Author: Frank, PANews

With the overall recovery of the DeFi boom in the crypto market, on-chain activities have surged simultaneously. In the process of cross-chain communication between different chains, the role of cross-chain bridges cannot be ignored. The activities of cross-chain bridges not only reflect the fluctuations in on-chain activity but also serve as a true reflection of the demand for activities across different chains. So, how have the leading cross-chain bridges performed this year? PANews conducted a comprehensive review of this.

Market Overview: Cross-Chain Transaction Volume Increases Year by Year, Transaction Frequency Remains Stable

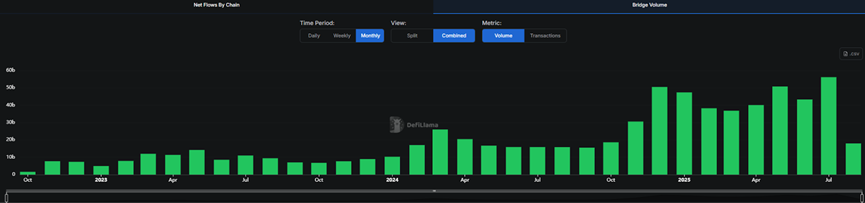

In terms of overall data for cross-chain bridges, activity began to ramp up at the end of 2024. The total cross-chain transaction volume in September 2024 was only about $18.6 billion, but by November 2024, this figure rapidly grew to $50 billion, an increase of approximately 188%. After entering 2025, it has maintained this active level.

Cross-Chain Transaction Volume Change Chart

In July, the highest on-chain cross-chain transaction volume reached $56.1 billion, setting a historical record. However, looking at the other side of the data, we find that this increase in transaction volume is largely due to large transactions. In terms of transaction counts, the monthly transaction count in May 2024 had already reached 15.12 million, and by November 2024, the transaction count was still around 14.47 million, not showing a significant increase despite the surge in transaction amounts. According to PANews calculations, the average single transaction amount on-chain in May 2024 was about $1,051, which grew to $3,489 by November 2024, an increase of 231%.

Cross-Chain Transaction Count Change

The main reason behind this shift may be due to the rise and fall of public chains like Solana, Base, and BSC from 2024 to early 2025, driven by MEME coins, airdrops, and other trends, leading to frequent changes in small on-chain funds. Since April 2025, the popularity of these themes has declined, but more well-capitalized mature players have entered the market. This has gradually shifted on-chain activities from high-frequency, small-scale interactions to larger-scale capital deployment and transfer.

