Author: The DeFi Investor

Translated by: Tim, PANews

Where Are We in This Bull Market Cycle?

It's always fascinating to observe how quickly market sentiment can change.

We just experienced: a wave of optimism about Ethereum on crypto Twitter, only for many to turn bearish overnight.

I also want to share some thoughts on the future direction of the market.

Let’s zoom out and analyze the data.

First, let’s review some historical trends. Here’s a chart showing Bitcoin's price performance in previous bull market cycles:

If you study past cycles, you’ll find that the timing of Bitcoin's cycle peaks has been quite consistent:

- In 2021, Bitcoin peaked in November

- In 2017, Bitcoin peaked in December

- In 2013, Bitcoin peaked in December

So far, every cycle peak has occurred in the fourth quarter of the second year after the halving (2013, 2017, 2021, and now 2025).

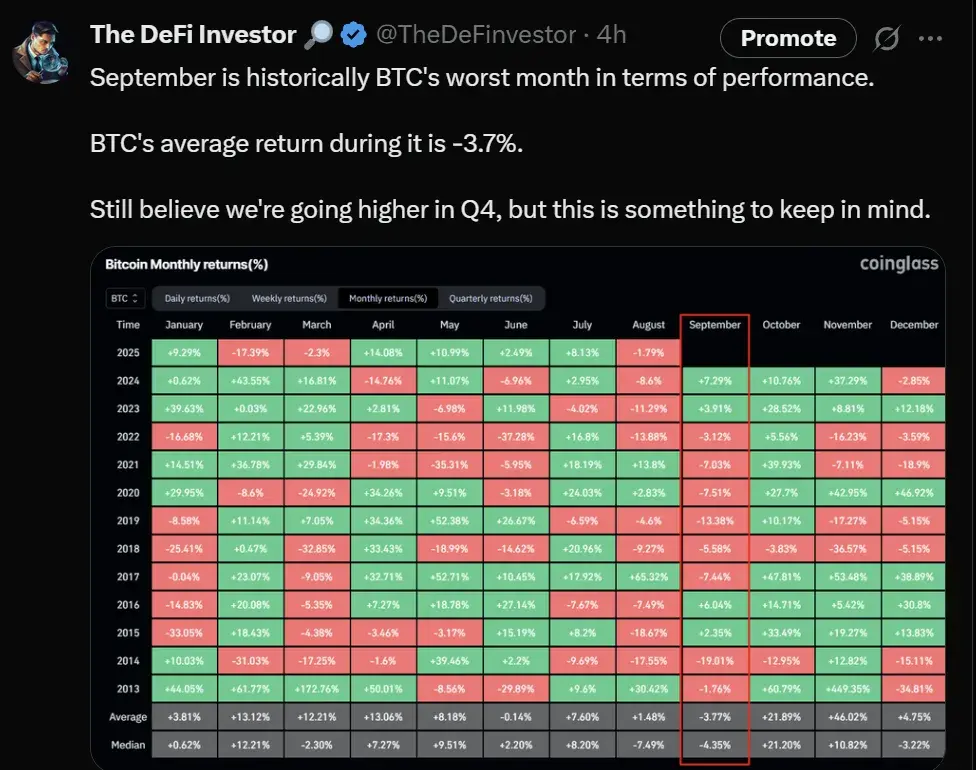

Another interesting phenomenon is that September is usually the weakest month for Bitcoin, while October has historically been one of the strongest months.

Despite many people feeling panic due to the recent crash, as you can see, it’s not uncommon for the market to experience a downturn around September (the end of the third quarter).

If there’s anything to say, it’s that it aligns with what has happened in the past.

Does this mean this cycle will be exactly the same as previous cycles? Not necessarily. While history doesn’t repeat itself, it often looks remarkably similar.

Regarding September, given what has happened in previous cycles, I have mixed feelings, but I believe the fourth quarter will be a good quarter for cryptocurrencies, as the final stages of every bull market cycle have historically been very strong in terms of returns.

In addition to seasonal factors, several other factors lead me to believe that the fourth quarter will see an increase.

Interest Rate Cuts Are Coming (This Time It’s Real)

Now let’s temporarily set aside cryptocurrencies: the macro economy is important.

According to Polymarket's predictions, there is a 64% chance that the Federal Reserve will cut interest rates in September. Why is this significant?

