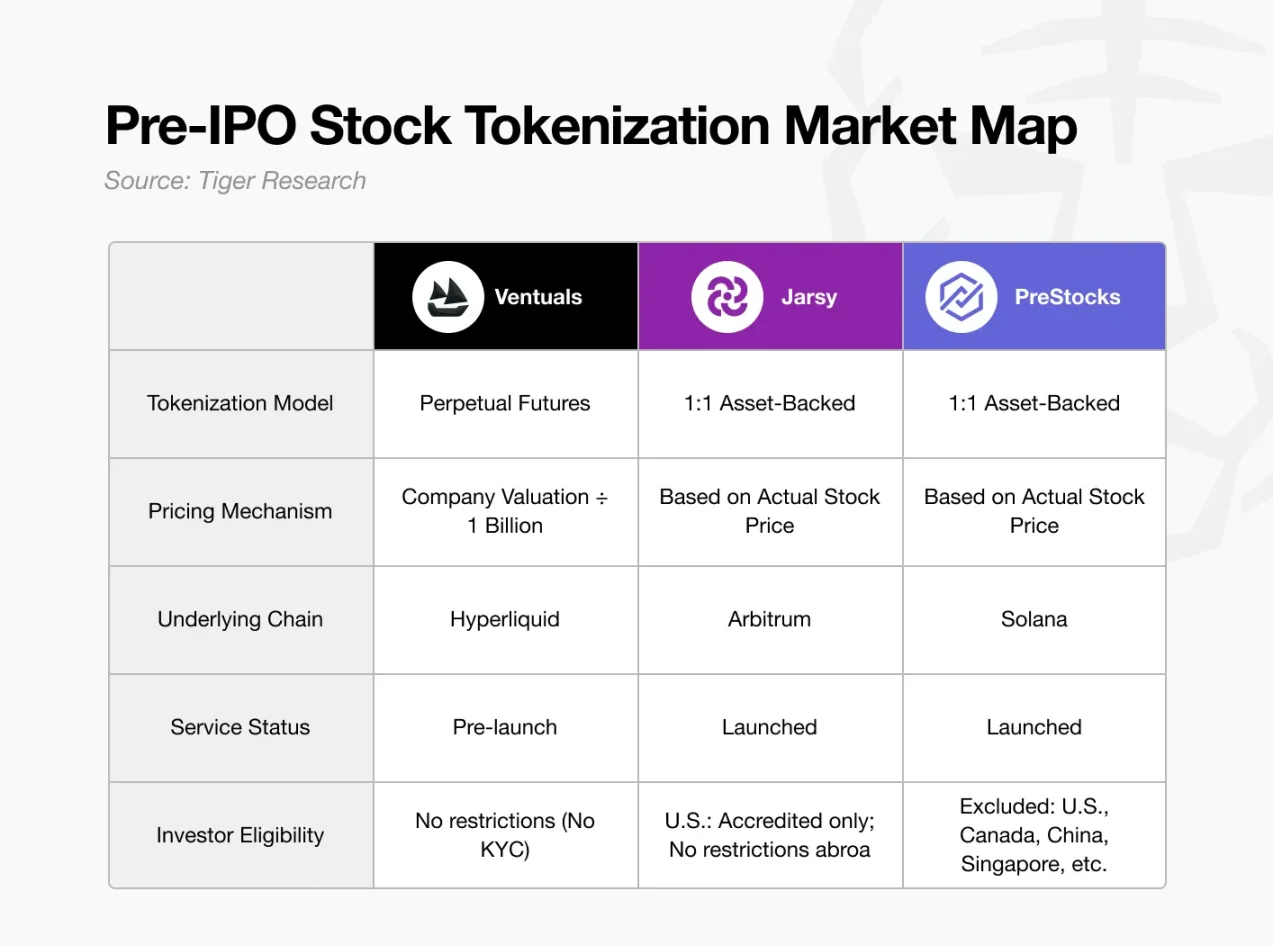

Through case studies of Ventuals, Jarsy, and PreStocks, this article explores how tokenization can lower investment barriers in the Pre-IPO equity market.

