Chainlink Supply Tightens as Reserve Locks Enterprise Funds

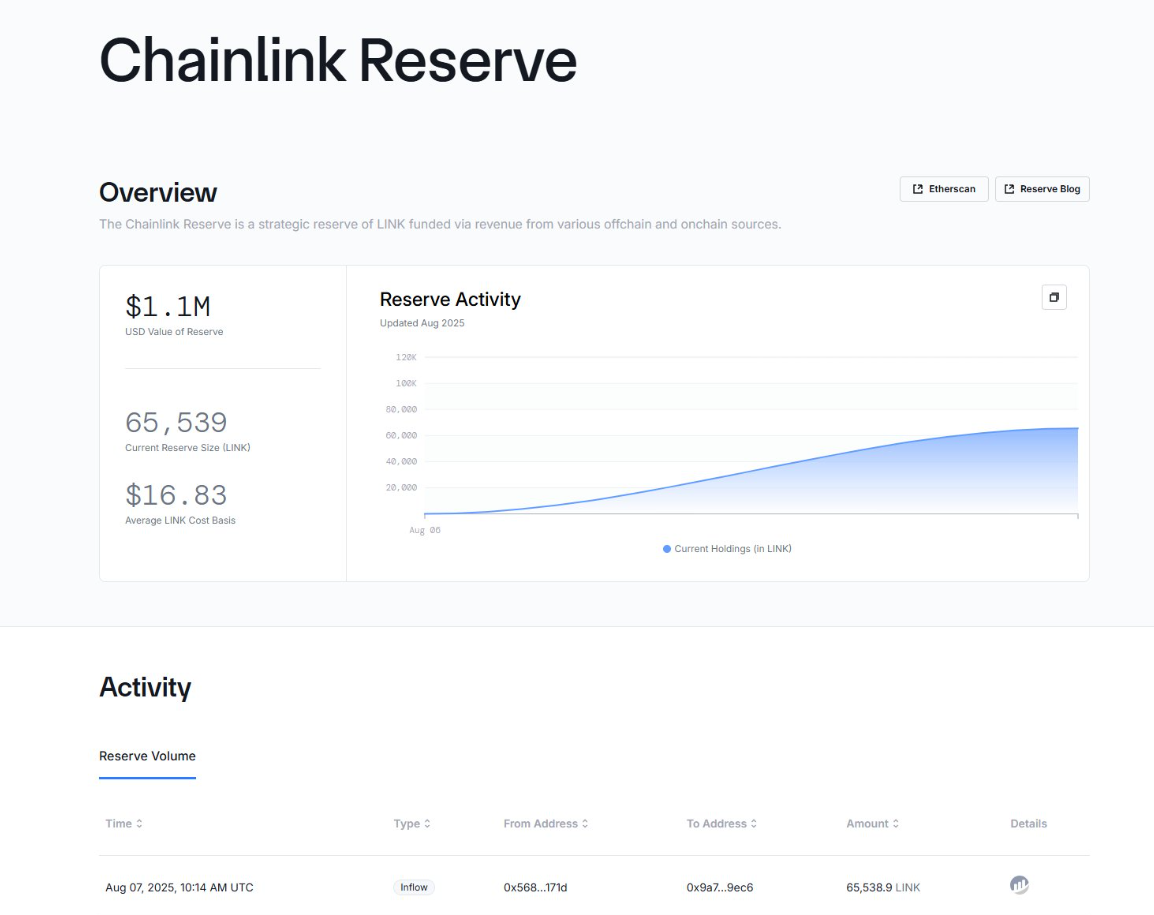

Chainlink has now introduced the Altcoin Reserve, a long-term accumulation on-chain pool that can be used strategically.

By August 7, 2025, the reserves will be in possession of more than $1 million worth of Altcoin, which will be fed by protocol-level services and enterprise payments.

The Reserve is financed with the off-chain and on-chain incomes, where the Payment Abstraction is applied to exchange stablecoins and gas tokens to Altcoins.

Source : X

These exchanges are done in the form of Altcoin smart contract infrastructure and decentralized exchanges like Uniswap V3.

