The mechanism currently driving the market capitalization of Ethena's USDe to soar will eventually become the culprit behind its collapse.

Written by: Duo Nine⚡YCC

Translated by: Saoirse, Foresight News

Once the short sellers return, Ethena and Fluid will severely impact the cryptocurrency market.

This is certain, and I will explain how this will happen below.

The mechanism currently driving the market capitalization of Ethena's USDe to soar will eventually become the culprit behind its collapse.

Where have we seen this before?

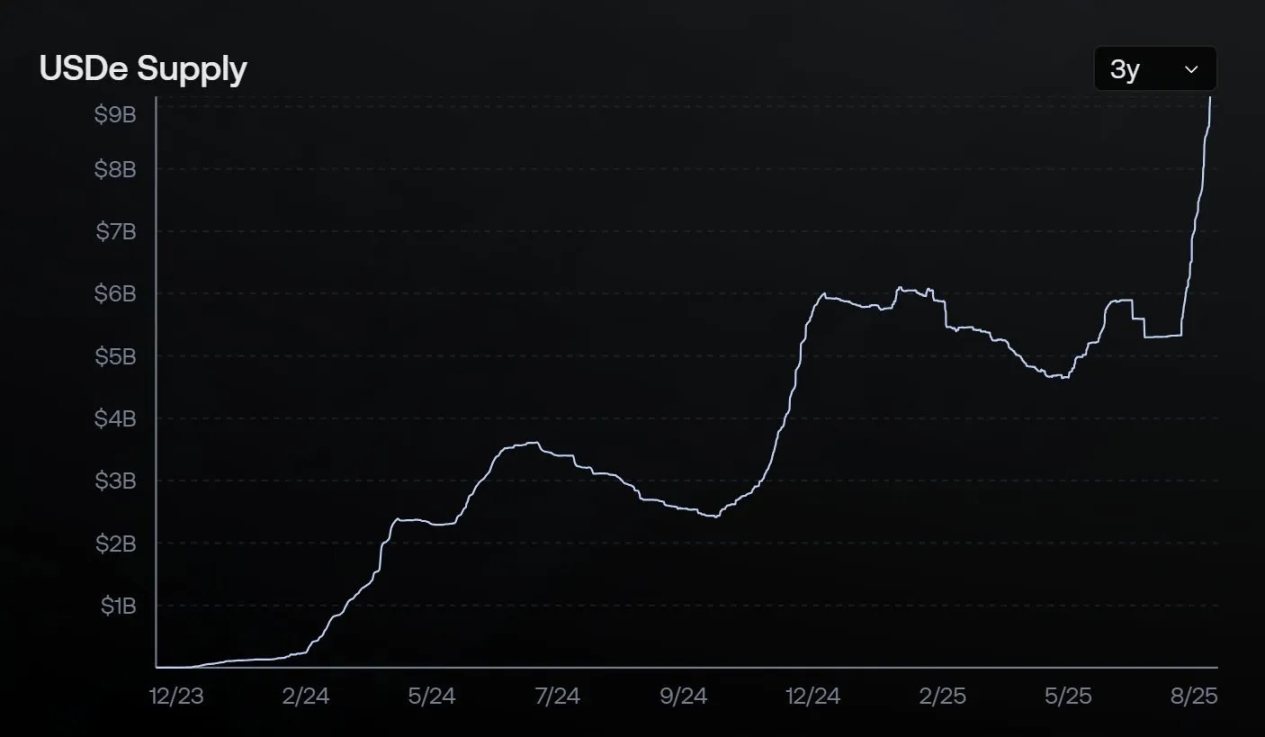

At the time of writing, the market capitalization of Ethena's USDe stablecoin is nearing $10 billion, making it the third-largest stablecoin currently. This should not excite you but rather alert you. Because this growth is largely not based on solid foundations, but more like a castle in the air.

In short: The leverage cycle is fueling this bubble!

