Taking BNB as a representative case, this report delves into its economic model, on-chain applications, and valuation logic.

Authors:

Jessica Feng, Investment Manager of Hash Global BNB Fund;

James (KK) Shen, Founder of Hash Global.

CZ (Founder of Binance):

“I am not an expert in valuation models, but Hash Global's previous estimates have all been realized. The value composition of a token should have many facets; if such a simple formula can capture all value manifestations, that would be impressive. Market prices often deviate from fundamentals, sometimes too high, sometimes too low. Binance will continue to build and create the fundamentals of BNB's value, while experts like Hash Global can assess the market price.”

Liang Xinjun (Co-founder of Fosun Group):

“I have collaborated with the Hash Global team for many years. One aspect I appreciate about the team is that while their investments may sometimes have missteps, their decisions are always based on rational analysis and judgment rather than blind faith. They discussed the value of the Binance ecosystem and BNB with me early on, and I participated in their node staking and BNB fund investments quite early, which yielded good returns. I have seen many institutional analysis reports on Bitcoin and Ethereum; in terms of BNB, I believe Hash Global's analysis is among the earliest and best in the industry.”

Chen Long (Secretary-General of Luohan Academy, Founder of Xie, former Chief Strategy Officer of Ant Financial):

“Although Web3 is increasingly becoming a new pillar of the financial system, there is a lack of consensus on how to value digital assets. Hash Global has proposed a very valuable perspective based on the monetary equation analysis framework.

If a country's money supply grows in sync with economic growth, it will not lead to inflation, which is the well-known benefit of seigniorage. This means that economic transaction activities require the lubricating function of money. With a stable velocity of money circulation, the overall value of money will synchronize with the volume of economic transactions.

Based on this reasoning, the monetary equation analysis framework can estimate the total value of ecological tokens around transaction volume. This method is based on many assumptions, but the logic is grounded in fundamentals, representing a clear advancement over most digital asset valuation logics, and is worth continuous exploration and refinement. Returning to the first principles of value creation is a good starting point.”

Wang Jingbo (Founder of Noah Wealth):

“As the largest wealth management platform serving the global Chinese community, Noah has always focused on the emergence and value of new asset types. The U.S. and Hong Kong are vigorously promoting the improvement of digital asset regulatory frameworks, and we observe that digital assets are being accepted by mainstream markets. We place great importance on guiding and helping investors to learn and understand the value of digital assets at the first opportunity. Over the past two years, we have invited the Hash Global team several times to share with our investors. Their research and analysis on 'value functional tokens' have provided us with many refreshing perspectives and insights. Their attitude and methods are worth paying attention to and emulating.”

Wei Zhijie (Head of KGI International Wealth Management):

“I have worked in the wealth management industry for many years, helping various family offices with intergenerational inheritance and asset allocation. KGI has noticed the optimization effect of digital assets on the risk-return ratio of portfolio allocation and is guiding clients to rationally recognize and accelerate the allocation of digital assets. We are particularly focused on functional tokens that have clear economic models and real application scenarios. Hash Global's innovative research in this new asset field has inspired us greatly, and we are discussing the value of these assets with them, jointly promoting traditional financial investors' understanding of the value of these assets.”

I. Introduction

In recent years, the rapid development of Web3 financial infrastructure is reshaping the operational rules of capital markets. Its programmability and openness are also reconstructing the sources of asset value, driving the emergence of a new type of asset. This new type of asset not only carries traditional equity value, representing the value mapping of platforms, protocols, or ecosystems, but also possesses clear utility value, which can be used for paying fees, obtaining service discounts, unlocking access permissions, etc. This report collectively refers to these new types of assets as "value functional tokens," representing composite asset carriers that possess both "asset attributes" and "usage rights."

The emergence of new assets is driving the evolution of the concept of "value" itself, and the valuation methodology of value investors must also evolve accordingly, just as the internet revolution in the early 21st century brought about a new logic for valuing internet stocks. Early advocates of value investment in crypto assets, such as John Pfeffer, proposed: “The first principle of value investing is independent thinking based on reliable valuation logic. When new types of assets first emerge, there is no corresponding valuation logic; value investors should strive to discover new valuation logic.”

We believe that the most representative value functional token currently is Binance's platform token—Binance Coin (BNB). BNB reflects platform value on one hand and possesses actual utility value within the ecosystem on the other, making it the earliest and most mature example of such assets. Binance completed the token economic design of BNB as early as 2017, defining the asset class of value functional tokens. In 2019, we adhered to the first principles of value investing and proposed a valuation framework based on the monetary equation (MV = PQ) to assess the value generation logic of BNB and value functional tokens.

