Research and Information on the Japanese Web3 Market in the Chinese Community

The research and information on the Japanese Web3 market in the Chinese community are relatively lagging, so we decided to update a study on the Japanese market.

After sharing the article "Web3 Practitioners' Relocation to Japan and Local Life" last time, although it was repeatedly stated that many peers living and working in Japan do not engage with the Japanese market, there are still many friends who want to understand the specific situation of Japanese users and industries.

Especially later, it was found that the research and information on the Japanese Web3 market in the Chinese community are quite outdated, so we decided to update a study on the Japanese market.

This article cites multiple contents from the Japan Cryptocurrency Association, the Financial Services Agency of Japan, compliant exchanges, and other data and information for research and reference.

The main content of this article includes:

The Japanese Web3 Market (Growing User Base)

The Scale and Growth of the Japanese Crypto Market (Opportunities?)

Profile of Investor User Groups (Not Engaging On-chain?)

Government Regulation (Attitude Towards Non-compliant Offshore Exchanges?)

Controversy Over Tax Rates (Increase or Decrease?)

How Projects Operate (Legal Risks?)

We hope the above content is helpful to you. ❤️

The Japanese Web3 Market

Overall, although Japan is one of the more developed countries in Asia with a population of 124 million, the number of young people is gradually decreasing. With the extreme prosperity of local stock markets, real estate, anime culture, and tourism, people's attention has become very scattered, which reduces the motivation of young people to focus on Crypto, with the middle-aged group being the majority.

However, due to the global promotion and popularity of cryptocurrencies, the local participation in Crypto in Japan is also accelerating, and by May 2025, the user base and trading volume reached new highs.

Characteristics: 12.41 million users, with the main participants being middle-class individuals aged 30-40, focused on financial management and long-term allocation rather than pure speculation, with the majority earning below 7 million yen (320,000 RMB) annually. The high capital gains tax on crypto (most are holding and not selling, waiting for the tax reduction policy in 2026).

The Scale and Growth of the Japanese Crypto Market

In 2022, the total spot trading volume of compliant exchanges in Japan was only about 1 trillion yen (approximately 6.8 billion USD). In 2023, it increased to 1.13 trillion yen (approximately 7.6 billion USD), with a growth of only about 13%.

However, by 2024, after Bitcoin was fully adopted by Wall Street, the total spot trading volume of crypto in Japan immediately surged to 2.06 trillion yen (approximately 14 billion USD), with a year-on-year growth rate of 82%, finally becoming a sizable market.

In terms of trading varieties: Bitcoin (BTC) accounts for about 70%, while Ethereum (ETH) accounts for only about 14%. This has led many compliant exchanges in Japan to primarily promote buying BTC in their advertising, for example, Tiktok frequently features ads for exchanges promoting Bitcoin.

Additionally, starting in 2024, the popularity of XRP slightly surpassed that of ETH.

Crypto Market with 12.41 Million Users

Although seeing this data may seem acceptable, with at least 12.41 million crypto users, in reality, this growth only began in 2024.

In 2022, the number of crypto users in Japan was only 5.61 million; in 2023, it was 6.46 million, with a growth rate of only 15%; but by 2024, this figure surged to 9.17 million, with a growth rate of 41%.

Currently, by May 2025, it has reached 12.419 million. Therefore, the crypto market in Japan is also experiencing accelerated growth in local users, with managed amounts exceeding 4.26 trillion yen (approximately 27.5 billion USD).

Profile of Investor User Groups

By May 2025, the crypto user group in Japan has reached 12.41 million, accounting for about 15% of the adult population in Japan.

Among them, the main investors are middle-class individuals aged 30-40, characterized by:

Heavy reliance on Youtube, X, and other social media

Having a certain level of stable income

Annual income below 7 million yen

In terms of investment behavior and motivation:

Financial management-oriented, favoring long-term allocation, not speculative

Mostly small-scale participation, operating through exchange apps

Low trading frequency, with most placing orders only a few times a year

On-chain native players, only a very small group

Overall, the crypto user group in Japan is gradually becoming more mainstream, but they prefer safety and convenience.

This has led most project teams and exchanges in Japan to find that advertising in the media is less effective than partnering with influencers on Youtube and X for long-term engagement. Thus, the Japanese crypto community has become a place where everyone is becoming an influencer, while traditional media is increasingly under pressure.

Regulatory Environment

Japan's crypto regulatory model is quite similar to that of the United States, involving a three-tier collaboration of FSA (Financial Services Agency of Japan) + JVCEA (Japan Virtual Currency Exchange Association) + JCBA (Japan Cryptocurrency Business Association).