Formation of the Bubble

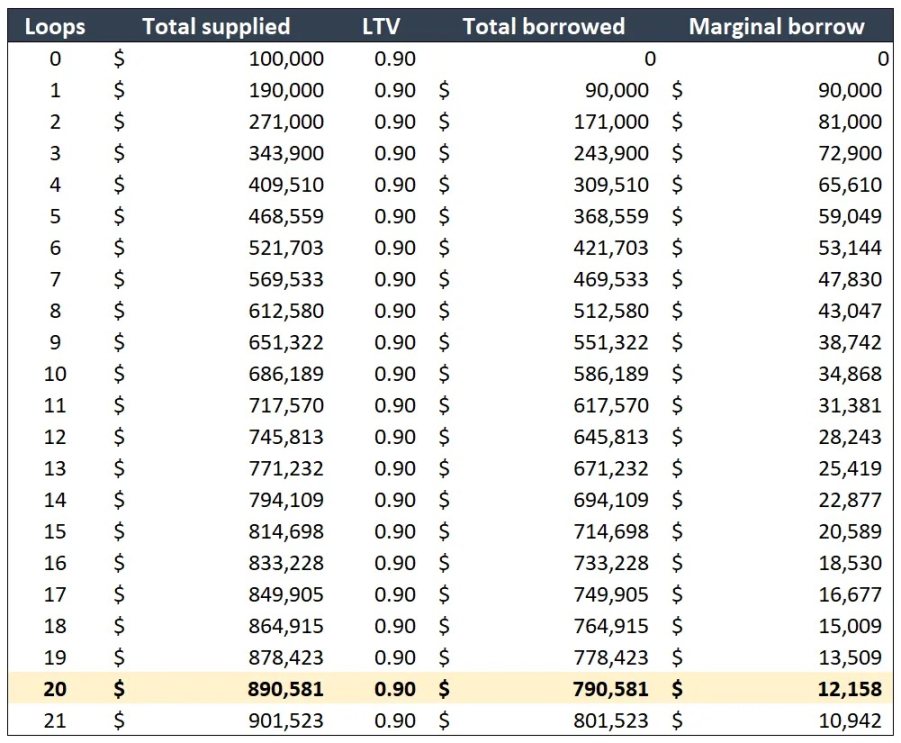

With just $100,000, you can create a position worth $1.7 million through this operation. Moreover, on the Fluid protocol, you can complete it with a single click of the "leverage" button. They are exaggerating the Total Value Locked (TVL) in this way.

(Note: The article refers to a nominal asset scale reaching $1.7 million, not actual net funds. It is the sum of the total collateral amount (Total Supplied) in the table below. Essentially, it amplifies the scale of liabilities and collateral through leverage cycles, rather than truly "creating" $1.7 million in value.)

You take $100,000, exchange it for USDe, and deposit it as collateral in Fluid's stablecoin pool (like the USDT-USDC pool). Then, you borrow $90,000 USDT and exchange it for $90,000 USDe.

You then deposit this $90,000 USDe again as collateral, borrow $81,000 USDT, and exchange it for USDe. Repeat this exchange and borrowing process 20 times. After 20 cycles, your remaining borrowing limit is $10,000. Congratulations, you have created "magical network currency" this way.

Chart 1

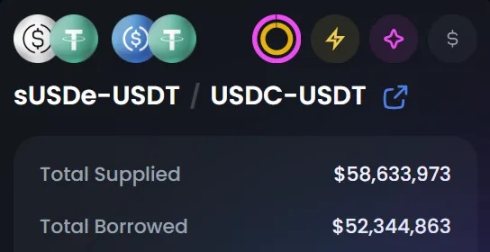

With protocols like Fluid, this operation has become extremely simple. If you check Fluid's stablecoin pools, you will find that almost all pools are nearing full capacity.

For example, the borrowing ratio of the USDe-USDT/USDC-USDT pool has reached 89.2%, while the maximum collateralization ratio is capped at 90%. If it reaches 92%, liquidation will be triggered.

What happens if USDe depegs by 2% relative to USDT/USDC? This will be explained in detail below.

Why are people rushing to buy USDe?

Because it offers the highest returns!

Currently, with an initial capital of $100,000, the $1.7 million position we built can generate $30,000 in annual returns. After deducting borrowing costs (collateral annualized at 8% - debt annualized at 5%, see Chart 1), the actual annualized return rate still reaches 30%.