Over the past six years, we have released five reports, receiving numerous inquiries and feedback from investors and institutions. We continuously optimize our model, which has also received preliminary validation from the market. We now organize this methodology as follows, hoping to assist asset management institutions, investors, industry researchers, and project parties in their analysis and decision-making regarding investment evaluation, asset pricing, and token economic design for value functional tokens.

Web3 distributed ledger technology has already and will permanently change the foundation of capital markets. A more efficient and transparent Web3 financial system will undoubtedly become the core of future financial infrastructure. As the global regulatory framework for crypto assets continues to improve, such as the recent passage of the "Digital Asset Market Structure Clarification Act" (the "CLARITY Act") in the U.S., and the introduction of stablecoin legislation in both the U.S. and Hong Kong, we believe that we will see a large emergence of value functional tokens represented by BNB, just as Tesla issues new "stocks," which will be value functional tokens issued on Ethereum or Binance Smart Chain, not only having "equity value" but also allowing discounts for charging at charging stations using ecological tokens. We look forward to value functional tokens becoming the primary form of asset carriers in future capital markets!

II. Definition and Characteristics of Value Functional Tokens

The value functional tokens defined in this report refer to crypto assets that possess the following two types of value foundations simultaneously:

Asset Attributes/Equity-like Attributes: Represent the value mapping of a certain platform, protocol, or ecosystem. Its value is usually driven by macro factors such as ecosystem scale, user growth, and transaction activity, logically similar to company equity.

Functional Attributes/Currency-like Attributes: Play actual roles in specific usage scenarios, such as paying fees, gas fees, staking, participating in governance, exchanging services, or enjoying platform discounts.

For this type of asset, the report chooses to construct a valuation model based on the monetary equation (MV = PQ), mainly considering the following two points:

First, although value functional tokens possess certain "equity-like" characteristics, their asset attributes still differ from traditional securities. Taking BNB as an example, this token does not represent any form of equity or cash flow rights in Binance. From the perspective of ecological development, the founding team of Binance has bound the interests of all participants in the ecosystem (shareholders, management, users, and other ecosystem stakeholders) together since the project's inception, placing the growth of ecological value on the unique token BNB, embodying the spirit of ecological co-construction and sharing that Web3 advocates. Since 2021, Binance has further adjusted the BNB burn mechanism from "profit-linked buyback and burn" to "automatic burn based on on-chain transaction volume," actively severing the direct link between token value and platform financial performance to avoid securities risks.

In 2025, the CLARITY Act issued by the U.S. will further clarify the distinction between "digital commodities" and "security tokens." Under this regulatory direction, we believe that future value functional tokens will be designed to lean towards "digital commodities." While they may derive value support from traditional equity value, their design avoids the standards of "investment contracts" and the Howey test for securities tokens. Therefore, such tokens do not possess the legal characteristics of traditional equity-like assets; in terms of valuation methodology, they cannot be directly assessed using cash flow discount-based corporate valuation models.

On the other hand, the value of functional tokens primarily comes from their actual usage scenarios within the ecosystem. They perform functions such as payment, gas, staking, participating in governance, etc., essentially acting as circulating currency within the economy. Their value is influenced by multiple factors, including the scale of ecological economic activities, token usage frequency, and supply adjustment mechanisms. Therefore, compared to securities valuation methods, the monetary equation is more suitable for capturing the "currency-like" attributes of these tokens and modeling the diverse sources of value within a unified logical system.

In summary, the core advantage of using the monetary equation to value value functional tokens lies in the fact that this model provides a clear structure, quantifiable variables, and strong adaptability, capable of comprehensively covering all sources of value for such tokens.

III. Building the Valuation Model

This methodology constructs a systematic valuation model suitable for value functional tokens by combining the monetary equation (MV = PQ) with the Discounted Cash Flow (DCF) method:

MV = PQ: Used to construct the structural logic framework for token value generation

+

DCF: Discounts and sums the "monetary appreciation" brought by future ecological expansion, converting it into the current theoretical price of the token.

