This article will reveal how to leverage AiCoin and Bitget's top AI tool, GetAgent, to achieve excess returns in this market cycle.

Author: AiCoin Research Institute

Since August, Ethereum has strongly broken through $4,700, approaching its all-time high, and has accumulated over 100% growth in just a few weeks, firmly occupying the top spot in the cryptocurrency hot list. This is not merely a speculative frenzy but a value reassessment driven by profound structural changes.

Data shows that whales are aggressively accumulating ETH. From August 5 to August 14, the inflow of funds into U.S. Ethereum spot ETFs reached a staggering $3.9 billion, with assets under management nearing $26 billion. The publicly listed company Bitmine Immersion Technology even plans to issue additional shares to raise $20 billion, intending to hoard up to 5% of the total ETH supply.

In this institution-led new market, traditional trading methods have become completely outdated. This article will reveal how to leverage AiCoin and Bitget's top AI tool, GetAgent, to achieve excess returns in this market cycle.

01 In-Depth Market Analysis: Four Driving Forces Behind ETH's Rise

The upward trend in August was driven by four core factors that fundamentally changed the market landscape:

Record Institutional Inflows: Institutions like BlackRock, Fidelity, and Bitwise have significantly increased their holdings. Since mid-May, ETFs and corporate treasuries have cumulatively purchased over $10 billion worth of ETH, equivalent to 32 times the new supply of ETH during the same period, creating a significant demand shock. In July and August, ETF inflows reached explosive levels, with net inflows into spot ETH ETFs exceeding $1 billion for the first time on August 11.

Corporate funds are also actively positioning themselves; for example, SharpLink Gaming purchased $250 million in ETH in August, bringing its total holdings to $1.3 billion; companies like BitMine have holdings exceeding $2 billion. This non-speculative strategic buying behavior is systematically absorbing circulating supply, providing strong structural support for Ethereum's price.

Multiple Regulatory Benefits: The U.S. has passed the GENIUS Act, establishing a clear framework for crypto assets and DeFi. The Trump administration supports pension funds allocating to crypto assets and plans to establish a digital asset reserve. The European MiCA regulations have officially come into effect, allowing institutional funds in Germany to hold up to 20% in crypto assets, and banks are beginning to pilot Ethereum bond issuance. Clear policies are pushing ETH from a speculative target to a financial infrastructure.

Continuous Technological Upgrades: The Pectra and Dencun upgrades have improved network efficiency, with Layer 2 solutions processing transaction volumes close to historical peaks, averaging 1.875 million transactions per day, while mainnet gas fees remain low. The upcoming Fusaka hard fork in November will introduce new EIPs, enhancing scalability and stability while ensuring uninterrupted operation of smart contracts. These improvements make ETH more usable and attractive.

Macroeconomic Environment and Capital Rotation in the Crypto Market: The latest U.S. CPI data came in below expectations, leading the market to reprice the Federal Reserve's interest rate cut probability for Q4 2025. Risk assets are gaining favor with incremental capital, and ETH, as the second-largest cryptocurrency by market capitalization, naturally becomes a major beneficiary of capital inflows. Additionally, whales and institutions are withdrawing large amounts of ETH from exchanges, with daily peaks reaching $285 million, resulting in a decrease in circulating supply. At the same time, over 70% of holders have held their coins for more than a year, indicating long-term confidence.

Technical Analysis and Key Position Assessment

Currently, ETH has fallen below the $4,200 support level. Technical analysis shows:

Short-term (1-3 days): Market sentiment is bearish, and the technical outlook is weak. If it fails to reclaim $4,200 in the short term, it may trigger a deeper correction (such as testing the psychological level of $4,000). If it can hold and reclaim $4,200, it may stabilize sentiment and test upward.

Medium to Long-term: The core fundamental narrative remains intact. Continuous accumulation by institutions, the convenient access provided by ETFs, and the development of the Ethereum ecosystem itself all support its long-term value. The current volatility can be seen as a healthy adjustment and digestion of the recent significant rise.