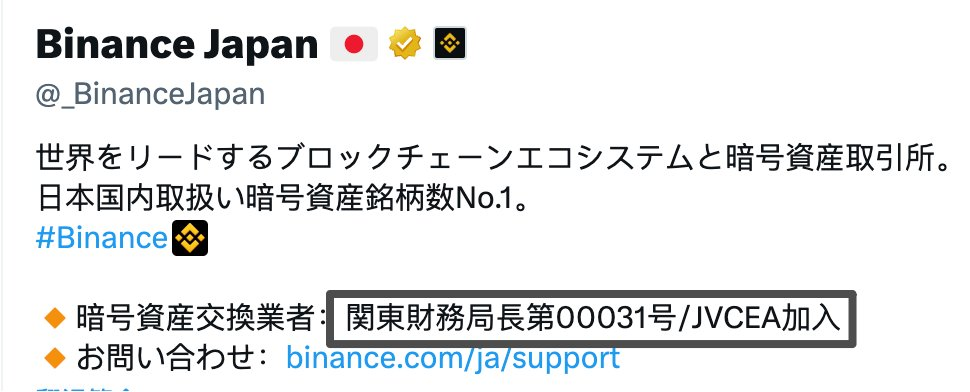

Therefore, it is found that most crypto companies operating in the Japanese market are members of both JVCEA and JCBA. For example, Binance Japan has publicly announced on Twitter that it is a member of JVCEA.

Currently, for exchanges and custodians to conduct market operations in Japan legally, companies must have the appropriate qualifications and licenses to join these associations. In recent years, asset management institutions and exchanges entering the Japanese market have generally adopted shell company methods to operate in Japan.

Attitude Towards Non-compliant Offshore Exchanges

In addition to the compliant exchanges mentioned above, there have been many non-compliant exchanges operating and promoting in Japan, gaining a large number of users. The main reasons why these users engage with offshore exchanges include:

Tax avoidance and evasion

A variety of cryptocurrencies available

Comprehensive leverage and contract products

Currently, these types of exchanges were targeted by the Financial Services Agency and the government in February 2025, with related download and access channels being completely removed from the Japanese regions of the Apple Store and Google Store. Some Japanese influencers who helped promote these exchanges have also received notification letters.

However, since Japan does not impose web access restrictions, Japanese users can still access these non-compliant offshore exchanges. To this day, there remains a portion of the user base trading on them, although the local promotion of these exchanges has become more conservative.

Controversy Over Tax Rates

Previously, local statistical agencies found in surveys of crypto users that the general feedback indicated that tax burdens and reporting costs are pain points, especially since most Japanese retail investors treat crypto as financial management (holding coins), which increases the complexity of comprehensive taxation and accounting, raising the usage threshold.

As is well known, if you buy 30 million yen worth of BTC through a local compliant exchange and make a profit, the following year you must pay 45% miscellaneous income tax + 10% resident tax, totaling about 55%.

Currently, the Financial Services Agency has confirmed that it will include crypto taxation in the adjustment scope for 2026, making cryptocurrency subject to a tax rate of about 20%, similar to stocks.

This means that investors will ultimately only need to pay a maximum of 15.315% national tax and 5% local resident tax. Moreover, once this tax is paid, it is equivalent to being completely onshore, and no further taxes are required. For corporate investors: only 15.315% national tax is payable, excluding local tax.

This expected implementation will coincide with the arrival of Japan's BTC and XRP spot ETFs in 2026.

How Projects Operate

Finally, the most frequently asked question recently is how projects operate in Japan and what restrictions they face.

According to previous statistics, there are currently at least 20 well-known projects operating and residing in Japan, but most do so under the guise of research and development companies.

The main reason is that if a project wants to conduct large-scale business in Japan (such as issuing tokens for fundraising aimed at Japanese users or listing on compliant exchanges), it must pass the review of JVCEA (Japan Virtual Currency Exchange Association). Therefore, compared to Southeast Asia and Dubai, the compliance threshold is higher, and the costs are significant.

As a result, most projects in Japan do not engage with the Japanese market. Operations and token issuance activities are conducted through BVI or other offshore entities; personnel, product development, office, and other fixed expenditure businesses are conducted through Japanese entities.

This is the current portrayal of most local projects and foreign projects operating in Japan.

People in Japan do not engage with the Japanese market.

We hope the above content is helpful to you. ❤️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。