Financial Law + Business, Comprehensive Analysis!

Written by: Meg, Zhao Qirui

"The long-term scale of the global stablecoin market is expected to reach between $1.4 trillion and $3.7 trillion, with USD stablecoins holding an absolute dominance. Against this backdrop, the success of RD Technologies is not measured by a market share in the hundreds of billions. Its true target market is to leverage a foreseeable, multi-billion dollar segmented market in scenarios such as cross-border trade in the Greater Bay Area, RWA, and the internationalization of the Renminbi."

1. Introduction

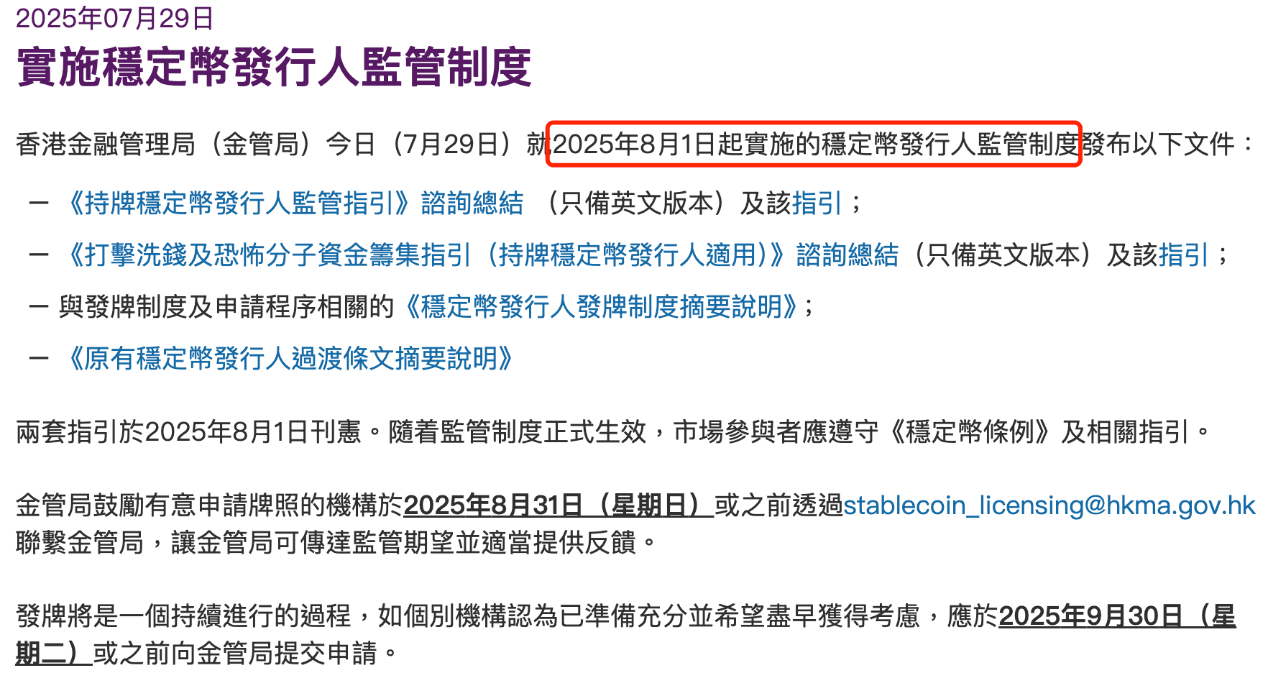

With the regulatory system for stablecoin issuers under the "Stablecoin Regulation" coming into effect on August 1, 2025, the issuance of fiat stablecoins has become a regulated activity that requires a license. Meanwhile, on July 30, 2025, it was reported that RD Technologies successfully completed nearly $40 million in Series A2 financing, led by ZhongAn International, Zhongwan International, Brilliant Investment, and Hivemind Capital, with participation from Sequoia China. This round of financing follows the $7.8 million Series A1 financing in September 2024, demonstrating investors' confidence in its vision of promoting digital currency trading and asset tokenization through secure, enterprise-grade stablecoin infrastructure.

How does RD Technologies stand out amidst policy benefits and market competition? Let us explore from financial, legal, and business perspectives.

2. RD Technologies: Overview + Financing Background

RD Technologies, founded in 2021 by former Hong Kong Monetary Authority President Norman Chan, has shareholders including HashKey, ZhongAn International, and Sequoia China, possessing advantages in the integration of Web3 and traditional finance.