Written by: Tiger Research

Translated by: AididiaoJP, Foresight News

Abstract

Although the private equity market offers high returns, it remains primarily accessible to institutional investors and high-net-worth individuals, making it difficult for ordinary investors to participate.

Tokenization can address the limitations of the traditional financial system in terms of liquidity, accessibility, and convenience, but it still faces significant legal and technical hurdles.

Projects like Ventuals, Jarsy, and PreStocks are exploring different approaches to tokenized private equity. While these attempts are still in the early stages, they have already shown potential to reduce structural barriers in the market.

Private equity is highly attractive, but ordinary investors cannot participate

How can ordinary people invest in SpaceX or OpenAI? As private companies, they are out of reach for most investors. Opportunities for ordinary investors are almost nonexistent, as investment opportunities typically arise only after a company goes public.

At the core of the issue is the exclusion of ordinary investors from the high returns generated in the private market. Over the past 25 years, the value created in the private market has been approximately three times that of the public market.

This structural barrier stems from two core factors. First, the fundraising process for private companies is highly sensitive, and transactions are usually only open to well-known institutional investors, regardless of the qualifications of other investors. Second, the growth of the private capital market has provided companies with more financing options, allowing many to raise billions without going public.

OpenAI is a typical example of both dynamics. In October 2024, it raised $6.6 billion from major investors such as Thrive Capital, Microsoft, Nvidia, and SoftBank. By March 2025, it raised another $40 billion in a funding round led by SoftBank, with participation from Microsoft, Coatue, and Altimeter, becoming the largest private financing in history.

This phenomenon reveals a reality: only a few institutional investors can participate in the private market, while a mature private capital infrastructure provides these companies with financing options outside of going public.

As a result, today’s investment environment is becoming increasingly closed, exacerbating the inequality in the distribution of high-growth opportunities.

Equal access: Can tokenization solve structural barriers?

Can tokenization truly address the structural inequalities in the private equity market?

On the surface, this model is quite appealing: real-world assets are converted into digital tokens, enabling fractional ownership and supporting round-the-clock trading in global markets. However, fundamentally, tokenization is merely repackaging existing assets like Pre-IPO equity into a new form. Solutions to improve accessibility already exist in traditional finance.