Chainlink Supply on Exchanges Drops to Multi-Year Low

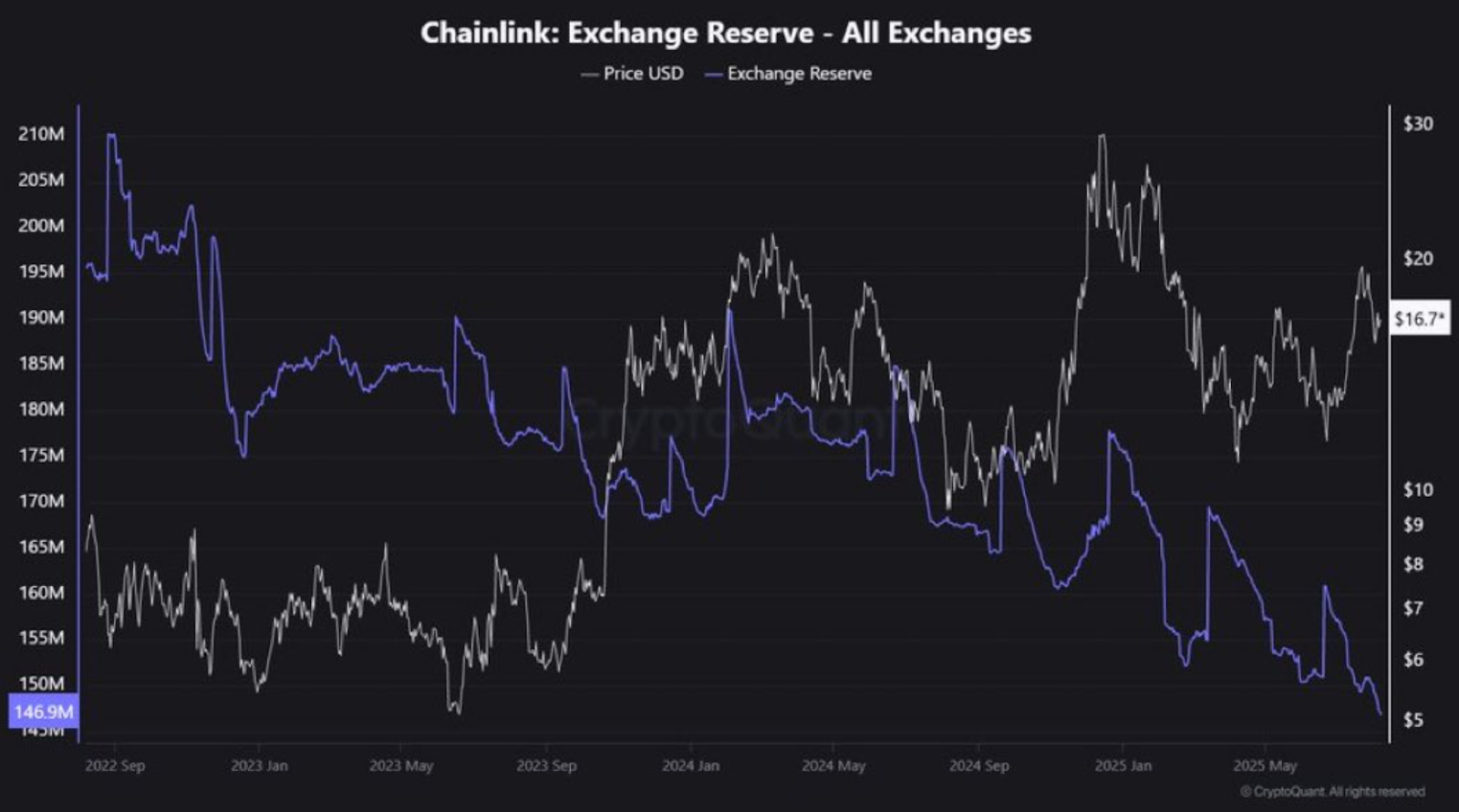

CryptoQuant data showed that Altcoins exchange reserves are at 146.9 million Altcoins, the lowest in more than two years.

This decline is consistent with a declining trend since the middle of 2022 when the amount of reserves was above 205 million.

Chainlink Exchange Reserve - All Exchanges : Source : CryptoQuant

Such a decline is an indication of a contraction in the circulating supply on centralized platforms.

Analyst Quinten described the trend as a possible pointer to a LINK supply shock since there is ongoing outflow thereby decreasing the liquidity available.

The design of the Holding fund also helps in this tightening as the tokens will be locked out of circulation several years.

Altcoin has also assured that it does not intend to make withdrawals in the near future, further reducing supply.

Reserve Funded by Verified Usage, Not Speculation

The Altcoin Reserves is in the form of real revenue as it converts enterprise payments and usage charges into LINK tokens.

This is automated through Payment Abstraction, which lowers friction and makes LINK the ultimate settlement asset .

Altcoins has begun to channel 50% of service fee staking verification into the Reserves instead of remunerating node operators.

This rebalancing has placed the economic model on service delivery, as opposed to token inflation and speculation.

Altcoins has already been used in major financial institutions in DeFi platforms, tokenization pilots, and cross-border finance.

The platform supports over 60 blockchains, 2,000+ price feeds and has over $80 billion of secured value.

Chainlink links demand to tangible real-world usage by converting offchain revenues into LINK.

It is one of the earliest large-scale implementations of crypto reserves backed by enterprise adoption and integration into the capital markets.

The transparency is provided publicly through a dashboard at Holding fund.chain.link and an open contract on Etherscan.

Chainlink has stated that the Holding fund will keep on building as the demand increases without affecting the dynamics of the token supply.

LINK Price and Volume Spike Following Reserve Rollout

LINK is currently trading at $17.75, reflecting a 7.66% 24-hour increase and a 2.25% weekly gain. The price increased by 9.06% after the Holding fund announcement and reached the new level of $18.07 after several months.

Trading volume jumped over 84% to reach $668 million in daily turnover. Market capitalization rose to $12.2 billion, showing a renewed interest in Chainlink’s token utility and business integration.

Chainlink Price Forecast : Source : X

On the 3-day chart, LINK broke out of a falling wedge and reclaimed $16.70 as support. The subsequent resistance areas are at 18.00 and 21.00, with the long-term target at around 30.00 in case the momentum continues.

Also read: Spur Protocol Daily Quiz Answer 08 August 2025: Earn Free Rewards免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。