Financing Background: Series A2 financing details: $40 million, led by ZhongAn International, Zhongwan International, Brilliant Investment, and Hivemind Capital, with participation from Sequoia China. The funds will be used to expand platform capabilities and compliance preparations.

The Series A2 financing features a strong lineup of investors, with ZhongAn International being an active participant in the Web3 space. The Hong Kong "Stablecoin Regulation," effective August 1, 2025, provides a clear regulatory framework for stablecoin issuance, and ZhongAn Bank is actively involved in this process.

ZhongAn International and ZhongAn Bank are both part of ZhongAn Online, focusing on technology investment and compliance financial services, respectively, to collaboratively promote the development of the crypto industry. ZhongAn International invests in projects like RD Technologies to lay out its Web3 strategy, while ZhongAn Bank provides payment and compliance support, jointly facilitating the development and application of HKDR.

3. Hong Kong Stablecoin Policy and Market Opportunities

The Hong Kong Legislative Council passed the "Stablecoin Regulation Bill" on May 21, marking the official establishment of a licensing system for fiat stablecoin issuers in Hong Kong.

Internationally, stablecoin legislation is also accelerating. The U.S. Senate passed a key procedural vote on the "Guidance and Establishment of a National Stablecoin Innovation Act" on May 20, which may complete legislation by the end of the year. The UK released regulatory proposals on May 27 regarding stablecoin issuance, crypto asset custody, and the financial soundness of crypto asset companies. In March, Japan refined its regulatory adjustments for crypto assets and stablecoins.

As of August 3, 2025, the Hong Kong Monetary Authority has not issued any stablecoin licenses. The HKMA adopts a high threshold, strict regulation, and steady progress attitude towards stablecoin licenses, initially expected to issue single-digit licenses (about 3-5), with the first batch of licenses expected to be issued in early 2026. The regulatory framework emphasizes financial stability and anti-money laundering while balancing innovation, but high compliance costs and a cautious pace may limit short-term market activity.

However, the current regulatory requirements are quite stringent, with the following requirements for stablecoin licensing:

- Any institution issuing fiat stablecoins in Hong Kong or claiming to anchor the value of the Hong Kong dollar must apply for a license from the HKMA.

- Applicants must be companies registered in Hong Kong or overseas "recognized institutions" and meet high capital and financial requirements, with paid-in capital not less than the specified amount.

- Stablecoins must be backed by equivalent high-liquid assets (such as Hong Kong dollar cash, short-term bonds, or U.S. dollar deposits, U.S. Treasury bonds), with reserve assets needing to be isolated and subject to independent audits, and algorithmic stablecoins are prohibited.

- Licensed institutions must comply with anti-money laundering and terrorist financing guidelines, deploy smart contracts for real-time transaction monitoring, and ensure the safety of customer assets.

In other words, if an entity issues fiat stablecoins in Hong Kong or claims to anchor its business to the Hong Kong dollar, it must apply for a license; otherwise, it is considered illegal operation. The registration requirement is either in Hong Kong or as an overseas "recognized institution." Current market conditions indicate that companies intending to apply for stablecoin licenses in Hong Kong prefer to register in Hong Kong, as they are concerned that future policy changes in third countries may affect their business development.

The high compliance requirements for stablecoin issuers, along with the requirements for the liquidity of underlying assets, serve as a sort of "commercial moat." RD Technologies, as one of the first participants in the HKMA's "Stablecoin Issuer Sandbox," has entered the testing phase and plans to issue HKDR on the Ethereum public chain. ZhongAn Bank collaborates with RD Technologies to test the HKDR stablecoin backed by Hong Kong dollar reserves.

ZhongAn International's VASP license and ZhongAn Bank's virtual banking license form a compliance closed loop, meeting the HKMA's strict requirements for stablecoin issuers (transparency of reserve assets, regular audits) and virtual asset services. RD Technologies relies on ZhongAn Bank's virtual banking license and payment system to provide technical and compliance support, while the bank's cross-border payment and retail settlement services can provide application scenarios for HKDR.

As an international financial center, Hong Kong, with its hub position in the Greater Bay Area, strict stablecoin regulatory framework, and the stability of the Hong Kong dollar, provides advantages for the development of Hong Kong dollar stablecoins. Hong Kong dollar stablecoins can reduce costs and improve efficiency in cross-border trade, especially with significant potential in the Greater Bay Area and Renminbi internationalization scenarios. Retail payment applications are limited by the local market size and need to rely on the development of cross-border consumption scenarios. Compared to USD stablecoins, Hong Kong dollar stablecoins have compliance and localization advantages in the Asia-Pacific region, but global competition is limited by market size and acceptance, primarily serving as a regional supplement in the short term.