3.1 Introduction to the Monetary Equation (MV = PQ)

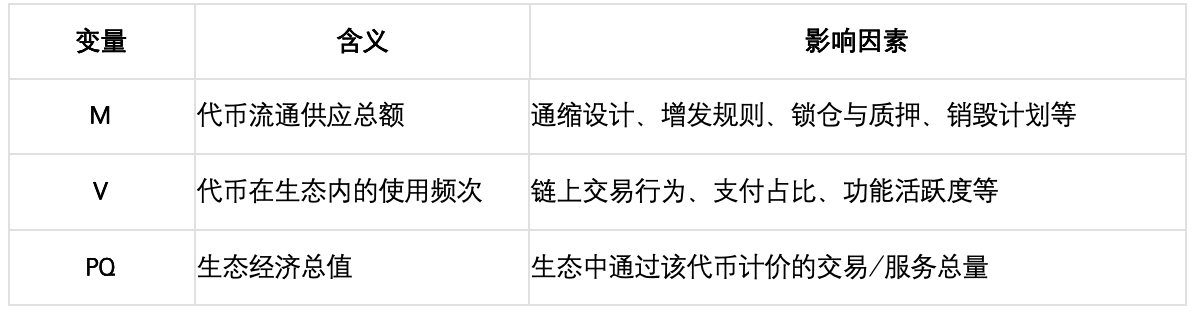

The quantity theory of money was proposed by economist Irving Fisher and is a classic theory explaining the relationship between the total money supply and economic activity. In this equation:

· M: Money Supply

· V: Velocity of Money

· P: Price Level

· Q: Total Transactions or Total Output Value

In traditional macroeconomics, MV represents total money demand, while PQ represents nominal economic output, and both should remain consistent in a long-term equilibrium state.

We believe that for functional tokens with actual usage scenarios in on-chain ecosystems, their economic role is highly similar to "currency within the ecosystem." Their value primarily comes from the expansion of ecosystem scale and changes in the token supply-demand structure, aligning closely with the logic of the monetary equation. This model is particularly suitable for tokens with the following characteristics:

Serving as the main medium of payment within the ecosystem (such as fees, gas, etc.);

Having a transparent issuance system, deflationary design, or lock-up mechanism that affects effective circulation;

Their value primarily based on the development of ecological activities.

3.2 Structural Modeling Based on the Monetary Equation

Under the MV = PQ framework, the theoretical value of a token is driven by two main paths:

· PQ: The total economic value of the ecosystem

· M × V: Represents the token supply and its velocity

Any variable that affects the token's value (such as the number of users, transaction volume, burn mechanisms, etc.) ultimately impacts the token price through its effect on PQ or M × V.

Among these, V (velocity) is a technical challenge in modeling. Due to the lack of directly observable data, it is often assumed in actual valuations that the initial market price reflects a reasonable equilibrium state, and then V is inferred from known PQ and M, assuming that this velocity remains stable or moderately increases or decreases in the future.

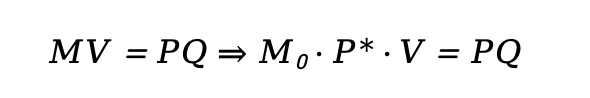

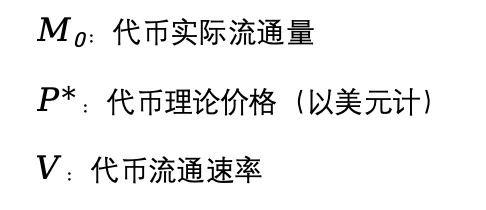

Theoretical price derivation:

Unlike general national fiat currencies, the price of ecosystem tokens is usually denominated in USD. Therefore, in the model, the total circulating supply of the token (M) can be broken down into:

Where:

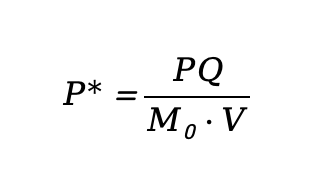

Rearranging gives:

The total value of the ecosystem (PQ) divided by the token circulation and velocity gives the theoretical price of the token. This formula serves as the valuation foundation of this model.

3.3 Introducing Discounted Cash Flow (DCF) for Quantitative Valuation

The monetary equation provides a logical framework for the token value generation mechanism but does not directly output a price. Based on this, we further introduce the Discounted Cash Flow (DCF) method. By forecasting the growth of the total ecological economy and combining changes in token supply and velocity, we calculate the annual increment of the token's unit value and discount and sum the future value to obtain the theoretical valuation. This process can also be understood as calculating the present value of "monetary appreciation."

