Author: capradavis

Compiled by: Tim, PANews

The new features introduced in Bio Protocol V2 strengthen the incentive model while removing the complex and costly multi-step funding application process from V1.

However, what is even more interesting is how these upgrades make capital allocation in the DeSci field more attractive.

It is reported that Bio V1 launched a multi-stage community governance-based launch platform in March 2025, which adopted an updated token economic model. In this model, project financing is conducted in two stages, ultimately launching the BioDAO token paired with BIO when it goes live on DEX.

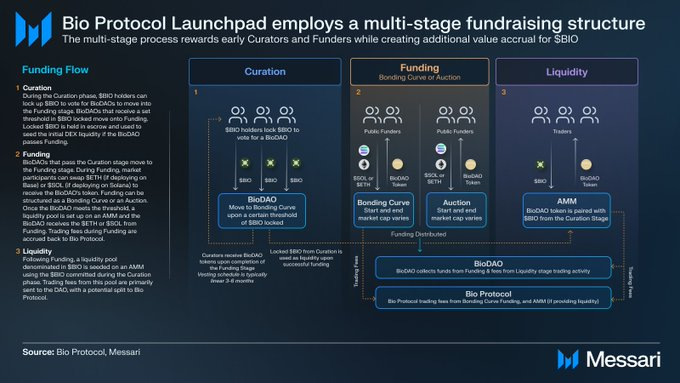

The Bio launchpad consists of three main steps: 1) Curation 2) Fundraising 3) Creating liquidity and trading

1) Curation: BIO token holders stake BIO tokens to vote, and the winning project will receive corresponding BioDAO tokens, released linearly over 3-6 months.

2) Fundraising: Using Bonding Curve or auction models, new users can participate in fundraising with ETH or SOL tokens and receive corresponding BioDAO tokens according to the fundraising rules.

3) Creating liquidity and trading: BioDAO tokens will form an AMM trading pair with BIO, allowing users to provide liquidity and participate in trading.

In addition to the launchpad upgrade, the V2 version also marks Bio Protocol's first foray into the artificial intelligence field by introducing BioAgents, aimed at accelerating research processes for BioDAOs and assisting with daily operational tasks.

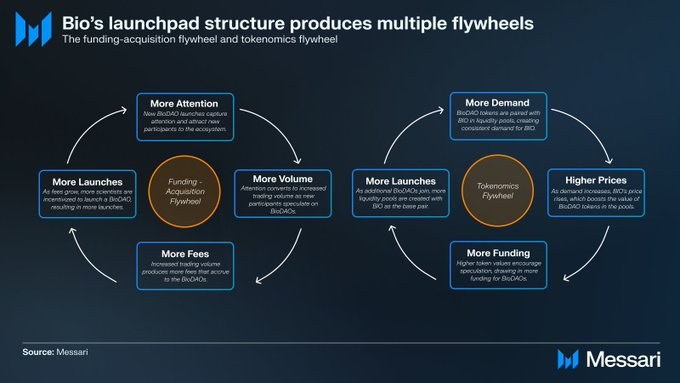

The V1 launchpad mechanism of Bio established a dual-flywheel structure, which continues to be applied in the V2 version. The first is a funding circulation mechanism based on transaction fees (similar to the Believe platform), and the second is a flywheel mechanism of token economics (similar to the Virtuals platform).

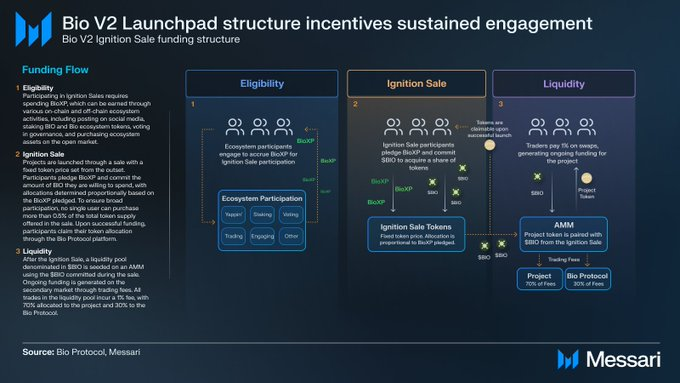

The upgrade of Bio Protocol's V2 version shifts the fundraising model from large one-time fundraising to small high-frequency fundraising, incentivizing positive behavior through mechanisms like BioXP.

The Bio V2 incentive system consists of three parts: 1) Participation eligibility 2) Ignition sale 3) Liquidity providers

1) Participation eligibility

To participate in the ignition sale, points for BioXP can be obtained through:

Social media posts (Yappin')

Staking BIO and ecosystem tokens

Governance voting

Trading ecological assets

2) Ignition sale

The project starts the sale at a preset fixed token price:

Participants stake BioXP and commit to a certain amount of BIO

Token distribution is determined by the proportion of staked BioXP

Individual subscription limit: 0.5% of the total sale token amount

Tokens can be claimed through the Bio platform after successful fundraising

3) Liquidity

After the sale is completed, a liquidity pool is established in AMM using the $BIO raised from the sale.

Secondary market trading continuously generates cash flow:

a) A 1% fee is charged on all transactions in the liquidity pool

b) 70% is allocated to the project party

c) 30% is allocated to the Bio protocol

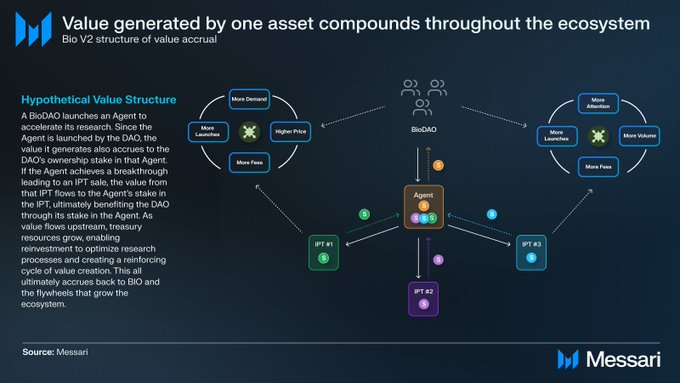

The V2 version also achieves unification of the Bio ecosystem. In the new version, BioAgents are tokenized, and IPTs (previously issued through the Molecule platform) will be uniformly issued through the V2 platform, with all three types of digital assets adopting a standardized issuance model.

This is inherently strong, as all assets contribute to and benefit from the dual-flywheel system. However, what is impactful is the model formed when the value created by a certain asset can achieve compound growth across multiple assets.

The interconnected relationships between BioDAOs, Agents, and IPTs build several sub-ecosystems within the larger Bio Protocol network. This structure provides more ways to balance risk exposure while effectively mitigating the risk of capital fragmentation, as each type of asset can feed back into upstream assets.

With greater flexibility, richer creative expression carriers, and more convenient circulation methods between assets, Bio V2:

1) Establishes Bio Protocol as the ultimate platform for laying out DeSci;

2) Promotes the DeSci field to become a more viable narrative and accommodate a larger pool of funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。