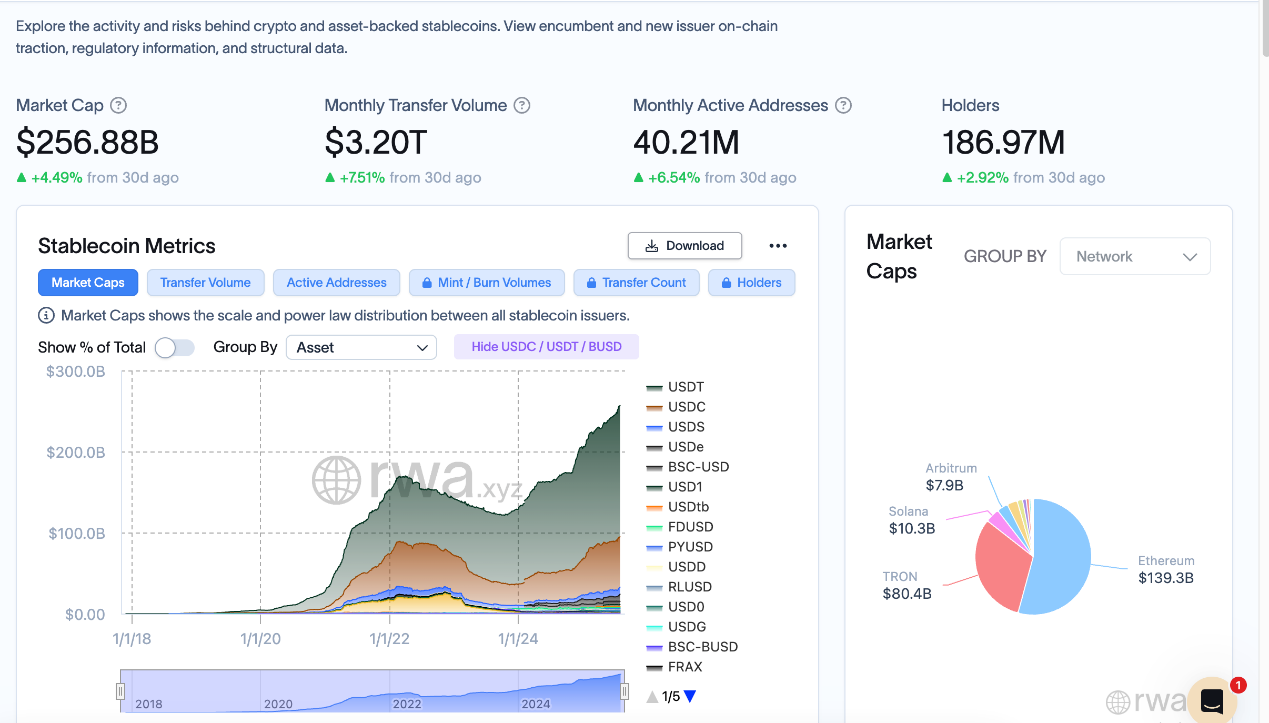

Looking ahead: Although USD stablecoins (such as USDT, USDC) currently account for over 90% of the global stablecoin market share (as of August 3, 2025, the global stablecoin market value is approximately $250 billion, with USDT accounting for about 60%), the market size of Hong Kong dollar stablecoins is limited by the circulation of the Hong Kong dollar (approximately HKD 400 billion, about $50 billion). However, Hong Kong dollar stablecoins have localization advantages in the Asia-Pacific region, especially in the Greater Bay Area and "Belt and Road" countries, and can combine with Renminbi tokenization to attract markets looking to reduce dependence on the USD (such as Southeast Asia and the Middle East), forming differentiated competition in specific scenarios.

