Author: Sara Gherghelas, Dappradar

Translated by: Felix, PANews

July was anything but calm for Web3. Despite a slight decline in the overall number of active wallet users, dropping to 22 million daily (an 8% decrease), the month was still rife with undercurrents. NFT trading volume surged by 96%, with user activity surpassing DeFi for the first time in months. Meanwhile, DeFi's total locked value reached $270 billion, setting a new all-time high, while the market capitalization of tokenized stocks skyrocketed by 220%.

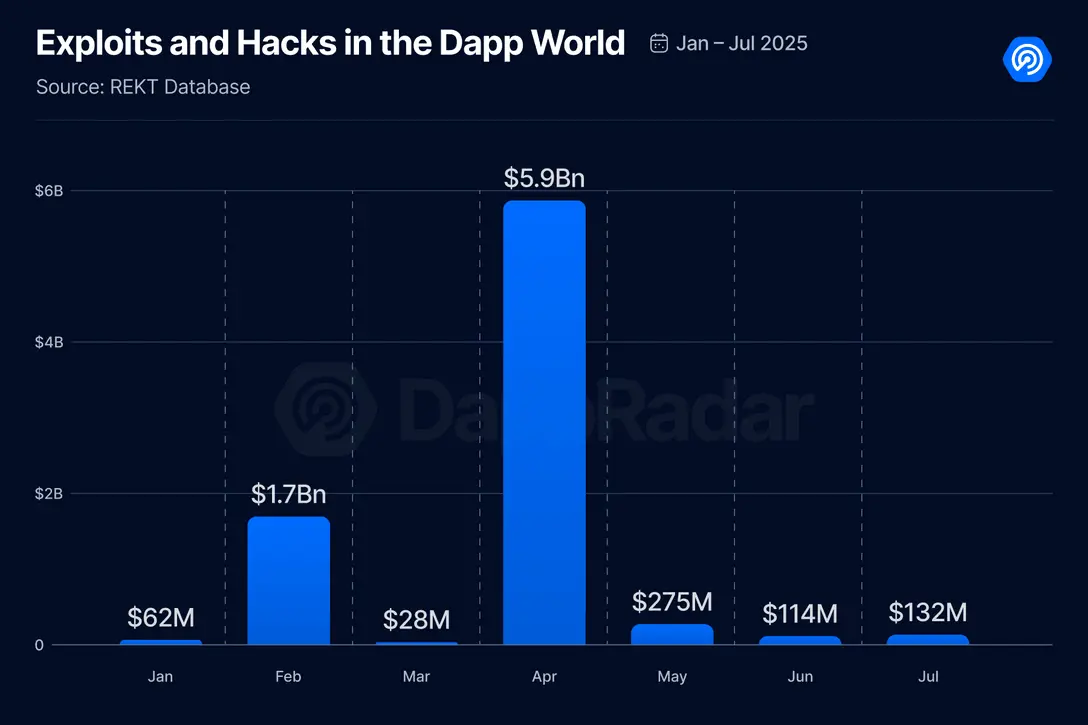

However, growth does not come without risks. Hackers caused losses of $132 million, and while AI remains one of the most promising fields, the usage of most AI dapps saw a double-digit decline. Regulation is rapidly catching up, with the U.S. passing several significant cryptocurrency bills, and a global regulatory framework is beginning to take shape.

From the strong momentum of blue-chip NFTs to record-breaking DeFi capital flows, this month proved that Web3 is far from slowing down; it is merely changing lanes.

Key Points:

