Trump Tariff Moves Spark Fresh Volatility Across Crypto Assets

Fed Holds , Trump Tariff Acts: Crypto in the Crossfire

The recent tweet of Kobeissi Letter on X handle highlights how President made several major announcements like tariffs on Brazil and copper imports, his strong words on BRICS, talks and deals with India and China, right when the Fed revealed its interest rate decision.

The timing suggests a possible strategy to shift market focus and send strong global signals.

Source: X

It is clear that the more the Fed holds a firm interest rate, the louder Donald Tariff gets with his moves. This tug-of-war on rates and trade is disturbing the crypto market.

Crypto investors are left confused, unsure whether this dispute will bring big gains or painful losses in the ahead days.

India Talks: Is Trump Tariff Boosting Web 3 Adoption?

President has imposed a 25% tariff and an added penalty on India for buying oil and arms from Russia and also links it to India’s role in BRICS.

But, this move puts financial pressure on India as the global tensions rise and dollar faces objection, might India lean further into decentralized systems like Web3, crypto and DeFi.

These tools offer more financial independence and less reliance on politically driven systems like traditional bankings. It would be great news for Indian investors if the central government shakes hands with the decentralized systems apart from only collecting 30% tax and 1% TDS over it.

This tightens regulations for making policies and pushes stronger towards the crypto framework to avoid over-reliance on the dollar based systems.

Trump Tariff Tensions: Is Bitcoin the New Safe Haven?

Bitcoin is riding a rollercoaster as the global tension rises. With the Fed staying quiet on rates and Donald threatening 100% tariffs on countries trading with Russia , markets are reacting fast.

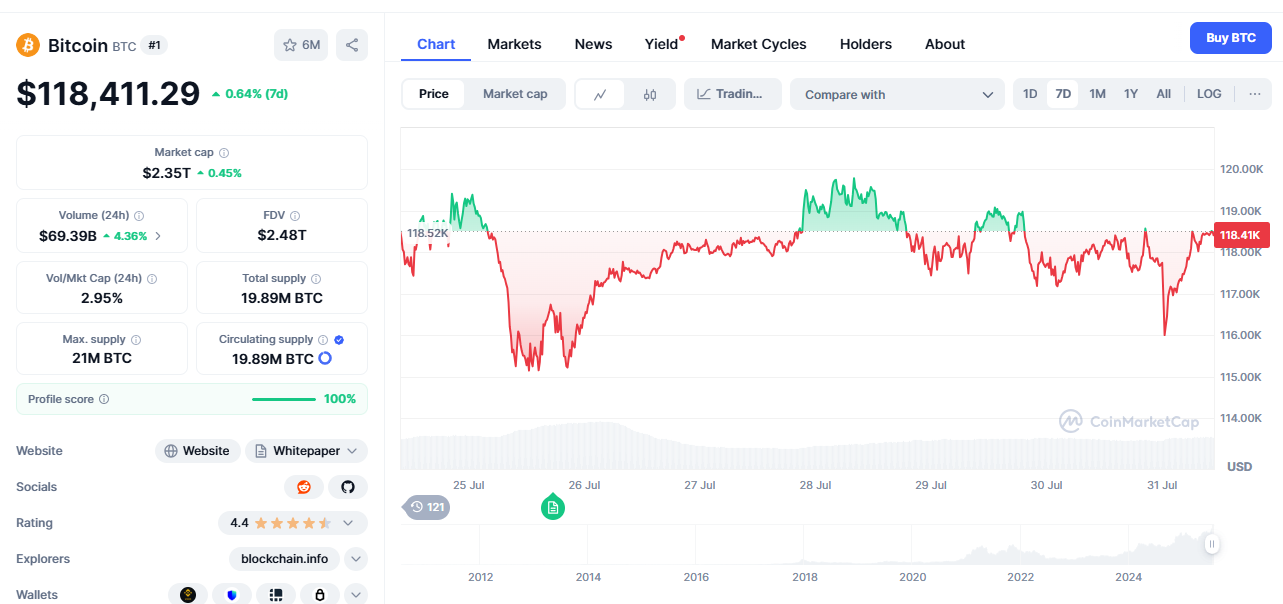

Bitcoin had just reached an all time high of $121,000 but dipped to $117,000 after President's warning. Surprisingly, after Trump Tariff announcement it saw a downfall at $116,000 and then again it bounced back and is now trading at $118,436. This shows that while short-term dips may happen during political shocks the investors still trust BTC.

In a world full of taxes, wars and uncertainty the BTC continues to act like a safe haven for those looking beyond traditional finance.

BTC, ETH, SOL: How Prices Reacted Instantly

Amid the global tension of tax Bitcoin Ethereum and Solana showed a downfall in its price but gained rose later. Let’s understand the change in market prices due to Trump tariffs one by one. All mentioned sources are collected from CoinMarketCap

