In the future crypto world, holding underlying assets may be more valuable than holding the platforms that trade these assets.

Written by: Prathik Desai

Translated by: Luffy, Foresight News

Over the past few months, I have been tracking ARK Invest's daily trading activities in crypto companies. This American fund management firm oversees several ETFs and an asset under a venture fund. Their buying and selling strategies reveal an interesting phenomenon: how they precisely time their moves in this seemingly difficult-to-navigate field.

One operation might be a coincidence, two perhaps intuition, but ARK's crypto trading demonstrates an unusual sense of timing. This is intentional rather than a passive reaction. The evidence is that in just June and July, by trading shares of Coinbase and Circle, they made over $265 million in profit.

A closer look reveals that ARK is withdrawing funds from exchanges and trading platforms, shifting towards infrastructure, asset reserves, and more.

Recent trades by ARK give us a glimpse into how one of the most watched institutional investors optimizes returns for its crypto investors through quick and often precise entry and exit timing. This is in stark contrast to the crypto sector's "diamond hands" (long-term holding) rhetoric, and is more complex and sophisticated.

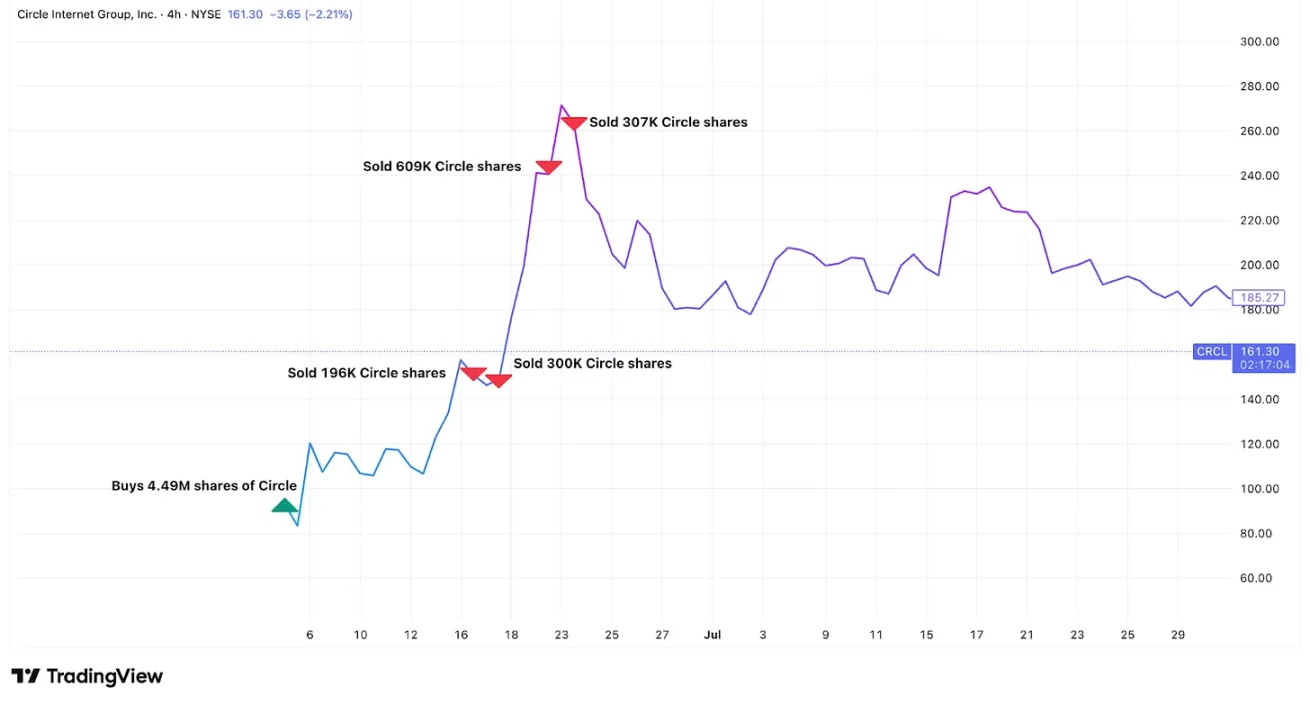

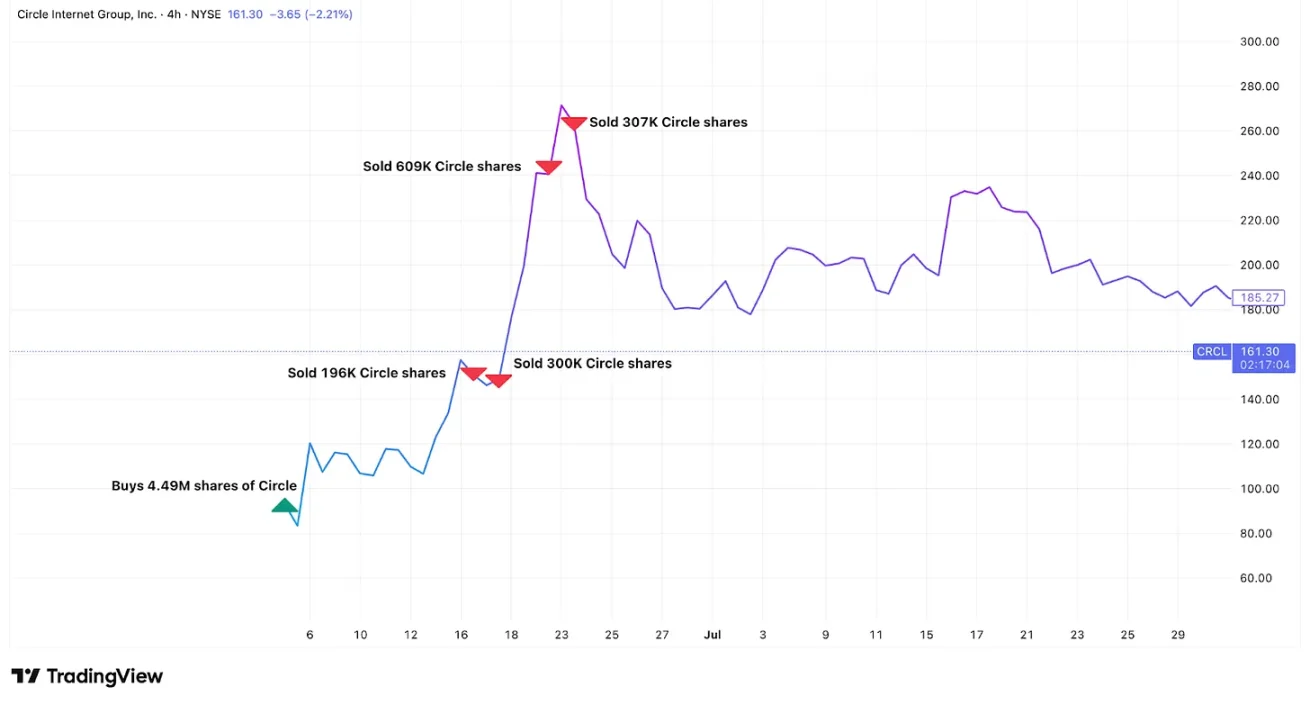

On June 5, 2025, Circle, the issuer of the largest compliant stablecoin USDC, went public on the NYSE at an issuance price of $69. As a cornerstone investor, ARK purchased 4.49 million shares through its funds, totaling approximately $373 million.