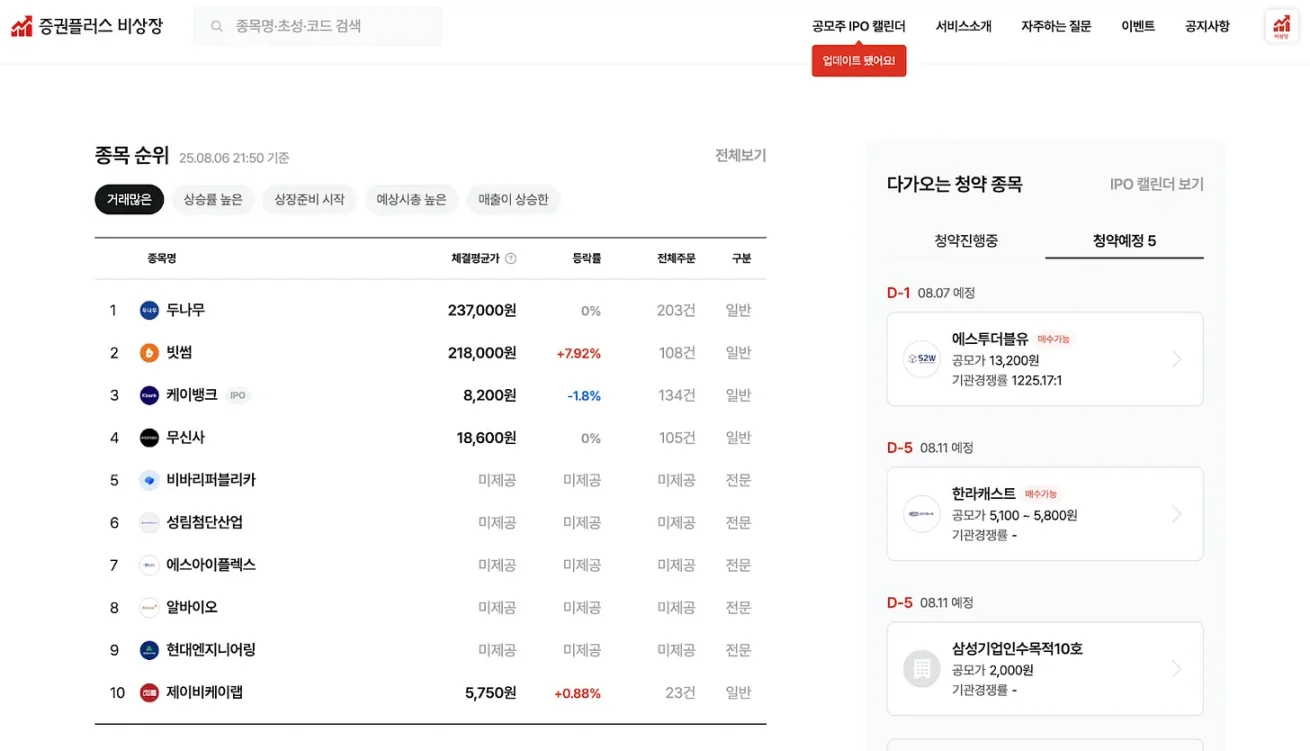

Source: ustockplus

For example, platforms like Dunamu's Ustockplus in South Korea, Forge, and EquityZen in the United States allow ordinary investors to trade private stocks within the existing regulatory framework.

So, what is unique about tokenization?

The key lies in the market structure. Traditional platforms use a peer-to-peer (P2P) matching model, where buyers must wait for sellers to list their orders. If there is no counterparty, the transaction cannot be completed. This model suffers from low liquidity, limited price discovery, and unpredictable execution times.

Tokenization has the potential to address these structural limitations. If tokenized assets are listed on centralized exchanges (CEX) or decentralized exchanges (DEX), liquidity pools or market makers can provide continuous counterparties, thereby improving execution efficiency and pricing accuracy. In addition to reducing friction, this approach can redefine market architecture.

Moreover, tokenization can enable functionalities that the traditional financial system cannot support. Smart contracts can automatically allocate dividends, execute conditional trades, or implement programmable governance rights. These functionalities open the door for the creation of new financial instruments that are designed to be both flexible and transparent.

