Author: Jiahua, ChainCatcher

On August 8, the native token $K of Sidekick was launched on Binance Alpha, dropping from a high of $0.505 to a low of $0.194 within two days, a decline of 61.58%. At the same time, the reduction of airdrop rewards from Kaito and the issue of early Telegram users not receiving airdrops sparked widespread controversy in the market. This article will explore whether participating in the current airdrop race is still worthwhile.

Sidekick Airdrop Incident: From Hype to Disappointment

As a leader in the LiveFi sector, Sidekick's token $K officially launched on Binance Alpha on August 8, and airdrop queries opened on August 10. This event was supposed to invigorate the community but unexpectedly caused a huge uproar, with the community accusing the project of "betrayal" and "fraud." The core controversy of this incident centered on two aspects, exposing the lack of transparency in the project's tokenomics design and the failure to fulfill community commitments.

Controversy 1: The project initially promised to allocate 1% of the total token supply to reward users who "interacted" on Kaito, but at the Token Generation Event (TGE), it was announced that this reward would be distributed in 10 phases, meaning users could only receive 0.1% at the first distribution, with the remaining portion to be gradually unlocked in the subsequent 9 phases. This change was seen as "wordplay," leading to user dissatisfaction.

At the same time, X user @sanmishen posted that a batch of tokens was distributed the day before the TGE, suspected to be insider trading by the project, and that the platform's streamer tokens were only 33% unlocked, with no announcement on how the rest would be unlocked. This series of actions further exacerbated distrust.

Controversy 2: The project created massive hype through SideFans, attracting countless early users (mainly from abroad) to participate in interactions and promotions, but ultimately, these users were excluded from the final tokenomics design.

SideKick's TG mini-program SideFans, launched in 2024, is a claw machine mini-game where users can play by completing tasks or purchasing diamonds. Currently, there are 15 million users participating in this game, but they are not included in the airdrop scope. Many users claimed they had been actively participating on SideFans for a year without any results. X user @ibo_successful posted that "they (SideKick) blocked users who inquired about the Telegram bot airdrop issues."

These controversies not only damaged Sidekick's reputation but also triggered broader industry reflections: projects utilize social tools for hype while ignoring real contributors, leading to a collapse of community trust and a gradual shift from a win-win relationship to opposition between users and the project.

The Current Airdrop Race is No Longer a "Golden Path"

The Sidekick airdrop controversy is not an isolated case; it is just the tip of the iceberg of the challenges facing the airdrop sector in the 2025 crypto cycle. In the previous cycle, airdrops were seen as "low-risk, high-reward" opportunities, such as the UNI airdrop easily bringing in $10,000 to $20,000 in profits, and ARB providing participants with $50,000 in rewards (at peak prices). However, in this cycle, this sector has transformed into a battlefield of "high competition, low returns." Studio volume manipulation, witch hunts, and strict claiming standards have diluted the earnings of real users.

The essence of airdrops is that users earn free tokens by participating in project activities (such as interactions, promotions, or providing liquidity), aiming to profit from early distributions. It originates from the decentralized philosophy of Web3, where users contribute time and resources in exchange for rewards, forming a low-threshold "mining" model. However, as the market matures, this sector has fallen into difficulties: high competition, low returns, studio volume manipulation, and witch hunts have diluted the earnings of real users.

The primary purpose of projects distributing airdrops is to create community buzz, attract users, and enhance token liquidity. Through airdrop expectations, projects can quickly accumulate a user base and discussion momentum, essentially a promotion similar to Web2, but replacing cash incentives with token rewards. However, as of now, there are still many projects that have been "cut down" and are facing backlash.