On June 23, Circle's stock price peaked at $263.45, implying a market capitalization of about $60 billion, equivalent to 100% of its then-managed asset scale. This may be due to the market's optimistic outlook on the future of stablecoins, attempting to estimate Circle's forward revenue at ten times its current assets under management (AUM). However, compared to traditional asset management company valuations, this seems overly exaggerated. For reference: BlackRock manages $12.5 trillion in assets but has a market cap of just over $180 billion, about 1.4% of its AUM. This was a signal for ARK.

Daily trading documents show that as Circle's stock price premium soared, ARK systematically sold its shares through multiple funds.

ARK began selling off before Circle's stock price peaked, ultimately selling about 1.5 million shares (33% of total holdings), cashing out approximately $333 million during the parabolic rise in stock price. Compared to when ARK built its position, this realized over $200 million in profit, with a return rate of 160%.

ARK's interest in hot IPOs does not stop there.

Last week, they purchased 60,000 shares on Figma's IPO day. This San Francisco-based design software company revealed in SEC filings that it holds a $70 million Bitcoin ETF and has been approved to repurchase $30 million more.

Figma's stock price soared over 200% on its IPO day, closing at $115.50, a 250% increase. The next day, Figma's stock price rose another 5.8%.

ARK's recent trades in Coinbase further reveal its systematic profit-taking pattern.