This high-volatility environment is the golden period for ETH/USDT perpetual contract trading, and Bitget, with its excellent liquidity and depth, has become the preferred battleground for professional traders. However, to truly capitalize on these fluctuations, relying solely on manual monitoring and experience is often insufficient. At this point, the intervention of AI tools becomes particularly crucial.

02 Smart Tools: Two AI Tools Reshaping Trading Decisions

In the context of ETH entering a new round of volatility, traders need not just a "monitoring tool," but a comprehensive intelligent assistant that can truly help them from market interpretation to strategy execution.

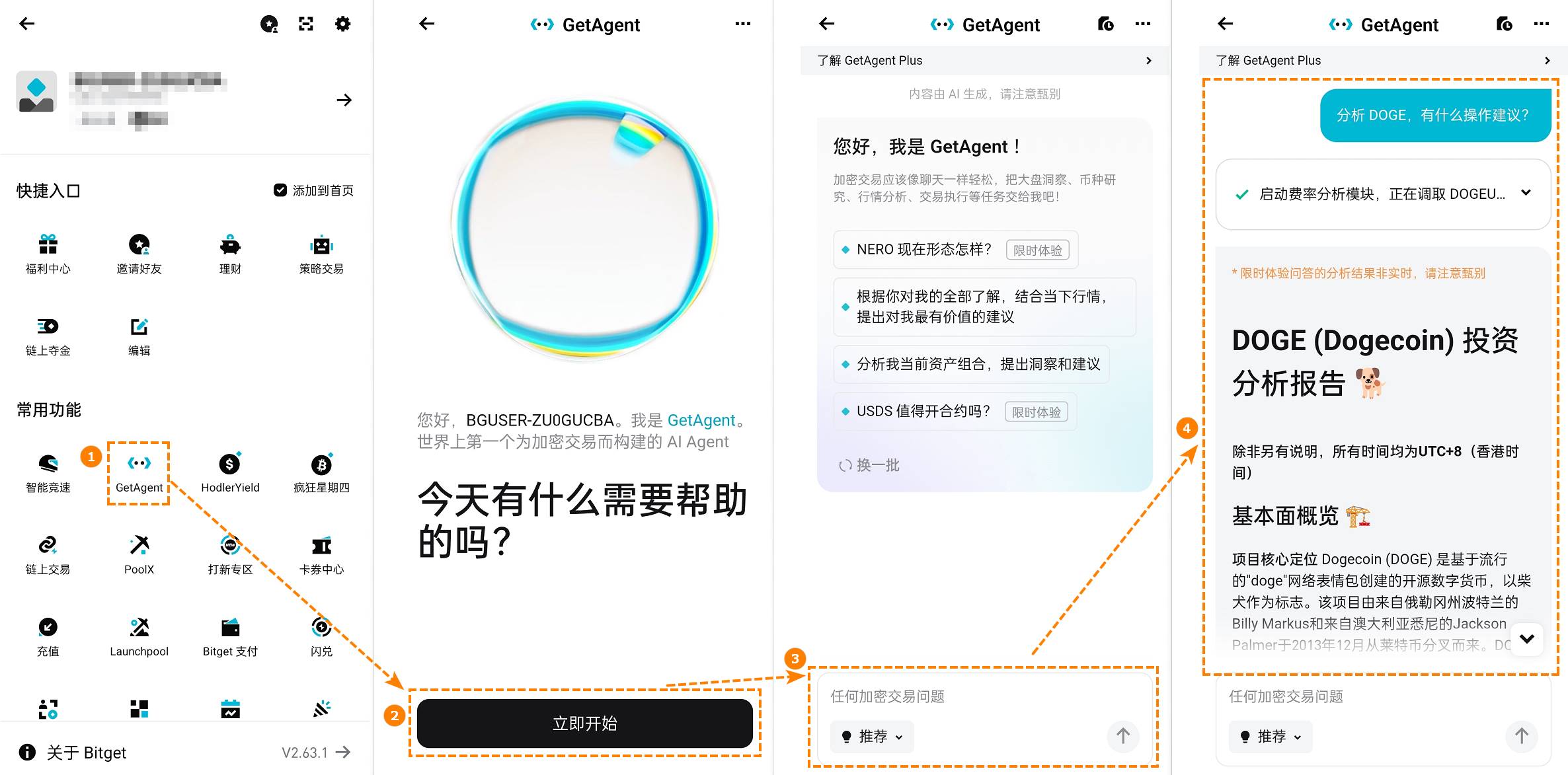

Bitget GetAgent: Your Personal AI Investment Advisor

Bitget GetAgent is an AI trading assistant directly embedded in the Bitget App, positioned as "your personal investment advisor." Its uniqueness lies in:

👉 Fully open, offering free, Plus, and Ultra tiers, covering everything from basic market information to professional strategy customization, catering to different levels of traders' needs.

👉 Conversational interaction + various MCP professional tools, covering a complete closed loop from information acquisition, trend analysis, position diagnosis, risk management to direct trading.

Six Core Capability Scenarios

- Market Analysis and Trend Interpretation

Just ask, "What do you think about ETH today?"

The system integrates K-line indicators (MA, RSI, MACD, etc.), on-chain data, and market sentiment to provide a multi-dimensional interpretation.

- Strategy Suggestions and Risk Alerts

- For example, "Is now a good time to increase my ETH position?"

GetAgent combines market trends and account risk tolerance to return interval suggestions and provide take-profit and stop-loss points.

- Smart Money Tracking and Hotspot Prediction

- Monitor large transfers by whales and the flow of institutional funds.

Combining KOL social mention frequency, predict the next potential hotspot sector.

- Position Analysis and Rebalancing Recommendations

Detect account position concentration and provide diversification suggestions.

Long-short hedging analysis, offering reasonable position allocation.

- Learning AI Coach

- Can explain everything from basic concepts to complex arbitrage logic through dialogue.

- Automated Trade Execution

Supports executing trades via natural language commands.

"Buy 1 ETH" or "Close 50% of the long contract" can be completed in one sentence.

➡️ GetAgent transforms the process that originally required manual collection, analysis, and operation into a single dialogue. It is not just a single tool but a true AI personal trading advisor.

