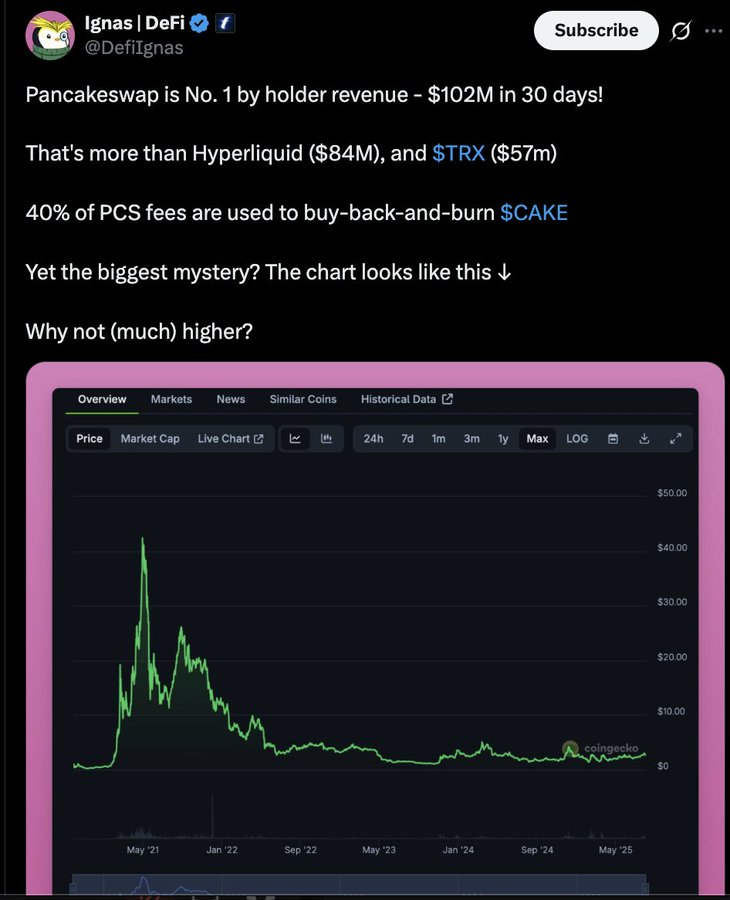

Token buybacks reduce supply. After the supply decreases, people may think that demand will increase, thus driving up value. However, many cryptocurrency tokens do not have intrinsic fundamental demand. Most demand comes from attention and cognitive market share, which is often the main focus of most projects.

As the industry matures, projects with stronger fundamentals will make buyback mechanisms more effective in the long run. We have already seen some projects begin to experiment with the "flywheel effect" (protocol-level buyback mechanisms), which aim to link basic income to token value. Whether these attempts will succeed remains to be seen. Meanwhile, buybacks are often used to alleviate negative sentiment or create short-term price fluctuations, with varying effectiveness.

What can token buybacks really bring?

Before delving into buybacks in the cryptocurrency space, let’s first look at some cases from Web2 companies.

In traditional public markets, buybacks are typically used for the following purposes:

Boosting stock prices

Creating scarcity

Rewarding shareholders

Consuming excess cash

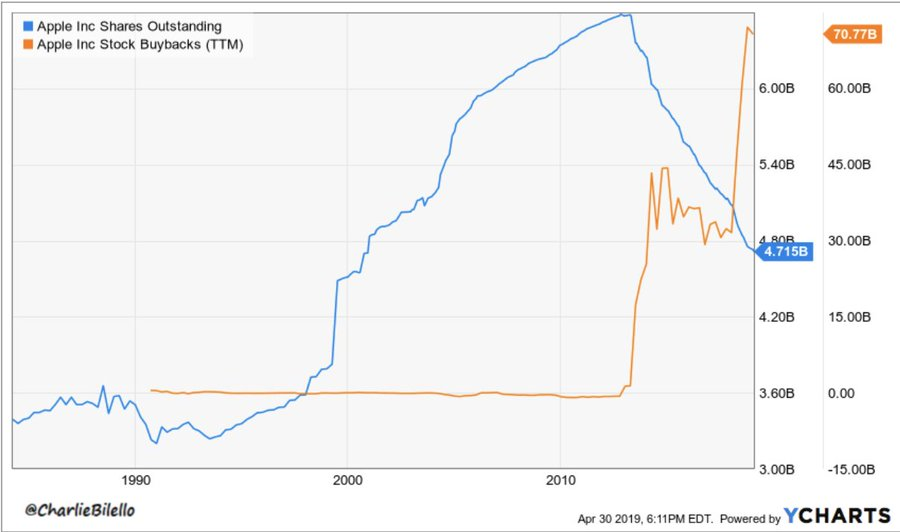

Apple is a typical example—since 2012, Apple has spent over $650 billion on buybacks, reducing its share count by about 40%. This strategy has been effective because Apple's earnings have continued to grow. In contrast, buybacks by General Electric (GE), IBM, or some oil giants have failed to stop stock price declines as these companies' fundamentals have gradually deteriorated.