Because when central banks lower interest rates, borrowing costs become cheaper. The decline in bond yields also encourages investors to shift towards riskier assets like cryptocurrencies.

Historically, significant interest rate cuts have been favorable for risk assets.

Crypto Treasury Companies Are Continuously Buying Large Amounts of Cryptocurrency

The amount of capital is quite astonishing.

According to data from www.strategicethreserve.xyz, last week, crypto treasury companies purchased over 532,000 ETH (worth over $2 billion at current value).

Note that a staking Ethereum ETF has not yet been approved.

Source: www.strategicethreserve.xyz

A $2 billion weekly buying spree is a huge positive for ETH and altcoins.

Crypto treasury companies will eventually run out of funds, but given the current inflow of capital, it’s hard for me to believe that the peak of this bull market has already arrived.

Another reason I believe the cycle peak has not yet arrived is as follows:

Common peak signals are rarely reached.

Recently, the search volume for "cryptocurrency" hit a four-year high, and Jim Cramer has turned bullish, which is why I took some profits earlier this week.

But aside from that, the other "important signals" I mentioned last week have not been triggered.

For example, Coinbase's app store ranking is still over 200. In the last cycle, it was the number one app in the app store.

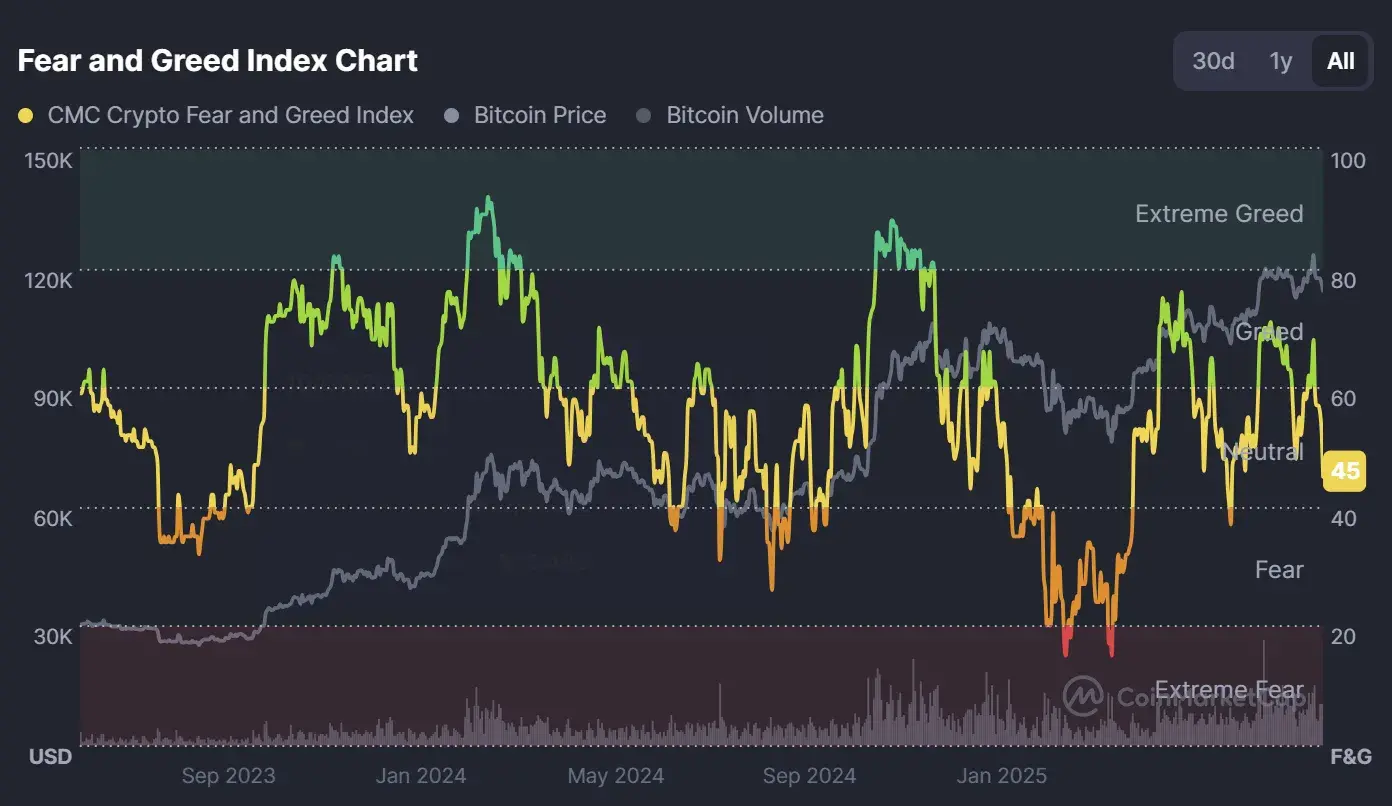

The Fear and Greed Index also shows a healthy state. Although the market has rebounded recently, it has not reached an irrational frenzy. However, in the case of Ethereum, its price has seen significant gains over the past few weeks, and a short-term pullback is entirely normal.