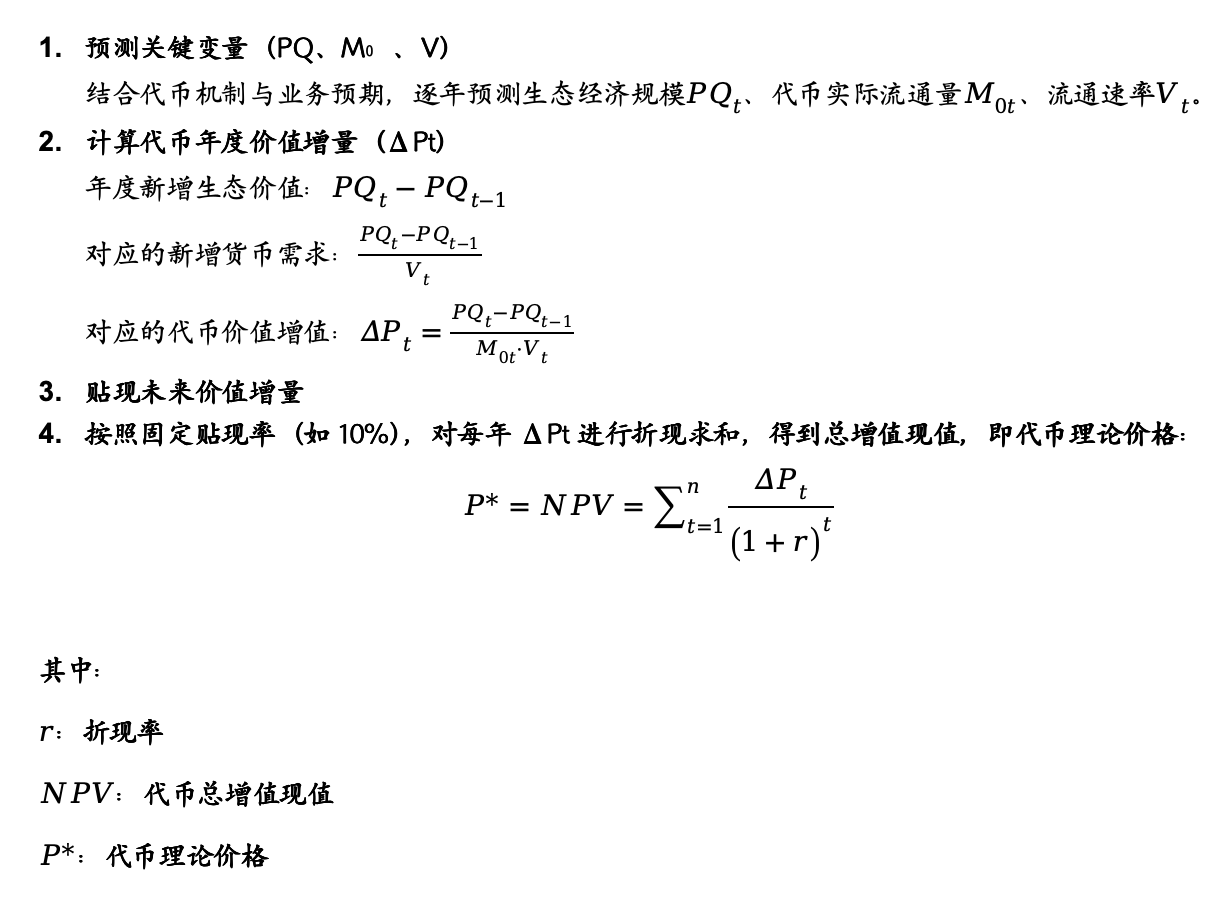

The specific steps are as follows:

IV. Valuation Case: Taking BNB as an Example

To demonstrate the applicability of this valuation method in practice, we take BNB as an example and apply our proposed “MV = PQ + DCF” model for quantitative valuation analysis.

4.1 BNB as a Value Functional Token: The Monetary Equation is the Best Valuation Model

BNB is the core value carrier of the Binance ecosystem (Binance Exchange + BNB Chain) and has two sources of value:

Asset attributes/equity-like attributes: The economic model of BNB integrates the value creation logic of traditional finance. Just as U.S. stocks enhance shareholder equity through stock buybacks, BNB continuously reduces its circulating supply through a quarterly burn mechanism, creating a long-term deflationary trend on the supply side, providing stable support for the token price. However, unlike traditional equity, BNB's burn mechanism is not linked to platform profits but is anchored to its supply-demand relationship within the ecosystem. Therefore, BNB is not strictly an equity asset but possesses a "quasi-equity" attribute—constructing a value mapping relationship between BNB and the Binance ecosystem by reducing the actual circulating amount of BNB through burns.

