The listing of Circle has ignited market attention towards stablecoins, making Circle the first compliant stablecoin stock. However, behind the glamour lies potential crises.

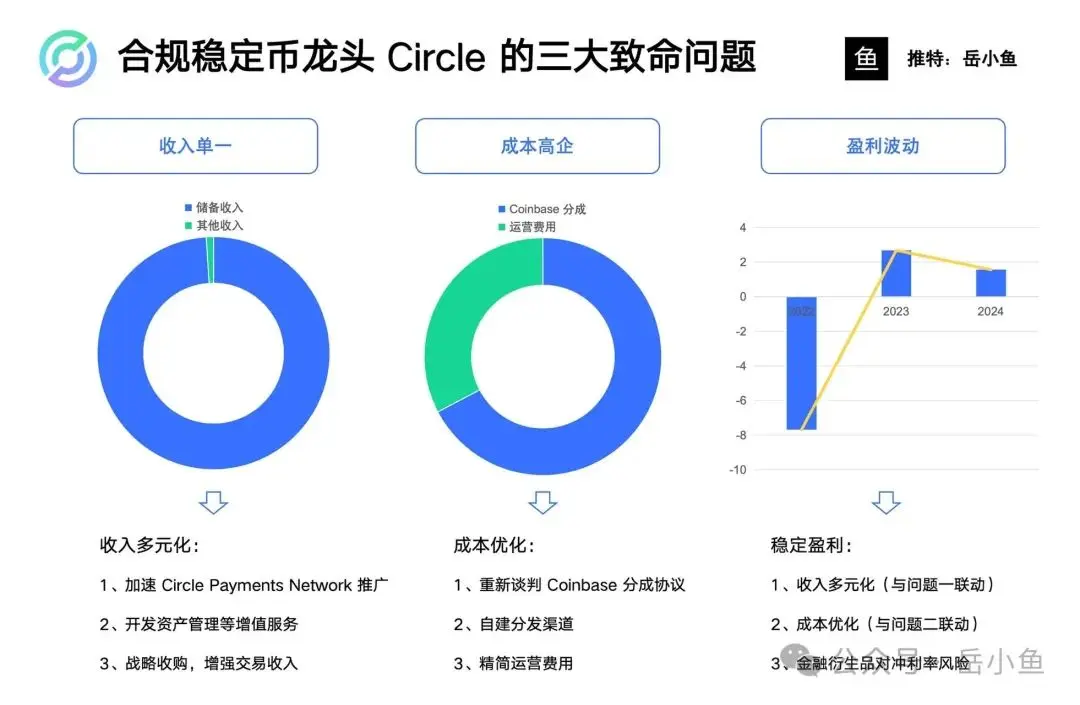

After reviewing Circle's IPO prospectus, we can identify three major fatal issues with Circle:

First, revenue is singular, with 99% coming from reserve fund income and only 1% from other sources;

Second, costs are high, with 60% of revenue going to Coinbase, resulting in a net profit margin of only 9%;

Third, profit volatility, with unstable earnings—net losses of $770 million in 2022, profits of $270 million in 2023, and a drop back to $160 million in 2024.

Let's examine the causes behind these three major issues and what efforts Circle is making to address them.

1. Singular Revenue

With 99% of income coming from reserve funds, this means Circle lacks other profit points, which presents a clear "valuation ceiling" for the company.

Let's first look at this core business model:

The USDC issued by Circle is a stablecoin pegged 1:1 to the US dollar, backed by low-risk assets such as US dollars and short-term government bonds.

When users hold USDC, Circle invests these funds in assets like US Treasuries to earn interest income, while USDC holders do not receive interest.

This model is essentially a form of "interest-free financing," where Circle invests user funds without incurring costs, similar to how banks absorb deposits and then lend them out, but with lower risk (due to investing in government bonds rather than loans).

Circle's business model can be seen as a bond arbitrage for digital dollars.

Thus, Circle's profitability relies on two variables:

One is the circulation of USDC; the larger the circulation, the larger the scale of reserve assets, and the higher the interest income;

The second is the interest rate environment, as US Treasury yields directly determine reserve income, with a high-interest environment being extremely favorable for Circle.

Although Circle has already occupied the ecological niche of "compliant stablecoin leader," allowing it to capture a larger share of the growing market, the Federal Reserve has now entered a rate-cutting cycle, and US Treasury yields may drop to 2% or lower, directly halving Circle's profits.

Additionally, with more traditional finance entering the space and competitors (some emerging stablecoins) beginning to pay interest to holders, Circle's "interest-free financing" model will face challenges, potentially further losing market share in compliant stablecoins.

At this point, with Circle relying solely on reserve fund income as a profit point, it cannot support a higher market valuation.