From 2010 to 2019, Apple reduced its outstanding shares by over 50% through a series of aggressive programmatic buybacks. During the same period, its stock price rose from $11 to $40, an increase of 300%.

Why are stock buybacks more significant than token buybacks?

Will the cryptocurrency space begin to adopt earnings per share (EPS) as a method for evaluating token value?

Stock buybacks directly enhance earnings per share (EPS) by reducing the number of outstanding shares. Investors pay close attention to EPS and valuation multiples.

However, in the cryptocurrency space, there is no equivalent to EPS. Prices are more driven by attention, liquidity, and narratives rather than financial comparisons.

Additionally, programmatic buybacks in cryptocurrency face a challenge: income is cyclical and often fluctuates with bull and bear markets.

Founder's Buyback Decision Checklist: Should You Buy Back?

Does your protocol have a stable source of income? (Or is it consuming cash reserves?)

Is your cash reserve strong enough to support buybacks without affecting growth?

Are you combining buybacks with fundamentals, such as product launches, partnerships, or user growth?

Is your goal price support or merely to create a superficial effect?

If the answers lean towards "superficial effect," you may just be pushing for a one-time exit pump.

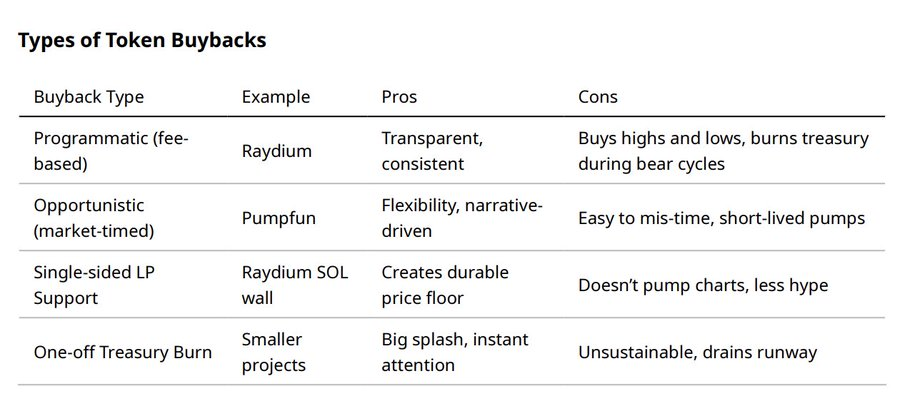

Types of Token Buybacks

Different buyback methods are suitable for different situations.

The Buyback Process: Before, During, and After

Announce the buyback plan: Sometimes, market reactions stem solely from the announcement of the buyback plan ("pre-pricing" news).

Execute the buyback: In some cases, the execution of the buyback may trigger sell-offs—providing exit liquidity for holders waiting to sell.

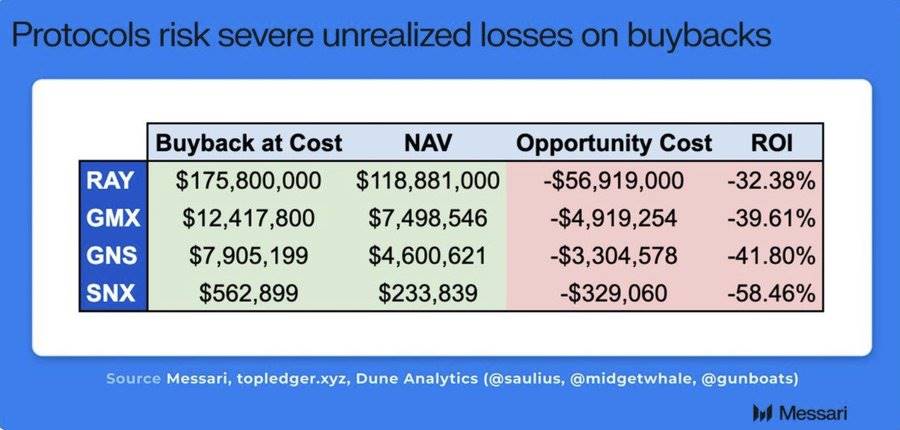

Programmatic buybacks: Considered the optimal choice, but can be unstable during income cycles. For example, Raydium has burned over $175 million of RAY, but its price still fluctuates with market attention cycles.

Overpaying: Executing buybacks at high valuations consumes more cash reserves. Using algorithms or volume-weighted methods can help smooth this process.

Case Studies

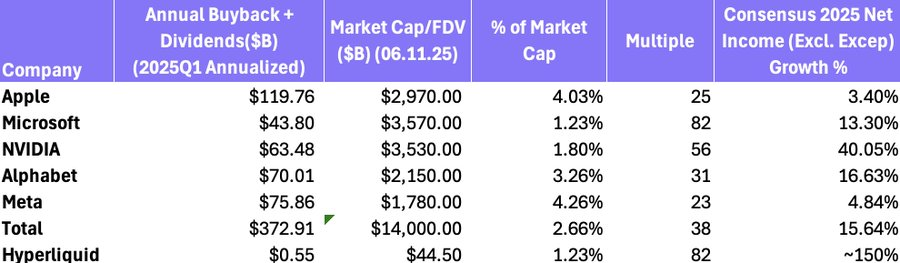

- Hyperliquid ($HYPE): 97% of its decentralized exchange (DEX) revenue is used for daily buybacks of about $3 million, with an expected annual revenue of $650 million. With strong revenue and bold buyback plans, $HYPE is often hailed as the most successful buyback project. (The next question is when or if the foundation will sell.)