(Note: Annualized return rate = (Collateral income - Borrowing cost) / Initial capital, calculated based on the total collateral amount and total borrowing amount generated from 20 cycles, i.e., APY = (890,581×8% - 790,581×5%) / 100,000, approximately equal to 31.717%)

If the basis trading yield of sUSDe further increases, the annualized return on the same principal could even reach 50% or 100%. Sounds wise, right?

But it is only wise to "exit before the music stops." As history shows, there is no such thing as a free lunch. Someone always has to pay the price, and you must ensure that you are not the one footing the bill.

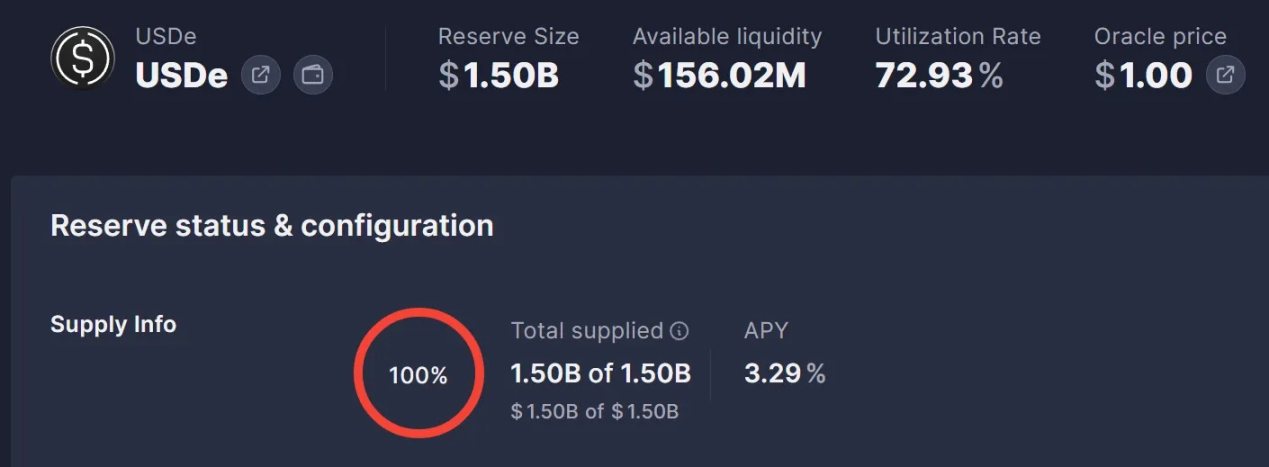

Otherwise, your entire principal could evaporate overnight, especially when you reinvest the returns into this cycle. At the time of writing, AAVE's $1.5 billion USDe supply on the Ethereum network has reached its limit, and people are pushing this leverage operation to the extreme.

Before the bubble bursts, the market capitalization of USDe will continue to set new records. When its daily growth reaches around $1 billion, make sure to exit completely. The top is near, and someone always has to pay for this feast.

Make sure that person is not you!

Inevitability of the Collapse

At this moment, it can be confirmed that a collapse will eventually occur. Why do I assert this?

Because the larger the market capitalization of USDe, the greater the pressure for the bubble to burst when the "music stops."

Essentially, when the short sellers return, the higher the market capitalization of USDe, the faster and larger its decoupling will be. A mere 2% decoupling is enough to trigger large-scale liquidations on Fluid, further exacerbating the crisis.

⚠️ The decoupling of USDe is the "safety valve" of this massive bubble!

At that time, all users engaging in leveraged cycle operations on Fluid and other protocols will face liquidation. Hundreds of millions of USDe will suddenly flood the open market for sale.

As the chain reaction of liquidations begins, USDe may decouple by 5% or even more. Countless people will lose everything, which could trigger systemic risks, impacting the entire decentralized finance ecosystem. The situation could turn dire.

Moreover, the trigger for the collapse may also be the exhaustion of market demand: when the basis trading yield of USDe continues to decline (even turning negative), until the leverage cycle operations lose profitability, i.e., borrowing costs exceed returns, the crisis will erupt.