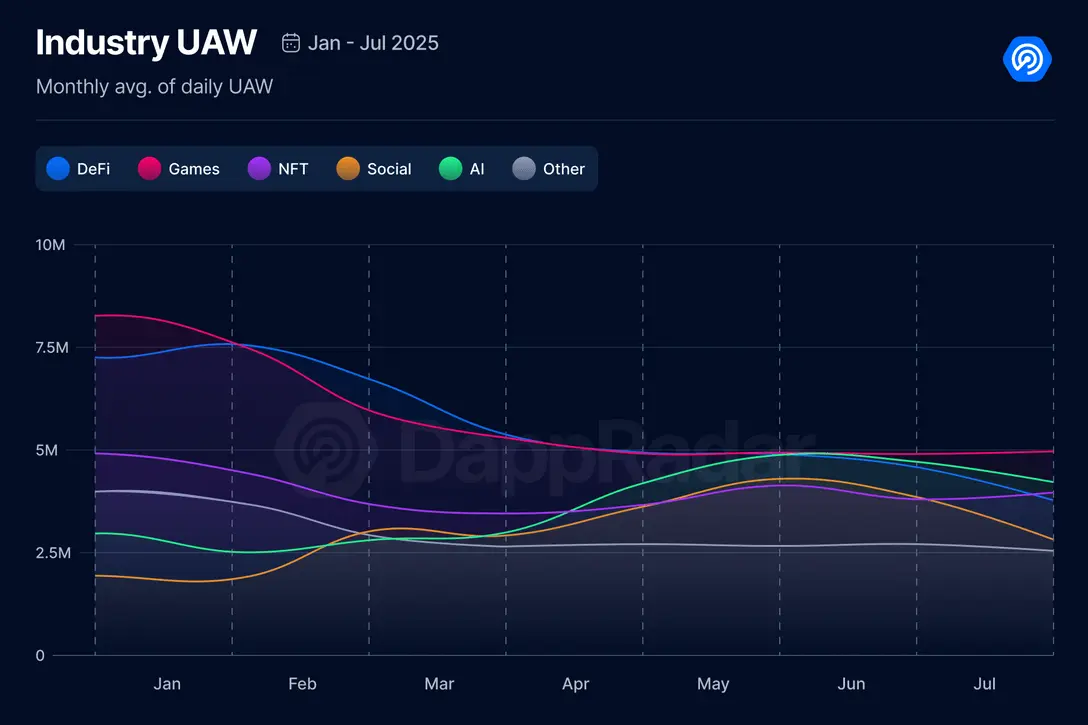

- In July, there were 22 million unique active wallets interacting with DApps daily, a month-on-month decrease of 8%.