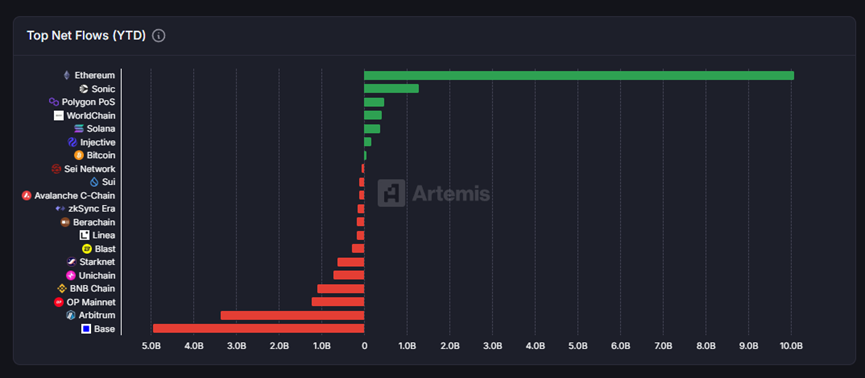

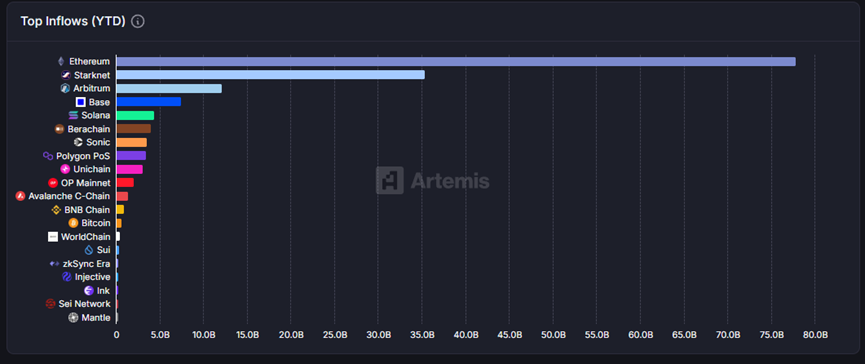

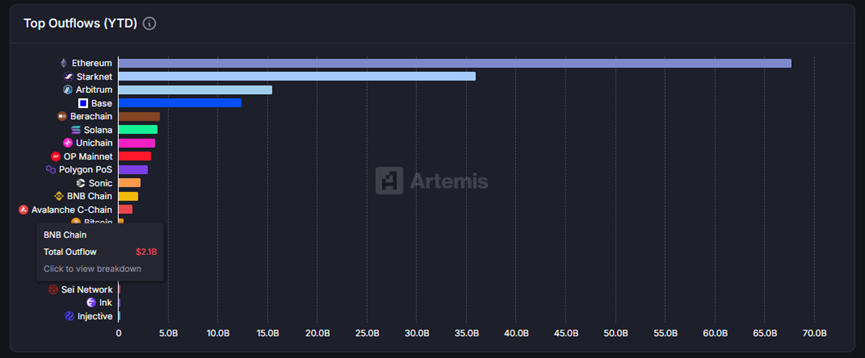

From the liquidity changes of various public chains this year, Ethereum remains the absolute leader in cross-chain transactions. Whether in terms of inflow, outflow, or net flow, Ethereum ranks first, with a net inflow of $10.1 billion from the beginning of the year to now, nearly eight times that of the second-ranked public chain.

Sonic unexpectedly became the second-ranked public chain in net inflow, with a total net inflow of about $1.279 billion. Its net outflow amount is very small, and the vast majority of cross-chain activities are inflows. However, this may mainly be due to the statistical inflation caused by the migration of assets from old chains to new chains, which does not represent its true level of activity.

In terms of net outflow, Base ranks first with a net outflow of $5 billion. This may be related to the recent siphoning effect of the Ethereum mainnet. In the past three months, the funds flowing from Base to Ethereum reached $5.9 billion, even exceeding the total net outflow from the beginning of the year to now.

Another interesting data point is that Starknet's cross-chain activities seem quite active. Both inflows and outflows rank second, with transaction volume being about half that of the Ethereum mainnet.

Competitive Landscape: The Battle for Traffic Among Leading Protocols and Applications

In terms of cross-chain messaging protocols, LayerZero remains the leading project today. In the past month, the cross-chain transaction volume completed through LayerZero reached $4.965 billion, accounting for nearly half of the total cross-chain transaction volume for the month. Circle CCTP's transaction volume ranked second in the past month, reaching $3.8 billion, which is directly related to the growing popularity of USDC. Additionally, the established cross-chain protocol giant Wormhole ranked third, while the emerging Hyperlane ranked fourth.

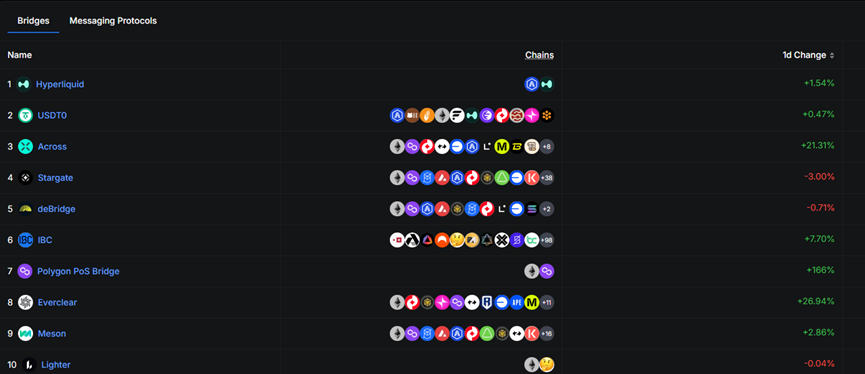

In terms of cross-chain bridge applications, Hyperliquid has become the most active cross-chain bridge recently, with a monthly transaction volume of about $4.965 billion. Although Hyperliquid's cross-chain structure is quite simple, involving only the flow of stablecoins between Hyperliquid and Arbitrum, the current trading heat of Hyperliquid and the lack of a native stablecoin mean that the vast majority of inflows and outflows can only rely on cross-chain bridges. This has also propelled Hyperliquid to seize the leading position in cross-chain bridge applications.

The second-ranked cross-chain bridge is USDT0; however, the main reason USDT0 made the list may still be due to statistical criteria. The data panel includes "issuer-level minting and burning migration" as part of "cross-chain bridge traffic." In simple terms, this means that the exchange and issuance of the stablecoin USDT across various chains are counted as cross-chain transaction volume.