As of April 30, 2025, ARK held 2.88 million shares of this largest U.S. crypto exchange. Subsequently, they systematically took profits before the end of July.

Meanwhile, as Bitcoin reached a historic high of over $112,000, Coinbase's stock price also rose, briefly surpassing $440, setting its own historical high. On July 1, ARK sold $43.8 million worth of stock; on July 21 (the day Coinbase's stock peaked), ARK reduced its holdings by $93.1 million through three funds. From June 27 to July 31, ARK sold a total of 528,779 shares (about 20% of total holdings), worth over $200 million, with an average selling price of $385 per share. In contrast, ARK's weighted average cost of acquiring Coinbase over four years was about $260, resulting in profits exceeding $66 million from these trades.

In the past two months, Coinbase is no longer the top holding in ARK's fund portfolio.

After the market closed on July 31, Coinbase's second-quarter results disappointed investors, leading to a 17% drop in stock price the next day, from about $379 to $314. On August 1 (the day of the plunge), ARK bought $30.7 million worth of Coinbase stock.

These trades are not isolated events but part of a strategic shift, moving funds from the overheated crypto exchange ecosystem to areas that have just begun to attract widespread attention.

While selling Coinbase shares, ARK also reduced its stake in its competitor Robinhood. These two reductions coincide with ARK's significant investment in BitMine Immersion Technologies, which is referred to as "the MicroStrategy of Ethereum." Led by Wall Street veteran Tom Lee, BitMine is building an Ethereum reserve, aiming to hold and stake 5% of the total Ethereum supply.

On July 22, ARK invested $182 million in BitMine through a block trade. But they did not stop there; they systematically bought in during each significant pullback, accumulating over $235 million in just two weeks.

These trades indicate that ARK is shifting from crypto exchanges and payment companies to the so-called crypto infrastructure sector. Coinbase and Robinhood profit from people's crypto trading, while BitMine profits from directly holding cryptocurrencies. Both methods can capture the benefits of cryptocurrency adoption, but their risk profiles differ.

Exchanges benefit from market volatility and speculative behavior. When cryptocurrency prices fluctuate dramatically, trading activity increases, and exchange revenues rise, but this is cyclical. In contrast, reserve-type companies like BitMine directly benefit from rising cryptocurrency prices; if Ethereum rises by 50%, BitMine's assets will also rise by 50%, independent of trading volume or user behavior. Even without significant capital appreciation, staking Ethereum on the network can generate stable income.

However, high returns come with high risks: reserve-type companies also face direct downside risks. When Ethereum prices fall, BitMine's asset value will proportionally shrink, making the beta value (risk coefficient) of the reserve strategy higher.

ARK's trading reflects its belief in cryptocurrencies: cryptocurrencies are maturing from speculative trading markets to closer to permanent financial infrastructure. In such a world, holding underlying assets may be more valuable than holding the platforms that trade these assets.

The interesting aspect of these trades is the precision of timing. They sold all the way up during Circle's dream surge until it peaked; they captured a 250% increase on Figma's IPO; they sold at Coinbase's peak and then added to their position after its disappointing earnings plunge; they bought into BitMine during multiple pullbacks.

ARK's methodology combines traditional value investing principles with precise timing: when Circle's market cap reached 100% of its managed asset scale, it may have been overvalued; when Coinbase dropped 17% in a single day due to disappointing earnings, it may have been undervalued. ARK also seems to time trades around predictable events (earnings releases, regulatory decisions, market volatility).

There is also a more critical question: why do these stocks have such a significant premium relative to their underlying assets? Circle's market cap once equaled its managed asset scale, and BitMine's stock price also had a multiple premium over the value of its held Ethereum. This premium largely exists because most investors cannot easily purchase cryptocurrencies directly; even if they can, the experience of depositing and withdrawing on platforms is not smooth enough for retail investors. If you want to allocate Ethereum in your pension for its appreciation benefits, buying shares of a company that holds Ethereum is far easier than directly purchasing Ethereum.

This creates a structural advantage for companies holding crypto assets. ARK's trades indicate that they are well aware of this situation: buy when the premium is reasonable, sell when the premium is too high.

ARK's strategy proves that investing in crypto stocks is not necessarily a simple buy-and-hold, especially when you want to optimize returns. For anyone trying to track ARK's crypto trades, simply knowing what they bought is not enough; one must also understand the reasons for their purchases, the timing of potential sales, and what targets they might turn to next.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。