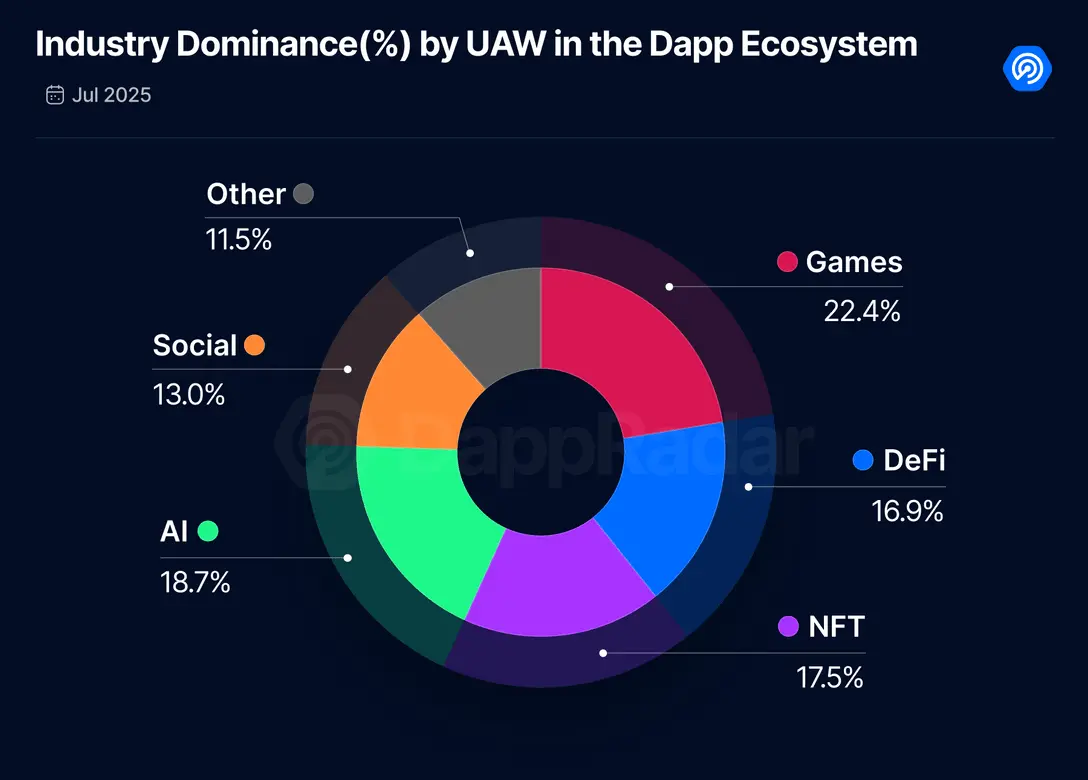

- Gaming applications accounted for the highest share at 22.4%, followed by artificial intelligence (18.7%) and NFTs (17.5%).

- NFT trading volume increased by 96%, reaching $530 million, with the average NFT price doubling to $105.

- The total locked value (TVL) in DeFi hit a new high of $270 billion on July 28, a month-on-month increase of 30%.

- The activity of AI dApps declined, but Dmail, XPIN, and ChainGPT showed steady growth.

- In July, losses due to vulnerabilities amounted to $132 million, a 16% increase from June.

1. Dapp Activity Cools Down

As in previous years, July saw a typical summer slowdown, with the number of daily unique active wallets decreasing by 8% to 22 million.

The social sector experienced the most significant cooling, with daily active users (dUAW) dropping by 27% to 2.8 million. This is not surprising, as social dapps often fluctuate with the waves of hype. Currently, InfoFi platforms like Farcaster and the new Base dapp have become the focus, but many such communities still have strict entry barriers. This makes it difficult for new users to participate, even though the potential is enormous. However, in the long run, this category may become foundational. The creator economy has already dominated traditional media and is making strong inroads into the Web3 space.

The AI sector also saw a noticeable decline of 14%, with dUAW dropping to 4.1 million. Meanwhile, DeFi shrank by 6%, continuing the recent cooling trend. However, the gaming sector showed resilience, growing by 2%, while NFTs remained stable.

The gaming sector continues to lead the DApp ecosystem, capturing 22.4% of the market share in July. Following closely are artificial intelligence (18.7%) and NFTs (17.5%). A significant change is that DeFi, which was the dominant sector two months ago, has now fallen behind NFTs. This clearly indicates a shift in user behavior, perhaps reflecting changing priorities for users when interacting with Web3.

