Author: Nancy, PANews

Following the bold Bitcoin reserve strategy of MetaPlanet, which has created a flywheel effect in its main hotel business, more and more Japanese companies are beginning to follow suit. The latest cross-industry player to emerge is a nail salon chain, Convano Inc., which recently announced a significant investment in Bitcoin, aiming to hold 21,000 BTC within two years, resulting in a surge in its stock price.

Nail Company Launches Bitcoin Reserve Strategy, Aiming for 0.1% of Global Supply

On July 17, Convano officially announced its entry into the cryptocurrency asset space, launching its Bitcoin reserve strategy.

Convano is a publicly listed company headquartered in Tokyo, Japan, established in 2007, primarily engaged in nail salon and media businesses, including several nail brands such as FASTNAIL, FASTNAIL PLUS, FASTNAIL LOCO, and CONST. It operates approximately 50 directly managed and franchised nail salons in areas like Shinjuku, Shibuya, and Ginza, and has recently begun to explore the cryptocurrency and AI data sectors.

In its announcement, Convano explained that in recent years, with rising prices and increasing exchange rate volatility, the importance of anti-inflation capabilities and currency diversification in business operations has grown. As a countermeasure, the company will use BTC as an inflation hedge and a means of value storage to strengthen the stability of its financial structure and protect against potential purchasing power losses due to growth in its core yen business.

To ensure the effective execution of this strategy, Convano also announced the establishment of a dedicated Bitcoin strategy office led by director Taiyo Azuma, who has early investment experience in cryptocurrency assets, to oversee investment planning and risk control.

Subsequently, Convano announced financing of 1.5 billion yen (approximately 10.1 million USD) and 2 billion yen (approximately 13.54 million USD) for the purchase of more Bitcoin.

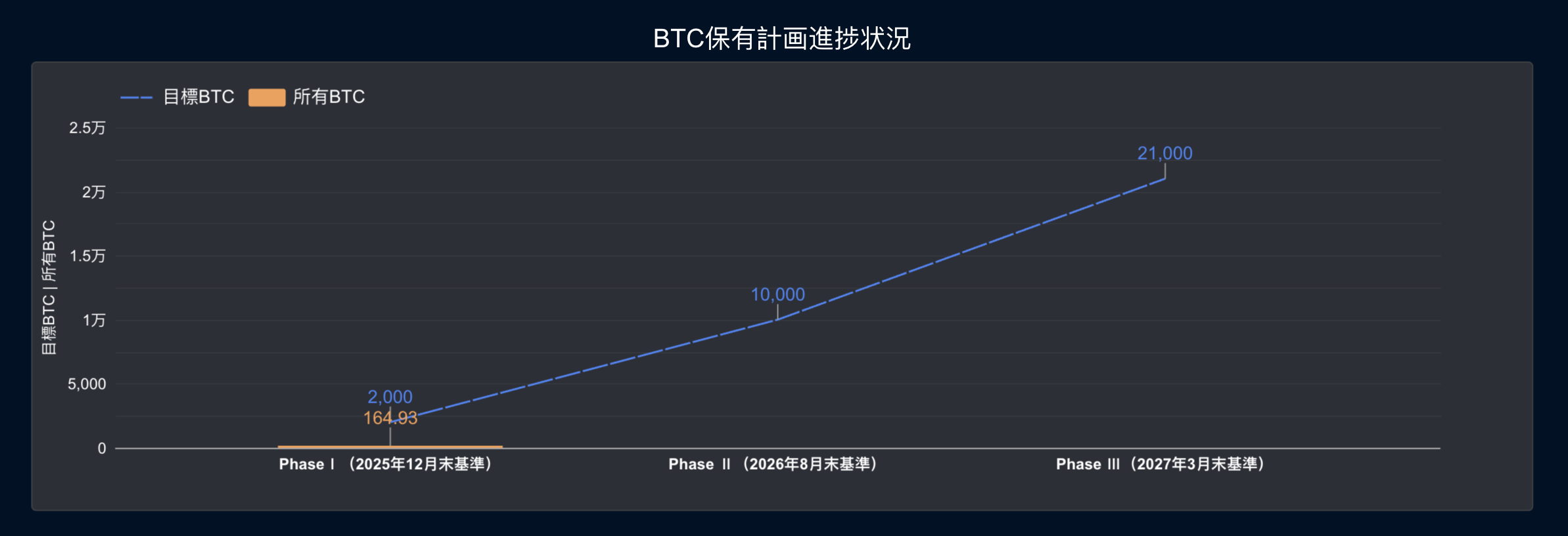

Earlier this month, Convano stated its plan to hold 21,000 Bitcoins by the end of March 2027 in three phases, which would account for approximately 0.1% of the total Bitcoin supply. The targets are: to hold 2,000 Bitcoins by the end of December 2025, increase to 10,000 by the end of August 2026, and finally reach 21,000 by the end of March 2027.

To support the initial phase of this plan, the company has announced the issuance of its third ordinary corporate bond with a scale of 2 billion yen for the next round of purchases. Convano reiterated in this announcement that it views Bitcoin as a financial defensive asset, not for short-term speculation or aggressive profit-making strategies. Additionally, Convano revealed that it has established a monitoring mechanism to track the potential impact of Bitcoin asset fluctuations on performance and promised to disclose relevant information in a timely manner when necessary.

Since July, Convano has accumulated investments totaling 2.9 billion yen (approximately 19.7 million USD), with holdings reaching 164.93 Bitcoins. Meanwhile, following the announcement of its Bitcoin reserve strategy, Convano's stock price surged by as much as 78.76%, hitting a historic high. With market optimism, Convano has recently raised its performance expectations for the fiscal year ending March 2026, increasing its sales revenue forecast to 7.16 billion yen (an increase of 160 million yen from previous estimates) and its operating profit forecast to 1.52 billion yen (an increase of 520 million yen from previous estimates).