The scale of $HYPE's buybacks is similar to that of Web2's Microsoft, with a market cap/fully diluted valuation (MCAP/FDV) buyback ratio of 82 times, and the annual buyback scale is quite substantial compared to the circulating supply.

Pumpfun ($PUMP): On-chain buybacks and burns of 118,351 SOL triggered a 20% price increase, but the price fell back within a day. Scarcity did not translate into attractiveness—competitor BONK continued to capture attention. (As of August 22, 2025, Pumpfun regained market share leadership, but $PUMP has not reacted.)

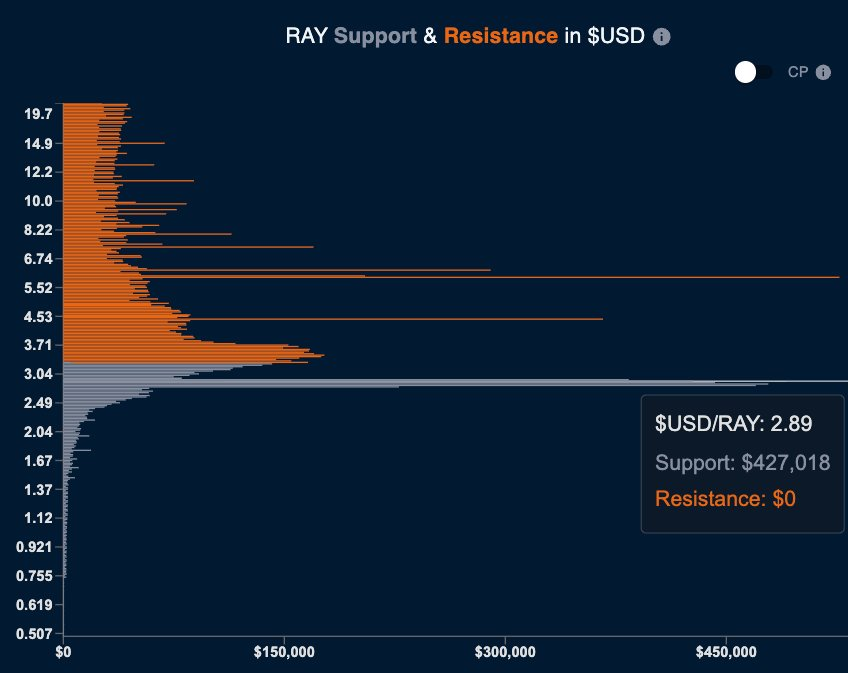

Raydium ($RAY): Programmatic buybacks combined with unilateral SOL liquidity experiments. The latter adopted a healthier approach by creating price floors rather than chasing price increases.

Unilateral liquidity created significant passive buybacks at the $2.89 price level.

BNB Burn: The largest and most stable buyback/burn model in the crypto industry (programmatic burn based on centralized exchange revenue, totaling $35 billion in BNB burned). This model has succeeded because Binance generates billions in revenue annually from fees, providing sustainable funding support.

MakerDAO surplus auctions and burns: Protocol revenue is used to buy and burn MKR.

Buybacks can become unprofitable due to market corrections, so an effective fund management system is needed to optimize return on investment (ROI).

Investor Perspective: Where Does the Buyback Money Come From?

Smart money looks beyond the surface to the essence. The strength of buyback signals can be ranked as follows:

Supported by sustainable income → Strong signal

Programmatic buybacks, linked to fees → Medium signal

Opportunistic buybacks, supported by cash reserves → Weak signal

One-time burns, consuming cash reserves → Bearish signal

Buybacks supported by protocol revenue are positive signals, while buybacks that deplete cash reserves are dangerous signals.

For example, a Solana project with a fully diluted valuation (FDV) of $5 million has a manual buyback plan (each orange line represents 0.5% of the total token supply bought back). Through buybacks, the project's portfolio value increased fourfold, actively managing liquidity with this growth.

Three Rules for Effective Token Buybacks

Must be supported by sustainable income (not one-time cash reserve burns).

Must be combined with fundamentals (e.g., product launches, partnerships, or user growth).

Must be transparent and predictable, allowing holders to build confidence rather than sell during short-term price fluctuations.

Final Summary: In the stock market, buybacks amplify fundamentals. In the crypto space, buybacks can create scarcity—but scarcity does not equate to attractiveness. Unless a protocol can establish stickiness, sustainable income, and utility on the demand side, buybacks are mostly just narrative tools. When combined with real fundamentals, they can become a strong signal; if merely a superficial effect, they will only facilitate others' exits.

Other Examples:

$RAY Buybacks and price trends from July 2022 to July 2025

$PUMP Buybacks and price trends from July 17 to August 4

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。