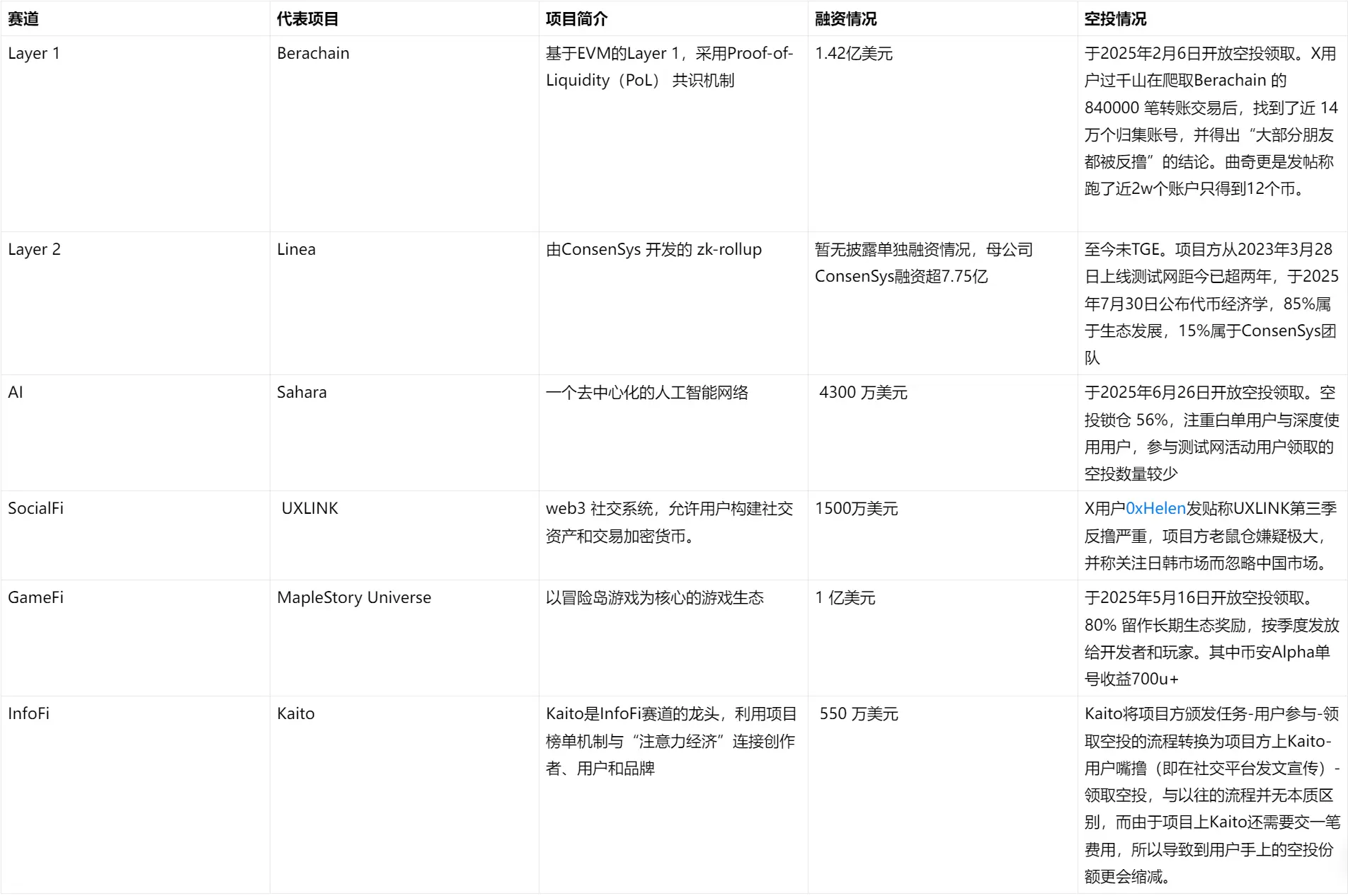

So, is it still necessary to invest significant effort in airdrops in this cycle? We can review the development of some airdrop sectors over the past six months.

From the table above, it can be seen that there are still certain opportunities in the airdrop sector in this cycle, but it is no longer a "wealth handbook" of low thresholds and high returns. For players with technology, funds, and patience, focusing on airdrops may still yield considerable returns, especially through refined operations and early positioning. Conversely, ordinary retail investors lacking resources and strategies are advised to treat airdrops as a side hustle rather than a full-time investment in a "golden path."

It is worth mentioning that most airdrop projects today no longer interact directly with users but instead involve exchanges (such as Binance Alpha) and social promotion rankings (such as Kaito's Yappers system) as intermediaries. This can improve promotion efficiency, but on the other hand, it may also lead to a reduction in the actual token share users receive due to platform fees and distribution mechanisms.

Rebuilding Trust: Projects Should Focus on Build Rather Than Hype

The Sidekick airdrop controversy and the challenges of the Kaito Infofi model signify that the traditional airdrop sector is gradually coming to an end. Users need to shift from "mining" to value creation to avoid a trust crisis. Projects must also go beyond short-term incentives and focus on creating long-term, value-driven models that align the interests of all participants. This means that users and developers should not only be rewarded for participation but also for ongoing involvement and contributions to the ecosystem's growth over time.

Overall, the crypto market will place greater emphasis on real contributions, and airdrops will evolve into a "content economy," driving Web3 from hype to practicality. Only by reshaping fair mechanisms can the community regain trust, and the entire industry can shift from hype to building.

Click to learn about job openings at ChainCatcher

Recommended Reading:

Linea Airdrop Countdown: When L2 Begins to Reinvest in L1

Must-Read for Projects: Say Goodbye to Airdrop Traps, Letting the "Wool Come from the Pig" Model Achieve Long-Term Growth

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。