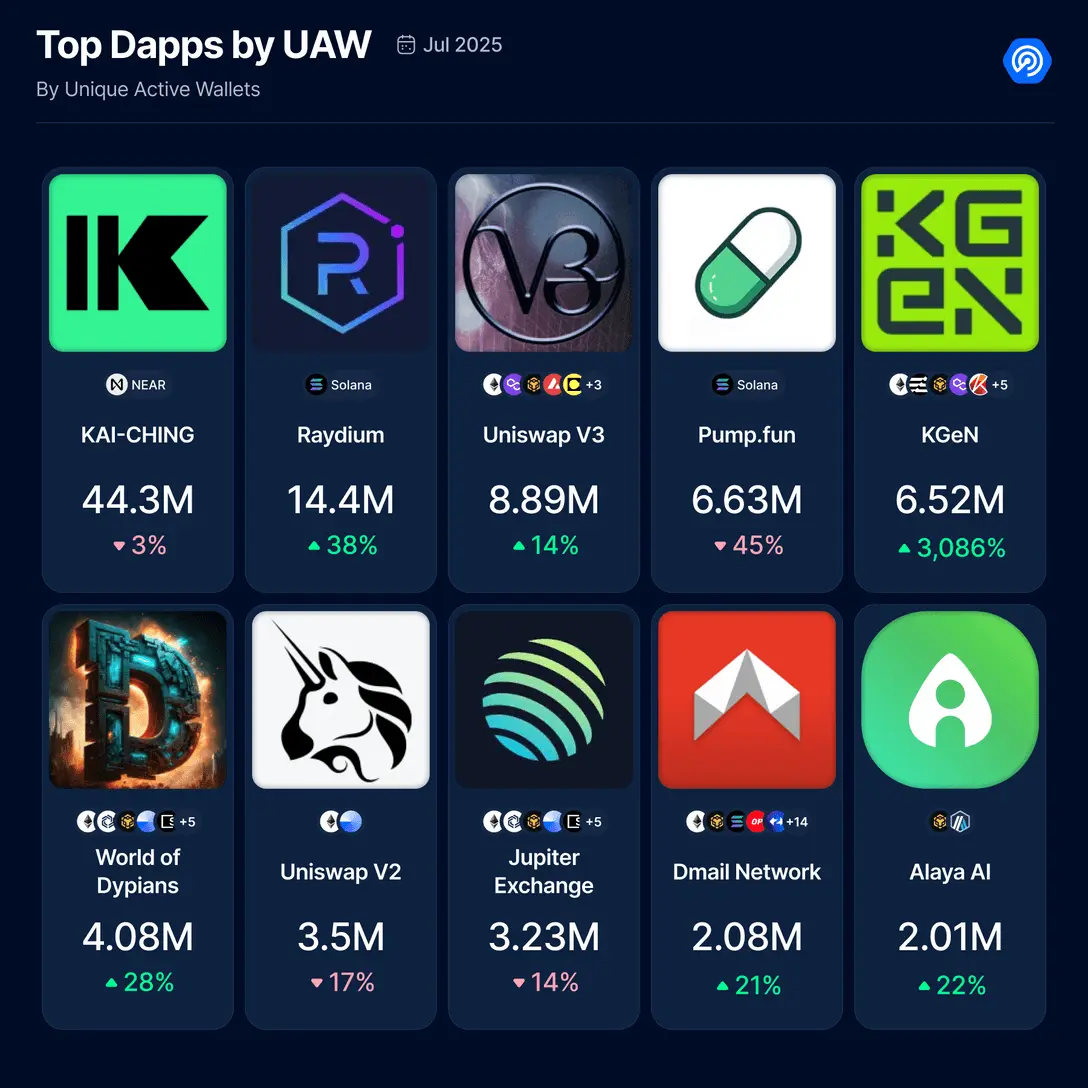

2. Most Used Dapps in Web3

Ranking of daily unique active wallets (dUAW)

Solana-based DEXs continue to dominate. The memecoin craze is far from over, and these exchanges remain key venues for retail activity.

Outside of DeFi, another notable dapp is "World of Dypians," a gaming dapp that has consistently maintained a stable user base and continues to drive steady increases in user activity.

Also noteworthy is that two AI DApps have made it to the top of the rankings. Their emergence indicates that user interest in AI-driven Web3 experiences is not a passing fad but has become ingrained in daily activities.

Although DeFi may no longer dominate in terms of overall wallet share, it still holds a leading position in the DApp rankings. Why? Because launching a DeFi DApp and truly gaining users is no easy feat, but those DApps that successfully break through often achieve higher levels of activity and loyalty.

In contrast, the variety of DApps in areas like gaming, social, or NFTs is much richer, and user attention is more dispersed.

3. AI Dapps: Rise, Fall, and Future

In July, most AI DApps saw a decline in activity, but three projects stood out with steady growth: Dmail Network, XPIN Network, and ChainGPT. These projects, along with others, are worth watching.

- Dmail Network: A blockchain-based encrypted email service.

- Exorde: Uses AI to gather global news and insights.

- ChainGPT: A suite of AI-based crypto tools, including ChainGPT Pad, a launch platform for early projects. (ChainGPT Pad is also part of our DappLaunch program!)

Additionally, one of the biggest initiatives in this field comes from Lightchain AI, which launched a mainnet designed for on-chain machine learning. With a virtual machine specifically for AI and a "smart proof" consensus mechanism, it offers a glimpse into the future development of decentralized AI infrastructure.

Theta Network is also accelerating its efforts, integrating Amazon's Trainium and Inferentia chips to support use cases like "Quakebot," an AI agent for the Major League Soccer (MLS) San Jose Earthquakes.

Protocols like Aethir and Render Network are making decentralized computing a reality. Aethir's compute hours have reached 1 billion, and it has launched an AI-driven crypto credit card, while Render has migrated to Solana for faster and more cost-effective performance.

