This year, Ethereum spot ETFs listed in the United States have attracted over $6.7 billion in net inflows.

Written by: Long Yue, Wall Street Insights

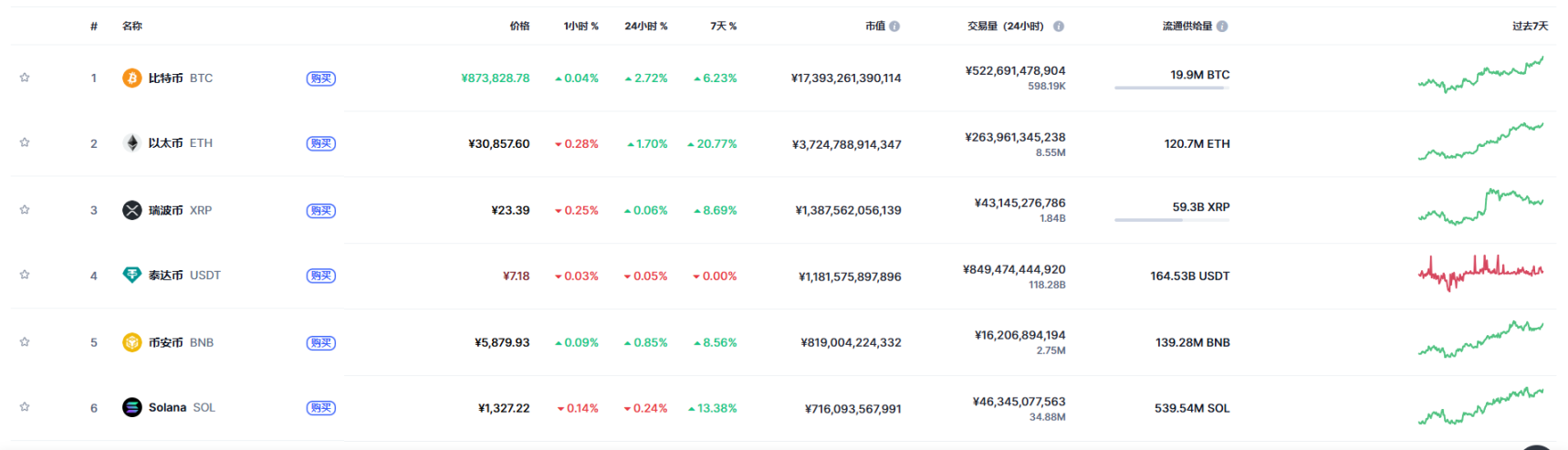

As the second-largest cryptocurrency by market capitalization, Ethereum (Ether) outperformed other major digital assets over the past weekend.

On Monday during the Asian trading session, its price rose by 2.9%, breaking through $4,300, reaching its highest level since December 2021. Over the past 7 days, Ethereum has accumulated a gain of over 20%. Meanwhile, Bitcoin's price also surpassed $121,000 today, approaching its historical high.

Behind this surge is the growing interest from large investors. Data shows that since the beginning of this year, nine Ethereum spot ETFs listed in the U.S. have collectively attracted over $6.7 billion in net inflows. Additionally, so-called "digital asset financial companies"—those that have shifted their business focus to accumulating cryptocurrencies—have also fueled Ethereum's rise. According to data compiled by strategicethreserve.xyz, these companies have so far accumulated approximately $13 billion worth of Ethereum.

Sean McNulty, head of derivatives trading for the Asia-Pacific region at digital asset brokerage FalconX Ltd, stated that funds are flowing from Bitcoin to Ethereum, constituting a "significant positive sentiment shift driven by strong spot ETF inflows, increasing corporate financial adoption, and broader tailwinds from stablecoins."

The options market also reflects bullish sentiment, with Ethereum's overall put-call ratio at 0.39. According to Deribit data, call options expiring on December 26 are heavily concentrated at a strike price of $6,000.

Interestingly, Eric Trump, son of U.S. President Donald Trump, praised Ethereum's upward trend on the X platform. According to Bloomberg last Friday, large investors are discussing plans by World Liberty Financial, a company supported by the Trump family, to establish a publicly traded company holding its WLFI tokens.

ETF Fund Flow Reversal

Changes in fund flows are the most direct reflection of market sentiment. An article from Wall Street Insights noted that since May, U.S. Ethereum spot ETFs have consistently recorded net inflows, significantly outperforming Bitcoin in recent times. Data shows that during six consecutive trading days in late July, the total net inflow for Ethereum ETFs approached $2.4 billion, far exceeding the $827 million for Bitcoin ETFs during the same period.

This trend is also reflected in price performance and the derivatives market. Over the past few weeks, Ethereum has consistently outperformed Bitcoin, with the price ratio of the two rebounding strongly from a low not seen since 2019. Meanwhile, the annualized premium of Ethereum futures on the Chicago Mercantile Exchange (CME) relative to spot has exceeded 10%, surpassing Bitcoin's level, prompting some traders to shift positions from Bitcoin to Ethereum.

Is Market Dominance Shifting from Bitcoin to Ethereum?

Following several companies adopting Bitcoin as a financial reserve asset, a similar trend is now emerging with Ethereum. Goldman Sachs' crypto team pointed out that, similar to the increasing number of companies incorporating Bitcoin into their financial reserves, some U.S. listed companies have recently begun to establish Ethereum reserves. It is estimated that these companies have collectively purchased over $1.5 billion in ETH over the past month.

At the same time, Ethereum has significantly outperformed Bitcoin in recent weeks, with the price ratio of the two rebounding strongly from the previously established low not seen since 2019. The annualized premium of Ethereum CME futures relative to spot has exceeded 10%, surpassing Bitcoin's level, prompting some positions to shift from Bitcoin to Ethereum.

Swiss blockchain research firm Swissblock expects this trend to continue, believing that "as the market enters a new cycle, ETH is replacing BTC as the market leader."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。