SBI Holdings News: Stock Gains on Ripple and Startle Deals

Ripple partners with SBI to launch RLUSD stablecoin in Japan

If you’ve been following SBI Holdings news, you know the company has been one of the most active financial institutions in Asia when it comes to blockchain adoption. Its latest move is a big one: teaming up with Ripple to introduce the RLUSD stablecoin to Japan.

Source : Website

The launch is expected in the quarter first of 2026, and the stablecoin will be distributed via SBIVC Trade , the group’s crypto-focused arm. Because RLUSD is completely backed by Treasury bills, U.S. dollar deposits, and other short-term reserves, it offers Japanese investors a new, reliable choice for digital payments and trading, which is what makes the development remarkable. The timing aligns perfectly with the move as Stablecoins are on rise globally in the crypto market.

Startale Group and SBI Holdings to launch tokenized stock platform

The second wave of SBI Holdings news today is all about tokenized assets. It has partnered with blockchain infrastructure firm Startale Group to build a platform that allows 24/7 trading of tokenized stocks and real-world assets.This is not some normal move it is focused to give a long term solution to the project. Traditional stock markets close most of the time, and settlement can take days. Firm’s new platform promises continuous trading, faster settlements, and even fractionalized ownership, something that could open investment to a much wider audience.

Source : sbigroup

Startale ’s founder Sota Watanabe called this “the next frontier” for capital markets. By integrating tokenized stocks with DeFi tools, company is hinting at a future where investors could move easily between traditional equities, crypto, and even tokenized real estate, all from one platform. It’s still early days, and no launch date has been confirmed, but the direction is clear. For anyone keeping an eye on SBI Holdings news, this is a sign that the company is going after market gaps no one else is filling.

Investments, Licenses, and a Clear Long-Term Vision

Perhaps the most significant aspect of recent SBI Holdings news is how many sectors the business is addressing at once.Earlier this year, SBIVC Trade became the first firm in Japan to receive a license to distribute foreign stablecoins. It has already partnered with Circle to bring USDC to the market and even invested $50 million in Circle’s IPO . It’s also exploring new use cases, such as Project Trinity, which looks at using stablecoins to settle security tokens—a growing market in Japan, particularly for real estate investments.

Beyond banking partners like SMBC, banks’s moves show it’s positioning itself not just as a financial player but as a technology leader. From stablecoins to tokenized assets, this is a company looking at the next decade of finance, not just the next quarter. And that’s why so many people are paying attention to SBI Holdings news right now.

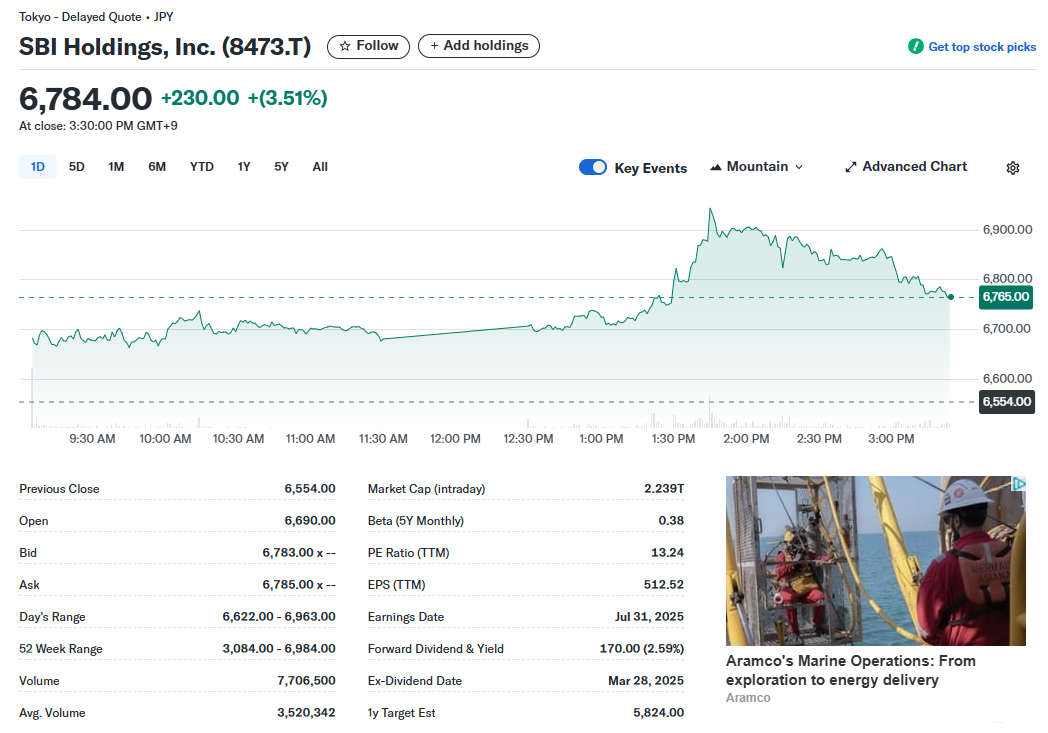

SBI Holdings News Gave Kick Boost to Stock Price

Source : Yahoo Finance

The organisation's stock saw a healthy boost on Thursday, gaining roughly 3.5% to trade near ¥6,784 from its previous close of ¥6,554. The rally came as investors welcomed two big developments: Ripple’s plan to launch its RLUSD stablecoin in Japan through its crypto arm and a new joint venture with Startale Group to build a blockchain-based platform for tokenized assets.

Also read: Andrew Tate Scores $16K Profit From Shorting Kanye West’s YZY Token免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。