Policy, Economy, and Market Sentiment Resonating, Crypto Treasury Becomes a Hot Topic in Japanese Stocks

Since MetaPlanet gained popularity, cryptocurrencies like Bitcoin are becoming new financial tools for Japanese companies to attract funding, gain attention, and hedge risks.

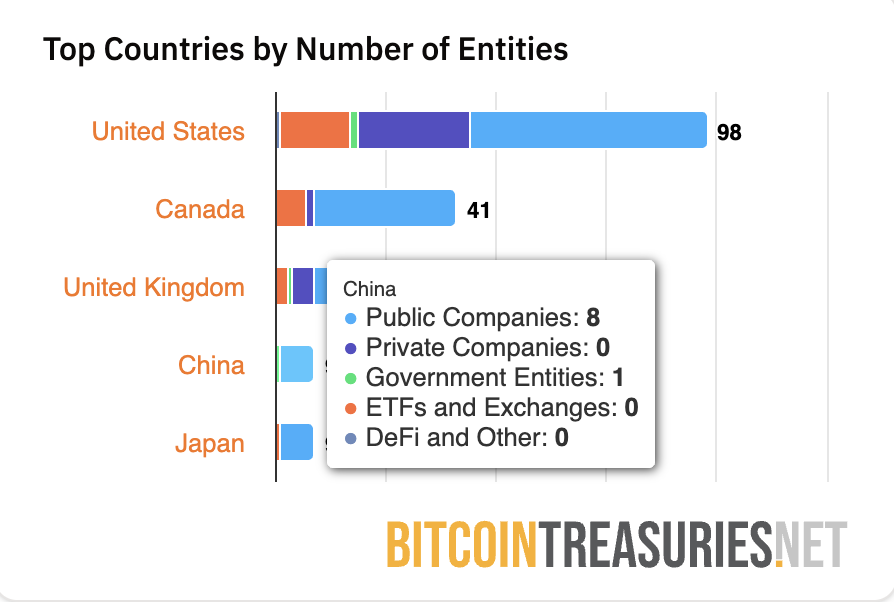

According to data from Bitcointreasuries.net, Japanese companies occupy 9 of the top 100 publicly listed companies globally holding the most Bitcoin, placing Japan among the top five countries for Bitcoin corporate reserves, following the United States, Canada, the United Kingdom, and China. In recent months, several Japanese companies, including publicly listed Remixpoint, fashion brand ANAP, AI company Quantum Solutions, Japanese textile materials company Kitabo, and national clothing chain Mac House, have announced their active embrace of Bitcoin.

The rise of crypto treasuries as a hot topic among Japanese companies is not coincidental but driven by multiple factors.

On one hand, Japan's tax system for cryptocurrencies has long been considered overly burdensome. Under current regulations, any income from cryptocurrency, whether through trading, mining, or other means, is classified as miscellaneous income and subject to a maximum comprehensive tax rate of 55% (including a 10% resident tax), which poses a heavy burden on investors and companies.

To alleviate this pressure, Japan's ruling party has proposed to unify the tax rate on cryptocurrency income to 20%, aligning it with the capital gains tax rate for traditional financial assets like stocks, and allowing losses to be carried forward for three years to offset future profits. This reform is expected to simplify the tax structure and lower the entry barriers for the cryptocurrency market.

In contrast, stock investments in Japan enjoy more tax advantages. For example, the capital gains tax is fixed at around 20%, and the government has actively promoted the tax incentive system NISA (Nippon Individual Savings Account), allowing up to 3.6 million yen in investment income to be completely tax-free each year. This policy has significantly stimulated domestic stock investment in Japan, boosting market activity.

This also partly explains why more and more Japanese investors are inclined to invest in cryptocurrency concept stocks. For companies, the allocation of cryptocurrency assets is gradually shifting from early speculative operations to more forward-looking strategic asset allocation. Especially in Japan's retail investor-dominated market structure, investment sentiment has a strong driving force on market trends, further fueling corporate interest and demand for the cryptocurrency market.

On the other hand, MetaPlanet's successful strategic transformation provides a replicable example for other companies. This budget hotel management company, once in dire straits, transformed into a Japanese version of Strategy and achieved a dramatic increase in value through its aggressive Bitcoin reserve strategy. According to Bitcointreasuries.net, as of August 5, MetaPlanet holds over 17,000 Bitcoins, making it the seventh largest publicly listed company by Bitcoin reserves. Its success offers a practical template for other Japanese companies facing transformation pressures.

Moreover, Japan's current economic challenges, including sluggish growth, high national debt levels, and a continuously depreciating yen, are prompting companies to seek alternative assets for value preservation. As Bitcoin continues to reach new highs, it further solidifies its status as digital gold, especially against the backdrop of global currency overproduction, with more Japanese companies viewing Bitcoin as an important means of hedging risks and diversifying asset allocation. Additionally, Japan's policy environment has provided a favorable setting for companies to invest in Bitcoin, such as recognizing cryptocurrencies as legal payment methods and recently proposing a bill to classify cryptocurrencies as financial products under the Financial Instruments and Exchange Act, considering the approval of Bitcoin spot ETFs, which would provide more convenience and legitimacy for institutional investors entering the market.

In summary, the acceleration of Japanese companies becoming core players in the global cryptocurrency market is the result of tax system optimization, corporate transformation pressures, macroeconomic uncertainties, regulatory friendliness, and global trends. Of course, market FOMO sentiment has also accelerated the penetration of Bitcoin and other cryptocurrencies in Japan's capital market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。