Bitcoin ( BTC) hovered around $114K on Wednesday afternoon while stocks fell across all major indices for a second consecutive day. Palantir Technologies (Nasdaq: PLTR) was one of the notable stragglers among equities, shedding roughly 2% over 24 hours and more than 15% in the last five days.

Both stock and crypto markets have traversed choppy waters this week, but for now, it seems digital assets are outperforming their traditional counterparts. The broader crypto ecosystem was up 1.48% at the time of writing, according to Coinmarketcap. Meanwhile, the S&P 500 and Nasdaq were both in the red and the Dow managed to stay mostly unchanged.

(Federal Reserve Governor Michelle Bowman wants the Fed to buy crypto so that staff can better understand it. / fed.gov)

Bitcoin was also unchanged and seems to have reached a bottom at $113K. The cryptocurrency’s correlation with stocks has once again jumped as the digital asset gains more mainstream notoriety. Just yesterday, U.S. Federal Reserve Governor Michelle Bowman suggested the central bank should acquire crypto to help staff better understand it.

“Our approach should consider allowing Federal Reserve staff to hold de minimus amounts of crypto or other types of digital assets so they can achieve a working understanding of the underlying functionality,” Bowman said in a speech at the 2025 Wyoming Blockchain Symposium in Teton Village, Wyoming. “I certainly wouldn’t trust someone to teach me to ski if they’d never put on skis.”

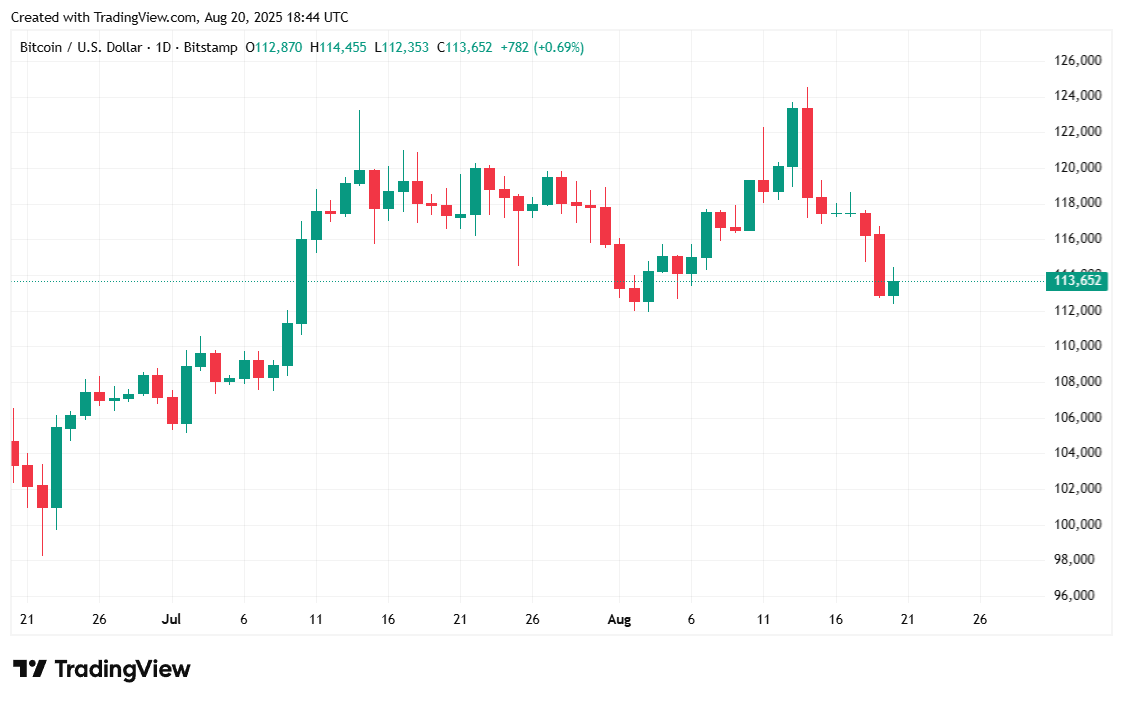

Bitcoin was trading at $113,611.92 at the time of reporting, mostly flat but slightly up by 0.14% over 24 hours but lower by 6.67% for the week, according to Coinmarketcap. BTC’s price has been moving between $112,387.96 and $114,443.24 since Tuesday.

( BTC price / Trading View)

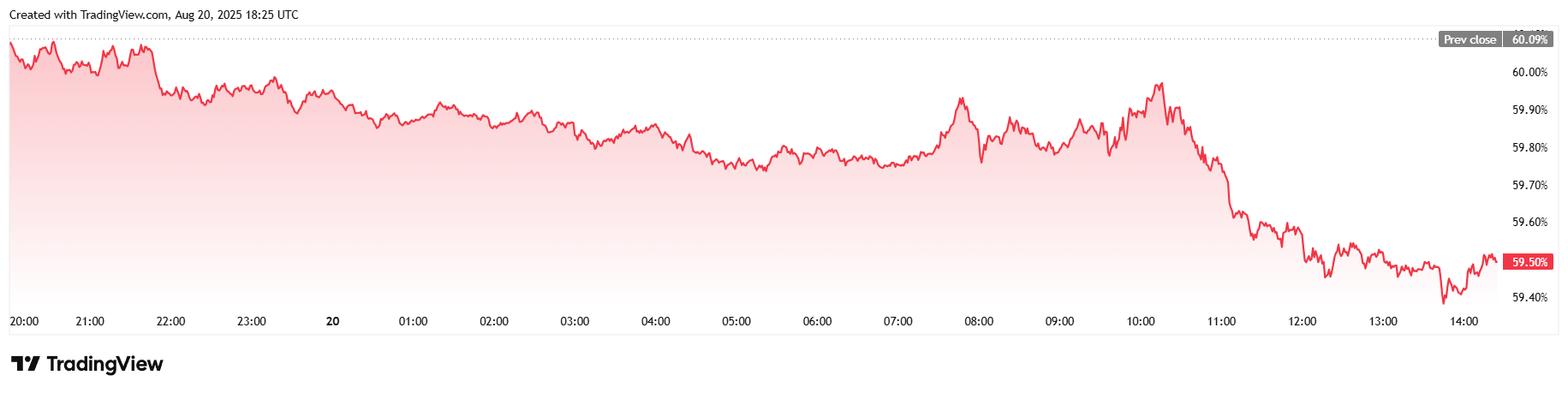

Trading volume edged higher at $71.13 billion, up by 2.6% over the last 24 hours. Market capitalization was practically unchanged for the day, up by only 0.16%. Bitcoin dominance fell 0.98% since yesterday and stood at 59.50% at the time of writing.

( BTC dominance / Trading View)

Total bitcoin futures open interest dropped for the second day in a row, dipping to $80.61 billion, a 0.72% decrease. Coinglass data also showed that bitcoin liquidations reached a total of $107.66 million. Long and short liquidations were relatively balanced at $48.49 million for the former and $59.17 million for the latter, suggesting mixed sentiment regarding the cryptocurrency’s short-term direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。