This will first lead to leveraged users on Fluid receiving liquidation notices, and if it triggers a chain liquidation, the peg mechanism of USDe will completely collapse. No one can predict the exact timing, but at the current pace, that day will inevitably come.

Only those without liquidation points or with very low liquidation thresholds will survive. Once the leverage is completely cleared, USDe may be able to restore its peg.

The ideal scenario for alleviating the crisis is for the USDe bubble to slowly and orderly deflate, but this is nearly impossible in the current market environment. Especially for a bubble with a market capitalization exceeding $10 billion, market reversals are often extremely violent.

History Repeats Itself

This time is no exception. It is just like every cycle I have experienced. Ethena, Fluid, and many protocols are actively creating conditions for this collapse.

No one talks about this issue because it is not "sexy" enough.

Ethena is pleased, as the soaring market capitalization of USDe means a surge in revenue; Fluid is also pleased, as the skyrocketing total locked value brings revenue growth. But be aware: they are not the ones paying the bill; they are the restaurant owners.

This is the root cause of the cyclical fluctuations in the cryptocurrency market!

Bear markets are the cycles of leverage clearing, while bull markets are the cycles of leverage creating bubbles.

There is nothing new under the sun.

Personal Opinion

Since the early launch of Ethena, I have participated in its yield mining, and their achievements to date are impressive. However, I currently hold no USDe and have no plans to do so in the future, as the risks are simply too high.

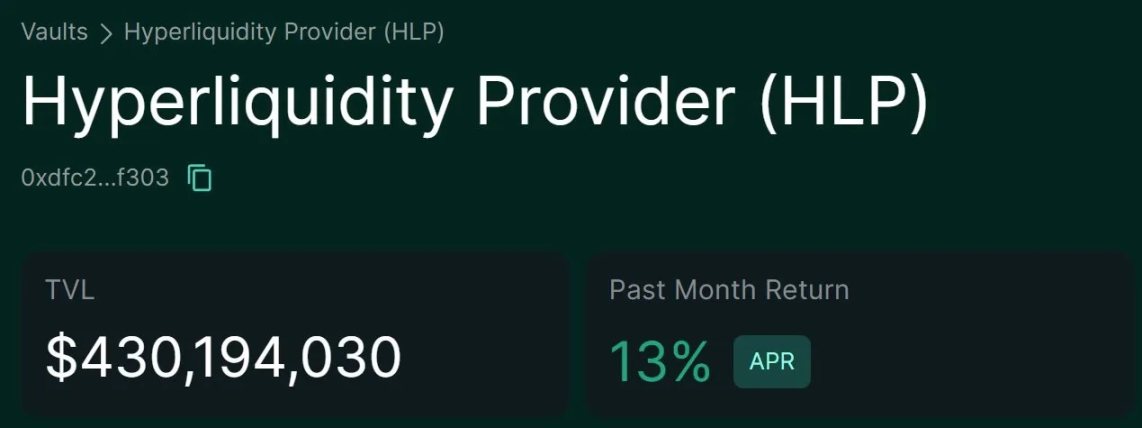

There are better protocols in the market that can provide comparable or higher annualized returns with lower risks. For example, Resolv's USR/RLP or Hyperliquid's HLP vault. HLP does not support leveraged cycle operations, which is precisely its advantage.

As for Fluid, they have indeed innovated: allowing users to earn higher returns on stablecoins and simplifying leveraged cycle operations to be accessible to everyone. Judging by their growth scale, this model has undoubtedly succeeded.

However, these two protocols and all projects built on Ethena or Fluid are collectively inflating a massive bubble. I issue this warning because I have seen this scenario too many times.

I have no bias against these protocols; they are simply the biggest drivers of the current bubble, and the number of followers is increasing.

Lastly, I want to say that Bitcoin is the last source of liquidity in the cryptocurrency market. This means that when a crisis erupts, Bitcoin will absorb the shock, its price will bear the pressure, providing a buffer for people in the bubble they created. Also, keep an eye on Saylor and his MSTR bubble.

Every cycle has new players, but the plot never changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。