Cited data source: https://app.rwa.xyz/stablecoins

4. RD Technologies: Business Model + Competitive Advantages

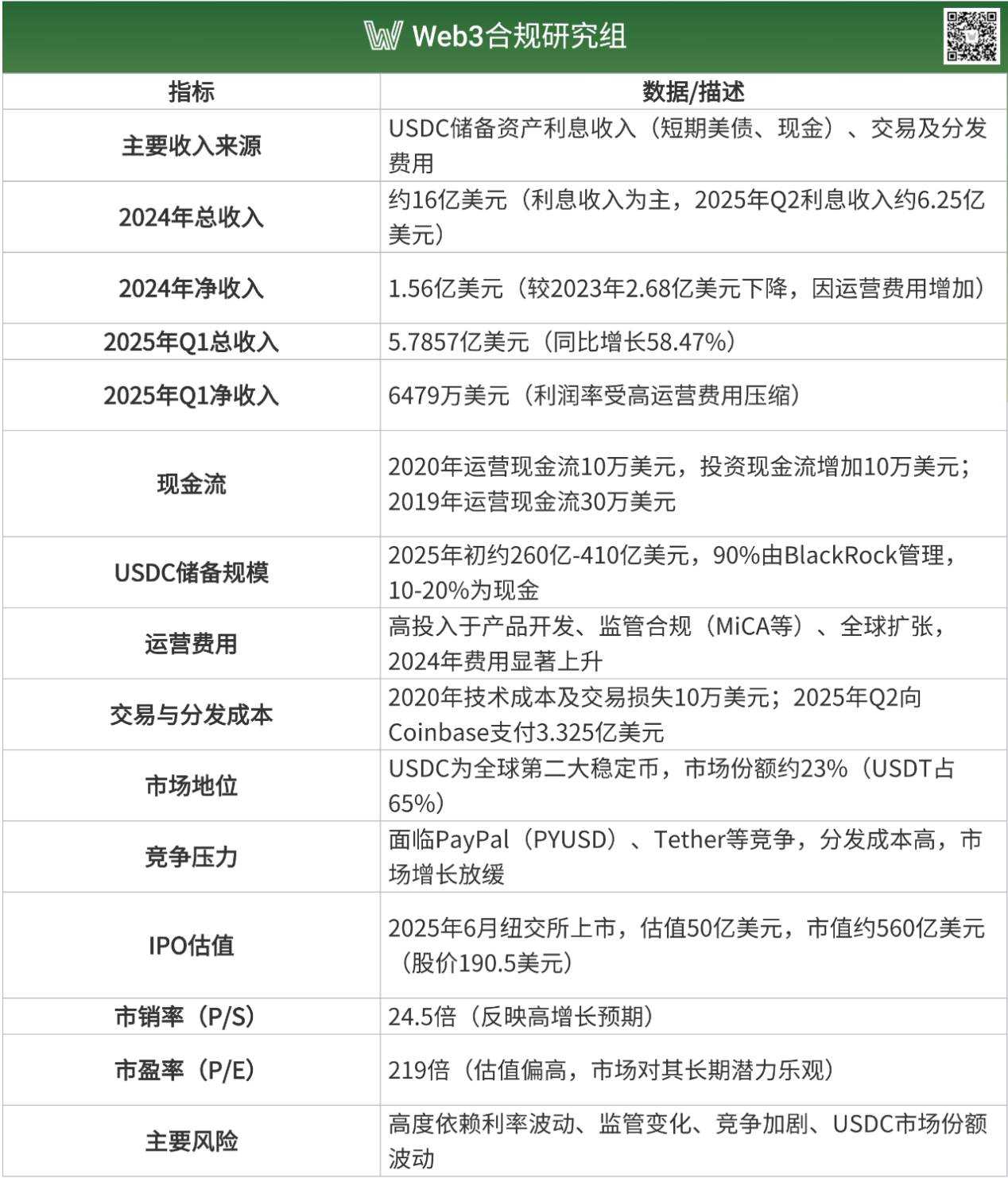

We benchmark the financial data of the U.S. stablecoin company Circle to illustrate the opportunities for RD Technologies.

The business model of stablecoin issuers is quite simple and understandable, but not everyone can execute it. It disrupts the traditional bank's interest margin model (traditional bank gross profit = loan interest income - deposit interest expense), where the gross profit of stablecoin issuers = interest income - channel costs (or marketing costs).

Currently, retail investors or users receive zero interest income and do not benefit from the interest income dividends from stablecoin issuers purchasing U.S. Treasury bonds, making it evident that the current profit margins of stablecoins are much higher than those of traditional banks! Circle (the issuer of USDC) reported a net profit of $156 million in 2024, with 99% coming from reserve interest.