Projects attempting to tokenize Pre-IPO equity

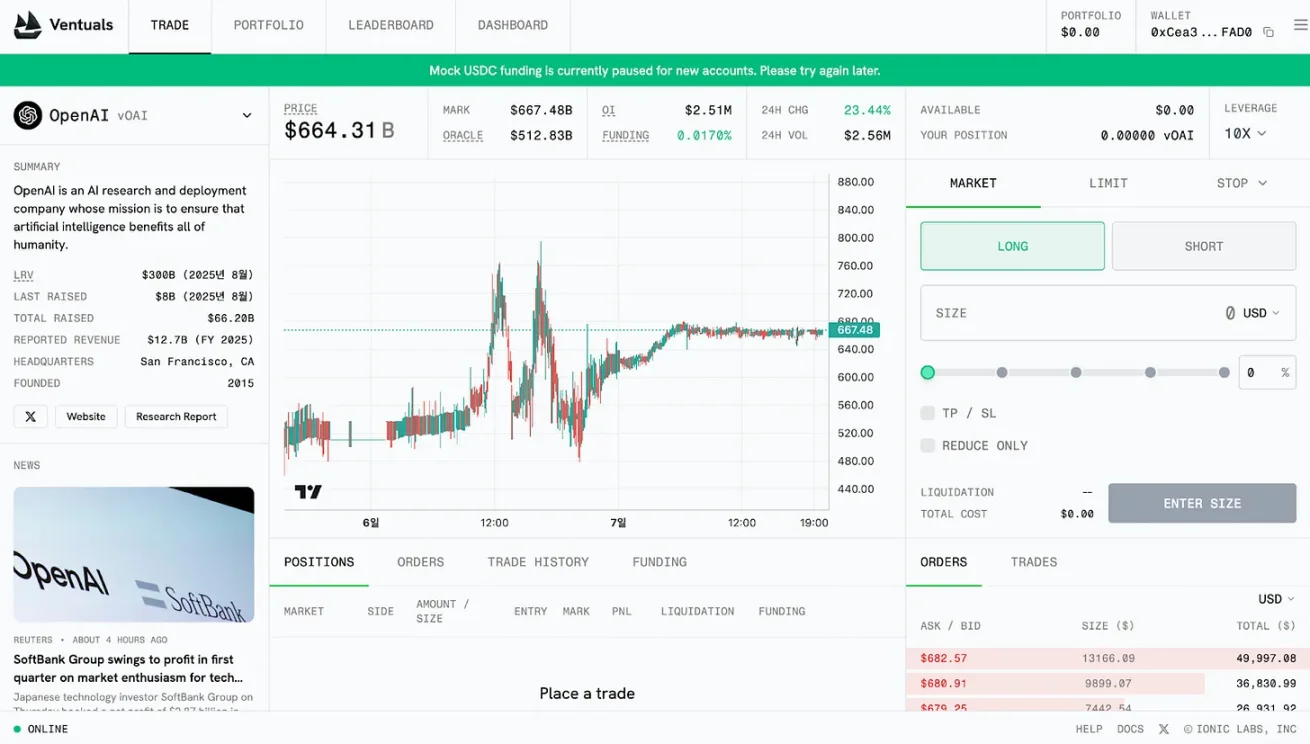

Ventuals

Source: Ventuals

Ventuals is building a perpetual contract structure. Its core advantage lies in the ability to trade derivatives without holding the underlying asset. This allows the platform to quickly launch a large number of Pre-IPO stocks while avoiding conventional regulatory requirements such as identity verification or accredited investor certification.

Perpetual contracts are implemented through Hyperliquid's HIP-3 standard. However, this standard is currently only operational on the testnet, and Ventuals is still in the pre-release phase.

Its pricing model is also unconventional; the token price is not based on stock prices or actual market transactions but is calculated by dividing the company's total valuation by one billion. For example, if OpenAI's valuation is $35 billion, then the price of one vOAI token would be $350.

This low-barrier model also brings structural challenges, the most prominent of which is the reliance on oracle data. The valuation data of private companies is opaque and updated infrequently. Derivatives based on such incomplete information may exacerbate information asymmetry in the market.

