On August 1, the highly anticipated Hong Kong Stablecoin Regulation officially came into effect.

In the face of a heated speculative atmosphere in the market, regulators unexpectedly doused stablecoins with cold water. From the content alone, the Hong Kong stablecoin regulation has many restrictions, and its stringent real-name verification requirements have successfully earned it the title of "the world's strictest stablecoin legislation." Coincidentally, just a month ago, Singapore, which has always been a competitor to Hong Kong, also sparked widespread discussion by issuing "the world's strictest crypto regulations."

In contrast, on the day before the implementation of the Hong Kong stablecoin regulation, the U.S. Securities and Exchange Commission (SEC) launched a new initiative called "Project Crypto," which passionately outlined the future of crypto in the U.S., sending out strong positive signals.

The regulatory landscape on both sides of the ocean presents a stark contrast, and the differentiation in the crypto landscape is set to accelerate from this moment.

On August 1, the Hong Kong Stablecoin Regulation officially took effect. This milestone event not only represents a significant step for Hong Kong's virtual currency sector but also marks the implementation of the world's first comprehensive regulatory framework for fiat-backed stablecoins, with extremely far-reaching implications.

Looking back at the content of the regulation, it requires any institution issuing fiat-backed stablecoins in Hong Kong, or any issuer of stablecoins pegged to the Hong Kong dollar overseas, to implement a mandatory licensing system, with a minimum paid-up capital of HKD 25 million. Regarding reserve assets, it mandates full reserves, meaning that issuers must allocate 100% of reserve assets to highly liquid assets such as cash and short-term government bonds, and these assets must be independently custodied by licensed banks. Each type of stablecoin must have a separate reserve asset portfolio to ensure it is segregated from other reserve asset portfolios. Anti-money laundering (AML) is also a top priority, requiring issuers to establish a comprehensive AML mechanism, publicly disclose daily reserve asset audit reports, and prohibit interest payments to prevent disguised deposit-taking. In terms of redemption, users can unconditionally redeem fiat at face value, and issuers must process redemption requests within one business day.

Overall, the requirements of the regulation are not significantly different from the draft released in June, but the implementation details can only be described as stringent. On the eve of the regulation's official implementation, on July 29, the Hong Kong Monetary Authority (HKMA) released a series of supporting regulatory documents regarding the new regulation, including a consultation summary and guidelines for licensed stablecoin issuers, guidelines for combating money laundering and terrorist financing applicable to licensed stablecoin issuers, a summary of the licensing system and application procedures for stablecoin issuers, and a summary of transitional provisions for existing stablecoin issuers.

According to the requirements, the HKMA will accept the first round of stablecoin issuer license applications from August 1 to September 30, 2025, and has set a six-month transition period for enterprises. The simultaneous advancement of innovation and legal regulation reflects the Hong Kong government's consistent attitude of being inclusive yet cautious, but the KYC provisions have sparked a heated debate in the market.