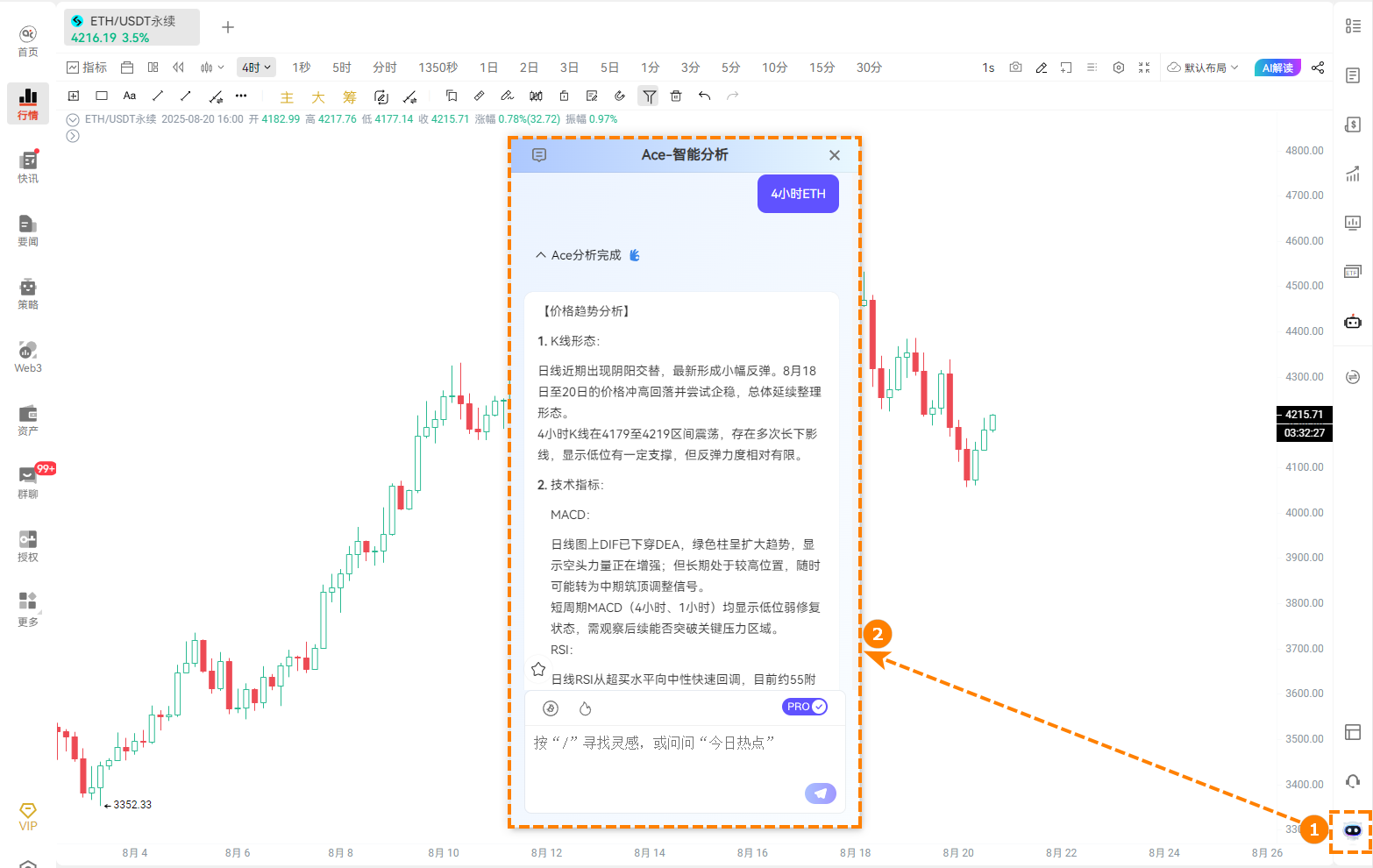

AiCoin ACE Smart Analysis: "One-Minute Market Doctor"

If GetAgent leans towards "advisory + execution," AiCoin ACE is more like a "professional diagnostic tool," specifically designed to analyze market conditions.

Input "4-hour ETH," and Xiao A can complete four tasks in one minute:

- Personalized Interpretation of Coins and K-line Structure

Automatically identify key support and resistance levels, marking trend strength.

- Analyze Indicator Signals

Simultaneously reference multiple indicators like MACD, EMA, volume, etc., to avoid single-point judgments.

- Identify Entry and Exit Points

Clearly indicate: "You can go long in the 4600–4620 range, target 4750, stop loss 4540."

- Future Trend Prediction

Combine volume and market environment to provide short- to medium-term tendencies.

Unlike the plethora of "mechanical signals" on the market, Xiao A's strength lies in integration + interpretation, using language that humans can understand to tell you "what to do."

➡️ Xiao A helps you translate complex K-lines into plain language, making the market understandable for ordinary traders.

03 Practical Strategies: Precision Strike Plans Powered by AI

The market always has three forms: upward, downward, and sideways. Corresponding to different market environments, the combination of Bitget + AiCoin can provide clear actionable plans.