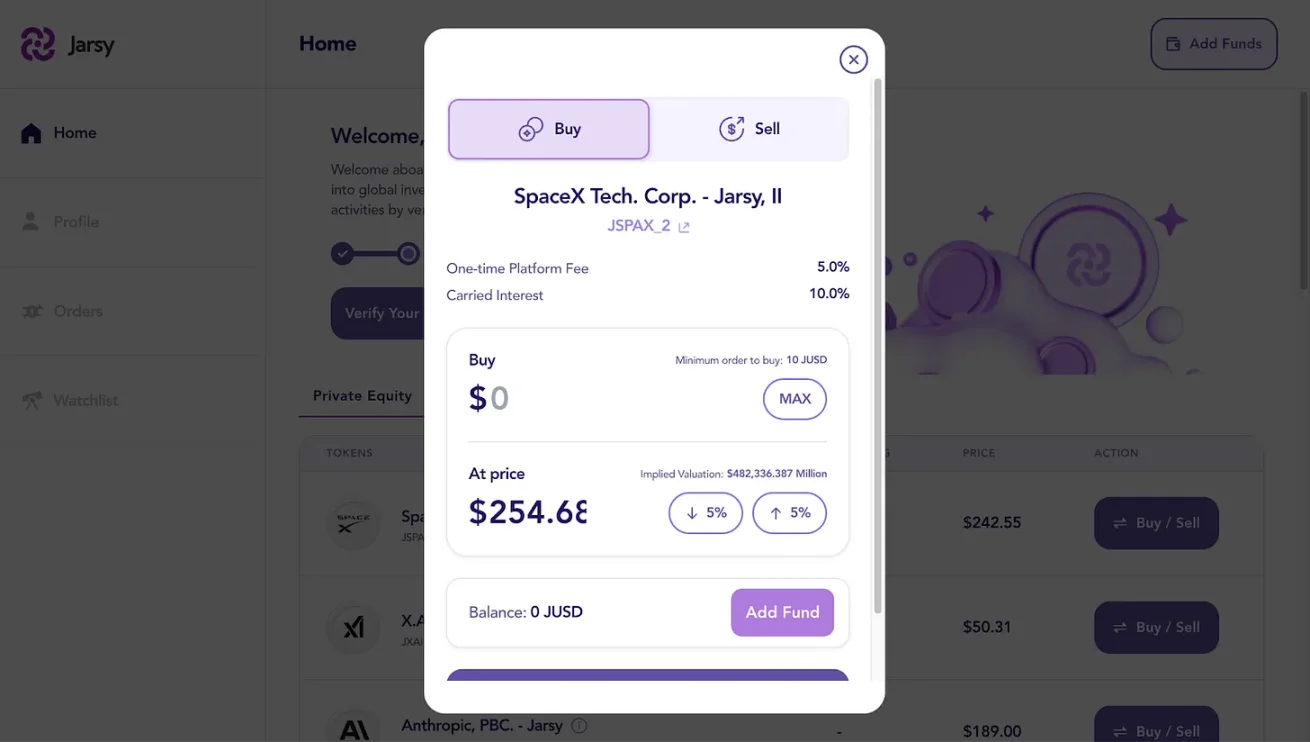

Jarsy

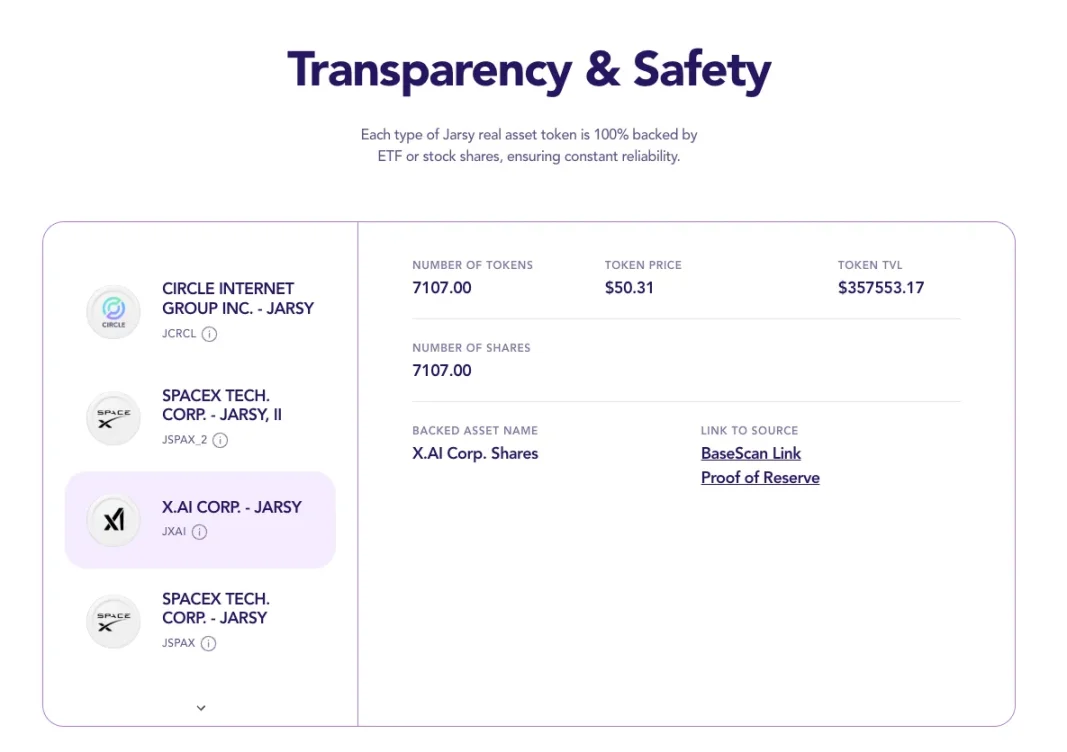

Source: Jarsy

Jarsy adopts a 1:1 asset-backed tokenization model. Its core mechanism involves directly acquiring Pre-IPO stocks and issuing one token for each share held. For example, if Jarsy holds 1,000 shares of SpaceX stock, it will mint 1,000 JSPAX tokens. Although investors do not directly hold the underlying stocks, they enjoy all related economic rights, including dividends and capital appreciation.

Source: Jarsy

This model relies on Jarsy’s role as an asset management entity. The platform first tests investor demand through a presale of tokens and then uses the raised funds to purchase actual stocks. If the purchase is successful, the presale tokens will be converted into official tokens; otherwise, the funds will be refunded. All assets are held by a special purpose vehicle (SPV) and are verified in real-time through a reserve proof page.

The platform also significantly lowers the investment threshold, with a minimum investment amount of only $10. For investors outside the U.S., there are no qualification requirements, thus expanding global accessibility. All transaction records and asset holdings are stored on-chain, ensuring auditability and transparency.

However, this model has structural limitations. The most pressing issue is liquidity, stemming from the platform's limited asset holding size for each company. For instance, Jarsy currently holds approximately $350,000 in X.AI, $490,000 in Circle, and $670,000 in SpaceX stocks. In such a low-liquidity market, even small sell orders from large holders can trigger significant price fluctuations. Given that private equity is itself opaque and illiquid, price discovery becomes particularly challenging, further amplifying volatility.

Additionally, while the asset-backed model provides stability, it limits scalability. Each new token issuance requires the actual purchase of stocks, a process that involves negotiation, regulatory coordination, and potential procurement delays, hindering the platform's ability to respond to rapidly changing market trends.

Nevertheless, Jarsy is still in its early stages, having been launched for just over a year. As the user base and assets under management (AUM) grow, liquidity issues may gradually ease. With the platform's expansion, a broader coverage and deeper pool of tokenized equity may naturally form a more stable and efficient market.