Bitcoin

Currently trading at: $118,436.12

At the time of announcement: $116,000.56

Price fall by : $2,435.56

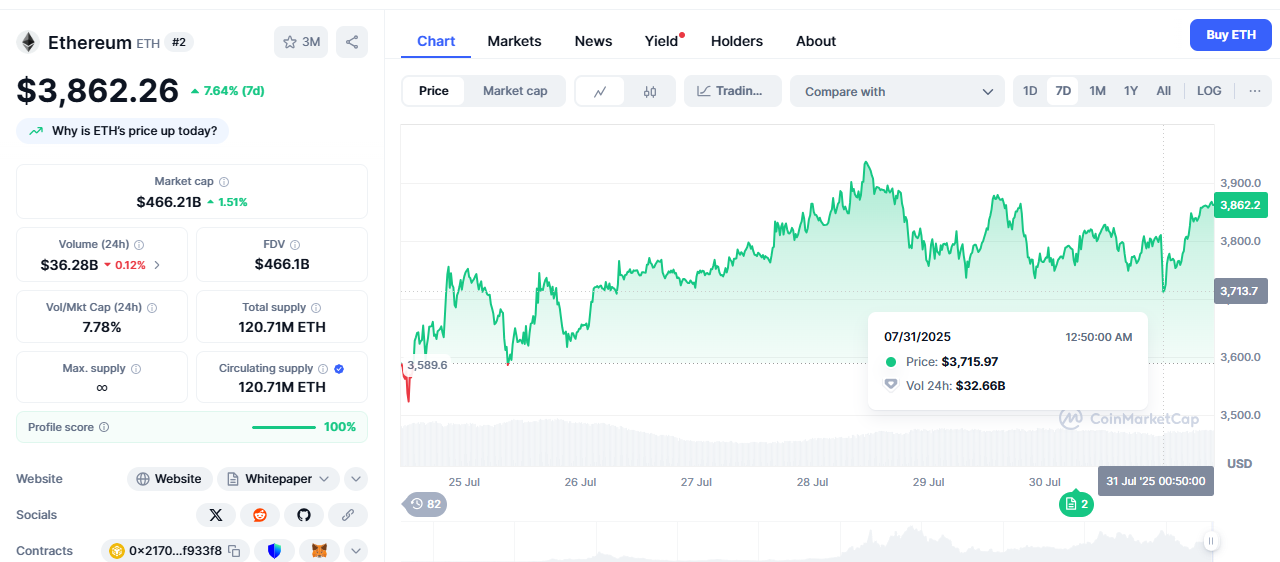

Ethereum

Currently trading at: $3,862.26

At the time of announcement: $3715.97

Price fall by: $146.29

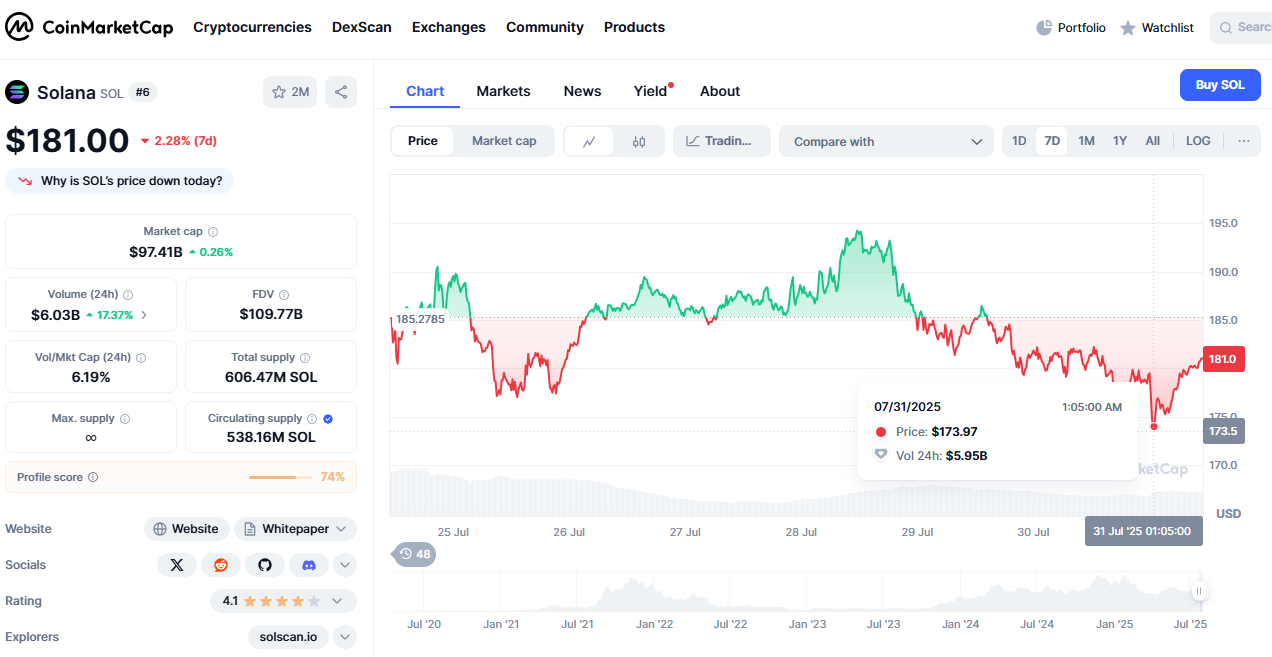

Solana

Currently trading at: $181.00

At the time of announcement : $173.97

Price fall by: $7.03

The data clearly shows that whatever the decision of the political leaders the market will show a small downfall but attain its value aggressively.

Trump Tariffs vs Bitcoin: What’s Next?

President Trump tariff news shook crypto briefly, but Bitcoin bounced back fast. This shows that despite political shocks, Bitcoin still holds strong as a trusted choice for many investors.

Also read: Trump Weighs Firing Powell as September Rate Cut Odds Slide免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。