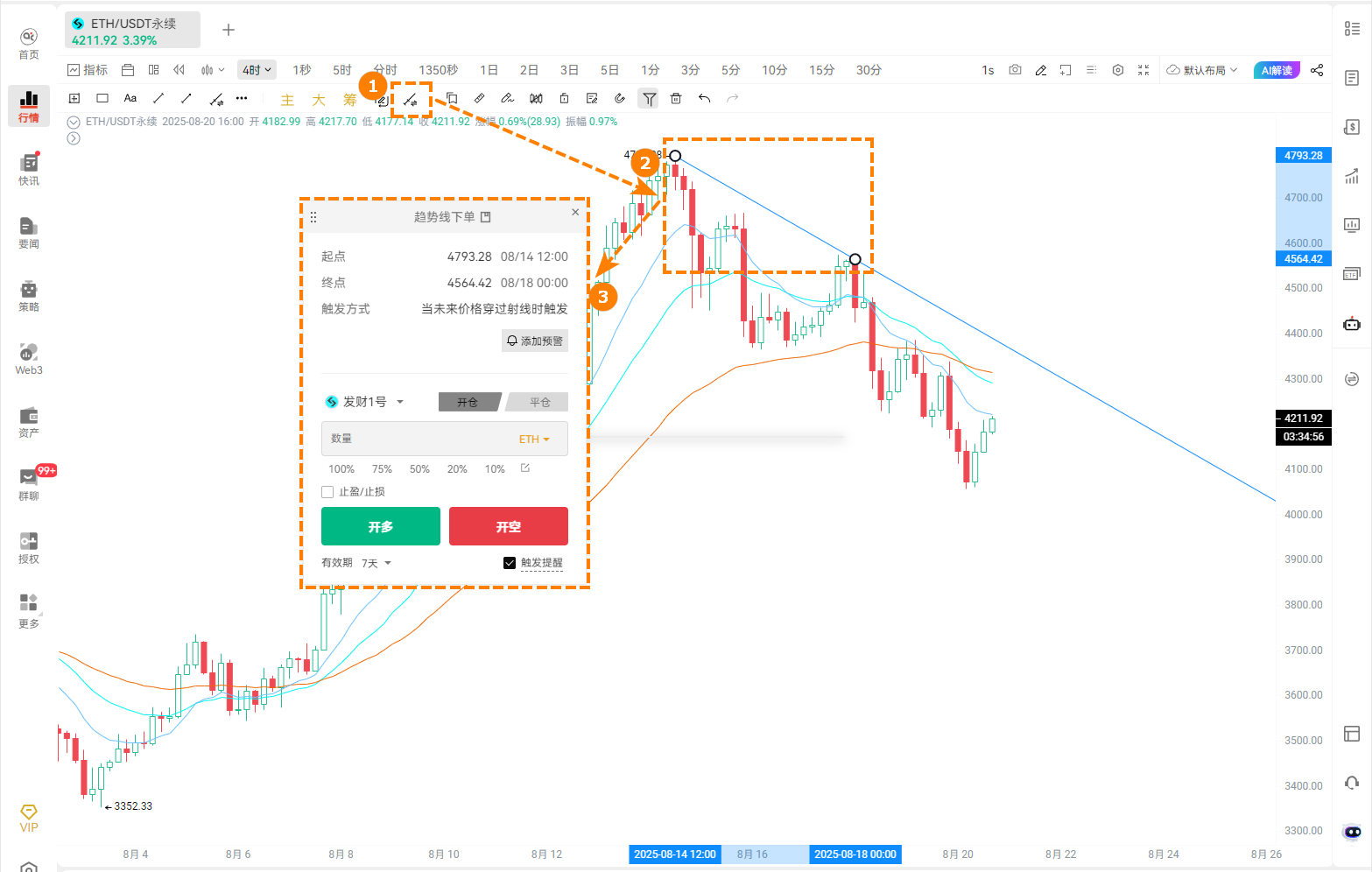

1. Upward Market: Trendline Orders — "Buy on Dips"

[Method]

Draw a trendline: Connect multiple low points to create an ascending support line.

Logic: In an upward trend, prices often retrace to confirm the trendline before continuing to rise.