Top Cross-Chain Bridge Rankings

Core Players Review: Differentiated Competition Among Three Major Protocols

The cross-chain bridges ranked third to fifth are Across, Stargate, and deBridge. These three cross-chain bridges better represent the market situation of cross-chain bridge protocols.

Across:

From the data, Across has a transaction volume of about $1.4 billion in the past month, with approximately 20,000 transactions. Across is a cross-chain bridging protocol based on UMA's Optimistic oracle, which completed a $41 million financing round led by Paradigm in March, with participation from well-known institutions such as Coinbase Ventures, Bain Capital Crypto, and Multicoin Capital.

In May, Across connected to the BSC ecosystem and launched one-click cross-chain swaps on PancakeSwap and KyberSwap. With the popularity of the BSC chain, it has seen a continuous increase in activity. In July, it released the V4 version upgrade, reducing the time to add new chain support from "weeks to months" to "hours." The current transaction volume level is about $46 million per day, roughly double the average level at the beginning of 2024. Across's average single cross-chain transaction size is about $4,718, supporting 19 chains.

From the perspective of ecological development strategy, Across's current strategy is to capture leading DEXs (PancakeSwap, KyberSwap) and make "cross-chain" a step in "swapping coins," while using V4 to increase the "speed of adding new chains."

Stargate:

Stargate is a composable liquidity transfer protocol built on the LayerZero messaging layer. Its transaction volume in the past month is about $990 million.

In 2025, Stargate's focus is on introducing optimizations and key Hydra mechanisms in the V2 version. Hydra expands liquidity from mature "core" chains to emerging L1/L2 by locking native assets in the core pool and minting fully homogeneous tokens on the target chain. This innovation allows new chains to receive liquidity for tokens like USDC/USDT/ETH directly from any connected chain without needing to set up pools everywhere first. One of Stargate's biggest advantages is the large number of supported chains; according to its official statement, it currently supports 80 chains.

However, Stargate's governance token STG has consistently performed poorly, declining since the beginning of 2024. In August 2025, the LayerZero Foundation proposed a $110 million acquisition proposal aimed at acquiring Stargate. This proposal plans to dissolve the Stargate DAO and discontinue the STG token, with all STG holders exchanging at a fixed ratio of 1 STG for 0.08634 ZRO tokens.

The public rationale for the proposal is to accelerate development, provide more resources for Stargate, and create a unified tech stack for the LayerZero ecosystem. Given that Stargate was initially developed by LayerZero Labs, this move is seen as "bringing the bridge home." However, there has been significant opposition within the STG community, with many believing that this offer severely undervalues Stargate's substantial revenue stream (expected annual revenue exceeding $1.4 million) and its historical transaction volume of over $70 billion. The proposal requires a 70% absolute majority to pass, and LayerZero insiders holding STG will abstain from voting. The voting for this proposal is expected to conclude on August 21.

Overall, maintaining "multi-chain coverage" remains Stargate's primary goal.

deBridge:

deBridge is a universal messaging protocol secured by an independent, elected network of validators that run nodes for all supported chains. deBridge's transaction volume in the past month is about $814 million, with over $13.4 billion in settled transaction volume.

deBridge is one of the most profitable cross-chain bridges, with revenues of $2.96 million in Q1 2025 and $2.06 million in Q2. The annualized expected fees exceed $19 million. On July 24, 2025, the deBridge Foundation announced the launch of a reserve fund, using 100% of the protocol's revenue to repurchase its native token DBR on the open market. Following this announcement, DBR experienced significant market stimulation, with several rapid increases of 50% in a short time, nearly doubling in price within days. However, such news-driven spikes have not stabilized the market, as prices quickly fell back after each surge.

In summary, the cross-chain bridge market in 2025 presents a complex situation of "macro heat, micro differentiation."

On one hand, under the transformation towards larger-scale capital deployment and transfer, the overall cross-chain transaction volume has reached a historical high, with Ethereum undoubtedly becoming the largest capital hub due to its strong consensus and liquidity. However, the other side of the data reveals that this prosperity is driven more by large transactions rather than a broad increase in user numbers, indicating that cross-chain activities are shifting from retail speculation to deeper capital flows.

On the other hand, competition among cross-chain protocols has transcended mere transaction volume contests. Applications like Hyperliquid and USDT0, while ranking high on the list, reflect specific business needs or statistical criteria rather than fully representing the true market landscape of general cross-chain bridges. The real focus is on core protocols like Across, Stargate, and deBridge, which are engaged in a comprehensive battle over technical architecture, ecological integration, and economic models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。