PreStocks

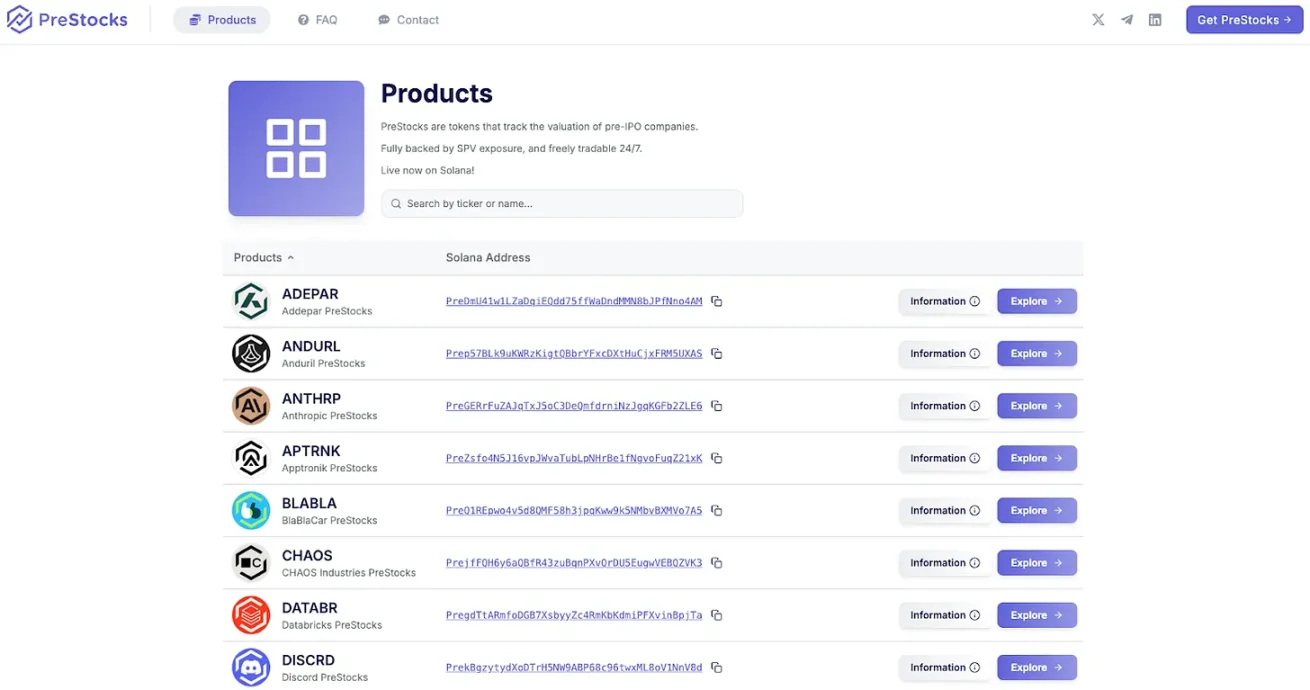

Source: PreStock

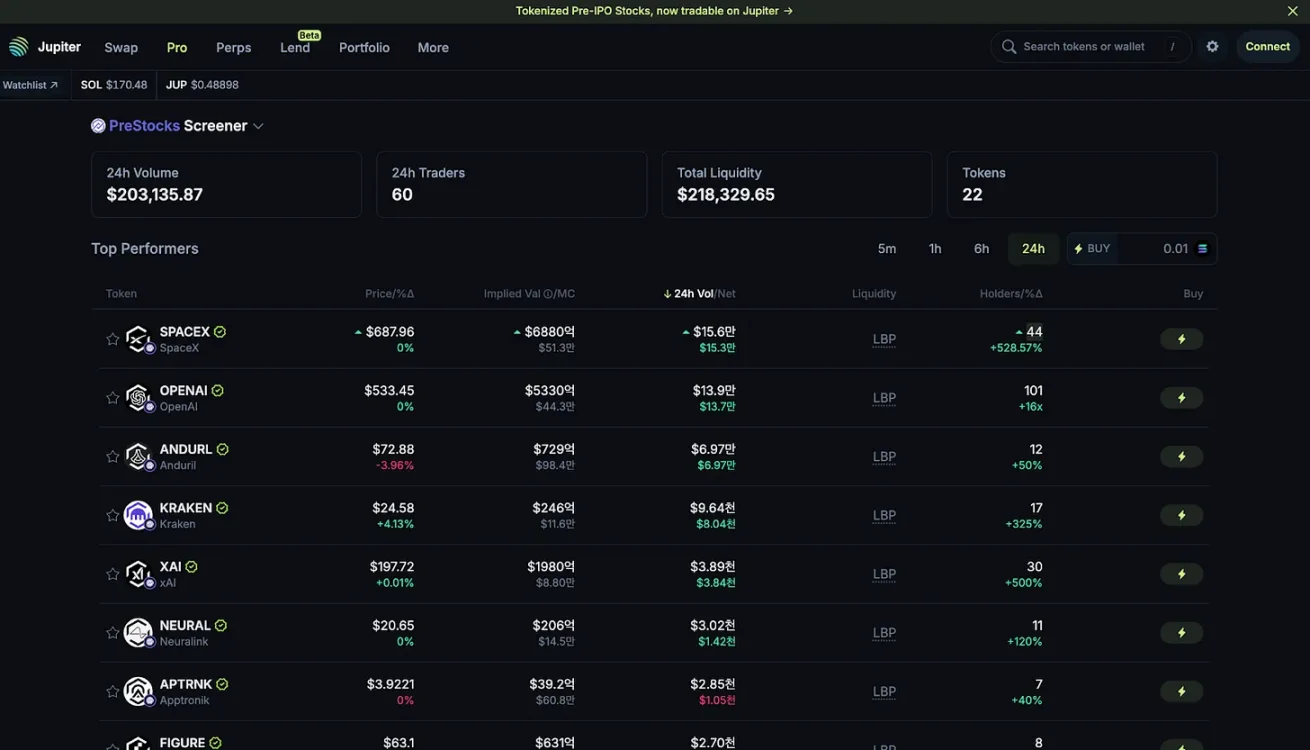

PreStocks employs a model similar to Jarsy, purchasing private company stocks and issuing backed tokens at a 1:1 ratio. The platform currently supports trading of 22 Pre-IPO stocks and has opened its products to the public.

PreStocks is built on the Solana blockchain and facilitates trading through integration with Jupiter and Meteora. It offers round-the-clock trading and instant settlement without management fees. There are no minimum investment requirements, allowing anyone with a Solana-compatible wallet to participate, further lowering the access barrier.

However, the platform also has some limitations, as users from the U.S. and other major jurisdictions cannot access it. Although all tokens are reportedly fully collateralized by the underlying stocks, PreStocks has not publicly disclosed detailed holding verification documents. The team has stated that it will regularly release external audit reports and can provide paid individual verification services upon request.

Compared to Jarsy, PreStocks has a closer integration with decentralized exchanges (DEX), which may support broader secondary use cases such as token lending. In the Solana ecosystem, tokenized public stocks (like xStock) are already actively used, and PreStocks may benefit from ecosystem-level synergies.

Obstacles to tokenizing Pre-IPO stocks that remain unresolved

The tokenized stock market is in its early formation. Although platforms like Ventuals, Jarsy, and PreStocks show early development momentum, significant structural challenges still exist.