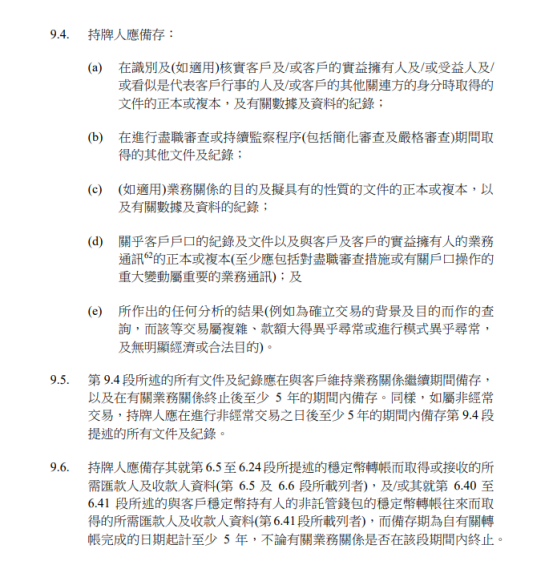

In the "Guidelines for Combating Money Laundering and Terrorist Financing (Applicable to Licensed Stablecoin Issuers)," the HKMA requires licensed stablecoin issuers to take effective measures to identify and verify the identities of stablecoin holders. Customers must undergo a complete customer due diligence (CDD) process and regular reviews (such as name, date of birth, ID number, etc., with records retained for at least five years). Non-customer holders generally do not need to verify their identities directly, but if monitoring detects wallet addresses associated with illegal activities, sanction lists, or suspicious sources, and the licensee cannot prove that their risk mitigation measures (such as blockchain analysis tools) are sufficient to prevent ML/TF risks, the licensee must further investigate and verify the identities of the relevant holders.

In short, to meet anti-money laundering risks, stablecoin issuers must not only verify user identities and retain real-name data for over five years but also cannot provide services to anonymous users. They even have an obligation to verify the identity of every stablecoin holder in the initial stages. The HKMA has also provided an explanation, with Assistant Chief Executive (Regulation and Anti-Money Laundering) Chen Jinghong pointing out that given the current industry's ongoing monitoring tools have not convinced the HKMA of their effectiveness in reducing money laundering risks, and international organizations such as the Bank for International Settlements emphasize the importance of preventing money laundering with stablecoins, the HKMA will adopt a "risk-based but cautious" regulatory approach.

However, from a practical perspective, especially in the context of cross-border payments in physical scenarios, it is nearly impossible to verify the identities of anonymous holders in offshore accounts in real-time, let alone cover every holder in a large-scale payment system. This move effectively excludes all types of applicants other than banking institutions to a certain extent. It is worth noting that under this regulation, Hong Kong stablecoins will also largely bid farewell to DeFi protocol interactions, as existing interaction wallets are all anonymous. In comparison to the openly usable USDT and USDC, the competitiveness of Hong Kong stablecoins will be significantly reduced.

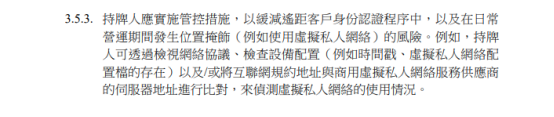

Internally, the responsibility of issuers is reinforced, and externally, jurisdiction is also clearly defined. The "Regulatory Framework for Stablecoin Issuers" explicitly states that licensees must comply with the laws and regulatory requirements of relevant jurisdictions. In other words, in addition to adhering to local laws and regulations in Hong Kong, compliance overseas is also under consideration. Issuers need to have a complete risk control system for cross-border operations and are prohibited from providing services to countries and regions where stablecoin bans exist. This even includes the identification of VPN usage by licensed institutions, as using a VPN to circumvent regulations will be blocked, indicating that mainland users will still find it difficult to access this system. On the other hand, issuers must also ensure compliance in overseas marketing and operations and continuously monitor policy changes in overseas regions to build a dynamic compliance system.

From the entire process, the ultra-high threshold is the keyword for licensed institutions. However, even with such high application requirements, Hong Kong stablecoins have also imposed restrictions on the important functions of the stablecoins themselves, not only blocking crypto functionalities such as DeFi, anonymous wallets, and open protocols but also severely regulating the use of overseas economies. The free circulation of stablecoins on-chain has essentially become a mirage. Against the backdrop of an already limited market scale, the development of Hong Kong stablecoins will clearly face greater obstacles. From the issuer's perspective, mandatory real-name registration and high-intensity anti-money laundering measures will completely transfer the control of licensing to large banks and financial giants, making it unlikely for small and medium-sized enterprises to apply for licenses, and internet companies are also unlikely to be optimistic. It was even rumored that JD.com would cancel its license application. According to Caixin reports, Hong Kong may narrow the scope of the first batch of stablecoin licenses to three or four companies, with several Chinese banks' branches in Hong Kong, including Bank of China Hong Kong, Bank of Communications Hong Kong, China Construction Bank (Asia), and Xinhua International, eager to explore stablecoin business.