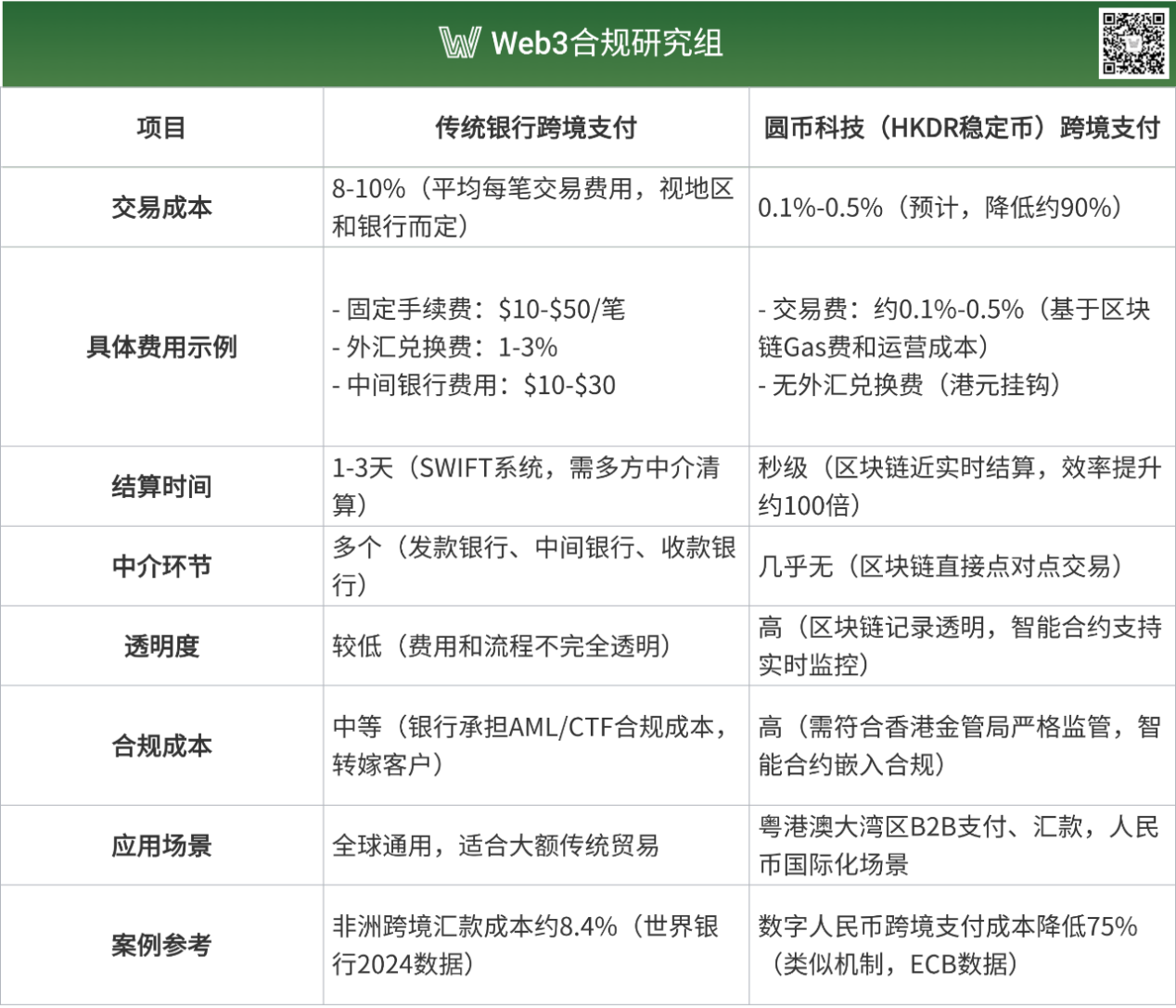

RD Technologies focuses on cross-border payments, achieving near real-time settlement (settlement in seconds, while traditional banks take 1-3 days) based on blockchain technology, automating transaction processes through smart contracts, and reducing intermediary steps. It is said to enhance efficiency by 100 times and reduce costs by 90% (as estimated in the table below).

Traditional Banks vs. RD Technologies Cross-Border Payment Costs and Efficiency

RD Technologies has shareholders like HashKey (licensed exchange) and ZhongAn International (payment experience), focusing on bridging the Web3 ecosystem with traditional finance, allowing for more flexible positioning. Its strategic cooperation with ZhongAn Bank enhances its ecosystem integration capabilities, while JD-HKD, backed by the e-commerce giant JD, focuses on retail and cross-border payments, each with its strengths.