Unless this is the worst cycle in history, I don’t believe the bull market feast is over.

So, How Do I Prepare for the Future?

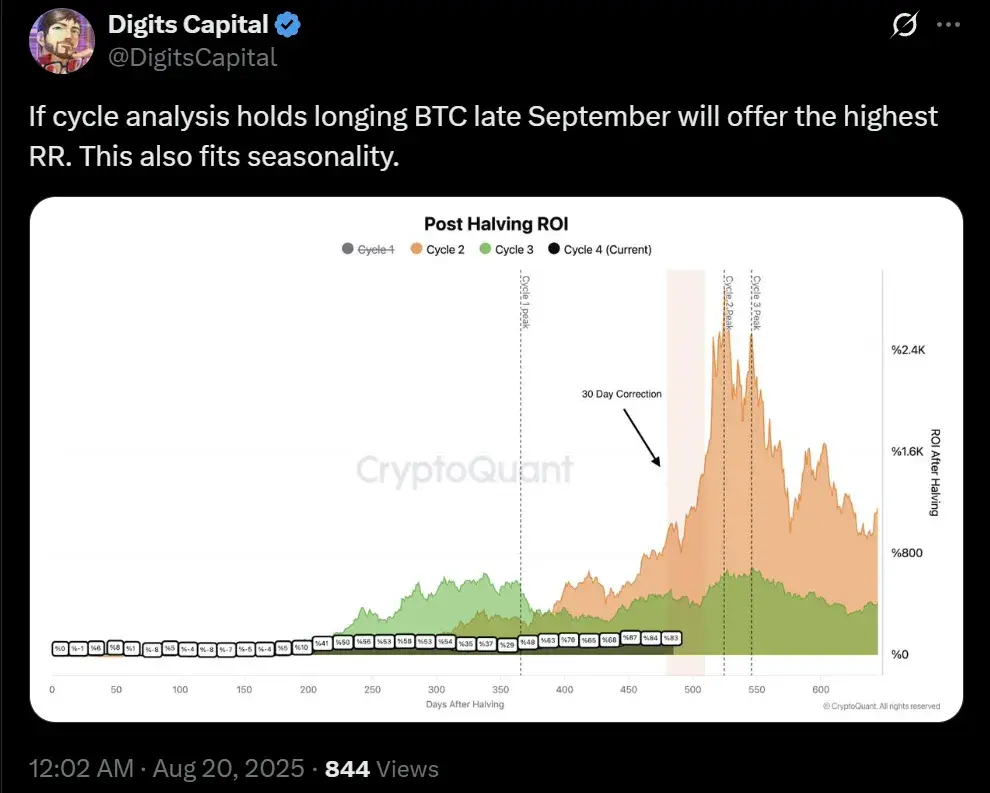

As mentioned below, historically, the best buying opportunity after Bitcoin's halving is in late September of the following year (the most recent Bitcoin halving occurred in 2024), as October is usually an excellent month for Bitcoin performance.

This is exactly what I plan to do.

Based on market patterns in late September, if there is a significant drop, I will select a few popular tokens at that time to increase my position ahead of the fourth quarter.

Otherwise, I will continue to hold my current position.

If everything goes as expected, I will gradually take profits throughout the fourth quarter and significantly reduce my cryptocurrency holdings before the end of the year.

That’s my current plan.

However, remember that this is a game of probabilities, and many variables may arise in the coming months. As investors and traders, our responsibility is to adjust our strategies based on new conditions in a timely manner.

We can only speculate, so my advice is that you should formulate your own plan based on your expectations.

But regardless of what you think will happen in the coming months, and whatever your plan is, make sure that risk management remains one of your top priorities.

I’ve said this many times: the hardest part isn’t making money, but keeping the money you’ve made.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。