First, regulatory uncertainty is the most fundamental barrier. Most jurisdictions still lack a clear legal framework for tokenized securities. As a result, many platforms operate in regulatory gray areas, taking advantage of jurisdictional arbitrage without direct compliance.

Secondly, the resistance from private companies remains a key obstacle. In June 2025, Robinhood announced a new service for EU customers that provides exposure to tokenized investments in companies like OpenAI and SpaceX. OpenAI immediately publicly opposed this, stating, "These tokens do not represent equity in OpenAI, and we have no partnership with Robinhood." This response highlights private companies' unwillingness to relinquish control over their equity structure and investor management, which are core functions they tightly guard.

Thirdly, the complexity of technology and operations cannot be overlooked. Maintaining a reliable link between real-world assets and tokens, handling cross-border compliance issues, addressing tax implications, and executing shareholder rights are all non-trivial challenges. These issues could severely limit user experience and scalability.

Despite these limitations, market participants are actively seeking solutions. For example, Robinhood has stated plans to expand its token products to thousands of assets by the end of the year, despite facing numerous challenges in the public market. Platforms like Ventuals, Jarsy, and PreStocks continue to advance by offering differentiated access to tokenized equity.

In summary, tokenization offers a promising path to improving accessibility in the private equity market, but this field is still in its infancy. The current limitations are real, but the history of the crypto space shows that technological breakthroughs and rapid market adaptation can, and often do, redefine possibilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。