[Tool Usage]

After completing Bitget API authorization trading in AiCoin, use the [Trendline Order] function.

Draw the trendline on the K-line chart and complete the order settings.

When the price retraces and touches the trendline, the system automatically opens a long position.

[Example]

After ETH breaks through 4650, set the trendline support at 4600.

Conditional order: Automatically go long when touching 4600, stop loss at 4550, target at 4750.

Result: If the retracement confirms and rebounds, it allows for precise entry, avoiding blind chasing of highs.

➡️ Value: Follow the trend, buy low, and reduce missed opportunities.

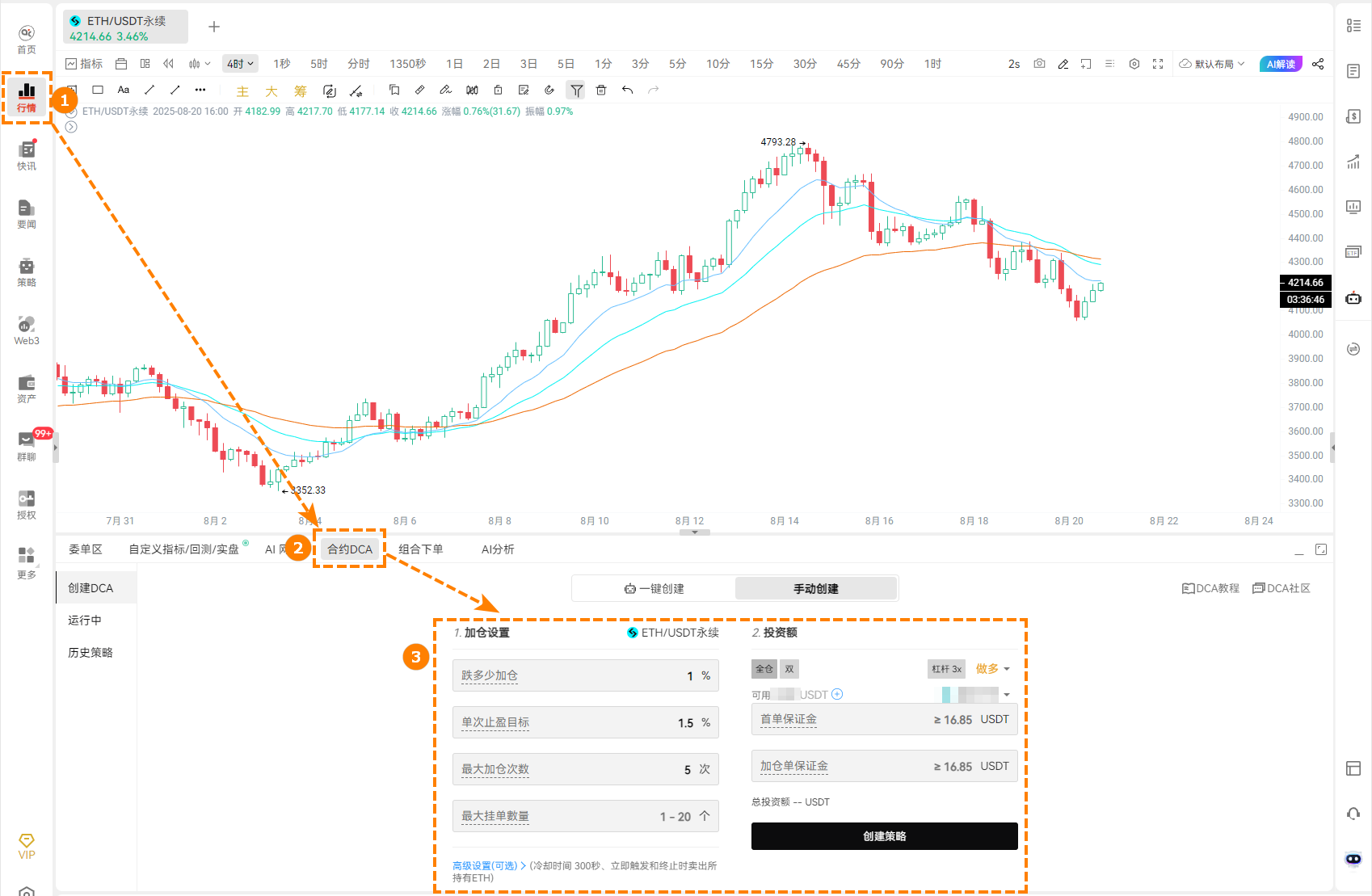

2. Downward Market: DCA Across All Coins — "Build Positions Gradually, Survive Against the Trend"

[Method]

Logic: The risk of a one-sided decline is extremely high, and trying to bottom out all at once can easily lead to being trapped.

Using DCA to buy in batches can average down the cost.

[Advantages]

AiCoin's DCA tool supports multiple modes for spot/contract trading, covering all cryptocurrencies.

It can overlay indicator triggers (MACD/RSI/TD, etc.) to avoid blind averaging down.

[Example]

ETH falls below $4,400.

Set up batch buying: first order of 1,000 USDT, automatically averaging down every 3% drop, 1x fixed investment, for a total of 5 times.

Average price lowered to 4,127.2 USDT; if it rebounds to $4,340, the entire position will profit over 5%.

You can also set "volume + holding period" controls to avoid the risk of infinite averaging down.

➡️ Value: Transform passive losses into active position control, increasing the probability of recovering costs.

3. Sideways Market: Neutral Grid — "Low Buy High Sell 24/7"

[Method]

Logic: Prices fluctuate repeatedly within a range, making grid trading ideal for capturing volatility profits.

Bitget's neutral advantage for ETH: supports bidirectional orders, maximizing grid efficiency.

[Tool Usage]

Open AiCoin's neutral grid, combining recommended parameters from GetAgent or Xiao A.

Complete the grid range and quantity settings.

Advanced settings: support for setting take-profit and stop-loss and moving grids.