Functional attributes/currency-like attributes: BNB has various use cases within the Binance Exchange and public chain ecosystem, including paying fees, participating in new token offerings, serving as Gas Fee, and participating in governance. BNB has essentially become the "circulating currency" of the entire ecosystem, and its value depends on changes in the scale of the ecological economy and the supply-demand relationship of the token within the ecosystem.

In summary, as the circulating currency of the ecosystem, the value of BNB primarily depends on the currency supply-demand relationship (MV) and the ecological economic value (PQ). Therefore, the monetary equation can comprehensively capture the core value drivers of BNB, making it the best valuation model.

4.2 BNB Valuation Calculation

The analysis will focus on the following three core steps:

Define and forecast key variables PQ, M₀, V

Calculate the annual value increment ΔPt of the token

Use the discounted cash flow method to discount and sum the future incremental value

Define and Forecast Key Variables: PQ, M₀, V

Total Ecological Economic Value PQ

The Binance ecosystem mainly includes the Binance Exchange and BNB Chain, so PQ is the total economic activity value driven by BNB in these two parts, mainly including:

The portion of trading fees from spot and derivative trading on the Binance centralized exchange (CEX) paid in BNB (trading volume × fee rate × proportion paid in BNB (assumed to be 50%));

BNB Chain Gas fees (total on-chain Gas revenue).

In the estimation, we assume the annual growth rate of the ecological economy to be the following values, summarizing to obtain the nominal total economic value PQt for future years.

· 2025–2027: 25%, 15%, 10%, respectively;

· 2028 and beyond: a long-term stable growth rate of 3%.

Total Circulating Token Supply M₀

According to the Binance white paper and on-chain data, the initial total supply of BNB is 200 million tokens. After deducting team-locked holdings (approximately 80 million tokens) and historical cumulative burns (approximately 11.65 million tokens), the current theoretical circulating supply is about 108 million tokens. Based on Binance's current burn mechanism and future burn predictions, it is expected that the circulating supply will remain at this level between 2025 and 2027 and gradually stabilize to 100 million tokens in the long term. This is the maximum supply available for secondary market trading without ecological use.

On this basis, further excluding the four major ecological locking scenarios (fee payments, node staking, financial products, long-term value holding), we can derive the actual circulating supply M₀t.

Velocity V

The velocity of BNB is difficult to measure directly. We use a reverse calculation method: by using the actual market price in 2024, PQ, and M₀, we derive a benchmark value for V of 0.57. For future years, we can set a ±10% range and verify its impact on valuation in subsequent sensitivity analyses.

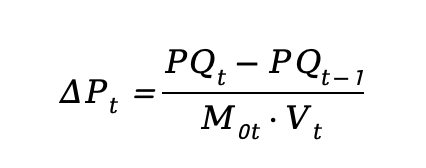

- Calculate Annual Value Increment ΔPt

According to the formula from the previous section:

We calculate the new ecological value added each year and divide it by the actual circulating scale of BNB and its velocity for that year to obtain the theoretical value increment per token each year.

Based on the actual data from 2024, assuming future growth rates of 25%, 15%, 10%, and a long-term rate of 3%:

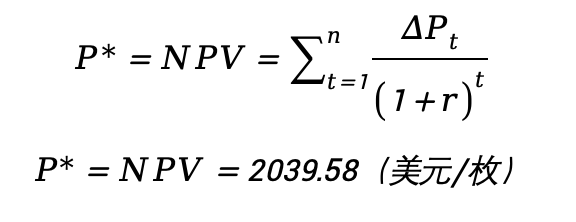

- Value Discounting and Summation: Calculate Theoretical Valuation

Using a discount rate of 10%, we discount each year's value increment ΔPt to obtain the total present value of all future "monetary appreciation":