With such a stringent implementation path, the Hong Kong Stablecoin Regulation is indeed rightly called "the world's strictest stablecoin regulation." Interestingly, the last region recognized by the market as having the strictest regulations was Singapore, which is often referred to as a "twin star" with Hong Kong. In June of this year, the Monetary Authority of Singapore (MAS) released the final policy guidelines for digital token service providers (DTSP), and due to strict regulations such as "no license, no operation" and "full industry chain jurisdiction," the market experienced a wave of Web3 retreat.

However, when looking across the ocean, the attitude of the United States stands in stark contrast to the aforementioned two.

On July 31, just one day before the Hong Kong stablecoin regulation took effect, the new chairman of the SEC, Paul Atkins, ignited a spark in the crypto community. On that day, Paul Atkins released a new policy called "Project Crypto," proposing a grand vision of fully integrating the U.S. financial market onto the blockchain, clearly stating the goal of making the U.S. the "global crypto capital."

In terms of specific measures, first, it abandons the traditional model of jurisdiction followed by law enforcement, establishing clear reclassification standards for crypto assets, providing clear disclosure norms, exemption conditions, and safe harbor mechanisms for common on-chain economic activities such as airdrops, ICOs, and staking, and adopting different regulatory models based on the nature of different assets; second, it grants legitimacy to decentralized applications such as DeFi, providing a clear path for on-chain software developers who do not rely on centralized intermediaries, protecting the developers of decentralized software and ensuring a place for decentralized software in the financial market; third, it aims to create "Super-Apps," merging the existing complex licensing systems to enable securities intermediaries to offer diverse products and services under one platform and one license. The SEC will draft a regulatory framework to promote this vision, such as allowing securities and non-securities types of crypto assets to coexist and trade on SEC-registered platforms, and relaxing certain listing conditions for assets on non-registered exchanges (such as platforms holding only state licenses); fourth, it introduces an "innovation exemption mechanism," focusing on commercial viability, allowing emerging business models and services that do not fully comply with existing rules to quickly enter the market, but such service providers must adhere to commitments to report regularly to the SEC, introduce whitelist or certification pool functions, and only allow securities tokens that meet compliance functional standards (such as ERC3643) to circulate.

From the design blueprint, the regulatory logic in the U.S. has completely changed, shifting from a punitive regulatory approach to inclusive enforcement, and further moving towards comprehensive policy support across the entire chain and framework, encompassing everything from source attributes to key applications, from platform construction to service guarantees. This reflects that the U.S. is forming a systematic regulatory framework around "crypto assets," which serves as a solid foundation and objective guarantee for the development of the crypto industry in the U.S. The regulatory plan has already fired the first shot, with the SEC stating in its latest guidelines that certain liquid staking activities do not involve securities, and individuals engaging in liquid staking activities do not need to register with the agency under securities laws.

In comparison, although both are regulatory policies, the U.S. stands in stark contrast to Singapore and Hong Kong. The former releases highly positive signals, while the latter presents more defensive postures amid innovation, which may be related to regional characteristics. Both Hong Kong and Singapore have limited geographical scope and are positioned as financial centers, exhibiting characteristics of a bridgehead or regional window. Therefore, stability and order are particularly important to them; if money laundering issues arise, the damage to the regional brand would be more severe, leading to significant negative externalities. In contrast, the U.S. has stronger autonomy and a greater voice in the development of emerging phenomena, allowing it to lead global order to a certain extent, thus being more open to specific industries. As a result, the market is already responding, with some crypto projects in Hong Kong and Singapore expressing intentions to migrate to the U.S. for development.

It is not difficult to foresee that the "U.S. center" pattern in the crypto industry will be further strengthened, and the U.S. market will become an important battleground for determining the development of crypto projects. Other regions may be destined to follow a differentiated path as subordinates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。