5. Challenges + Risks

The development path of RD Technologies is not merely about facing a series of isolated challenges but confronting a systemic dilemma woven from compliance, competition, technology, and geopolitical risks. Its core challenge lies in the compliance barriers that must be constructed for survival, which, through a transmission effect, internalize into high operational costs, directly weakening its competitive ability under the shadow of giants and forcing its technological choices, which in turn brings about new performance and cost contradictions. All of this is ultimately constrained by structural pressures in the global macro economy.

(1) As an Inescapable Compliance Shackles

The regulatory framework in Hong Kong provides a legitimacy foundation for RD Technologies, but this foundation comes at the cost of heavy, non-transferable expenses. This cost is akin to a custom heavy armor that, while providing protection, severely limits agility in action.

Firstly, compliance directly translates into financial pressure and strategic rigidity. The requirement of HKD 25 million in paid-in capital and 100% high-quality liquid asset reserves means that a large amount of capital is locked in before the product can achieve scaled revenue. This is not only a financial burden but also a direct stifling of strategic flexibility. During a critical window period that requires rapid iteration, market education, and user acquisition, this capital lock-in will make it difficult to compete with well-funded giants.

Secondly, compliance comes at the cost of efficiency, creating inherent friction with the core value of the product. Regulatory requirements mandate that all stablecoin transactions must go through regulated exchanges and impose additional risk controls on non-custodial wallets. While this design minimizes money laundering risks, it dulls the "low cost, high efficiency" advantages that blockchain technology should inherently possess. When the cross-border payment scenarios it promotes fall short of expectations due to compliance processes, "compliance" may become a barrier to market adoption rather than a facilitator.

(2) The Shadow of Giants Over the Current Market

The pressure of compliance costs is further amplified in the brutal market competition. The stablecoin sector has evolved from a crypto-native game into a battleground dominated by giants and financial institutions. RD Technologies faces not only the challenge of breaking the existing pattern but also the need to fend off the dimensional attacks from emerging giants.

The Gravitational Field of USD Stablecoins: USD stablecoins, led by USDT and USDC, have formed a powerful network effect. Their deep liquidity, extensive protocol integration, and entrenched user habits create an insurmountable barrier. For RD Technologies, this means that HKDR must offer significant additional incentives to persuade users to switch tracks, which will undoubtedly continue to erode its already thin profit margins.

Dimensional Attacks from New Giants: The real survival threat comes from tech giants (like JD.com and Ant Group) and traditional financial institutions (like Standard Chartered Bank) entering the market. The former possess vast user bases, mature payment networks, and substantial capital, allowing them to quickly capture market share through subsidy wars and scenario bundling. The latter holds natural trust endorsements and a large corporate client base; once they issue stablecoins, they will easily attract B2B clients with the highest compliance requirements, making RD Technologies' "compliance" advantage no longer unique.

To illustrate this competitive landscape more clearly, the table below summarizes the specific threats posed by major competitors:

Major Competitors

(3) The Dilemma of Technology Choices

Under the dual pressures of compliance and competition, RD Technologies' choice of technology route—issuing HKDR on the Ethereum public chain—also constitutes a new dilemma. This strategic decision, aimed at accessing a vast ecosystem, creates an irreconcilable internal contradiction in the core scenario of B2B payments.

This manifests as a "trilemma" reality: Ethereum's decentralization and security come at the cost of scalability. Its network congestion and fluctuating gas fees contradict the core demands of cross-border trade for "low cost, high efficiency, and high stability."

While Layer 2 solutions are seen as a potential way out, they resemble a trade-off of new problems for old ones. While alleviating performance bottlenecks, they introduce new challenges such as cross-chain bridge security risks, technical stack complexity, and liquidity fragmentation. This increases the maintenance costs and operational risks of the technical architecture, potentially affecting user experience. The lifeline of stablecoins—liquidity—will weaken in its ability to resist "de-pegging" risks if it becomes dispersed due to technical complexity.

(4) The Invisible Hand of Geoeconomics

Finally, all the aforementioned challenges are situated within the powerful gravitational field of global geopolitics and macroeconomics. These structural forces delineate invisible boundaries for the survival space of non-USD stablecoins.

Consolidation of USD's Digital Hegemony: The U.S. is accelerating the incorporation of stablecoin legislation into its financial regulatory system, with one of its strategic intentions being to shape stablecoin issuers into new "super buyers" of U.S. Treasury bonds. Each expansion of USD stablecoins objectively reinforces the digital hegemony of the dollar, creating a structural squeeze effect on all non-USD stablecoins like the Hong Kong dollar.