Circle's proposed solutions are:

Accelerating the promotion of Circle Payments Network: Circle launched the Circle Payments Network in May 2025, aiming to provide instant, low-cost cross-border payment services using USDC, connecting banks, digital wallets, and payment service providers.

Developing value-added services: Developing USDC custody and asset management tools targeted at institutional clients (such as crypto funds and banks) and charging management fees.

Exploring non-USD stablecoins and emerging markets: Circle has issued EURC (euro-pegged stablecoin) and plans to promote USDC and EURC in Asia and Latin America, where growth in these new markets has been quite effective.

2. High Costs

60% of Circle's revenue goes to Coinbase, primarily as distribution and promotion fees.

This revenue-sharing ratio is a significant burden for Circle.

Why does Circle give 60% of its revenue to Coinbase?

This is related to the development history of USDC, as Circle and Coinbase are co-founders of USDC.

Circle is responsible for the issuance of USDC and the management of reserve assets, while Coinbase provides distribution channels, technical support, and marketing, with both parties sharing USDC reserve income (mainly from US Treasury interest) based on an agreement.

When USDC was first launched in 2018, Circle's brand and distribution capabilities were weak, relying on Coinbase's exchange status and user network to quickly expand USDC's market share, thus Coinbase held a dominant position in the partnership.

Coinbase is a leading compliant exchange in the US, possessing strong bargaining power.

Moreover, for a long time, the circulation and trading volume of USDC heavily depended on Coinbase's infrastructure, making it difficult for Circle to detach in the short term.

For example, in 2024, based on a total circulation of $32 billion, Coinbase contributed approximately 50%-60% of USDC's circulation, roughly $16-19.2 billion.

Interestingly, there is a clause in the cooperation agreement between Circle and Coinbase:

If Circle cannot distribute this dividend to Coinbase under certain circumstances or faces regulatory issues, Coinbase has the right to become the issuer of USDC itself, meaning it could take over USDC and become the issuer.

Although Circle currently fully issues and operates USDC, Coinbase still plays a significant role.

Circle has also recognized the long-term risks of high revenue sharing and has taken measures such as renegotiating the revenue-sharing agreement and building its own distribution channels.

The former, renegotiating the revenue-sharing agreement, is challenging due to legal constraints, making it difficult for Circle to escape these limitations;

The latter, building its own distribution channels, can effectively alleviate the profit pressure from high revenue sharing.

3. Profit Volatility

It must be acknowledged that the market capitalization of stablecoins is strongly correlated with the cyclical fluctuations of the cryptocurrency industry.

The alternating bull and bear markets in the cryptocurrency market directly affect the overall scale of the stablecoin market.

Circle's net loss of $768.8 million in 2022 was due to the crypto bear market;

In 2023, the profit of $267.6 million was attributed to cost control and rising interest rates;

By 2024, the profit fell back to $155.7 million due to surging distribution costs.

We can review the changes in USDC issuance volume, which have several key nodes:

The first node is the DeFi summer of 2020, when USDC's issuance reached $55 billion;

The second node is the UST collapse in 2022, which saw a massive influx of funds into USDC, allowing it to maintain a high market cap even during the crypto bear market;

The third node is the strong rise of Solana in early 2023, which contributed to USDC's growth compared to USDT;

The fourth node is the collapse of Silicon Valley Bank in March 2023, coupled with unfavorable regulatory policies from the SEC, causing USDC's issuance to drop by about 30%, and by the end of 2023, it had fallen by around 50%;

The fifth node is Trump's election victory, which led to a resurgence in stablecoin issuance, with USDC growing to over $60 billion, an overall increase of 80%.

Thus, we can see that the bull and bear markets in the cryptocurrency market are extremely important for the growth of stablecoins, and the impact of policies on compliant stablecoins, especially those like USDC, is also crucial.

To mitigate profit volatility, Circle's actions are related to the first and second issues: on one hand, diversifying income to reduce reliance on interest rates, and on the other hand, optimizing costs to stabilize profit margins.

More importantly, Circle can leverage its compliance advantages to solidify its market position and respond to fluctuations in the crypto market.

In Summary

Stablecoins can be seen as a revolution in the traditional financial system.

Stablecoins are a crucial infrastructure that could replace SWIFT, bank clearing and settlement, and the foreign exchange system.

Circle's vision extends far beyond issuing stablecoins; it aims to build a new financial system, with USDC as the core of this new financial system.

However, Circle also faces numerous issues, particularly the three major fatal problems mentioned above, which need to be addressed.

Regardless of the outcome, Circle's listing has set a benchmark for the crypto industry, inspiring more people to pay attention to stablecoins, and we can continue to monitor this transformation in the financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。