The ASI Alliance, composed of SingularityNET, Fetch.ai, and Ocean Protocol, has officially merged under the $ASI token, aiming to create a fully decentralized AGI stack.

In the gaming sector, Elympics launched the $ELP token to enable AI-driven "Agentic Gaming," connecting it with NFT intellectual properties like Pudgy Penguins and Doodles.

AI tokens like TAO, RNDR, and AGIX are attracting investor attention, with TAO receiving a $10 million investment from TAO Synergies, the largest public AI fund to date.

Meanwhile, researchers unveiled A1, an AI agent capable of autonomously exploiting smart contract vulnerabilities, indicating that AI as a tool and risk is rapidly evolving.

In terms of regulation, the U.S. has passed several bills providing clear guidance for participants in the AI and cryptocurrency sectors and appointed an AI and cryptocurrency czar, marking the increasing role of AI in the blockchain space.

4. DeFi TVL Hits New Highs

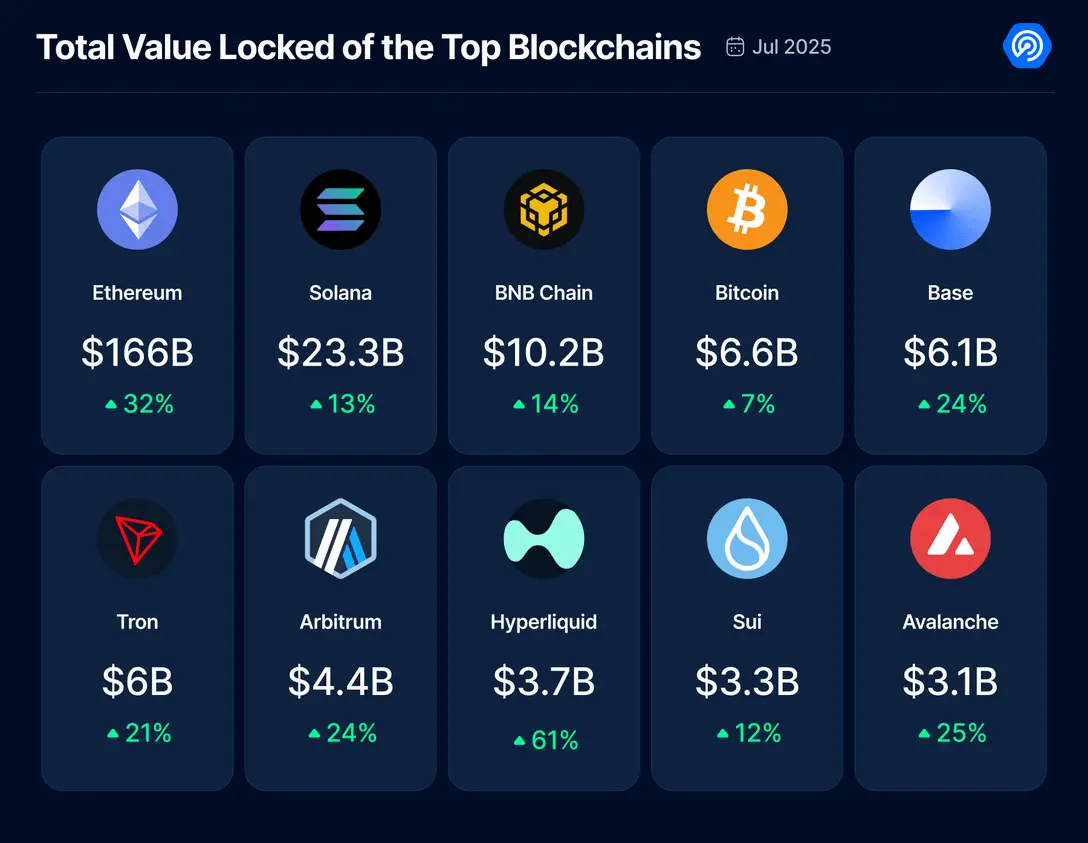

In July, DeFi performed exceptionally well. TVL grew by over 30%, closing the month at $259 billion. More notably, on July 28, DeFi TVL reached a historic high of $270 billion, clearly indicating increased market confidence, enhanced liquidity, and a growing demand from users for lending, trading, and tokenized assets.