The Real Ceiling of Renminbi Internationalization: Despite the enormous imaginative space, the development of offshore Renminbi (CNH) stablecoins is still constrained in the short term by the degree of openness of China's capital account and the insufficient depth of offshore markets, creating a "glass ceiling." This directly limits RD Technologies' future development potential in the grand narrative of Renminbi stablecoins.

Systemic Risk Vigilance of "Shadow Banking": Regulators view stablecoins as a "new form of shadow banking" and maintain a high level of vigilance regarding the systemic risks they may pose. This vigilance will ultimately translate into stricter and more detailed regulatory requirements, trapping RD Technologies in a spiral of "risk concerns -> regulatory tightening -> rising compliance costs," forming a difficult-to-break negative feedback loop.

6. Future Outlook

Market Forecast for Stablecoins:

2030: Citi predicts that the market size could grow 14 times to $3.7 trillion, driven by regulatory clarity and institutional adoption. Sei Network forecasts the market size will reach $1.4 trillion.

2035: MetaTech Insights expects the global stablecoin market to grow from $182.6 billion in 2024 to $1.1068 trillion, with a compound annual growth rate (CAGR) of approximately 17.8%, primarily driven by Ethereum-based stablecoins and multi-chain/Layer 2 solutions.

CBDC and Stablecoin Market: It is expected that by 2034, the total market value of central bank digital currencies (CBDCs) and stablecoins will grow from $66.4 billion in 2025 to $151.3 billion, with a CAGR of 9.58%.

The global stablecoin market is expected to grow to $300 billion to $400 billion by 2025, with long-term potential (2030-2035) reaching $1.4 trillion to $3.7 trillion, possibly even exceeding $1 trillion, dominated by USD stablecoins. The market size of Hong Kong dollar stablecoins is relatively small in the short term (a few billion dollars), but there is growth potential in cross-border trade in the Greater Bay Area and Renminbi internationalization scenarios, with long-term potential reaching hundreds of billions. Market growth will be driven by regulatory clarity, cross-border payment demand, and technological advancements, but it must overcome regulatory differences and infrastructure challenges.

As a stablecoin issuer, RD Technologies' future outlook can be reflected in the following aspects:

Short-term Goals: Complete sandbox testing, obtain a Hong Kong stablecoin issuance license, launch HKDR, and expand cross-border payment and Web3 scenarios.

Long-term Vision: As a globally significant financial center, Hong Kong, often referred to as Asia's Wall Street, is predicted to see the stablecoin market potentially exceed $1 trillion, with RD Technologies likely to occupy an important position in Hong Kong's Web3.0 ecosystem. Additionally, the second digital asset policy declaration in Hong Kong will promote the integration of traditional finance and blockchain, providing more innovative space for RD Technologies.

The future of RD Technologies is likely a journey from "license value" to "scenario implementation." Its success or failure will not depend on whether it can follow macro trends, but on whether it can transform compliance—this core asset—into an irreplaceable competitive advantage in specific niche markets under a stringent regulatory framework.

(1) Strategic Foundation: Compliance License as a Core Asset

The stablecoin license from the Hong Kong Monetary Authority is the foundation and core asset of all RD Technologies' strategies. In the context of tightening global digital asset regulations, the value of this license far exceeds a mere permit; it serves as a powerful "trust anchor." It effectively distinguishes RD Technologies from numerous non-compliant and gray area projects in the market, paving the way to attract risk-sensitive institutional clients and traditional financial partners, crucial for the first mile.

Obtaining the license means RD Technologies can transform its significant investments in reserve management, transaction monitoring, and anti-money laundering (AML) from "compliance costs" into "market credibility," which is its ticket to entering high-value B2B payment and real-world asset (RWA) scenarios.

(2) From Trillion-Dollar Blue Ocean to Niche Market Dominance

The global stablecoin market is moving towards a trillion-dollar scale. Citibank predicts that by 2030, the market size may reach $3.7 trillion, while MetaTech Insights expects it to exceed $1.1 trillion by 2035, with a CAGR as high as 17.8%. However, for RD Technologies, this trillion-dollar blue ocean dominated by USD stablecoins is both an opportunity and a warning.

Competing comprehensively is akin to hitting a stone with an egg. Its only viable strategy is to abandon the fantasy of "becoming the next USDT" in this vast market and instead pursue "dominance in niche markets."