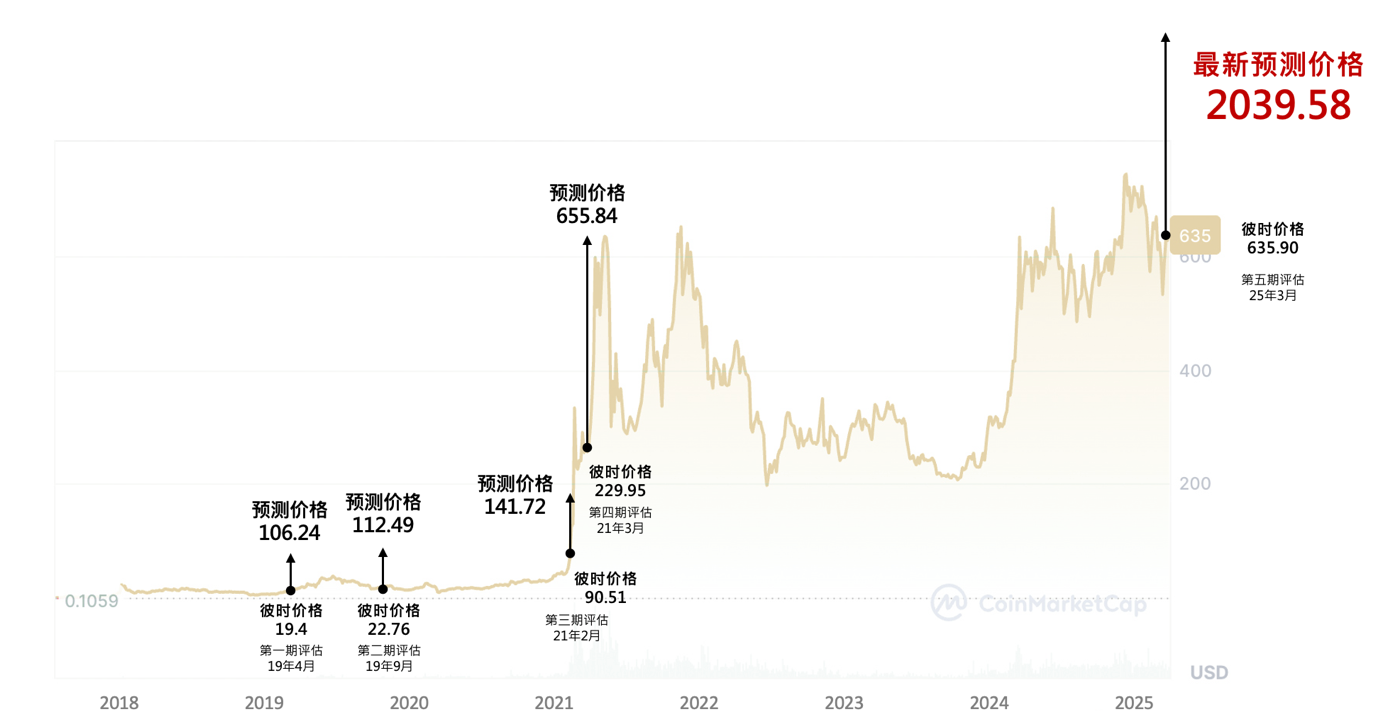

4.3 Hash Global's Previous Four Reports - BNB Target Price Achievement Timeline

V. Conclusion

This report uses BNB as a case study to propose the concept of "value functional tokens" as an asset class and constructs a systematic valuation framework based on the monetary equation. We hope this framework can provide references and insights for project parties in token economic design, investors in value judgment, and researchers in model evaluation.

As the Web3 industry is still in a phase of rapid evolution, we will continue to update our models and research findings. We welcome investment institutions, researchers, and developers to discuss and provide feedback on the report's content.

For updates on the report, model details, or further communication, please visit our official website or contact team members. We look forward to your feedback and suggestions:

• Official website: www.hashglobal.io

• Authors' Twitter: @longwinsk, @Jf4172

• Contact email: contact@hashglobal.net

Disclaimer

This report aims to share information and does not constitute any investment advice, nor should it be viewed as a guarantee of future market performance. This report is based on Hash Global's independent research and publicly available information, and we have made every effort to ensure the accuracy and completeness of the data and analysis. However, we make no commitments or guarantees regarding the applicability of the final results or opinions. Investing in crypto assets carries a high degree of uncertainty and volatility; readers should fully understand the associated risks and assume all responsibility before making any investment decisions. Hash Global and its related personnel are not responsible for any direct or indirect losses arising from the use of this report's content.

As of the date of this report's publication, Hash Global and its managed funds hold some BNB assets, and the related analysis and opinions may be influenced by these holdings. We will continue to track related assets based on market dynamics and update research content as necessary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。