VanEck Competes With Grayscale Solana ETF Filing on Fee Terms

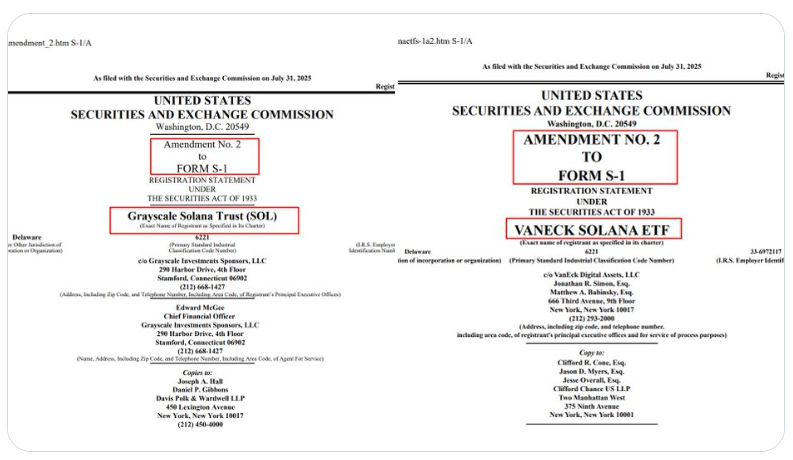

Major Firms Submit Amended including Grayscale Solana ETF Filing

Bitwise, Fidelity, Canary Capital, CoinShares, VanEck, and Franklin Templeton submitted amended S-1 registration statements to the SEC. The race for Sol ETFs is heating up the market. As they may come closer to receiving the U.S. Securities and Exchange Commission's approval, companies aiming to introduce spot Sol exchange-traded funds filed adjustments to their registration.

Source: Website

Grayscale Solana ETF Filing, intends to collect a 2.5% fee for its fund, which will be paid in SOL. Updated S-1 files for Grayscale and VanEck's Sol ETFs have been submitted to the SEC, indicating that both companies are moving closer to approval. The most important phase in the procedure is the submission of these updated S-1 forms. It seems that both are probably on the correct track toward compliance and have received preliminary replies from the SEC.

VanEck Counters Grayscale Solana ETF Filing With Staking Plan

VanEck is launching the VanEck Sol Trust fund, listed on Cboe BZX under the ticker VSOL, pending regulatory approval. The fund charges a 1.5% annual sponsor fee, lower than Grayscale's, and is unique among US-based crypto ETFs. It includes staking of coin from the start and has stringent criteria for staking validators, including performance metrics, slashing history, and security certifications.

SEC Reviewing Multiple firms with Grayscale Solana ETF Filing Proposals Simultaneously

The SEC is considering a number of plans to introduce a SOL Electronic Trading Fund in addition to dozens of other cryptocurrency products, ranging from those that follow DOGE to XRP. Fund fees, staking plans, and custodian information are among the updates. Under the Trump administration, the IRS has adopted a more accommodative posture toward digital assets, indicating that the funds may eventually be approved.

Source: X Profile

Nate Geraci, president of NovaDius Wealth, also reported about the news in his social media post. He stated that VanEck, 21Shares, Grayscale Solana ETF filing are among the spots that are now undergoing the implementation of S-1 changes.

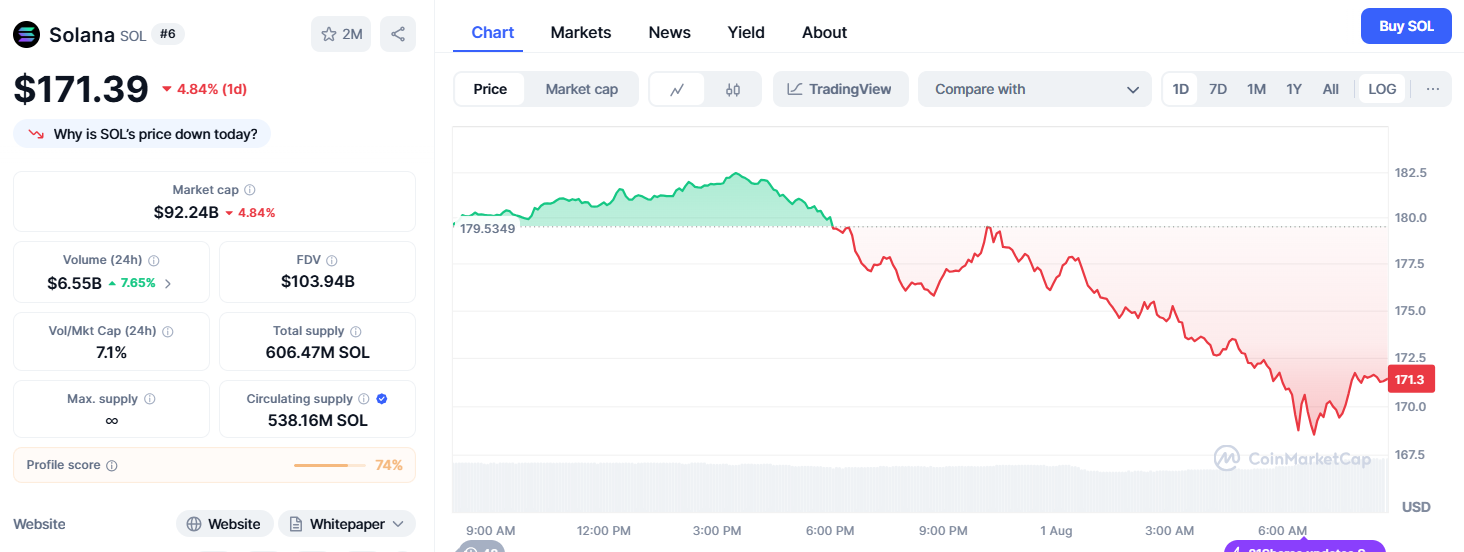

Token Price Falls Despite the Hype

Source: Coinmarketcap

Despite Grayscale Solana ETF Filing SOL is facing a dip of 4.84% in the past day. The coin is currently trading at $171.39 with $92B market capital. If approved, SOL might be included into diverse crypto Exchange Trade Funds which could impact the price and increase volatility in the market.

Crypto Regulation Evolves Post Bitcoin ETFs Approval

The Grayscale Solana ETF Filing can gain momentum by the SEC raising option limitations for bitcoin funds earlier this week and authorized in-kind redemptions for Ethereum ETFs and spot bitcoin. Then on Thursday, the agency's Chair Paul Atkins presented " Project Crypto " in the name of revising the SEC's regulations and declared that, in contradiction to what the SEC said earlier, that "most crypto assets are not securities."

According to crypto industry analysts, it reflects a bigger trend. Regarding cryptocurrency investment products, the SEC has taken a more lenient position. It favors those that prioritize investor safety, custody security, and transparency after the historic spot Bitcoin Exchange Trade Fund approval in January 2025.

Grayscale Solana ETF Filing May Trigger Altcoin Market Surge

The approval could drive the Altcoin market to another level. As many big institutions are driving towards the Altcoin market and can lead to surge by the end of this year. If approved investors can facilitate access to it from many brokerage platforms and encourage institutional usage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。