Cross-Border Trade: The multi-trillion-dollar B2B payment volume in Hong Kong provides sufficient depth for HKDR. RD Technologies' breakthrough point is not to engage in a full-scale battle with giants like JD.com and Ant Group but to focus on specific customer groups underserved by traditional banks—for example, the 40% of small and medium-sized enterprises (SMEs) that have been turned away due to increased account opening thresholds. By offering more flexible and efficient compliance payment solutions, it can establish a foothold in these segmented industries (such as specific goods trade and SMEs going abroad).

Virtual Asset Trading: The licensed exchange under its shareholder HashKey Group provides HKDR with a valuable initial liquidity engine and application scenario. This ensures that HKDR has usability from the outset. However, its long-term challenge lies in expanding beyond the "HashKey ecosystem" to the remaining 10 licensed platforms in Hong Kong, avoiding becoming a "circular" token limited to a single platform, thereby building a true network effect.

RWA Closed Loop: The author believes that RWA is the ultimate application scenario for stablecoins, with HKDR serving as the key infrastructure for "on-chain funding." Once assets are tokenized, compliant and efficient on-chain funding is needed to complete the value loop. RD Technologies' challenge is not to create RWA assets but to establish deep cooperation with asset issuers (such as renewable energy projects) and tokenization platforms, ensuring a continuous supply of high-quality assets that can match HKDR, forming a seamless connection of "asset on-chain, funding online."

(3) Overview of Strategic Partnerships

The strategic partnership network of RD Technologies is a core weapon for executing its niche strategy. The value of these partnerships lies not in the memorandums themselves but in whether they can be transformed into sustained business flow and ecological barriers.

Core Partner Value and Challenges

The future of RD Technologies tests its ability to transform a heavy "compliance armor" into a "competitive sword" that excels in niche markets through precise strategic choices and efficient ecological collaboration. This is not only a challenge for RD Technologies but also a key factor in whether the Hong Kong stablecoin ecosystem can find its positioning in global competition.

7. Conclusion

The practice of RD Technologies is not only a strategic positioning for Hong Kong in the accelerated global stablecoin competition, centered on "compliance certainty," but also a key experiment to test whether non-USD fiat stablecoins can find a survival space within a highly regulated, USD-dominated digital financial system.

The core strategic paradox faced by RD Technologies lies in its reliance on a stringent compliance barrier for survival—comprising 1:1 reserve anchoring, a prohibition on fractional reserve models, clearly defined redemption rights, and a strict anti-money laundering (AML)/counter-terrorism financing (CFT) framework. While this grants it legitimacy and scarce trust endorsement, it may also become the heaviest shackles as it strives to catch up with market pioneers. Transforming this "compliance dividend" into a genuine "market advantage," rather than an "innovation shackle," is the fundamental challenge for RD Technologies and the entire Hong Kong stablecoin ecosystem in achieving scalable development. This requires unifying efficiency, scale, and compliance in core application scenarios such as cross-border payments, virtual asset trading, and RWA.

In the "second half" of stablecoins, the essence of competition has shifted from the early "barbaric growth" of technology and market share disputes to a compliance and ecosystem struggle characterized by "delicate dancing" within a strict legal framework. As a participant in the Hong Kong Monetary Authority's first batch of stablecoin issuer "sandbox," RD Technologies' progress will profoundly reveal how to achieve a dynamic balance between innovation and sovereign regulation under the new paradigm of Web3 transitioning from "decentralized" exploration to "compliance integration."

The long-term scale of the global stablecoin market is expected to reach between $1.4 trillion and $3.7 trillion, with USD stablecoins occupying an absolute dominance. Against this backdrop, the success of RD Technologies should not be measured by a global market share in the hundreds of billions. Its true target market is to leverage a foreseeable, multi-billion-dollar segmented market in scenarios such as cross-border trade in the Greater Bay Area, RWA, and Renminbi internationalization.

Hong Kong's stringent regulatory policies are a double-edged sword; they increase costs and limit the speed of certain innovations in the short term, but in the long run, they construct a high-certainty business environment that mitigates the risk of "bad money driving out good."

Looking ahead, the explorations of RD Technologies and similar institutions will compel global financial markets to reflect: in the context of the digital economy entering the "extreme virtual stage," how will true financial innovation find a viable coexistence path between the globalization and borderless wave of Web3 and the increasingly tightening compliance requirements of sovereign nations? Will the "compliance testing ground" of "dancing with shackles" lead the future, or will the gray areas of "regulatory arbitrage" continue to be the breeding ground for innovation?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。