Tokenized stocks became a major highlight. The number of wallets interacting with such assets surged from about 1,600 to over 90,000, with a total market capitalization increase of 220% during the same period. This is not just growth; it signals that RWA is beginning to reach critical mass.

Ethereum continues to dominate the DeFi space, with a total locked value (TVL) of $166 billion, far surpassing Solana's $23 billion. In July, ETH prices soared nearly 60%, likely driven by favorable regulatory news. Meanwhile, staking rewards annualized yield surged to 29.4%, reflecting increased market confidence and user participation.

On the Solana front, Hyperliquid performed impressively, generating 35% of the blockchain's revenue in July, thanks to rising demand for derivatives. Currently, Hyperliquid handles over 60% of the 24-hour perpetual contract trading volume, with open interest reaching $15.3 billion and facilitating $5.1 billion in USDC bridging.

In terms of policy, July was a significant moment for cryptocurrency regulation in the U.S. Legislators passed:

- The GENIUS Act – establishing a stablecoin framework.

- The CLARITY Act – clarifying the classification of digital assets (SEC vs. CFTC).

More importantly, SEC Chair Gary Gensler announced "Project Crypto," outlining a roadmap for the integration of DeFi with traditional finance, including proposals for token issuance, custody, and a dedicated compliance framework for DeFi.

5. NFT Activity Surpasses DeFi

The NFT market has shown strong vitality. In July, NFT activity exceeded that of DeFi, a shift not seen for some time. What is behind this momentum?

Trading volume nearly doubled, increasing by 96% to $530 million. However, sales dropped by 4% to 5 million. This reflects one thing: NFT prices have risen.

In June, the average price of NFTs was $52. In July, this price rose to $105, an increase of 103%. Blue-chip collections have once again become the focus, with whales leading the charge.

Thanks to professional traders and their Blend lending protocol, Blur dominates Ethereum NFT trading volume (with daily shares reaching up to 80%). OpenSea maintains its lead in user numbers (averaging about 27,000 daily) through long-tail asset listings and cross-chain activities. Zora has gained attention with its creator-first L2 network and $ZORA token, offering affordable and convenient NFT minting services.

Additionally, Starbucks has concluded its Odyssey NFT loyalty pilot project. Nike's SWOOSH continues to release digital products and has partnered with EA Sports to launch virtual sneakers in games. Louis Vuitton, Rolex, and Coca-Cola (China) have initiated NFT pilot projects related to authentication and collectibles. Netflix, NBA Top Shot, and FIFA are still involved, but the licensing terms are clearer.

A significant transformation? NFTs are evolving from hype to practical tools, transitioning from collectibles and culture to identity, ticketing, gaming, and tokenized real-world assets.

6. Vulnerabilities Lead to $132 Million in Losses

I wish I could report a month without hacker attacks or exploitations, but the current Web3 world is not so (at least not yet). Moreover, as signs of market recovery emerge, it seems that criminals are ramping up their attacks.

In July, losses due to exploits exceeded $132 million, a 16% increase from June.

Major vulnerabilities in July 2025:

- CoinDCX ($44 million) — An Indian exchange suffered a server breach targeting its internal liquidity accounts. Fortunately, user funds were unaffected, and the exchange continues to operate normally.

- GMX v1 ($42 million) — On July 9, a vulnerability in the GMX v1 version on the Arbitrum platform allowed malicious contracts to manipulate internal accounts, extracting funds beyond the allowed amount. The GLP pool was affected; other GMX versions were not impacted. A bounty has been set to recover funds.

- BigONE ($28 million) — On July 16, the hot wallet of centralized exchange BigONE was accessed without authorization, leading to losses across multiple chains. The platform stated that all user assets are secure and will bear the full loss.

These incidents serve as a reminder that security work in Web3 is still ongoing. Whether deeply involved in DeFi, NFTs, or AI DApps, be sure to carefully check smart contract permissions, avoid clicking on suspicious links, and use hardware wallets whenever possible.

Related article: 2025 Q2 Dapp Market Report: AI Agent Applications Dominate, RWA and Gaming Drive NFT Recovery

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。