Invest the amount and start the grid (zero position mode: positions are built only when price triggers).

[Example]

ETH fluctuates in the range of 4,500–4,700.

Set grid spacing at $20, with automatic bidirectional orders.

Result: Each time the price fluctuates by $20, the system automatically completes "high sell low buy."

➡️ Value: No more agony in a sideways market; automate capturing small volatility profits.

However, even the best strategies require a trading venue with sufficient liquidity and stable depth as a carrier. Otherwise, even the most perfect execution logic may fail due to slippage and poor execution.

04 Platform Advantages: Bitget's ETH Contract Liquidity

Having a strategy is not enough; the market position and liquidity of the exchange also matter. Bitget has a clear advantage in ETH perpetual contracts.

1. Trading Volume and OI (Open Interest)

Bitget's perpetual contracts have a 24-hour trading volume exceeding $7 billion, ranking fifth in the market.

ETH OI (open interest) exceeds 1.5 million contracts, second only to Binance (2.9 million contracts), ranking globally second.

→ This means Bitget is one of the core platforms for ETH contract trading, with a very high concentration of funds.

2. Liquidity and Depth

According to CoinGecko's "2025 Centralized Exchange Crypto Liquidity Status Report":

Within a +/- $2 price range, Bitget has the strongest ETH liquidity, even surpassing Binance and OKX.

Depth can reach $800,000 to $1 million, meeting the needs of most institutions and retail investors.

In a larger range (+/- $50), Binance still has the thickest liquidity, but Bitget has an advantage in narrow-range high-frequency trading.

3. User-Friendly and Slippage Control

Bitget's order book structure for ETH contracts is healthy, with slippage below the industry average. This means lower costs and more stable execution for traders employing strategies like DCA, grid trading, and trend following.

In summary: Bitget is the core battleground for ETH perpetual contracts, with trading depth, activity, and execution friendliness all in the industry's top tier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。